Good luck, and may everything go smoothly.

Author: Stephen | DeFi Dojo

Compiled by: Deep Tide TechFlow

Yes, the bull market is a moment many of us have been looking forward to. But don’t think that this means everything will go smoothly. A bull market also brings various pressures and anxieties.

Here are some emotional traps to be wary of:

FOMO (Fear of Missing Out)

This is obvious. In a bull market, many high-risk investments may see double or even triple-digit growth. When your ETH or BTC rises by 10% in a month, you might feel good about your investment strategy, but when you see someone on social media boasting about 10x, 50x, or even 100x returns, you may start to doubt your choices.

Here are some coping strategies:

Remember, those who achieve 10x to 100x returns are usually taking much bigger risks. They often invest in Memecoins like buying lottery tickets. They might invest in 40 tokens, with only one yielding significant profits. If you continue to invest rationally, their annual returns may not differ much from yours.

Diversify your investments appropriately. Use a small portion of your portfolio to research some Memecoins and try small investments. This can help you understand if high-risk investments are suitable for you. If you find that this is not your strength, it’s usually easier to avoid FOMO.

This is particularly important: respect market fluctuations.

This is also a good way to “fake it until you make it.” When you feel FOMO seeing others succeed, try sending them a congratulatory comment. Receiving their “thank you” will help you gradually get used to positive emotions rather than negative FOMO.

Stagnation Periods in a Bull Market

Even in a bull market, the market often consolidates most of the time. During periods of significant market volatility, whether in accumulation or distribution phases, it can be exhausting. Why is this? Because when we start to get used to the market continuously rising, we expect this trend to continue. However, this is not the case. Even in the most optimistic phases of the last bull market cycle, the market spent most of its time consolidating. In fact, during the rise from July to November 2021, the market was flat or down for two-thirds of the time.

Solutions:

Avoid over-leveraging. This helps you achieve “stress-adjusted returns.” Imagine if you opened a high-leverage long position before the market accumulated or fell; you would feel frustrated every time the market didn’t rise. Overexposure can lead to poor decision-making or losses.

Keep your funds liquid. A major mistake many make in a bull market is to invest all their funds immediately and then be left waiting passively. If you are an active yield farmer and enjoy it, that’s great. But for most people, the best way to alleviate boredom during market stagnation or decline is to invest in batches or buy on dips. Allocating funds weekly can help you always have a small amount available without waiting until the end of the month to act.

Engage in stablecoin or neutral investments simultaneously. This is a great way to stay active and earn while waiting for the next big market move. During a bull market, stablecoin or neutral investments can often easily yield over 30% annualized returns.

Down Days/Weeks

Similar to market stagnation, but more painful, there are also down days in a bull market.

In fact, since Bitcoin reached $27,000, there have been 23 weeks of decline (about 40%) out of 58 weeks!

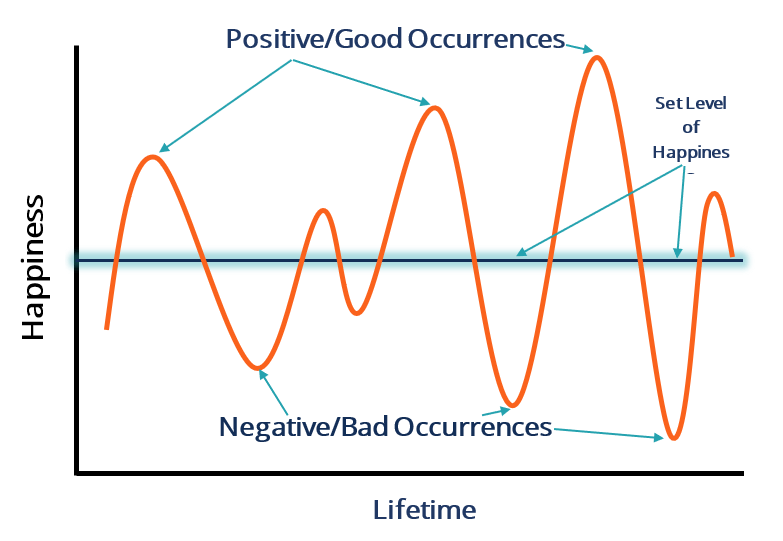

So even if your portfolio has grown by 50% or 100% since last month, you may have gotten used to that growth, but any loss will feel painful. This is known as the hedonic treadmill effect.

When you adapt to a new value, seeing a loss will feel painful.

The solutions are the same as before:

Avoid over-leveraging.

Keep your funds liquid.

Make some stablecoin investments (this is also a good way to keep funds liquid).

Another solution is to engage in long-short hedging. This is also known as pair trading. While not detailed here, the benefit of pair trading is that (even if not in equal positions), you can close short positions for profit when the market declines, thereby increasing your long positions.

Expectation Psychology

This is a common issue. Elections, interest rate cut days, presidential transitions, international conflict responses, and even major token listings, airdrop days, and other significant events can trigger a sense of anticipation. As a master once said, “Living in the future is anxiety.” Constantly worrying or anticipating an event to impact your investment performance is both exhausting and anxiety-inducing.

Solutions:

Join a community. When you speculate excessively about future events alone, you are essentially torturing yourself, often accompanied by fear. Trying to consider all possible good and bad outcomes is a neurotic and lonely behavior, and news reports often deliberately incite emotions, making them not the best source for speculation.

Instead, joining a community of smart individuals with similar investment goals and discussing and speculating with them can make you feel much more relaxed (sometimes even humorously relieving). This can help you see new perspectives and judge whether you are overreacting or underreacting.

Other Suggestions:

Try to avoid emotional trading. In a bull market, learn from your experiences and continue to invest rationally; you will reap good rewards.

When your investment doubles or triples, promptly withdraw your initial investment. No one goes bankrupt by taking profits in a timely manner.

Do not invest too much in new, small, or unaudited projects.

I expect that at some point, annual returns will be very high. There is indeed a season for scams. Small protocols are like binary gambling (i.e., either you make money or lose everything), so they are usually not worth taking up more than a single-digit percentage of your portfolio.

Try new chains. There will be some massive incentives during this cycle. This is a free opportunity with relatively good risk-adjusted returns.

For example, chain-level or institutional/foundation-based incentives (like ARB STIP or Optimum SuperFest) are the safest investment choices, as these incentives usually flow to top protocols.

Don’t hesitate to try a new chain with large-scale foundational incentives.

Investing in Aave on SillyChain at a 75% annual return is better than investing in NewPonzuFork on the ETH mainnet at a 100% annual return.

In Conclusion

Remember, life is like being on a hedonic treadmill.

The norm of life will never be ecstasy. You cannot always be in a state of ecstasy. Our nervous system simply cannot handle such a state.

Accept the fact that ecstasy is always temporary, and do not chase it; even in a bull market, fear and FOMO will occur from time to time.

The real key is to minimize deviations from the normal state.

Good luck, and may everything go smoothly.

@WordJizz says:

“This is our peak moment.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。