KAIA has gained attention due to the merger of Klaytn and Finschia. With the backing of Kakao and LINE, it actively builds a Web3 ecosystem for over 250 million users in East Asia. As the development of the Web3 ecosystem becomes a trend, KAIA's layout in this area has the potential to bring opportunities to participants. Recently, its Portal v1.2 was released to incentivize the core DeFi pool to improve the ecosystem. TON, relying on Telegram, has also performed well in the Web3 field. Although both have social platform support, their business, technology, and market positioning differ. Comparing the KAIA and TON ecosystems allows us to gain a deeper understanding of project characteristics, insight into the potential of blockchain application scenarios, and provides a strategic perspective for investment and innovative applications, grasping the development trends of the digital economy.

Focus Points After Klaytn Brand Restructuring (KAIA)

- Why rename and update?

- What is the development roadmap after the update?

- Is there a similar development relationship between Klaytn and LINE, analogous to TON's relationship with TG?

- What are the similarities, differences, advantages, and disadvantages between Klaytn and TON?

- What is the current development status of Klaytn? Does it have unique development prospects?

I. Review of KAIA Brand Restructuring

On April 30, 2024, Klaytn and Finschia officially merged into a unified Layer-1 platform through deep integration and rebranded as Kaia.

Kaia is backed by the joint support of two giants, Kakao and LINE, which undoubtedly injects strong momentum into its development. Kakao has a usage rate of 96% in South Korea, while LINE is also popular in Japan, Taiwan, and Thailand, resulting in a combined potential user base of over 250 million. With such a large user base, Kaia is expected to significantly enhance the popularity and acceptance of blockchain technology in the East Asian market, laying a solid foundation for the large-scale application of blockchain technology; thus creating the largest and most vibrant Web3 ecosystem in Asia.

- In June 2024, Kaia successfully launched its testnet.

- On August 29, 2024, the Kaia mainnet officially went live, showcasing its strong technical capabilities and development potential (during which it received upgrade support from exchanges like Binance).

