Original | Odaily Planet Daily (@OdailyChina)

On November 11, Binance announced the launch of spot trading for Meme coins ACT and PNUT. Subsequently, PNUT saw a daily increase of 250%, while ACT surged by 2000%, with its market cap rising from $20 million to over $300 million within a few hours. Following the launch of the "uppercase and lowercase Meme coin" Neiro, Binance's move once again sparked intense reactions from the market and the community, with some voices questioning the existence of a conspiracy behind it, while others actively supported Binance's backing of the community and sought to identify and position themselves for the next Meme coin that could be listed on Binance.

So, why has Binance, which once kept its distance from Meme coins, recently begun to frequently support them? Is it in response to the bull market rhythm or to cater to a popular trend? Is it a lowering of listing standards or a "victory for the community"? Odaily Planet Daily will analyze in this article the reasons behind Binance's launch of Meme coins and whether Meme coins can achieve a win-win situation for Binance and the community.

Why Binance Recently Launched Meme Coins

The first half of 2024 has been a year of demystifying VC and altcoins in the crypto space. Retail investors have gradually realized that tokens with high valuations and low initial circulation leave almost no profit space for secondary traders after TGE. Coupled with the market selling pressure from VC token unlocks, tokens backed by VCs have gradually lost credibility in the market.

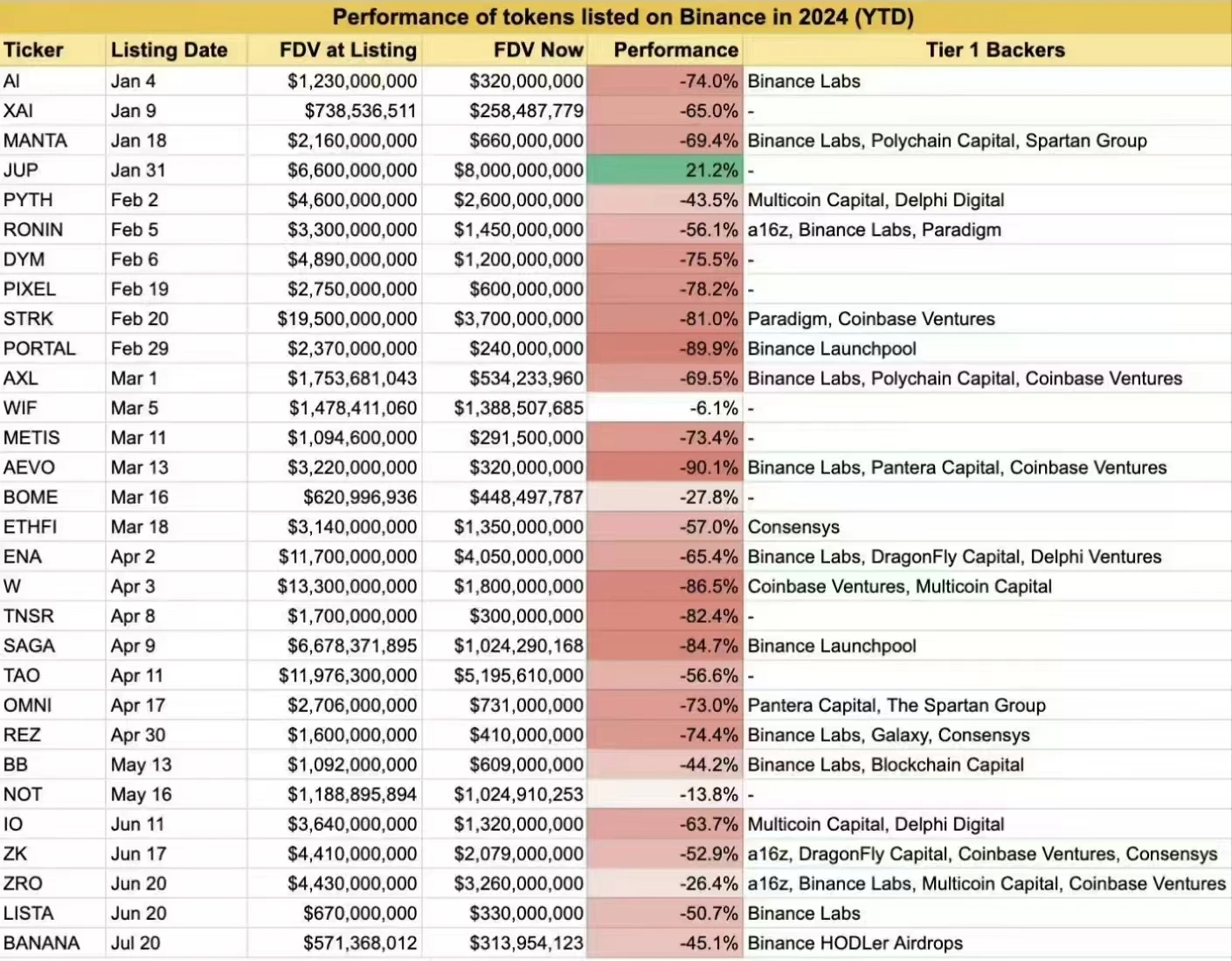

In this context, Binance, as the "liquidity hub of the crypto market," has also come under public scrutiny. Some users have pointed out the performance of VC coins launched on Binance in the first half of 2024, with several tokens dropping over 50% after listing. As a result, voices in the market have increasingly accused Binance of colluding with VCs and project parties to "harvest community profits" and excessively exploit users, damaging Binance's image and credibility among users.

Community summary of the performance of new coins on Binance, data as of August

The launch of Meme coins can be seen as a remedy for Binance.

The clues supporting Meme coins may trace back to a report released by Binance Research in May regarding "high valuation and low initial liquidity tokens," which pointed out the trend of VC coins launched in 2024 generally having high token valuations but low circulating supply, as well as the market pressure from token unlocks. Additionally, the report highlighted the advantages of Meme coins, noting that most Meme coins are fully circulating and have an MC/FDV ratio of 1, meaning holders are not diluted in value due to token issuance. Even if these tokens lack utility, these characteristics have made retail investors very interested in Meme coins.

