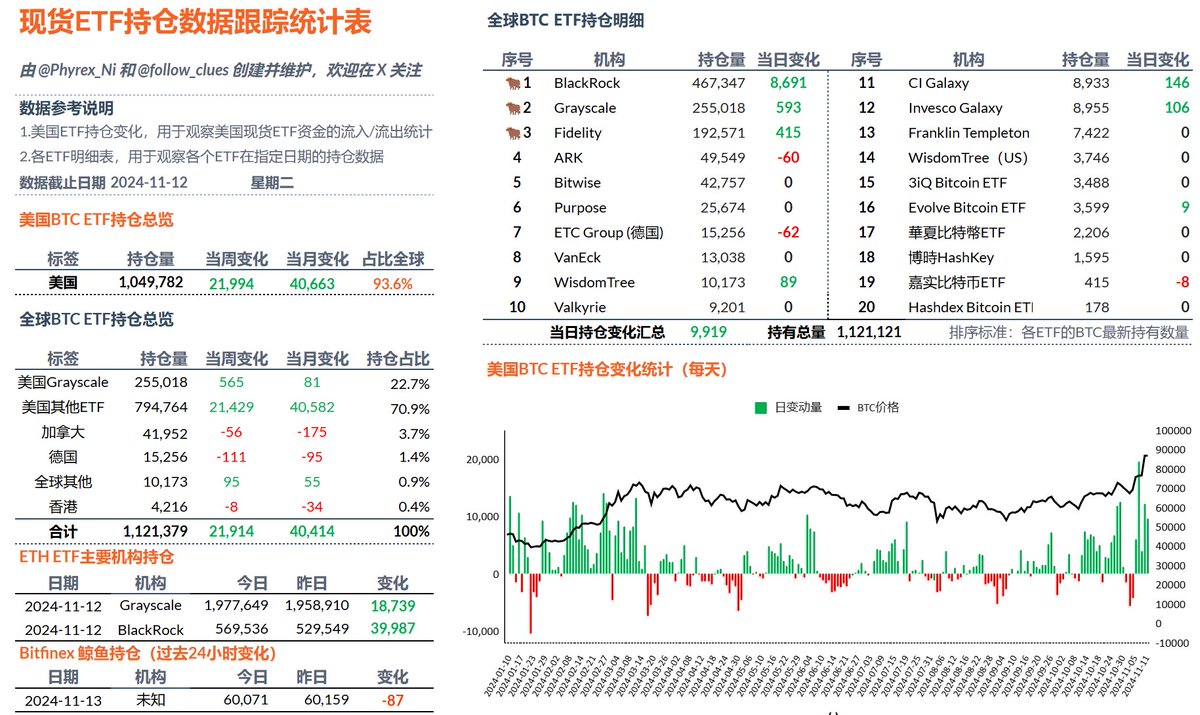

I forgot to mention the main point after rambling for a while; I neglected to share the data on the BTC spot ETF. After looking at the ETH data, the most direct conclusion is that BlackRock has already started to create a FOMO (Fear of Missing Out) sentiment among its users through its financial managers or similar roles. This is not only the case for #ETH but also for #BTC. In the past 24 hours, although the increases from other U.S. ETF institutions were quite average, BlackRock net purchased 8,691 BTC, the same amount as on Monday.

This truly indicates that at least BlackRock is conveying the message to its users that BTC and ETH are worth investing in. We mentioned this when BlackRock's stock ($BLK) released its earnings report, and now it can be proven to be completely correct. Therefore, I also suggest that many who are still hesitant about BTC consider making a "regular investment." As long as BlackRock continues to lead in increasing its BTC holdings, invest even a fraction of your funds to buy BTC.

In addition to BlackRock, there are a few other spot ETF funds with net inflows, but they are almost negligible. On the selling side, only ARK reduced its holdings by 60 BTC, while others did not see significant changes. In the past 24 hours, U.S. spot ETFs net increased their holdings by 9,745 BTC, which is a good figure, although the vast majority of this was contributed by BlackRock.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。