II. Roadmap: KAIA Phase Planning

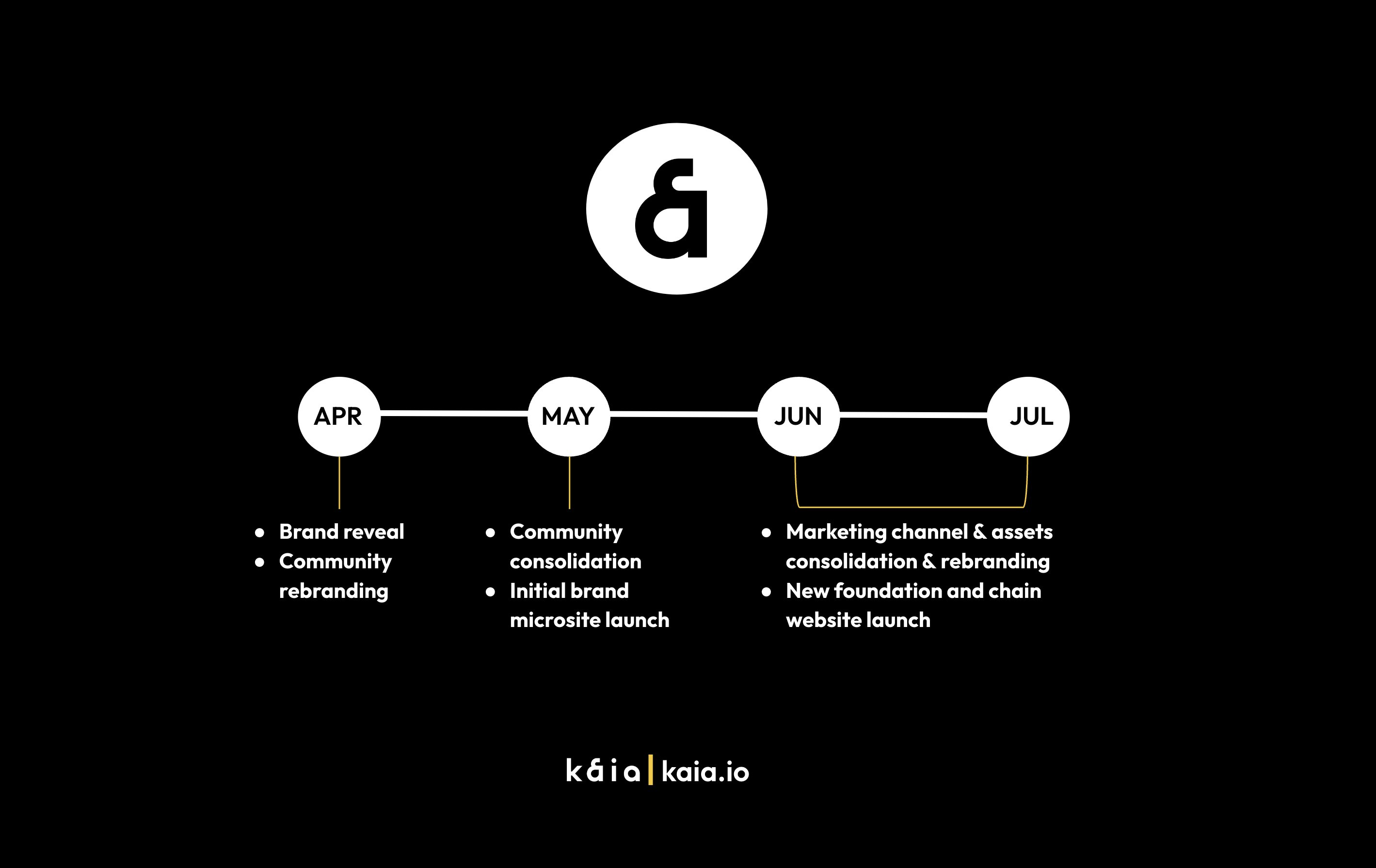

Next, we will interpret the project party's development plan after the brand restructuring based on the officially announced roadmap, which is divided into a two-step strategy. In the short term, it focuses on building the L1 public chain to improve infrastructure and basic services, while in the long term, it aims to expand institutional and official-level partnerships and clients through various channels, with the goal of creating the largest Web3 ecosystem in Asia.

Short-term Roadmap:

- Q1 2024: Integration, construction, and operation of Klaytn & Finschia. (Integrating the technical advantages and resources of both parties to lay a solid foundation for subsequent brand transformation and business expansion)

- Q2 2024: Establishing the new brand Kaia, creating a joint marketing system and community integration, etc. (Strengthening communication and collaboration with partners, promoting community integration, building consensus, and constructing a community ecosystem)

- Q3 2024: Issuing new integrated tokens and providing swap services, etc. (Enriching the financial product system of the Kaia ecosystem)

- Q4 2024: Foundation restructuring and joint business promotion, establishing a second integrated network. (Optimizing organizational structure and business layout to build long-term sustainable development)

Long-term Roadmap:

- Establishing infrastructure that meets institutional-level needs. (Integrating tokens and convenient deposit and withdrawal channels to lower the entry threshold for institutions)

- Strengthening large-scale DeFi infrastructure. (Building a DeFi ecosystem and expanding RWA-related services)

- Launching a native stablecoin. (This is fundamental)

- Accelerating the Asian community. (Cultivating developer and user communities in different countries, expanding governance and ecological partnerships)

- Discovering AI Dapps. (This wave cannot be missed)

- Large-scale on-chain tokenization of Web2. (The pathway from Web2 to Web3)

- Global intellectual property cooperation.

The roadmap does not emphasize the ecological relevance with LINE, which is a point we will compare with KAIA and TON later, as the latter has a strong correlation with Telegram. This may lead to completely different development outcomes.

