90,000 has arrived, how far can 100,000 be?!

Written by: A Ray's New World

GSR research analyst Toe Bautista stated after Trump won the U.S. election that, from the perspective of altcoins, many project teams have been waiting for the right moment, observing the issuance of other tokens and the election results. He also believes that if macro conditions remain favorable, the price of Bitcoin may rise further. "It is easy to foresee Bitcoin reaching $90,000, whether in Q1 next year or by the end of the month."

After Trump was elected President of the United States, everyone expected BTC to quickly break through $90,000, but no one anticipated that this $90,000 would come so soon.

Has the "crazy bull market" returned, and what concerns lie ahead?

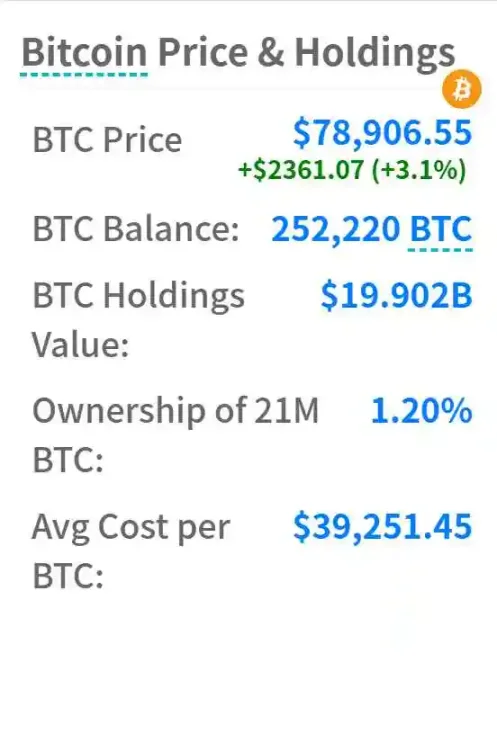

Micro Strategy Holdings

As a company that holds a large amount of BTC, MicroStrategy currently holds a total of 252,220 Bitcoins, with a total purchase cost of approximately $9.9 billion and an average purchase price of about $39,266. The current total value of Bitcoin holdings is $20.177 billion.

ETF Inflows

ETFs attracted significant attention when they launched, primarily due to a large influx of new funds, which also led to Bitcoin prices creating new historical highs. However, soon after, the total funds in ETFs began to see net outflows, and market sentiment started to decline. In contrast, recently, BTC ETFs have continued to see a large influx of funds, with the total inflow of the top ten ETFs consistently increasing over the past seven days.

This has not only been accompanied by a new high in daily net inflows but also a new high in open interest. The logic is clear: after Trump took office, there is a high possibility of a "crypto gold standard," and the political power in the U.S. supporting crypto will become stronger. For traditional financial "whales," the likelihood of allocating funds to crypto may increase, and BTC ETFs have become the most convenient channel for investing in crypto. For other U.S. stock investors, BTC ETFs will also become very attractive under Trump's endorsement.

Interest Rate Cuts

The Federal Reserve cut interest rates by 50 basis points in September, significantly exceeding expectations, and Bitcoin also surged in response. The November meeting confirmed a 25 basis point cut, which is generally understood by the market as a favorable factor, as the starting point of the last bull market was the interest rate cut in March 2020.

CPI

Tonight at 21:30, the U.S. released its CPI data, which was in line with market expectations. The U.S. stock market showed little volatility in response to the CPI data, while Bitcoin began to rise and broke through the $90,000 mark, with market expectations for CPI data returning to rationality. Overall, the CPI data has little impact on the Federal Reserve's interest rate cuts and other accommodative monetary policies.

November Historical Data

In addition to the data, there is also a sense of ceremony.

According to Coinglass data, Bitcoin's investment returns in the fourth quarter after halving in 2012, 2016, and 2020 have all performed well, with returns of 97.7%, 58.17%, and 168.02%, respectively. Notably, the return rate in November 2016 was 5.42%, and in November 2020, it was 42.95%. The return rate for this month is still worth looking forward to.

