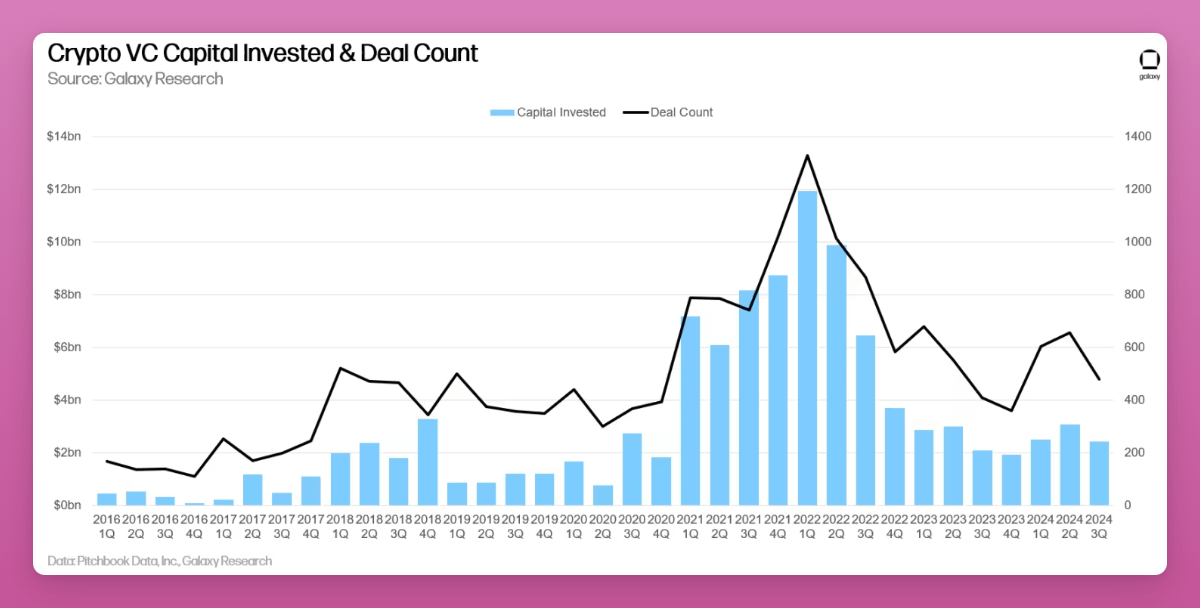

What baffles me this cycle is the extremely low fundraising amount from VCs.

BTC blown past its 2021 ATH, yet fundraising amounts are even below the 2018 bull run levels.

It's not just amounts invested, but also the deal count numbers.

We're at pre-2020 cycle levels.

Why?

It's ironic that we're tired of low-float, high FDV tokens from VCs, yet the VC sector doesn't seem to be thriving.

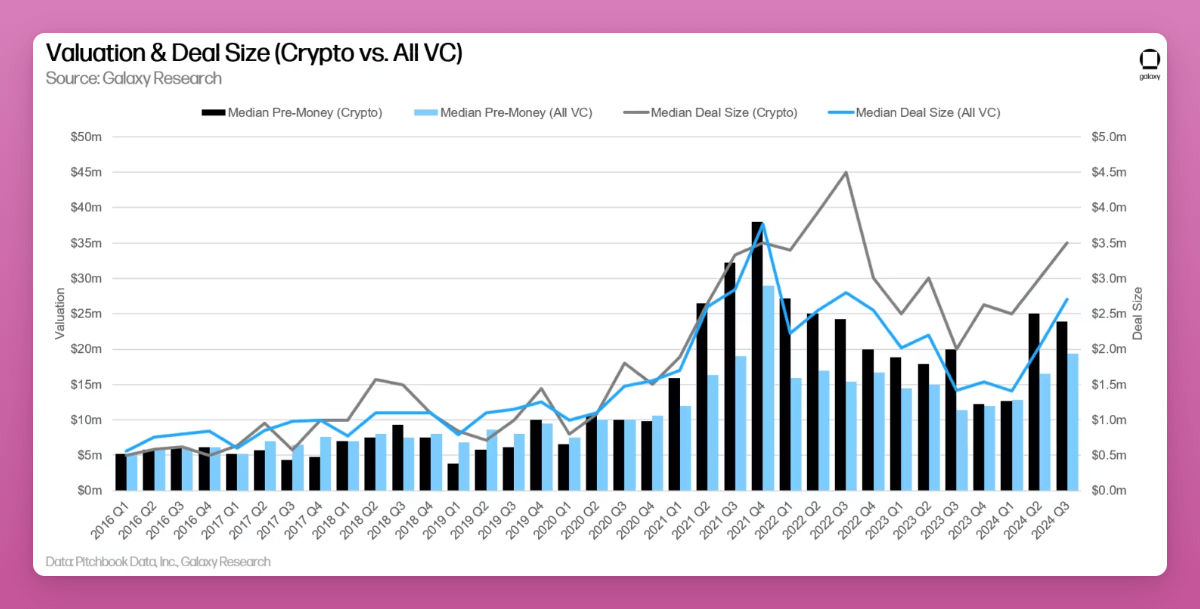

Valuations did go up since 2018 by at least 4x, averaging $25M. They are still lower than in 2021.

It's also true, that VCs invest at much lower valuations compared to the fully diluted valuations at the time of MOST public listings.

Most notable protocols this cycle list at hundreds of millions or even billions in FDV.

Still, not all deals end up profitable. Which could partly explain why fundraising numbers are so low right now.

For example, $SCR's valuation at the last round was $1.8B, now trading at $624M.

Feel free to share Scroll's Seed valuation, if you know.

If you are a VC or have insight WTH is happening, let me know.

Are they simply late and will FOMO in at the new BTC ATH again?

That wouldn't sound like smart money.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。