Those institutions that once ignored Bitcoin missed such a significant opportunity and may start to experience FOMO, overturning their previous positions to enter the market.

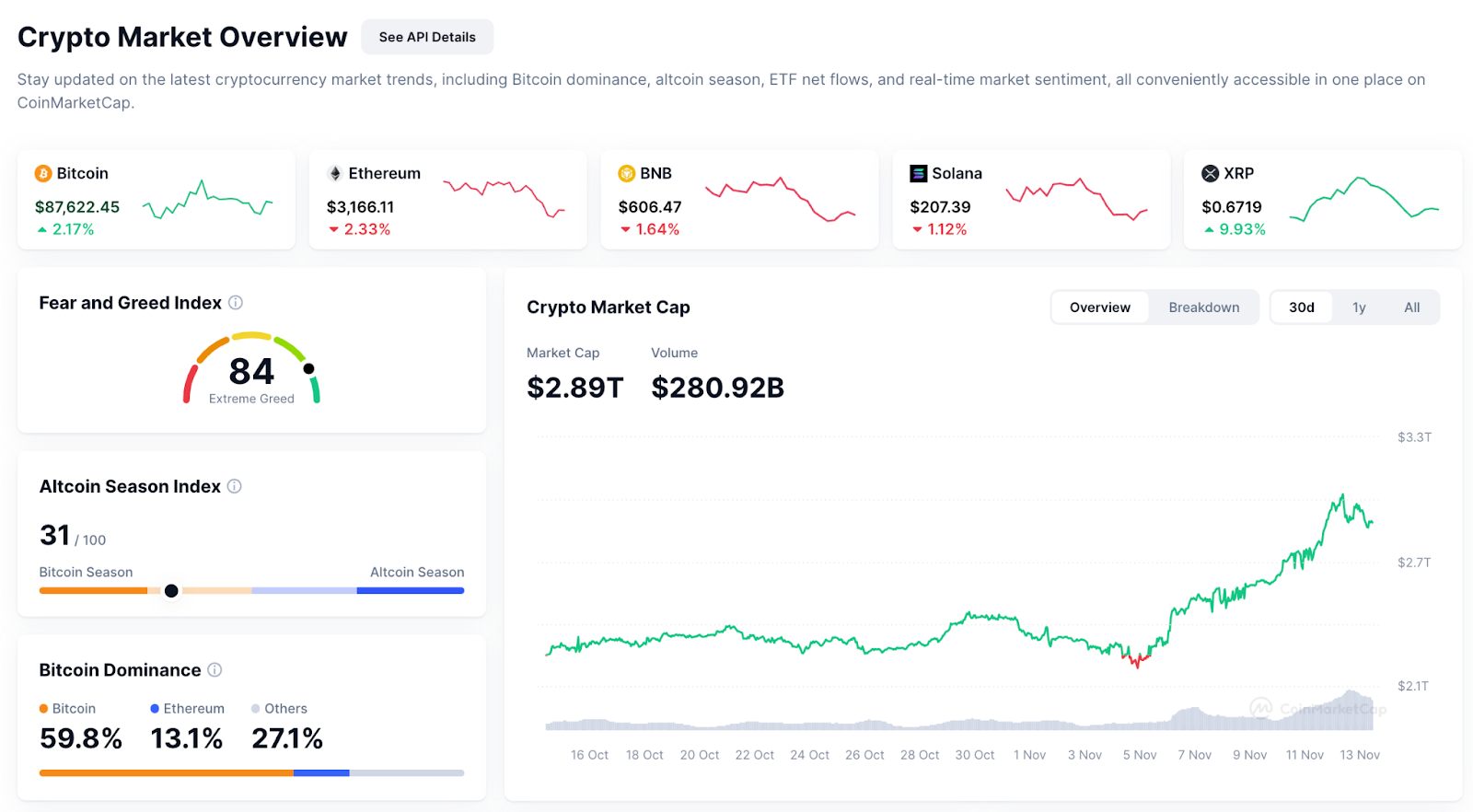

On November 5, the U.S. elected Trump as president again. As a politician who supports cryptocurrency, Trump promised to reduce regulation and accelerate Bitcoin's growth, after which the price of Bitcoin hit an all-time high of $89,915 (on November 12).

Since the beginning of the year, Bitcoin (BTC) has surged 114%, sending a clear message: those institutions that once overlooked Bitcoin missed a significant opportunity and may begin to experience FOMO, overturning their previous positions to enter the market. The question is no longer whether Bitcoin belongs in institutional portfolios, but rather: can you afford not to include it? From regulatory breakthroughs and ETF approvals to the continuously evolving infrastructure of Bitcoin, the narrative has changed. Institutional FOMO may become the main driving force behind the next round of BTC price increases.

