Trump's re-election as president and his active support for cryptocurrency may become a key catalyst for the development of the U.S. crypto market, thereby having a profound impact on the global crypto market.

Written by: Beosin

On November 6, Trump won the U.S. election, benefiting from his friendly attitude towards the crypto industry, with BTC repeatedly hitting historical highs and approaching the $90,000 mark. Trump's return to power has sparked market attention on financial policies, especially regarding the cryptocurrency industry.

On November 13, according to a report by The Verge, President-elect Donald Trump appointed Elon Musk and Vivek Ramaswamy to lead the government efficiency department DOGE—paving the way for his administration to "cut government bureaucracy, reduce overregulation, cut wasteful spending, and reorganize federal agencies."

According to a statement released on Truth Social, the department will operate in some way "outside of government" and will collaborate with the White House and the Office of Management and Budget. The statement indicated that Musk and Ramaswamy must complete their work by July 4, 2026.

Image source: Musk's X account

It can be seen that Trump's re-election as president and his active support for cryptocurrency may become a key catalyst for the development of the U.S. crypto market, thereby having a profound impact on the global crypto market. This could not only change the policy environment of the crypto industry but also help attract institutional capital and innovative talent, pushing the U.S. towards a leadership position in the global crypto economy.

1. Continuous Growth of Cryptocurrency Holders in the U.S.

In recent years, the number of cryptocurrency holders in the U.S. has significantly increased. According to market research data, over 20% of American adults owned some form of crypto asset in 2023, particularly mainstream coins like Bitcoin and Ethereum. This growth trend is driven by several factors, including economic uncertainty, fiat currency inflation, and the gradual penetration of blockchain technology in the financial industry. The market's optimistic expectations following Trump's return may further drive the increase in the number of holders in the short term.

Cryptocurrency holders include not only retail investors but also increasingly attract more institutional investors. Banks, hedge funds, pension funds, and other institutions are gradually entering the crypto asset management space, making the overall market participants more diverse. At the same time, the entry of institutional investors positively contributes to the market's stability and liquidity, further promoting the normalization of the cryptocurrency market.

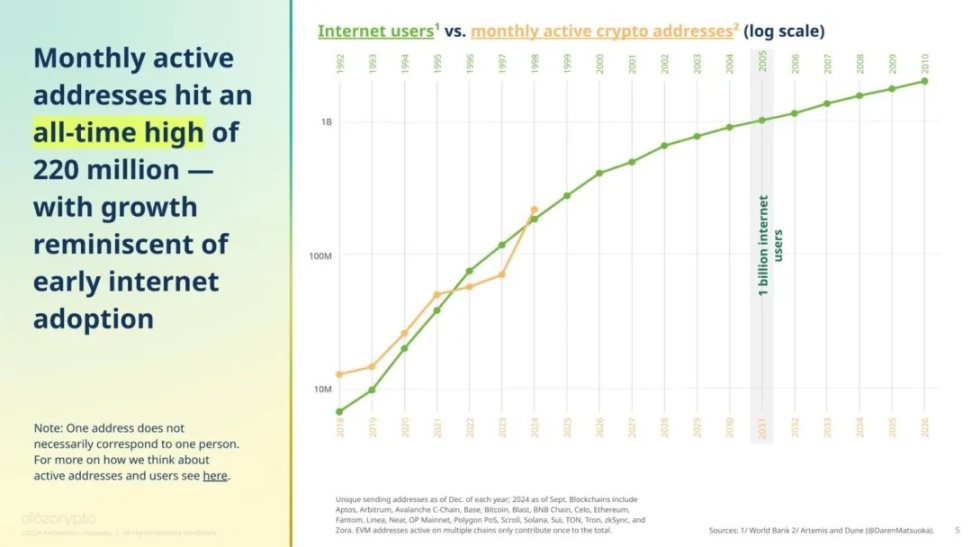

According to data, in September, there were 220 million addresses that had interacted with the blockchain at least once, more than doubling since the end of 2023.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

The surge in active addresses is mainly attributed to Solana, which has about 100 million active addresses. Following that are NEAR (31 million active addresses), Coinbase's popular L2 network Base (22 million), Tron (14 million), and Bitcoin (11 million). Among Ethereum Virtual Machine (EVM) chains, the second most active chain after Base is Binance's BNB chain (10 million), followed by Ethereum (6 million).

