On November 11th at 16:00, the AICoin Research Institute conducted a graphic and text sharing session on the topic of "The Best Path to Quick Freedom in a Bull Market: Funding Fee Arbitrage" in the 【AICoin PC Client - Group Chat - Live Broadcast】. Below is a summary of the live broadcast content.

The trading opportunities we wanted to share during the live broadcast still exist!

First, the host shared a screenshot of the opening position from the morning of the live broadcast.

Step 1: Open the PC client and find the strategy module.

Step 2: Select the arbitrage bot.

You can see that the price difference for BTC is still very high, and the funding fee rate is also high.

If you are a beginner, you can find this module.

Currently, there are still many arbitrage opportunities available, making it very suitable for large funds to come in and take advantage of the market.

Arbitrage is about making money using mathematics, meaning that unless the exchange's machines explode, you will always make a profit. After more than a decade of development, the probability of exchange downtime has become very low.

Therefore, it is also recommended that if you are arbitraging, do it on large platforms like OKX and Binance, which have strong technical capabilities.

This is the arbitrage position the host opened at 11 AM.

The operation was also conducted due to the significant arbitrage opportunity observed.

First, everyone should find the arbitrage section.

Then you can see that the arbitrage section is divided into several modules.

The front part is fee arbitrage, and the back part is price difference arbitrage.

Currently, there are many opportunities for fee arbitrage, which is worth everyone's attention!

Let’s briefly explain the rules of fee arbitrage, why we can make money from fee arbitrage, and where its stability lies.

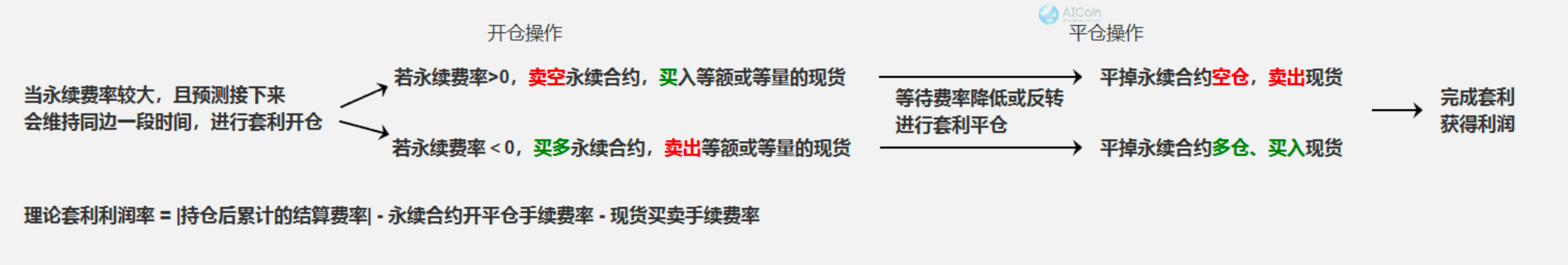

Fee arbitrage, specifically perpetual fee arbitrage, refers to simultaneously conducting two trades in opposite directions and equal amounts in the spot and perpetual contract markets, aiming to earn the funding fee income from perpetual contract trading.

In other words, there are equivalent returns between contracts and spot; one side makes money while the other side loses, averaging the positions of both, and then only earning the distribution of the funding fee.

That is, after arbitraging, you have opened both a short and a long position in equal amounts. Therefore, you will definitely not lose. Because one side is losing money while the other side is making money.

So how do you generate income? The income here is the funding fee income.

You only earn the distribution of the funding fee.

Now, what is the funding fee rate?

The funding fee rate is an important mechanism that anchors the spot price in perpetual contracts, used to balance long and short sentiments.

When the funding fee rate > 0, at settlement, the long pays the funding fee, and the short receives the funding fee;

When the funding fee rate < 0, the short pays the funding fee, and the long receives it.

Paying or receiving the funding fee = Nominal value of the position * Funding fee rate.

Simply put, the purpose of the funding fee is to maintain an important adjustment mechanism for average funds; the party making money in the market must compensate the party losing money.

For example, if the market is rising sharply, then the party going long is making money, and the party making money must compensate the losing party with the funding fee.

At this stage of rising prices, many funding fee opportunities will emerge.

The operation you can do is:

I buy a coin, then open a coin-based short position, and the arbitrage is complete.

