Stripe's acquisition of the stablecoin API infrastructure Bridge for $1.1 billion marks the largest acquisition in cryptocurrency history. What prompts our reflection is not the transaction itself, but the rapid advancement of the entire stablecoin ecosystem into traditional finance.

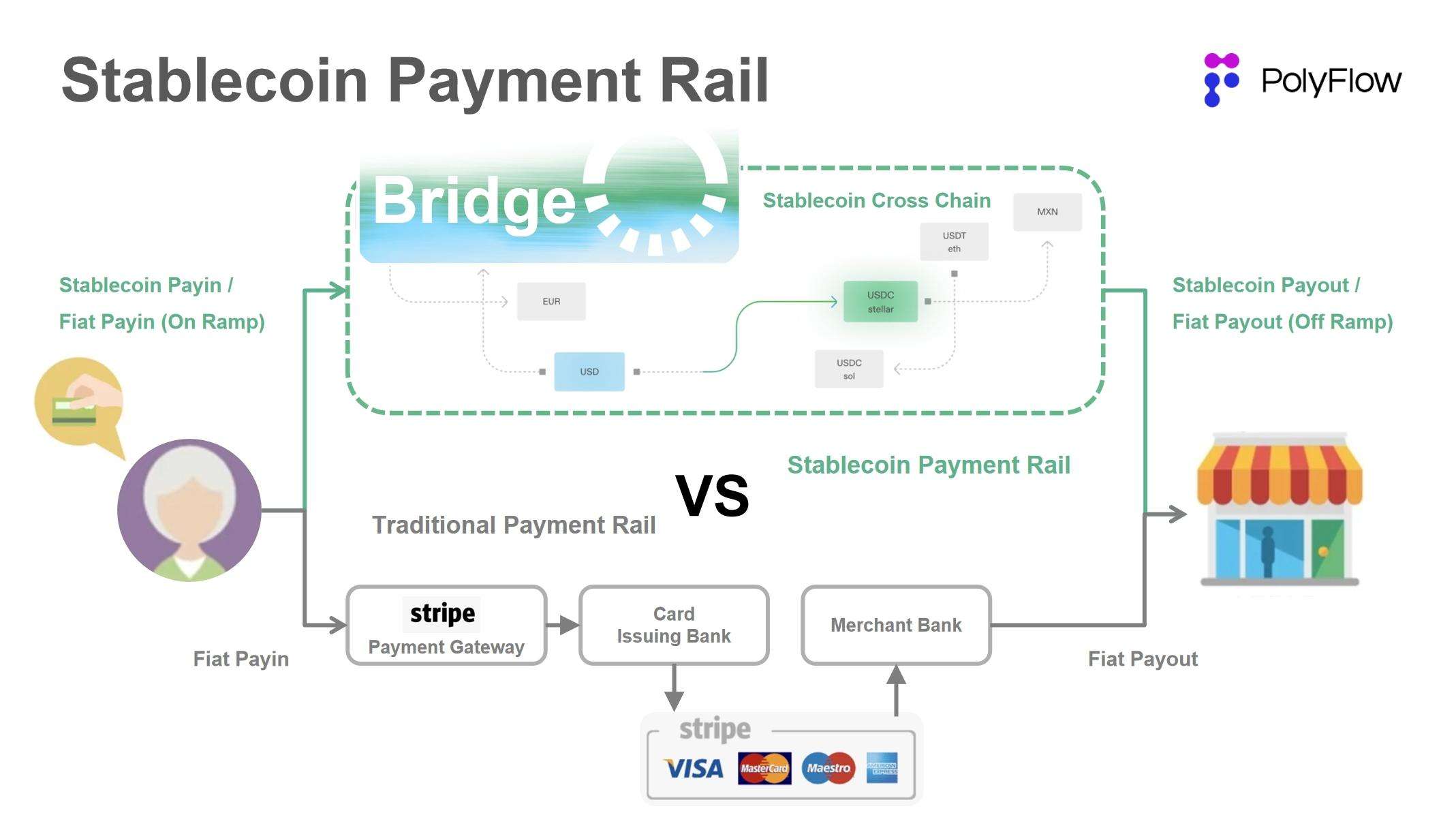

Both Stripe and PayPal have significant global influence and have already integrated existing ecosystems into stablecoin crypto payment networks in their own ways. By incorporating stablecoins, these fintech companies have taken a step forward in the entire payment value chain. After integrating stablecoins, the logical next step is to merge DeFi to create new PayFi application scenarios.