Although the report did not generate much market reaction at the time, it now indirectly proves that Binance had already recognized the appeal of Meme coins to users. Later, Binance co-founder He Yi published articles on Binance Square for two consecutive days in June, first clarifying that Binance does not control pricing and then suggesting that the ICOs of 2017, IEOs of 2021, and even the "haircut" strategies of 2023 may no longer be suitable for the current market, implicitly questioning whether a market without VC investments and fewer project parties would be healthier.

The subsequent story is well-known: Binance simultaneously launched the uppercase and lowercase Meme coin Neiro, officially starting its journey with Meme coins. (Related reading: Neiro and NEIRO listed on Binance, is the Meme coin track reaching a turning point?)

Although Binance's launch of Neiro and subsequent series of Meme coins has sparked some controversy, compared to the accusations faced from all users regarding the launch of VC coins, Meme coins have allowed Binance's image and credibility within the community to be restored. This time, by launching the token ACT, Binance's credibility among users has risen again, with even positive remarks like "miracles only happen on-chain + Binance" emerging.

After several months, Binance's community image "self-rescue" has garnered positive feedback.

Meme Coins Are More Accessible

In addition to restoring confidence, the greater accessibility and wealth effect of launching Meme coins in a bull market may also be an important reason for Binance's support of Meme coins. Binance Research released a report on November 4 stating that Meme coins, besides being fairer, provide more easily digestible narratives for everyday investors, allowing retail investors to understand Meme coins more quickly than the technically complex L2 or DeFi.

Especially for breaking into new circles, Meme coins can more quickly establish communities and drive user speculation, converting potential users. Compared to on-chain purchases, exchanges offer a more convenient and direct purchasing experience, which may truly bring incremental users and funds to exchanges during a bull market.

Are There Any Hidden Agendas Behind the Launch of Meme Coins?