Since you are shorting, when the price rises, the party going long will distribute the funding fee to you. Once you have made enough profit, or the opportunity has nearly disappeared, you can close the position and sell the coin.

In this process, you enter with U and exit with U, and due to the hedging, there is no loss; instead, you earn the funding fee income.

In summary, this process allows you to be a landlord in the crypto world, collecting rent three times a day.

The landlords of the crypto world will be everyone learning from the AICoin Research Institute!

Funding fees are generally collected every 8 hours, three times a day. The settlement times vary between different exchanges, and if you close your position before the settlement time, you will not need to pay or will not receive the funding fee.

Therefore, fee arbitrage requires attention to the funding fee.

Now let’s look at the arbitrage order the host opened before the live broadcast.

The host saw that the funding fee rate was high and the price difference was large. In recent days, it has been consistently positive, so the host immediately moved 14,000 U to open the arbitrage position.

Of course, if you are familiar with mathematics, arbitrage can be quite profitable.

Because you can calculate how much you can earn from each arbitrage.

Then, whether the money you earn each time with large funds can cover the risk-free rate of return (which can be approximated to the bank deposit interest rate), you will know whether to entrust your large funds to the bank for fixed-term wealth management or to use mathematics to make money yourself.

Regarding the principle of arbitrage, let’s give another example:

Funding fee arbitrage earns income through the funding fee settled in perpetual contracts.

If you only open a perpetual contract position, it is very likely that the contract loss will far exceed the funding fee income at settlement, so you need to make a position in the spot market in the opposite direction for hedging.

For example:

If you open a short position of 1 BTC in a perpetual contract, you need to buy 1 BTC in the spot market.

If the BTC price rises, your position will show a loss in the contract and a profit in the spot;

If the BTC price falls, your position will show a profit in the contract and a loss in the spot.

From the price calculation formula, you have already achieved a break-even point, no longer worrying about the price fluctuations, and can comfortably collect the perpetual fee rate.

Let’s do a simulation:

When the funding fee rate is greater than 0:

Currently, the funding fee rate for BTC perpetual contracts on Binance is 0.17%. Zhang San sees that there is still more than an hour until settlement.

At this time, Zhang San judges that the funding fee > 0 will continue; Zhang San shorts 2 BTC in the BTC perpetual market while buying 2 BTC in the spot market.

Then, after a little over an hour at settlement, Xiao Ming's short position will earn a funding fee income of: 2 * 0.17% = 0.0034 BTC.

So the funding fee income in terms of USDT is what Zhang San will steadily receive as rent.

When the funding fee rate is less than 0:

If a few days later the funding fee starts to decrease, or even turns negative, close the position and exit this arbitrage.

If the funding fee is negative, and you have coins in hand, then the suitable operation at this time is: go long in the perpetual market and sell coins (if you do not have spot to sell, you can borrow coins to sell).

However, I remind everyone that borrowing coins for reverse arbitrage carries certain risks. Therefore, the research institute generally recommends that beginners first learn to do forward arbitrage.

In fact, there are many quantitative teams in the market, and many programmers write numerous quantitative codes to help various large funds write hedging arbitrage codes. The arbitrage tools here at AICoin have already implemented all of this, simply put, it saves the cost of hiring a quantitative team for our AICoin users.

One person can do the work of an institution!

We have organized a secret tip chart.

You can take a screenshot and save it for understanding.

I believe everyone wants to earn more. When your funds accumulate to 100,000 U, 1,000,000 U, or 10,000,000 U, if you still operate unidirectionally, it is very risky.

If the students in our live broadcast room remember the AICoin live broadcast this time and use the arbitrage tools, then managing your large funds in the future will be effortless.