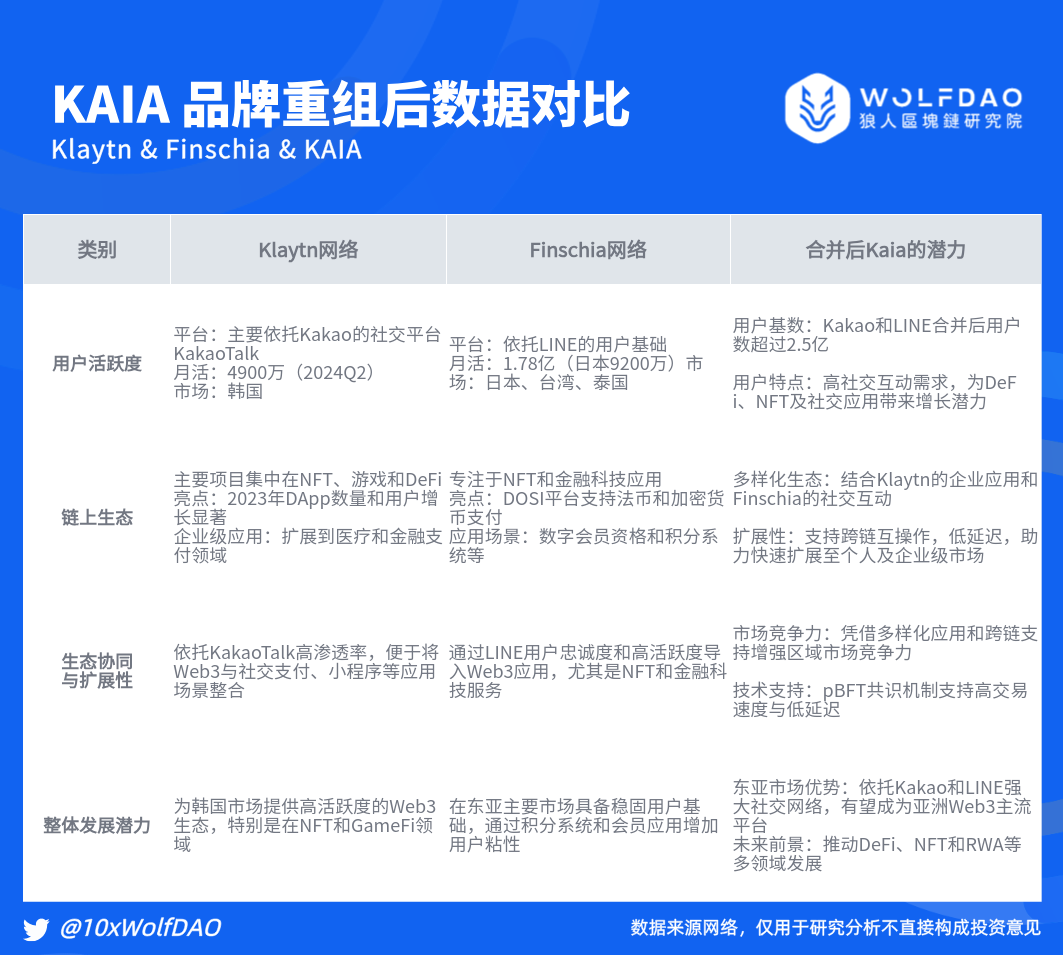

III. KAIA Ecosystem User and Project Activity

Before the merger, Klaytn and Finschia each formed different on-chain ecosystems, which laid a certain foundation for the user base and on-chain projects of the merged Kaia. Before the data for Kaia is clarified, we can gain insight from the activity levels of Klaytn and Finschia's ecosystems and projects.

Figure: Data comparison after KAIA brand restructuring Source: @10xWolfDAO整理

IV. Multi-dimensional Comparison of KAIA and TON Ecosystems

1. Core Business Logic Comparison

TON: Its unique business formula is TON = Telegram user base + Web3 mini-programs + PoS node group, with the core being the combination of Web2 + Web3 strategies. By fully utilizing Telegram's vast user base, it deeply embeds Web3 mini-programs into users' daily social scenarios, while leveraging the PoS node group to ensure efficient operation and security of the network, providing users with a new decentralized application experience.

Kaia: In contrast, Kaia's business formula is Kaia = Weak LINE user base + Stablecoin + Institutional services (INFRR + RWA), with the core being weak LINE integration and strong RWA integration. Although Kaia's user base is relatively weak compared to Telegram, it still possesses certain user traffic advantages through its partnership with LINE. Additionally, Kaia places greater emphasis on the issuance and application of stablecoins, as well as providing a series of professional services for institutions, including Infrastructure as a Service (INFRR) and Real World Asset tokenization (RWA), to build a more robust and sustainable business ecosystem.