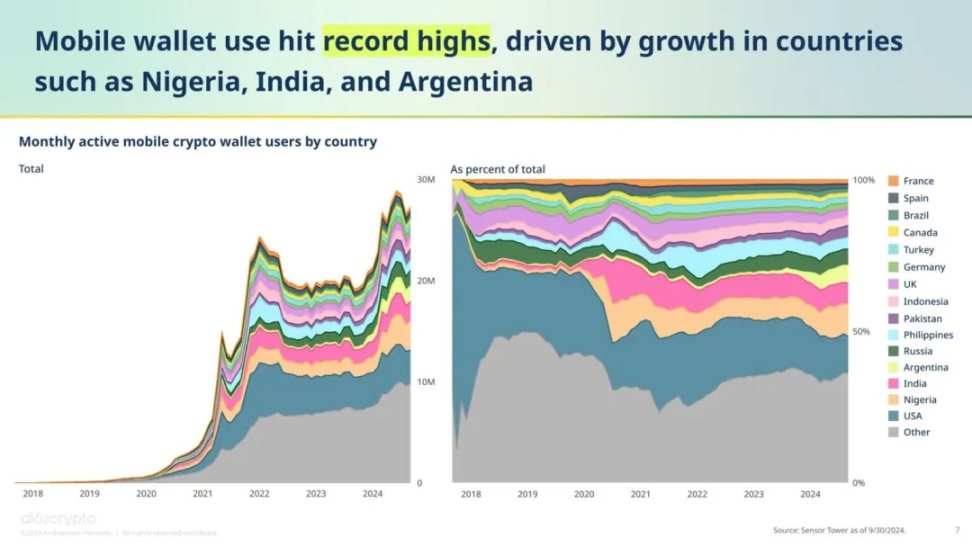

Meanwhile, in June 2024, the number of monthly active crypto wallet users reached a historic high of 29 million. Although the U.S. accounts for the largest share of monthly mobile wallet users at 12%, its share has declined in recent years as global adoption of cryptocurrency continues to grow, and more projects seek regulatory compliance by geofencing the U.S. out.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

2. Changes in Regulatory Policies Under the Trump Administration

In 2022, the collapse of the trading platform FTX led the Biden administration to intensify its crackdown on cryptocurrencies, causing dissatisfaction among executives and investors in the crypto space. Subsequently, federal regulatory agencies focused on combating fraud, taxing cryptocurrency investment gains, and attempting to classify more digital tokens as securities to strengthen regulation.

As a result, the U.S. Securities and Exchange Commission (SEC) became the primary regulatory body, and its chairman Gary Gensler has filed significant lawsuits against major platforms like Coinbase, Ripple, and Binance in recent years, accusing them of violating investor protection regulations. All companies have denied these allegations.

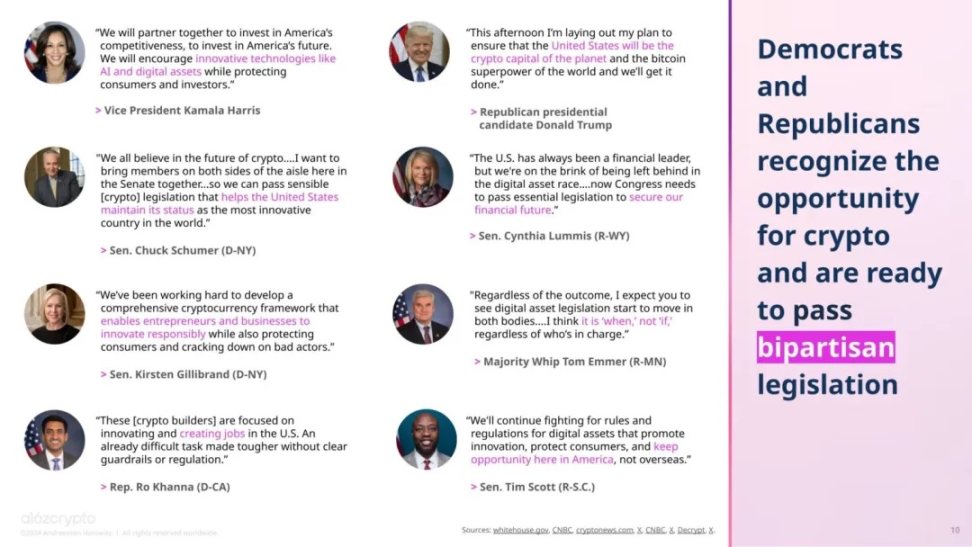

Before the election, many politicians anticipated that momentum would increase with the passage of bipartisan crypto legislation. An increasing number of policymakers and politicians have taken a positive stance on cryptocurrency.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

This year, the industry has also inspired other significant policy initiatives. At the federal level, the House of Representatives approved the Financial Innovation and Technology Act of the 21st Century (FIT21) with bipartisan support, with 208 Republicans and 71 Democrats voting in favor. The bill is awaiting Senate review and approval and could provide much-needed regulatory clarity for cryptocurrency entrepreneurs.