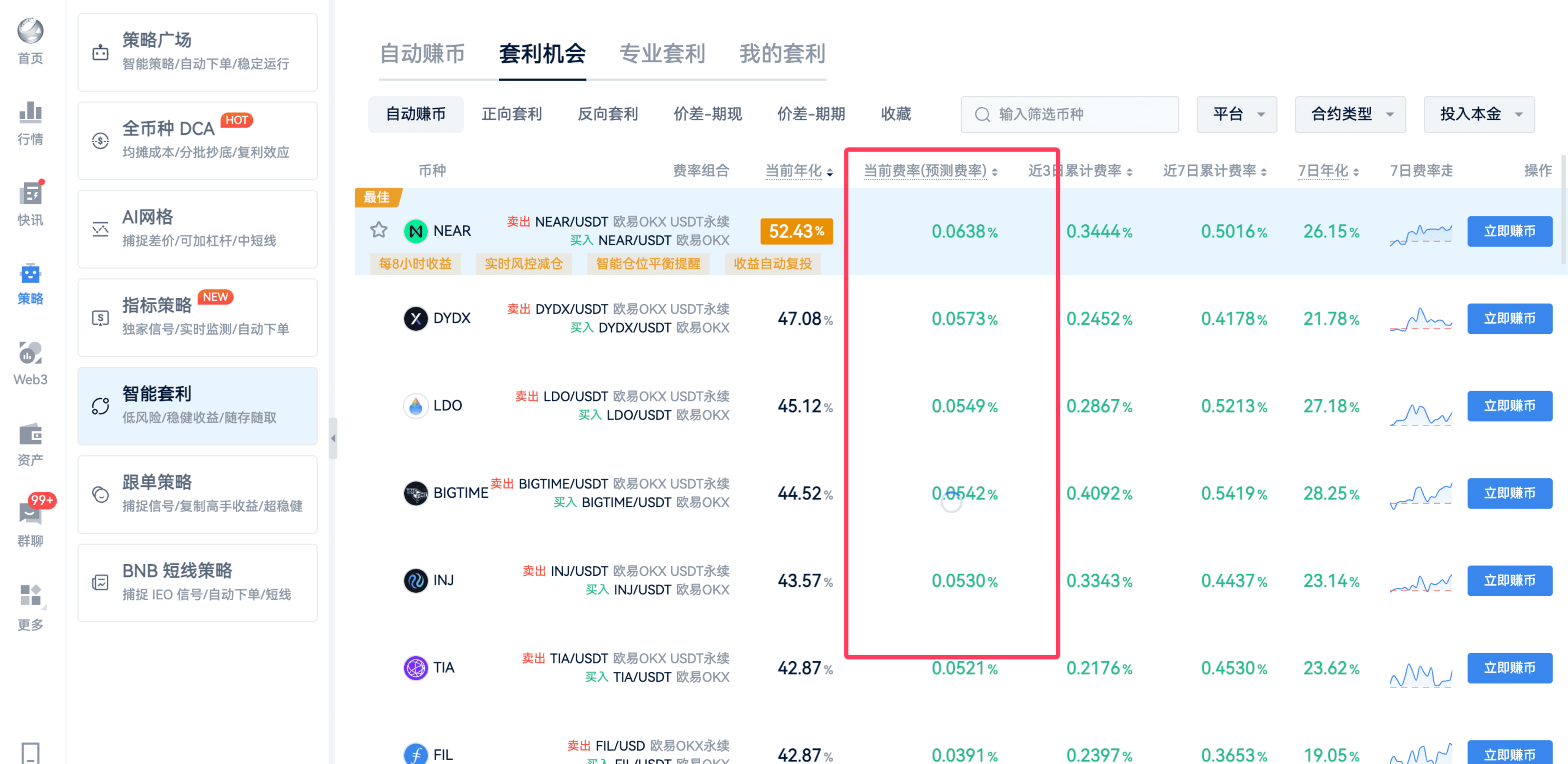

Automatically earning coins will recommend high-quality forward arbitrage opportunities.

I spoke too passionately because we really hope everyone understands the value of this arbitrage tool!