From Illegality to Institutionalization: The Stamp of Regulatory Recognition

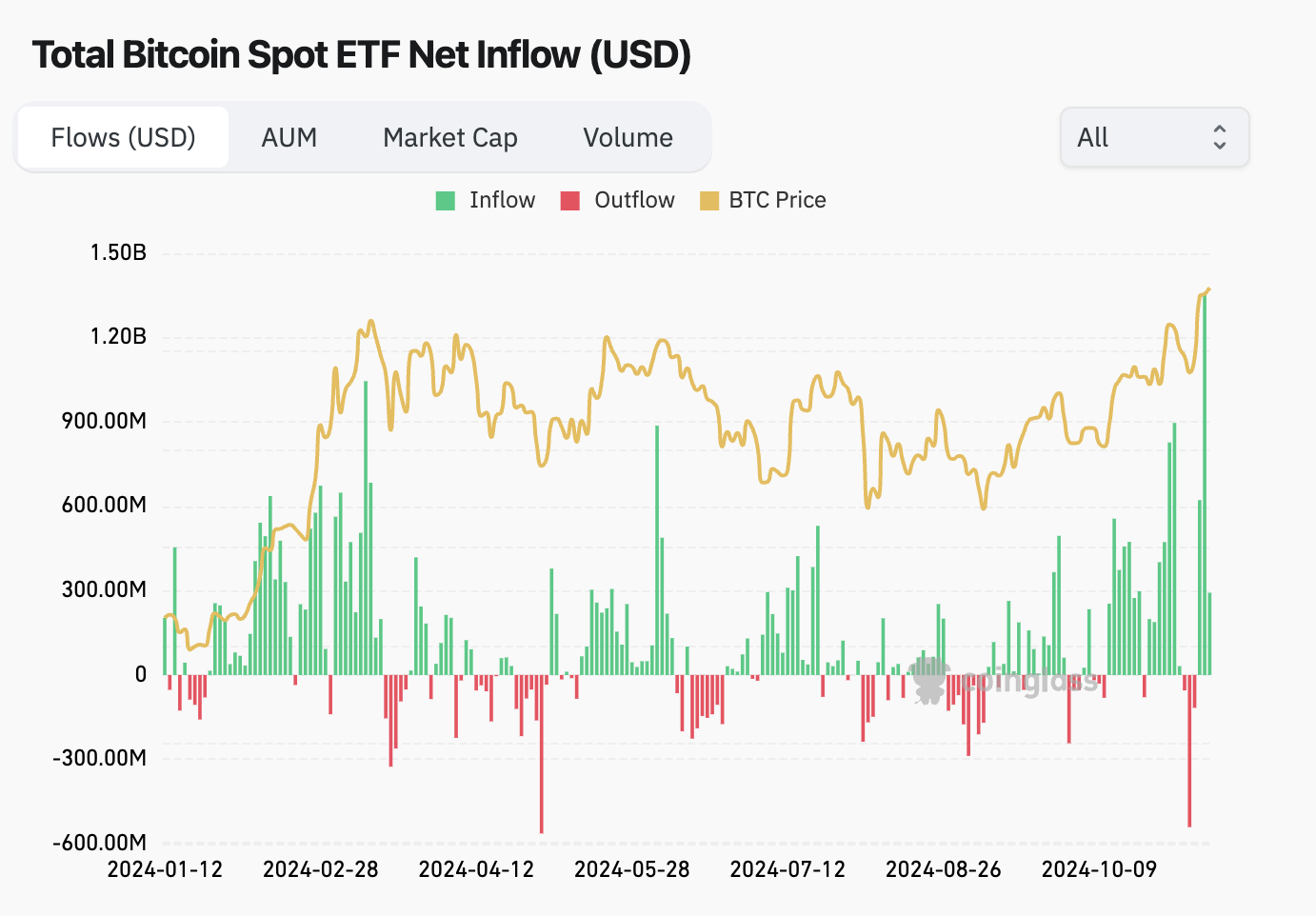

One of the main reasons institutions have avoided Bitcoin is its lack of legitimacy. However, the recent regulatory approval of Bitcoin ETFs has fundamentally changed this perspective. Institutional interest in Bitcoin is also clearly on the rise, with BlackRock's iShares Bitcoin Trust (IBIT) maintaining the top position in inflows among newly launched products by the company.