It is worth noting that Bitcoin's price rose by 7.35% in September this year, marking its best historical performance. Historically, whenever Bitcoin has risen in September, it has continued to rise until the end of the year.

After dawn, history will arrive.

What do traders think about Bitcoin's future direction?

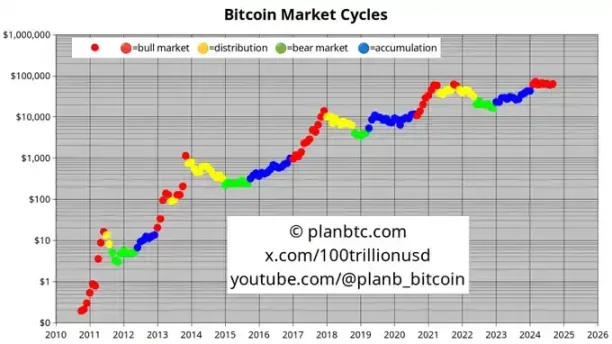

PlanB: BTC Expected to Reach $1 Million by the End of 2025

PlanB is the creator of the Bitcoin Stock-to-Flow (S2F) model and enjoys a high reputation in the crypto industry for his unique model of asset scarcity and price relationships. His analysis focuses on the long-term growth potential of Bitcoin's value, especially in price fluctuations after halving events. His latest prediction indicates that if Trump wins the upcoming presidential election, the Bitcoin market may experience an unprecedented price surge. PlanB has constructed a series of monthly timelines to illustrate the price development direction of Bitcoin under different market scenarios.

In a prediction made a few months ago, PlanB provided specific figures based on his S2F model:

November: Trump wins the election, Bitcoin price reaches $100,000. PlanB believes that Bitcoin will experience a significant turning point if Trump wins the election. He points out that Trump's presidency may bring friendly policies towards cryptocurrencies, thereby ending the current "war" against cryptocurrencies by the Biden/Harris administration, especially as the policy checks against regulatory officials like Gary Gensler and Elizabeth Warren will directly push Bitcoin's price to $100,000.

December: Massive inflow of ETF funds, Bitcoin soars to $150,000. PlanB believes that Trump's victory will clear obstacles for the approval of Bitcoin ETFs, and expects a large influx of funds into the market. The inflow of ETFs represents mainstream financial market acceptance and investor trust, further driving Bitcoin's price to $150,000.

January 2025: Crypto industry returns to the U.S., Bitcoin rises to $200,000. With the Trump administration's openness to cryptocurrency policies, many crypto industry companies and investors may bring their businesses back to the U.S. PlanB expects this to create significant market demand, pushing Bitcoin's price to $200,000.

February 2025: "Power Law" team takes profits, price falls back to $150,000. The February pullback is a prediction of market adjustment for Bitcoin. PlanB believes that profit-taking by investors will lead to a brief drop in Bitcoin to $150,000 after reaching a high. However, this adjustment will be short-lived and necessary, laying a more stable foundation for the next phase of growth.

March to May 2025: Globalization trend of Bitcoin, price breaks through $500,000. Starting in March, PlanB expects countries like Bhutan, Argentina, and Dubai to successively adopt Bitcoin as legal tender, and in April, under Trump's push, the U.S. will also initiate a Bitcoin strategic reserve. Following this, in May, he believes other countries, especially non-EU countries, will join this trend, further pushing Bitcoin to $500,000.

June 2025: AI boosts, price reaches $600,000. In June, PlanB proposed the hypothesis that artificial intelligence begins to autonomously participate in Bitcoin market arbitrage. He expects that with AI's participation in the Bitcoin market, this high-frequency trading will further drive prices up, pushing Bitcoin beyond $600,000.