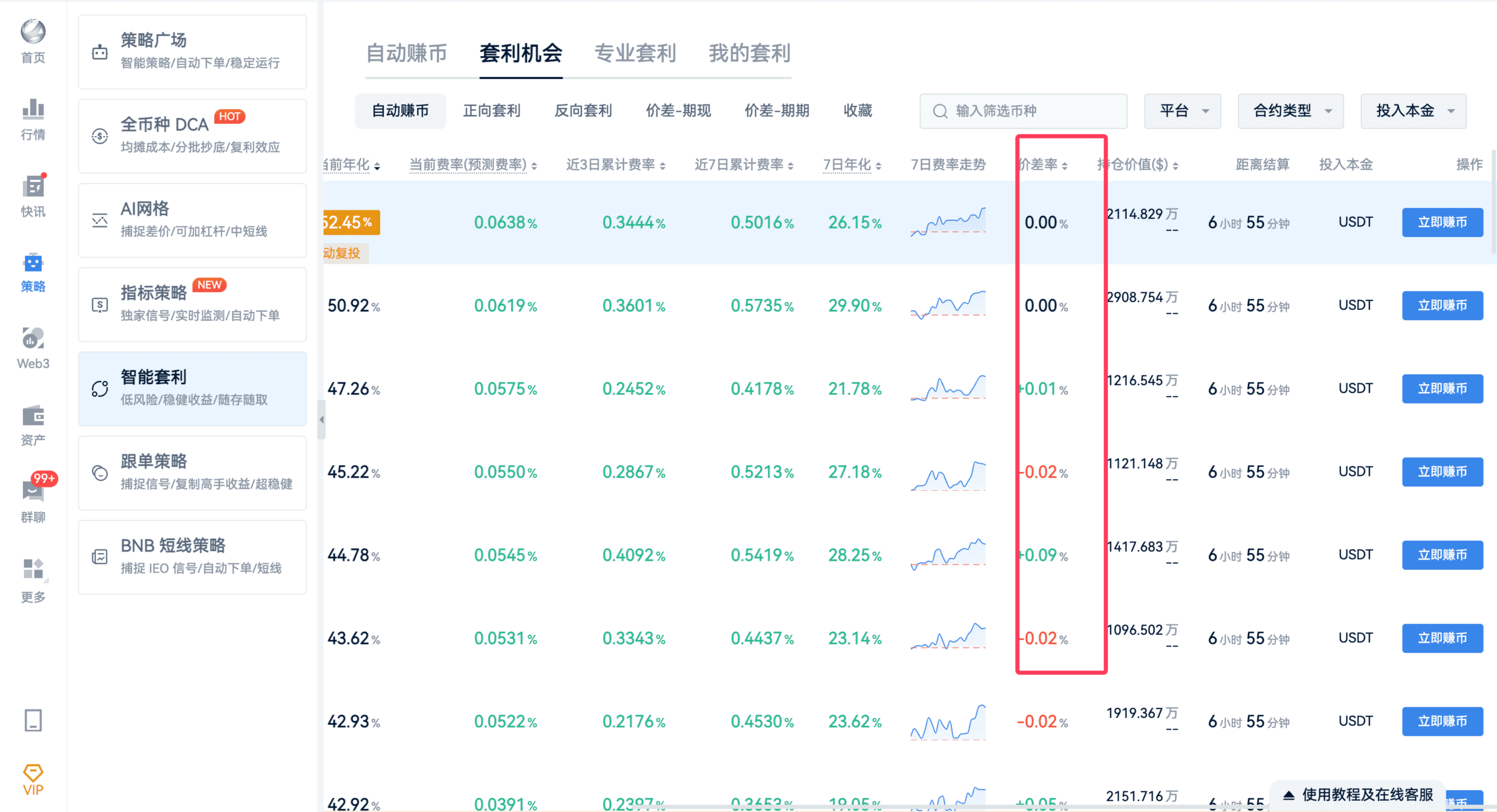

Now let’s study together which opportunities are worth pursuing.