1. Stripe & Bridge Acquisition Deal

Founded in 2009, Stripe is dedicated to providing online payment services for businesses, offering a one-stop payment solution. Stripe is one of the three major payment giants in the United States, with a payment transaction volume reaching $1 trillion in 2023, supporting over 135 currencies and more than 50 payment methods globally.

In 2014, Stripe became the first major payment company to offer Bitcoin payments, but the long confirmation times, high transaction fees, and price volatility of the Bitcoin network led to a decline in demand, and this feature was gradually phased out in 2018.

Despite this, Stripe has continued to focus on and gradually expand its crypto business. On October 10, Stripe announced the reintroduction of a crypto payment gateway (Pay With Crypto) for U.S. businesses, partnering with Metamask, Coinbase, Magic Eden, Audius, and others, allowing U.S. merchants to:

Accept USDC and USDP (Crypto Payin) from over 150 countries via Ethereum, Solana, and Polygon networks;

Receive stablecoin / dollar (Crypto/Fiat payouts);

Integrate checkout acquiring, element payment components, and payment intent APIs, which will soon be applicable to the company's subscription features.

Of course, Stripe wants more than just this.

Bridge's latest official announcement states: "Bridge and Stripe will work together to accelerate the adoption and utility of tokenized dollars, making it easier for everyone around the world to transfer, store, and spend currency. Through numerous practical cases, it has been proven that stablecoins can become the core global funding flow infrastructure, representing a new payment platform. This is not because consumers or businesses inherently want 'cryptocurrency,' but because stablecoins solve critical financial problems."

Bridge was founded by entrepreneurs Sean Yu and Zach Abrams and is a stablecoin API infrastructure that provides software tools to help businesses accept stablecoin payments. The two founders previously sold their Venmo competitor Evenly to Block in 2013; Abrams is also a former senior employee at Coinbase.

Bridge's main product is the Orchestration API, which integrates stablecoin payments into existing business operations, handling all compliance, regulatory, and technical complexities. Through the Orchestration API, combined with Bridge's own offerings of 1) cross-chain stablecoin transactions, 2) fiat/crypto deposit and withdrawal acceptance, and 3) virtual bank accounts, businesses can more conveniently use stablecoins for payments, experiencing a smoother and seamless process.

Bridge claims that using its API allows for global fund transfers in minutes, seamless stablecoin payments, converting local fiat currency into stablecoins, and providing global consumers and businesses with dollar and euro accounts, enabling users to save and spend in dollars and euros.

If Bridge can help Stripe build a stablecoin-based crypto payment network, expanding Stripe's ecosystem and capturing the network effects of the entire stablecoin ecosystem, then a PayFi network that combines crypto payments and decentralized finance can help Stripe achieve free-flowing value while further providing global financial services to users.