July to December 2025: FOMO fades, price reaches $1 million. In the following months, PlanB believes that the market's FOMO sentiment will begin to fade, and Bitcoin is expected to reach a new high of $1 million by the end of the year. At this point, Bitcoin will not only become a mainstream asset reserve but also an essential allocation for global investors.

2026-2027: Market adjustment and bear market. In 2026, PlanB expects Bitcoin's price to pull back from $1 million to $500,000, entering a distribution phase, and by 2027, the market will enter a bear market, with Bitcoin's price expected to drop to $200,000.

PlanB concluded that the key to this prediction lies in Bitcoin's scarcity value. He pointed out that scarcity will become the core factor driving asset prices, just like real estate and gold, which are also scarce assets. PlanB believes that in the next 18 months, Bitcoin's price is expected to leap due to the halving effect and market demand, thereby continuing to solidify its position as "digital gold" among global investors.

The key to PlanB's prediction lies in Bitcoin's scarcity value. He pointed out that investors favor scarcity, and there are currently basically three choices for scarcity: real estate (S2F 100, market value $10 trillion), gold (S2F 60, market value $20 trillion), or Bitcoin (S2F 120, market value $1 trillion). Therefore, Bitcoin's scarcity will become the core factor driving asset prices, just like real estate and gold.

PlanB proposed a contrary scenario, stating that if Harris wins, he believes this would represent "the end of Western civilization" and further exacerbate the decline of the American empire. He expects the crypto industry to be further pressured under Gensler and Warren's regulation, continuing more suffocating actions, and may even face harsher tax policies, such as the introduction of unrealized capital gains tax. However, he also emphasized that Bitcoin does not rely on a specific regulatory environment, and its value drive will still come from global demand for scarcity.

Alex Krüger: Spot BTC Dominates on Election Night

Argentinian economist, trader, and consultant Alex Krüger believes that the election results will directly impact the direction of Bitcoin's price:

Trump wins: Bitcoin's year-end target price is $90,000. Krüger believes that after Trump's victory, Bitcoin's price will quickly surge to $90,000 before the end of the year, giving a 55% probability of realization. In this scenario, he predicts that Bitcoin's price will "soar rapidly," as the market has partially anticipated the favorable impact of Trump's victory on cryptocurrencies. However, there remains a certain degree of price undervaluation, and the market's rapid response will be reflected shortly after the news is confirmed.

The Giver: Mid-term Decline After the Election

The Giver is an anonymous seasoned investor with extensive experience in buy-side and sell-side financial institutions. He is currently engaged in private equity investment in special situations and provides a different perspective. The Giver's strategy is more conservative and focuses on the short term compared to Krüger and PlanB. He believes that the Bitcoin rise driven by the election is more of a temporary phenomenon rather than a long-term trend. This view particularly emphasizes market liquidity and the driving effects of short-term events, pointing out that Bitcoin may experience a decline adjustment after the election. His specific analysis is:

The driving force behind Bitcoin's recent rise comes from event-driven "non-sticky" buyers, specifically some short-term speculators seeking to hedge against election risks, rather than an overall trend. These buyers are unlikely to hold Bitcoin for the long term; once the election dust settles, they may quickly exit the market. Therefore, this capital lacks "stickiness," and Bitcoin's price may face selling pressure after the election.

The underperformance of altcoins is correlated with Bitcoin's concentration. In his view, the inflow of funds is primarily concentrated in Bitcoin, rather than being widely distributed to altcoins, leading to the lackluster performance of altcoins. This indicates that the current flow of funds is more based on Bitcoin as a hedging tool rather than a positive sentiment for the entire crypto market.

The Giver expects that in the coming week, Bitcoin's open contracts and positions will remain crowded, potentially reaching new highs. He points out that this "right-side effect" may lead to a short-term surge in Bitcoin's price, but due to the limited market capacity in Q4 2024, it is unlikely to sustain into the next year. This short-term effect increases the likelihood of Bitcoin's price peaking before the election, but the speculative liquidity behind it is insufficient to support a long-term uptrend.