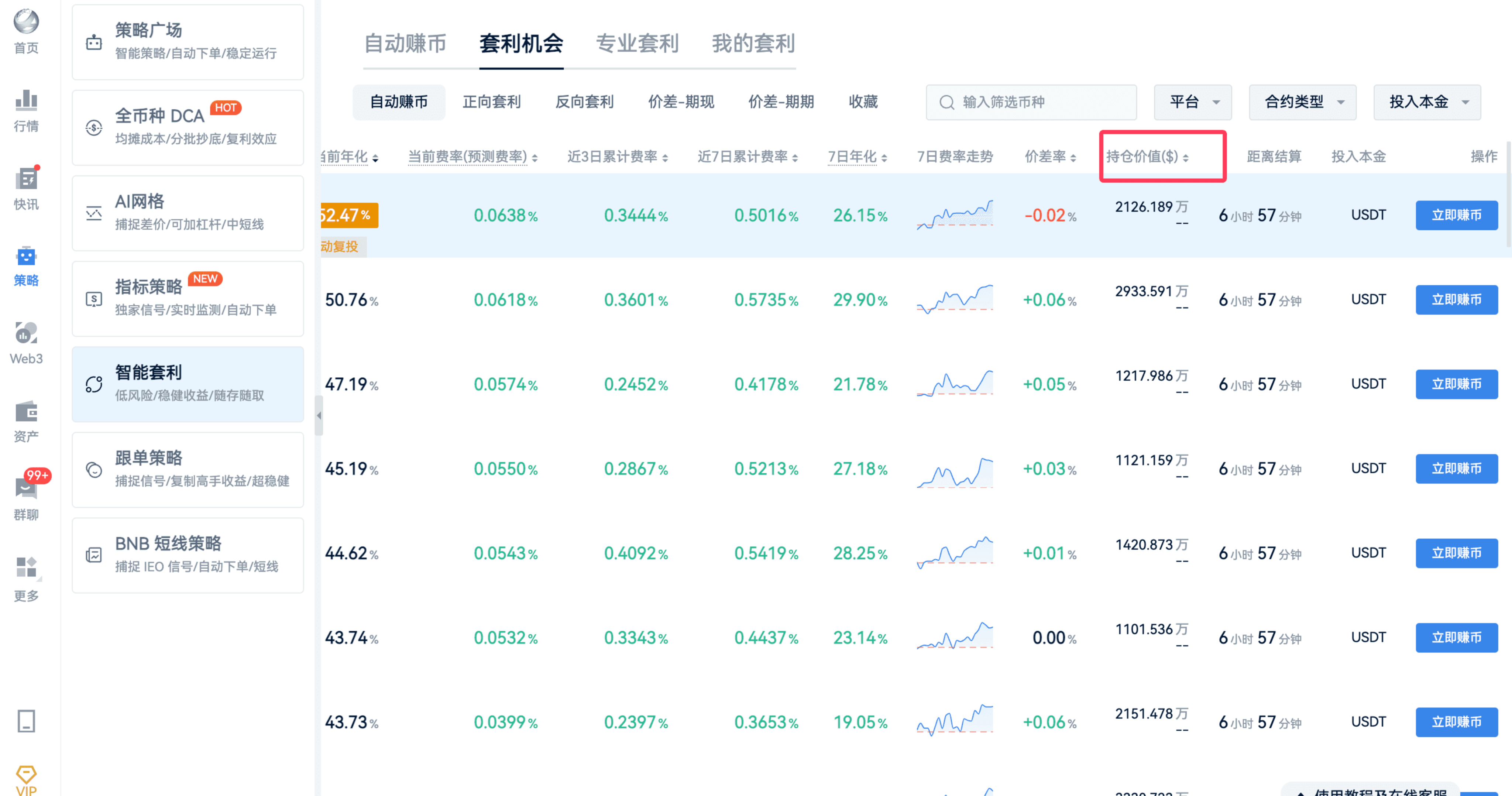

Step 1: Filter by annualized return!

Step 2: Filter for arbitrage combinations that meet three conditions.

The first condition: Look at the position value, which should be greater than 10 million USD. Of course, the larger the position value, the more attention it indicates.

The second condition: The current fee rate (predicted fee rate) should be above 0.03% (expected to recover expenses within 2 days), and the higher, the better.

The third condition: The price difference rate should be above 0.05%, the higher it is, the more floating profit there is when opening the position.

Step 3: Based on the filtered conditions, sort and select suitable arbitrage combinations to open positions! Make money!

The core is in Step 2.

Some students may say that there are many coins filtered in Step 2, so how to choose?

BTC and ETH are the first choices, and then other coins can be selected based on market capitalization and other criteria.

Now let’s return to see why the host opened a position this morning.

The funding fee was good, the price difference was high, and the position value was large. And it was BTC. So the host acted without hesitation.

That’s all for today’s sharing on funding fee arbitrage.

By the way, some people may ask: How to close the position after opening?

It's simple: when the funding fee rate turns negative and stabilizes, you can consider ending this funding fee arbitrage journey and wait for the next opportunity to make money.

That concludes the entire content of this sharing.

Thank you for watching, and we hope every AICoin user can find suitable indicator strategies and enjoy abundant wealth!

Recommended Reading

For more live broadcast insights, please follow AICoin's “AICoin - Leading Data Market and Intelligent Tool Platform” section, and feel free to download AICoin - Leading Data Market and Intelligent Tool Platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。