Outside the U.S., the global digital asset ETF market is expanding. Products have been launched and matured in regions such as Hong Kong, Australia, Canada, and Europe, establishing Bitcoin's foothold in regulated markets worldwide. Each ETF provides a framework that elevates Bitcoin from a speculative asset to a recognized asset class.

Debunking the Argument Against Intrinsic Value

For years, critics of Bitcoin have claimed it lacks intrinsic value. In recent years, the blockchain industry's significant investment in research and educational resources has gradually led institutions to accept the evolving role of this asset. Various publications, think tanks, and educational centers are deepening the understanding of Bitcoin's potential. An increasing number of institutions have accepted BTC's characteristics as "digital gold" and are beginning to use it to hedge against inflation and traditional market volatility. The on-chain transparency of blockchain is also an advantage that other traditional Wall Street assets cannot match; for institutions, this feature makes every transaction visible and traceable, providing a level of transparency that many traditional assets lack.

The New Frontier of Digital Gold and Payment Functionality

Bitcoin's role in the financial ecosystem has far exceeded that of a purely speculative asset. With advancements in Bitcoin infrastructure, including Layer 2 solutions and the Lightning Network, Bitcoin has been enhanced as both a store of value and a medium of exchange.

Additionally, two significant developments in the Bitcoin ecosystem in 2024—BTCFi and the trend of inscriptions/runes—emphasize Bitcoin's expanding utility. In particular, BTCFi represents a new class of financial products built around Bitcoin, directly linking DeFi functionalities to BTC. It unlocks the ability to issue fungible and non-fungible assets on the Bitcoin network, which can be transferred using the Bitcoin mainnet or its Layer-2 solutions. This broader availability supports Bitcoin's appeal as an innovative asset with practical applications, aligning with both retail and institutional interests.