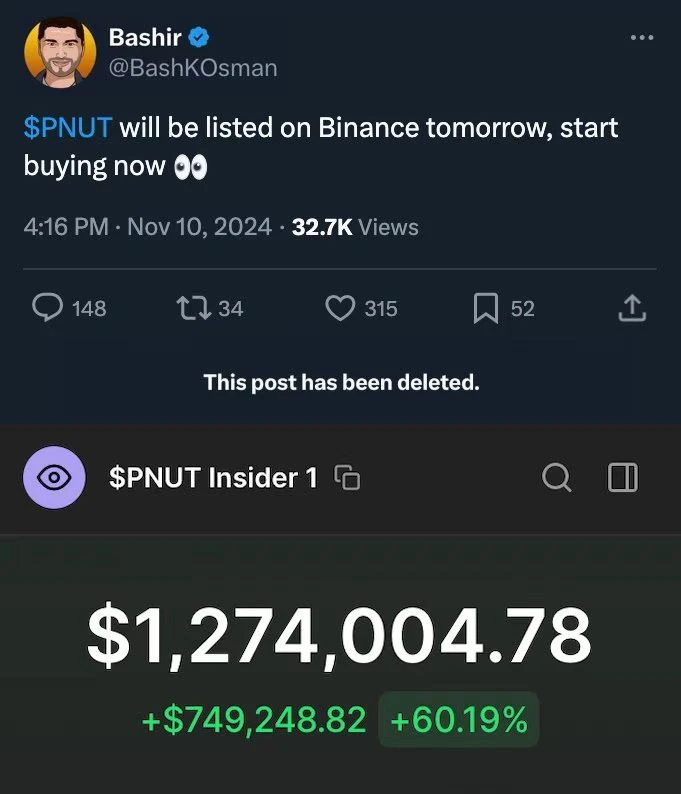

After Binance regained credibility through strong support for Meme coins, there are also voices suggesting that Meme coins are more prone to insider trading and "conspiracy groups." Before Binance announced the launch of ACT and PNUT, there were indications on social media and on-chain that some users seemed to have insider knowledge.

The day before Binance announced the launch of PNUT, a user posted on X platform stating, "Binance will launch PNUT tomorrow, start buying now," and by the time people realized, the account had already been deactivated.

The community's skepticism and "conspiracy theories" surrounding ACT are even greater, with users uncovering multiple addresses that purchased ACT for $4,000 to $10,000 within five hours before the announcement. There are also conspiracy theories regarding the listing of ACT on Binance—some speculate that Binance is manipulating ACT, while others suggest that there are other conspiracy groups behind ACT or that Chinese KOL 0xWizard had prior knowledge of the insider information.

Image source: Internet

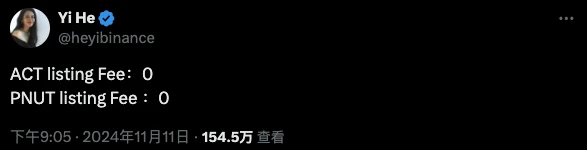

In response to the skepticism, Binance co-founder He Yi stated on the X platform that the listing fees for ACT and PNUT are both 0. 0xWizard also clarified that he was not aware of Binance's plans to list ACT that day, emphasizing that it was entirely a victory for the community.

As the "largest exchange in the universe," the standards and regulations for listing on Binance have always been a hot topic. Binance and He Yi have made many disclosures in this regard. When the launch of the "uppercase and lowercase Meme coin" Neiro sparked controversy, He Yi stated that the listing process at Binance consists of four stages: business, research team, committee, and compliance review. The listing standards require the project itself to have users, traffic, longevity, low market cap, and solid business logic. He Yi has also repeatedly explained the listing issues at Binance, including that if a project does not pass the screening process, no amount of money or percentage of tokens can secure a listing on Binance; he is not the final decision-maker in the listing process, and listing on Binance Futures does not guarantee a spot on the spot market, etc.

However, whether there are any hidden agendas behind Binance's launch of Meme coins remains a difficult issue to explain, regardless of how many times they clarify it. In the investment field, there are many uncertainties and elements of luck. When people are eager to find rationality for a situation or excuses for their investment failures, they may end up amplifying coincidences.

But in this market, which always offers opportunities, for speculators, discussing whether there is a conspiracy behind Binance's listings may not be the most important thing. What matters is to identify and position those Meme coins with a market cap of around $20 million, active communities, evenly distributed tokens, and good narratives in advance—what if Binance takes notice of them? (Related reading: Which Meme coin is likely to be listed on Binance next?)

Can Meme Coins Create a Win-Win Situation for Binance and the Community?