Equally significant, at the state level, Wyoming passed the Decentralized Non-Profit Association (DUNA) Act, which grants legal recognition to decentralized autonomous organizations (DAOs) and allows blockchain networks to operate legally without compromising decentralization.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

At the Bitcoin conference in Nashville in 2024, Trump promised to establish a committee of industry experts and implement policies favorable to cryptocurrency. He also pledged to designate Bitcoin as a "national strategic reserve" and to fire SEC Chairman Gensler. These commitments sparked enthusiastic responses again after Trump's victory.

Cameron Winklevoss passionately wrote on social media: "Imagine if the cryptocurrency industry no longer had to spend billions fighting the SEC, but instead invested that money in the future of currency; how much we could achieve in the next four years. Amazing things are coming."

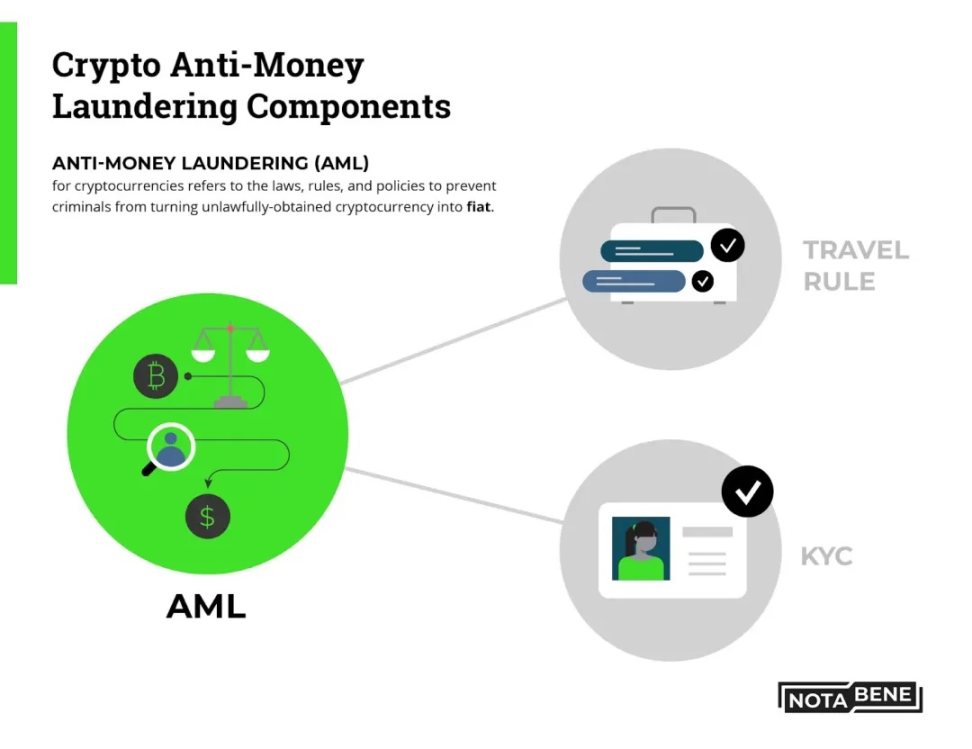

3. Anti-Money Laundering (AML) Remains Important in the Cryptocurrency Market

Anti-money laundering (AML) is crucial in the cryptocurrency market. The decentralized and anonymous nature of cryptocurrencies provides a convenient avenue for criminals to launder money. As the number of market holders increases, especially with the inclusion of institutions, AML requirements become increasingly important. The Trump administration may adopt stricter AML policies in the future to curb illegal activities.

In 2014, the FATF issued guidelines for anti-money laundering in cryptocurrency, prompting policymakers in FATF member countries to take swift action. The U.S. Financial Crimes Enforcement Network (FinCEN), the European Commission, and dozens of other regulatory agencies have incorporated most of the FATF's anti-money laundering recommendations for cryptocurrencies into law.