Volatility Issues? Comparing Bitcoin with Tech Stocks and Traditional Assets

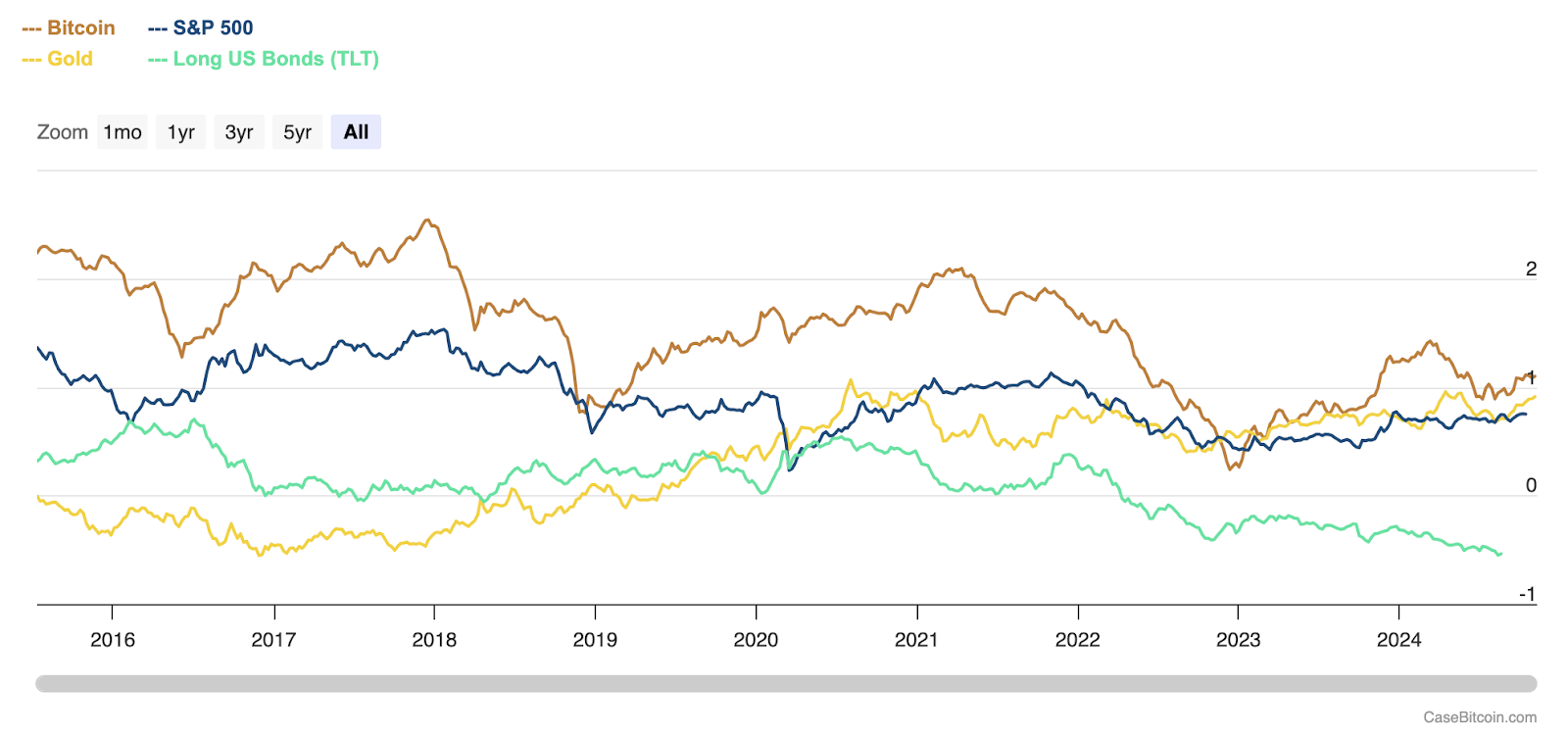

The issue of Bitcoin's volatility still exists, but recent data paints a more nuanced picture. When comparing Bitcoin's volatility and returns with those of tech stocks, Bitcoin appears to be more stable than commonly perceived.

Bitcoin vs. Traditional Assets' Sharpe Ratios (5-Year Time Frame)

The comparison of Bitcoin's price performance with traditional assets shows that as Bitcoin gradually becomes a financial instrument, its level of volatility seems more attractive. Moreover, its risk-adjusted returns (measured by the Sharpe ratio) often outperform traditional assets. In the current market environment, macroeconomic challenges and geopolitical uncertainties make it increasingly difficult to find assets with such potential returns.

Bitcoin's price volatility is gradually being understood as an opportunity rather than a drawback, providing diversification opportunities that traditional assets cannot match.

Accessibility for Institutional Investors: Growing Market Entry Channels

The excuses for institutions facing difficulties in investing in Bitcoin are no longer valid.

Firstly, institutions can now directly hold Bitcoin using institutional custody solutions. Companies like Coinbase Custody and Fidelity Digital Assets have significantly expanded their institutional custody services, offering more effective and secure storage options that meet institutional needs. These custody services comply with regulatory standards, reducing institutions' concerns about the risks of storing digital assets.

Secondly, institutions can invest through BTC derivatives. The Bitcoin futures market has now been fully institutionalized, with CME's Bitcoin futures open interest recently hitting a historical high of $14.6 billion this week. Institutional investors now have ample tools to hedge or speculate in a regulated environment, while long and short products also provide flexibility in investment strategies.

Thirdly, institutions can invest through ETFs, with spot ETFs now approved in the U.S., Hong Kong, Canada, Australia, and European markets, providing simplified and regulated channels that can meet the needs of large institutional asset management firms and consumer-facing investment platforms.

Reassessing Institutional Positions: Can You Still Confidently Reject Bitcoin?

Due to concerns about legitimacy, intrinsic value, accessibility, and volatility, institutional portfolios have long avoided Bitcoin. However, these arguments have been systematically addressed. ETFs have institutionalized Bitcoin; research and education have expanded its recognized value; custody solutions and financial products have improved its accessibility; comparative data indicates its viability as a high-return asset.

The ultimate question is: are the old reasons for institutions to reject Bitcoin still valid? The moment for institutions to enter the market has arrived; those entering now will be able to drive the next round of Bitcoin price increases. For those institutions still holding opposing views, they will be sitting on the sidelines, missing this opportunity to get on board.

Bitcoin's journey from a fringe asset to an institutional-grade investment has experienced rapid growth, robust infrastructure, and an increasing array of applications. As major sovereign funds, pension funds, large banks, and institutional investors consider their next steps, ignoring Bitcoin may no longer be an option. The moment of institutional FOMO has arrived: embrace this change or risk being left behind by the market.

Institutional FOMO: The Driving Force Behind the Next Bitcoin Surge?

With the development of Bitcoin's legitimacy, infrastructure, and market access, institutional interest is increasingly triggering a FOMO-like phenomenon. When institutions enter the market, they typically do so in a significant manner, which could drive Bitcoin's price higher.

Historically, Bitcoin's halving cycles have been associated with price increases, and a potential rebound could push Bitcoin's price above $100,000, expected to occur by the end of this year. As new administrative policies take effect in January, further regulatory clarity may catalyze more sovereign funds, pension funds, large banks, and institutional investors to participate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。