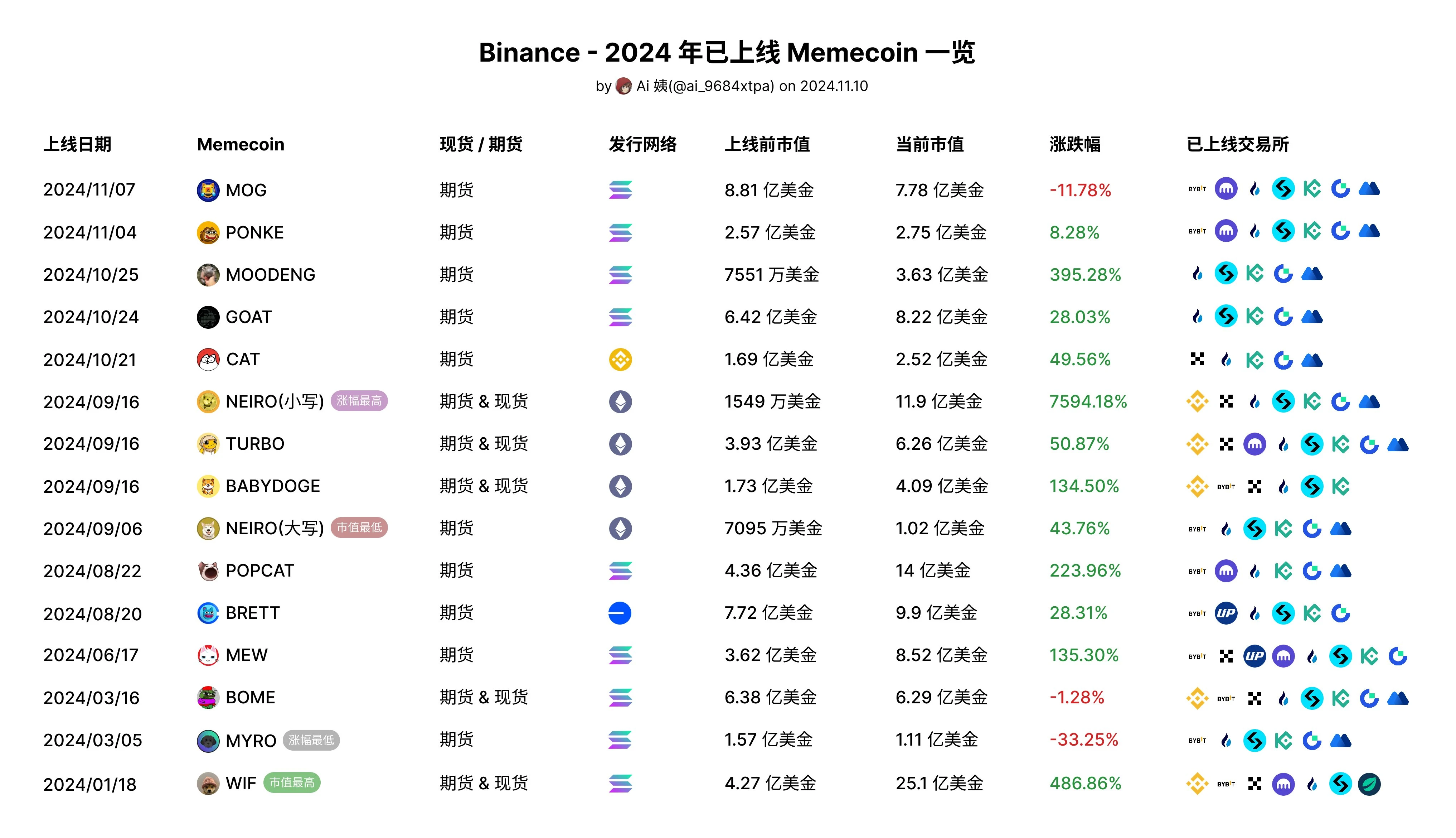

On November 11, on-chain analyst @ai_9684xtpa released an overview of the market performance of Meme coins launched by Binance in 2024. In stark contrast to the price performance of VC coins launched by Binance in 2024, the Meme coins listed on Binance exhibit a significant "listing effect," with the lowercase Neiro increasing by over 7000%, while ACT surged by more than 2000% on the day of its listing.

Such impressive returns are why users are flocking to Binance's listing of Meme coins today. From the results, it can be seen that Binance's launch of Meme coins has already achieved a win-win situation at this stage. For Binance, it has successfully restored its credibility in front of users and further enhanced the platform's influence and voice. The involvement of a major exchange can even reorder the rankings of leading projects in the sector; for users, both primary and secondary users still have significant profit margins after buying in post-listing.

But how long can this situation last? The "new Meme godfather" Murad stated that the asset class of Meme coins is rapidly being divided into two subcategories: PvP and PvE. However, Meme coins with PvE characteristics are rare in the market, as most Meme coins are merely products of PvP. Some users may believe that once a Meme coin is listed on Binance, it has moved away from PvP, but is Binance merely a larger PvP pool than on-chain? Currently, Binance has only listed a few dozen Meme coins, and once Meme coins become saturated on Binance like VC coins, it may also lead to a reduction in upward potential.

In this cycle, whether through primary listings or airdrop harvesting, VC-backed altcoins have lost their wealth effect, leading to fewer discussions about DeFi, GameFi, or Restaking. Blockchain developers have collectively embraced financial nihilism, turning their attention to the Meme world. In such a crypto space, is it truly a win-win situation that meets everyone's expectations?

On September 17, He Yi published a long article on Binance Square discussing the industry cycle, stating: "We are the pigs of the wind, stepping on the pulse of the times, and standing with users has brought us to today's Binance." This is indeed the case; not every action taken by Binance may be correct, but it is certainly what the market and community need.

Perhaps in the future, when the Meme coin market becomes saturated, the blockchain will experience a "technological renaissance," calling for attention to value coins. And by then, what choices will the market and Binance make?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。