The responsibility then falls on cryptocurrency exchanges, stablecoin issuers, and some DeFi protocols and NFT markets (depending on the situation), which the FATF defines as Virtual Asset Service Providers (VASPs). In the future, VASP compliance officers must conduct mandatory KYC checks and regularly monitor suspicious activities to prevent transactions that may be related to money laundering and terrorist financing.

Additionally, VASPs must report suspicious activities to relevant regulatory agencies and institutions responsible for analyzing the flow of funds and using various tools, including blockchain analysis, to trace illegal activities back to real-world identifiers.

Image source: https://notabene.id/crypto-travel-rule-101/aml-crypto

In recent years, the U.S. Treasury has introduced several policies that strengthen anti-money laundering regulations for cryptocurrencies. The Trump administration may continue this policy direction, with expectations to further enhance AML compliance review requirements for cryptocurrency exchanges. For example, cryptocurrency exchanges may need stricter identity verification measures while submitting more detailed transaction records to ensure compliance for all transactions. It is anticipated that under this policy push, cryptocurrency exchanges in the U.S. market will place greater emphasis on user identity verification, and projects that meet AML standards will gain market recognition.

Stricter AML policies may exert some pressure on market liquidity in the short term, but in the long run, they will help enhance market transparency and trust, paving the way for further entry of institutional investors. As regulatory policies are further implemented, compliant exchanges and projects may gain a greater competitive advantage in the market.

4. Possible Impact of Trump's Policies on Future Markets

With Trump's re-election as president, his supportive attitude towards cryptocurrency may have a profound impact on future markets. Here are some key areas of potential impact:

(1) Shift in the Regulatory Environment

Trump has promised to fire the current SEC Chairman Gary Gensler and replace him with a "regulator who understands crypto." This change suggests that the regulatory environment for the U.S. crypto industry may become more lenient and friendly. Currently, the U.S. cryptocurrency industry faces high compliance pressures, and if regulatory policies become more open, it will help reduce compliance costs for businesses, attracting more crypto projects to develop in the U.S. This could drive more capital and talent into the U.S. crypto market, further enhancing the competitiveness of the U.S. crypto industry.

(2) Improvement in Cryptocurrency Investment Sentiment

Trump's public support for Bitcoin and cryptocurrencies, stating that he hopes the U.S. will become a "Bitcoin superpower," is a significant boost for investor sentiment. Investors and businesses are often more willing to invest in and innovate with crypto assets in a confident policy environment. Trump's attitude may bring about a wave of bullish sentiment, driving funds into the crypto market and positively impacting the prices of mainstream crypto assets like Bitcoin, potentially even triggering a new bull market.

(3) Bitcoin Mining and Related Industries Returning to the U.S.

Trump's vision of "Bitcoin made in America" indicates that he may push to relocate the Bitcoin mining industry back to the U.S., further reducing dependence on other countries, especially mining giants like China. With more lenient energy policies and tax incentives, the U.S. mining infrastructure could expand rapidly, making the U.S. one of the global leaders in Bitcoin computing power. As mining activities increase, upstream industries such as mining equipment and power infrastructure will benefit, leading to job growth and technological innovation.

(4) Accelerating Traditional Financial Institutions' Engagement in Crypto

If Trump implements friendly crypto policies, banks, funds, and other traditional financial institutions may be more proactive in entering the crypto market. The participation of traditional financial institutions will bring more liquidity, enhance market maturity, and promote the compliance and credibility of crypto assets. The entry of institutional investors can deepen the market and reduce volatility, thereby attracting more mainstream users to participate in crypto investment and usage.

(5) Changing Global Cryptocurrency Industry Competitive Landscape

If Trump positions the crypto industry as part of an economic development strategy, the U.S. policy stance may influence the attitudes of other countries. If the U.S. becomes a "Bitcoin superpower," other countries may be forced to accelerate their cryptocurrency policy formulation to avoid falling behind in the global crypto economic landscape. This international competition will drive global policy reforms, and the overall development speed of the cryptocurrency and blockchain industry may further accelerate.

Summary

The direction of the financial market under Trump's administration will directly impact the regulatory environment of the cryptocurrency market. As the number of cryptocurrency holders steadily increases, the market's demand for regulation and compliance is also growing. This article aims to analyze the potential impact of the Trump administration on the U.S. cryptocurrency market, particularly regarding changes in regulatory intensity and anti-money laundering efforts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。