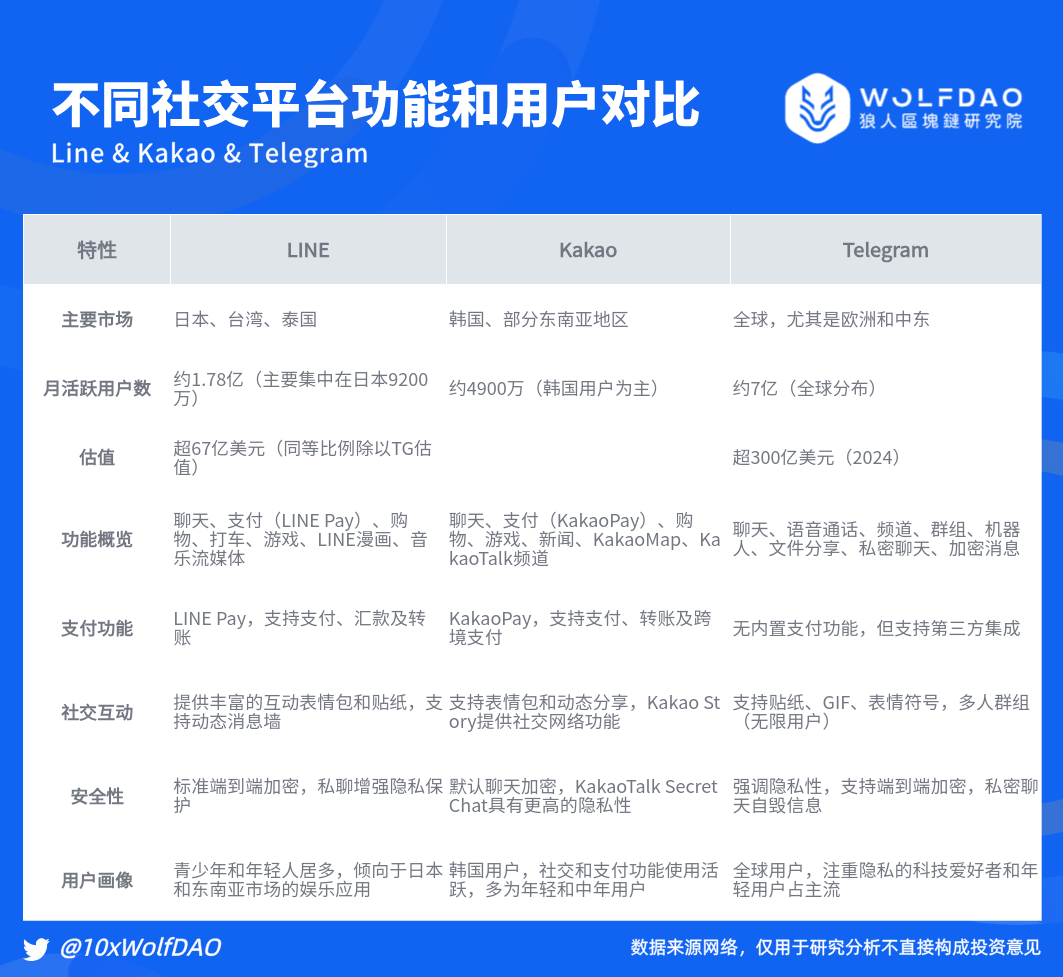

2. User Base and Market Positioning

KAIA: Deeply rooted in the East Asian market, it leverages LINE's approximately 178 million monthly active users in Japan, Taiwan, and Thailand, along with KakaoTalk's 49 million monthly active users due to a 96% penetration rate in South Korea, precisely targeting the social and financial needs of Asian users. Its users are primarily those accustomed to Asian social culture, with high demand for local financial services and frequent social interactions. KAIA aims to cleverly integrate blockchain services into their familiar social and payment scenarios, creating a Web3 ecosystem experience with Asian characteristics, akin to a life service platform tailored for local residents.

Estimated active user numbers: Telegram approximately 900 million (2024) over $30 billion (2024) globally (mainly in Russia, India, Brazil, Ukraine, and the US) Line approximately 200 million (2022) over $6.7 billion (proportional to TG valuation) Asia

TON: Relying on Telegram's approximately 700 million monthly active users, its market footprint is expanding globally, especially with a strong user base in Europe and the Middle East. TON's user group is broader and more diverse, encompassing global tech enthusiasts and young users who value privacy protection and pursue decentralization. It resembles a comprehensive digital square aimed at the world, providing a decentralized space for users from different regions and cultural backgrounds to communicate, trade, and innovate freely.