Based on this judgment, The Giver has proposed a relatively aggressive investment strategy: given the current market environment, he suggests going long on Bitcoin while shorting other mainstream coins and altcoins. Bitcoin is expected to test $70,000 before election day, but regardless of who wins, a mid-term decline is anticipated after the results are announced.

Markus: Long BTC and Short SOL Hedging Strategy

Markus Thielen is a well-known analyst at Matrixport and 10X Research, who gained rapid recognition in the investment community for his highly accurate prediction of Bitcoin's $1 trillion market cap a few months ago.

Markus's latest analysis is based on 10X Research's latest signal model, which has an accuracy rate of 73% to 87%, typically realized within 2 weeks to 9 months. He predicts that if Bitcoin's price continues to follow historical trends, it may rise by 8% in the next two weeks, 13% in a month, 26% in two months, and 40% in three months. Based on this, Bitcoin's price could exceed $100,000 by January 27, 2025, and reach a target of around $140,000 by April 29, 2025.

Regarding the election results, Markus analyzed the impact of different outcomes on Bitcoin and other crypto assets. He predicts that after Trump takes office, Bitcoin may rise by 5%, with Solana and Ethereum potentially seeing similar gains. He believes that Trump's victory will bring a more favorable policy environment for cryptocurrencies, likely driving the market upward.

In this scenario, Markus's suggested strategy is to "go long on Bitcoin and short Solana" to hedge against the uncertainties brought by the election. However, Markus also points out that if the election results are delayed or disputed, this will increase market uncertainty and could lead to increased volatility in Bitcoin.

In the case of disputed election results or a Harris victory leading to a short-term decline in Bitcoin, Markus emphasizes that Bitcoin may still demonstrate strong resilience, thus advising investors to seize the buying window after a short-term drop in Bitcoin.

From the derivatives market and on-chain data, the total amount of Bitcoin held by short-term holders increased in October, while the holdings of long-term holders decreased. This dynamic typically appears when prices are about to break through significant levels. The total open contracts in the Bitcoin options market have surged to $22.5 billion in 2024, indicating a strong bullish sentiment in the market. Bitcoin's 25 Delta skew is at the lower end of its annual range (-8% to -10%), suggesting a strong bullish sentiment.

Thielen also pays special attention to the impact of MicroStrategy's stock performance on Bitcoin's price. He notes that MicroStrategy's stock has risen by 33% since October, and this surge has created a "tail effect" on Bitcoin's price. The covering of a large number of short positions has further boosted the market's bullish sentiment towards Bitcoin.

Standard Chartered Analyst: If Trump Wins, BTC Will Rise to $125,000 by Year-End

According to a Cointelegraph report on October 25, Standard Chartered analyst Geoff Kendrick predicts that if Trump wins the election in November, Bitcoin's price could rise to $125,000 by the end of the year.

Kendrick's model indicates that on election day (November 5), Bitcoin may stabilize around $73,000. In the event of a Trump victory, Kendrick expects Bitcoin to immediately rise by about 4%, with a further 10% increase expected in the following days, driven by rising market confidence and a more relaxed regulatory environment.

Meanwhile, another brokerage firm, Bernstein, noted in its research report that if Trump wins the U.S. election in November, Bitcoin is expected to reach new highs later this year, with prices potentially hitting $90,000 in the fourth quarter. In contrast, if Harris wins, the market may anticipate increased regulation, causing BTC prices to fluctuate back to the range of $30,000 to $40,000.

The future we can currently foresee is that BTC has already broken through its all-time high (ATH), and there are technically no so-called "pressure points" for future price increases. BTC has not let down any spot holders, but there are still about two months until Trump officially takes office. Will this "narrative void" period see new narratives leading to further increases? Will Trump fulfill his previous promises after taking office? Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。