Protocol Market Cap FDV TVL 24h Vol. Validator User Count Active Wallets TON $12.9 billion $25.9 billion $390 million $300 million 38,311,140 32.47 million Kaia (just completed the swap, data not accurate) $730 million $730 million $55 million $100,000

3. Technical Architecture and Performance

KAIA: Adopts the pBFT consensus mechanism, which functions like an efficient traffic control system, capable of supporting rapid processing of 4,000 transactions per second, ensuring efficiency and smoothness of transactions. Moreover, it is compatible with the Ethereum Virtual Machine (EVM), which acts as a bridge, greatly facilitating developers to easily migrate existing projects to the KAIA ecosystem, providing strong technical support for the rapid enrichment and development of the ecosystem, allowing various RWA, DeFi, and NFT applications to quickly take root.

TON: Utilizes a multi-chain parallel mechanism combined with the PBFT consensus algorithm to build a lightning-fast transaction network. Its second-layer network—instant payment channels—creates exclusive high-speed trading channels for high-frequency traders, akin to providing top racing tracks for race car drivers. Although TON is not directly EVM compatible, it excels in cross-chain interoperability, enabling the free flow of assets between different chains through convenient cross-chain bridging technology, akin to constructing a vast interstellar trade network that easily connects resources and values from various planets (different blockchains).

4. Ecosystem Projects and Application Scenarios

KAIA: The ecosystem projects exhibit a diversified layout, ranging from decentralized exchanges (like DragonSwap) to liquid staking platforms (like Stake.ly), from lending services (like KlayBank) to yield aggregators, covering a wide array. Its application scenarios focus on the innovative integration of social and financial aspects, for example, leveraging user habits from KakaoPay and LINE Pay to promote the adoption of blockchain payments in social scenarios, while utilizing social interactivity to drive traffic to DeFi and NFT projects, facilitating project promotion and development, akin to integrating financial services into social gatherings, making every interaction a potential opportunity for value creation.

TON: The ecosystem has seen the emergence of traffic star projects like Notcoin and Catizen, achieving remarkable success in the stablecoin sector, with the on-chain USDT supply experiencing explosive growth in a short time, injecting strong financial vitality into the ecosystem. Its application scenarios span decentralized social, payment, and DApps development, and it emphasizes building a cross-chain ecosystem, achieving interconnectivity with other blockchain projects through cross-chain protocols, akin to constructing a vast cosmic alliance where resources are shared and developed collaboratively among various planets (projects).

5. Regulatory Compliance

KAIA: Primarily focuses on the East Asian market, benefiting from the relatively stable and clear regulatory environment in countries like Japan and South Korea. Within this regulatory framework, KAIA can conduct business in an orderly manner, with ample room for cooperation with local financial institutions and government departments, akin to competing in a clearly defined arena, allowing it to confidently leverage its strategic and technical advantages, reducing the uncertainty risks brought about by policy changes, and providing users and investors with a more reliable guarantee.

TON: As a global decentralized project, it faces a complex and ever-changing regulatory environment around the world. Different countries and regions have significant variations in their regulatory policies regarding blockchain and cryptocurrencies, requiring TON to continuously adapt and coordinate various regulatory requirements globally. This is like navigating a thorny path, needing to carefully balance compliance and innovation; a slight misstep could lead to regulatory challenges that impact the project's progress and development.

Figure: Comparison of functions and user profiles of different social platforms Source: @10xWolfDAO整理

In terms of the East Asian market and localized demand, Kaia has an advantage over TON, but TON still holds appeal in global decentralization and privacy protection. The two form a complementary ecological layout in market positioning and user needs. However, the arrest of TON's founder has somewhat weakened market trust and stability, providing an opportunity for Kakao and LINE to enter the market.

Nevertheless, TON still possesses unique appeal in decentralization and technological innovation, especially among the international developer community and decentralization enthusiasts. Therefore, Kakao and LINE are more likely to focus on replacing TON's position in the East Asian market for social + blockchain applications, rather than completely replacing TON's global influence (as even indicated by the promotional slogan on Kaia's official homepage, which has already stated that its target user market is in Asia).

V. Analysis of KAIA Ecosystem Development Issues

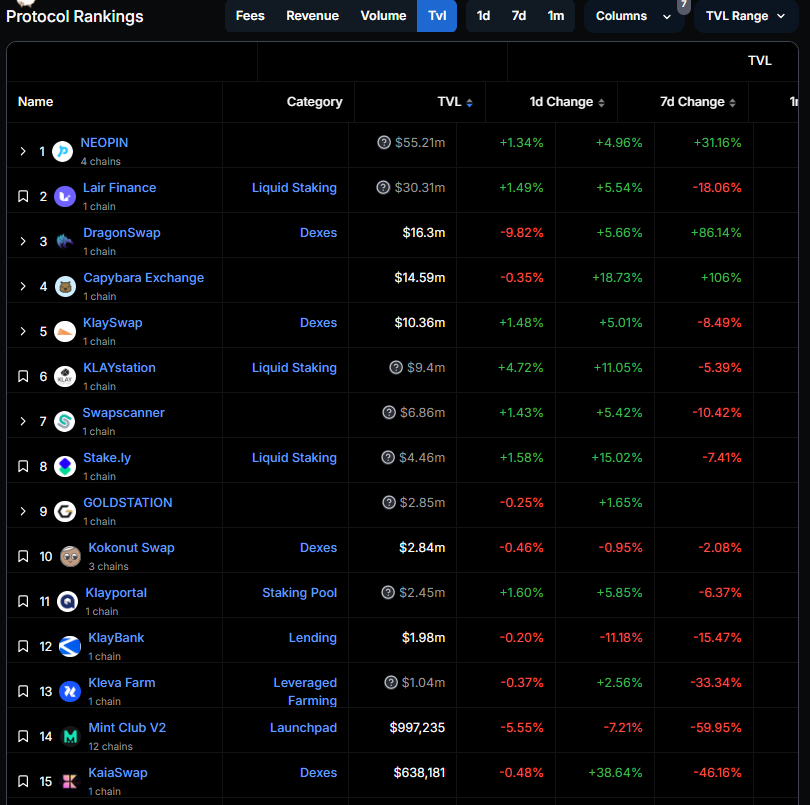

Currently, the Kaia ecosystem shows a relatively diversified project layout but also faces some key development challenges. Based on on-chain data disclosed by DeFiLlama, we can analyze Kaia's ecosystem development from the following dimensions.

Figure: KAIA - TVL data trend Source: Defillama x: @10xWolfDAO

Figure: Data comparison of projects in the same track Source: Defillama X: @10xWolfDAO

1. Uneven Ecosystem Structure and Project Distribution, High Dependence on Leading Projects

Kaia's ecosystem encompasses various categories such as decentralized exchanges (DEX), liquid staking, lending, yield aggregators, and cross-chain. This diversified structure helps attract different user groups with varying preferences and promotes widespread application of the ecosystem. However, the concentration of ecosystem projects is relatively high, particularly in DEX and liquid staking projects (such as NEOPIN, Lair Finance, DragonSwap, and Capybara Exchange), which attract the majority of users and trading volume, indicating that Kaia's users prefer highly liquid investment tools, while demand for other categories remains to be explored.

The trading volume and user activity of leading projects are significantly higher than those of other protocols, indicating that Kaia's ecosystem has not yet fully matured. In the future, Kaia can balance its ecosystem layout by supporting more innovative projects, encouraging users to diversify their investments and interactions to achieve more stable ecosystem growth.

2. User Trading Preferences and Conversion

The cumulative trading volumes of projects like NEOPIN, Lair Finance, and DragonSwap are close to $600 million, $182 million, and $715,000, respectively. These high trading volume projects are concentrated in the DEX and liquid staking sectors, indicating a high demand from users for these projects. In particular, DEX platforms provide convenient token trading channels, attracting frequent traders. User activity is primarily concentrated on projects that offer high liquidity and stable returns, showing that Kaia's users tend to prefer products with high liquidity. However, the relatively singular application scenarios make it difficult to meet users' diverse needs.

Additionally, user base conversion is also a challenge. Effectively converting the massive user base of social platforms into active users of the blockchain ecosystem is an important issue that Kaia needs to address. If it cannot timely expand application scenarios and improve user conversion efficiency, it may lead to user attrition, affecting the long-term development of the ecosystem.

3. Total Locked Value (TVL) and Liquidity Analysis

Although the leading projects within Kaia have high trading volumes, the overall locked value (TVL) of its ecosystem is relatively low.

Lending platforms (like KlayBank) and liquid staking projects (like Stake.ly) have the potential to enhance TVL by attracting more funds into the ecosystem through staking rewards and locked rewards. If Kaia can further enrich its DeFi tools and increase high-yield products like leveraged trading and options, it may attract more users and increase fund retention, significantly boosting TVL.

4. Insufficient Technical and Ecological Infrastructure

Although Klaytn has strong network performance and low transaction costs, it still faces certain limitations in actual DeFi and cross-chain compatibility, especially when compared to the Ethereum ecosystem. Klaytn and Finschia have not formed a unified resource integration and market promotion strategy in their ecological development. Projects fighting alone find it difficult to form a synergy, and when promoting NFTs or social applications, they have not provided sufficient developer support and funding. In contrast, projects on mainstream chains receive more development resources and community attention.

5. Cultural Characteristics and Policy Environment of the Cryptocurrency Ecosystem in Japan and South Korea

The cryptocurrency ecosystems in Japan and South Korea have unique cultural characteristics and policy environments. Users in Japan and South Korea, especially in South Korea, have a strong acceptance of high-risk financial instruments. This is reflected in their enthusiasm for cryptocurrency trading and preference for short-term investments. On one hand, users tend to pursue high-yield financial tools, which may lead to excessive speculation and market volatility within the ecosystem, increasing operational risks for projects. On the other hand, although policies in Japan and South Korea are relatively lenient, market regulation still has shortcomings, which may trigger potential risks and uncertainties, such as market manipulation and money laundering, posing threats to the healthy development of the ecosystem.

6. Limitations of Operational and Market Promotion Strategies

Although Kakao and LINE have high brand recognition in social applications, both companies are relatively cautious in promoting blockchain projects. This contrasts with the high-profile marketing and incentive mechanisms of many mainstream blockchain projects. Klaytn and Finschia lack clear user incentive strategies and educational promotion activities, leading to a lack of driving force in their ecosystem development. There is little cross-chain cooperation and liquidity sharing with other chains, making it difficult for their ecosystem to attract users and developers from other chains. This also limits the project's scalability and cross-chain asset liquidity, indirectly leading to weak ecosystem growth.

VI. The Future Restart Path of KAIA

Kaia's competitiveness lies in its regional advantages and the stability of its regulatory environment. In the highly compliant markets of Japan and South Korea, Kaia can legally provide financial and NFT services, increasing its trust and usage rates in the Asian market. Compared to TON's global decentralized positioning, Kaia is expected to quickly capture the East Asian market through localized services and regulatory support.

Kaia's rise in the East Asian market is not only the result of the merger of Klaytn and Finschia but also represents the potential of blockchain in mainstream social and payment applications. Its success will depend on whether it can continuously invest in diversified products, user education, and market promotion to achieve widespread coverage of the Web3 ecosystem. Based on the current project activity levels and protocol development status, Kaia's path to a thriving ecosystem remains challenging. Currently, Kaia has released the Portal task (announced on October 30 that it will launch Portal v1.2 to enhance incentives to attract more participants), and exchanges in different regions have expressed support for Kaia's conversion, as summarized in the table below, but the operational status of the ecosystem needs long-term attention.

Looking ahead, as a new blockchain project formed by the merger of Klaytn and Finschia, Kaia possesses unique competitiveness and development potential. Its regional advantages and stable regulatory environment provide strong support for its rise in the East Asian market, and it is expected to leverage the strong user bases of LINE and Kakao to create a widely influential Asian Web3 ecosystem.

The rebranded KAIA is writing its unique story in comparison and competition with the TON ecosystem. Its future is full of uncertainties but also contains infinite possibilities, making it worthy of our continued attention and anticipation.

Special Thanks

Creating is not easy. If you need to reprint or quote, please contact the author for authorization or indicate the source in advance. Thank you again for the support of the readers;

Written by: Cage / Mat / Darl / WolfDAO

Proofread by: Punko

Special thanks: Thanks to the above partners for their outstanding contributions to this issue's content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。