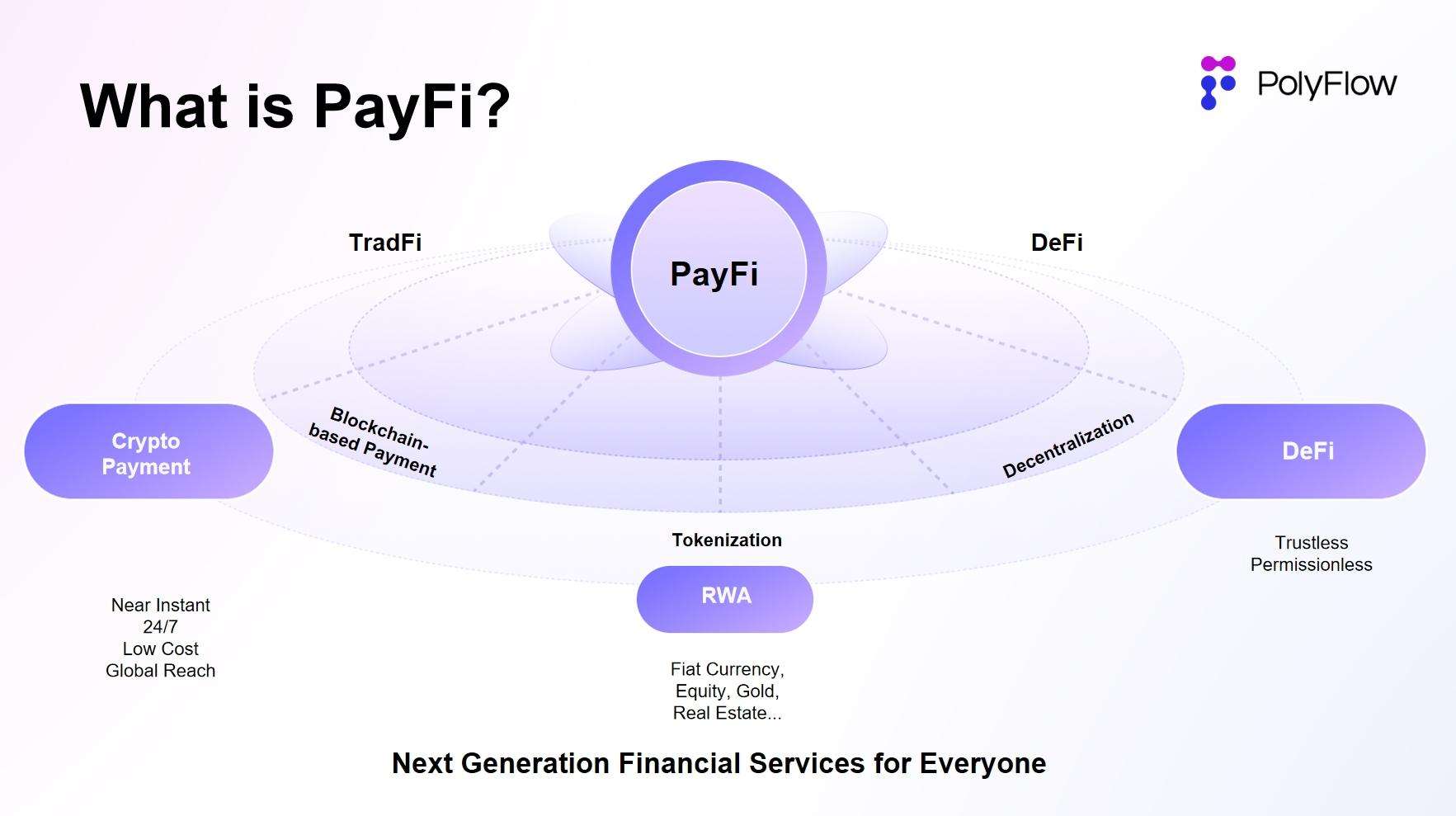

2. What is PayFi

PayFi, or Payment Finance, refers to an innovative application model that combines payment functions with financial services based on blockchain and smart contract technology. The core of PayFi is to use blockchain as a settlement layer, leveraging the advantages of crypto payments and decentralized finance (DeFi) to facilitate the efficient and free movement of value.

The goal of PayFi is to realize the vision of the Bitcoin white paper, building a peer-to-peer electronic cash payment network without trusted third parties, while fully utilizing the advantages of DeFi to create a new financial market, including providing new financial experiences, constructing more complex financial products and application scenarios, and ultimately integrating a new value chain.

PayFi was first proposed by Lily Liu, chair of the Solana Foundation, at the 2024 Hong Kong Web3 Carnival. In her view, PayFi is a new financial market built around the time value of money (TVM). These are difficult or impossible to achieve in traditional finance.

In this new PayFi financial market, not only can the efficiency of crypto payments compared to traditional finance be realized—instant settlement, reduced costs, transparency, and global reach—but it can also achieve decentralization, permissionless access, asset ownership, and personal sovereignty based on decentralized finance (DeFi).

3. Why is Stripe & Bridge's next step PayFi

PayFi is a further construction, expansion, and deepening of the crypto payment network, based on which a new financial market is built through blockchain and smart contract technology, introducing DeFi to create payment-related financial derivative services globally, such as lending, wealth management, and investment.

The emergence of Bridge can help realize Stripe's Pay With Crypto strategy, with more existing businesses settling through stablecoins to achieve internal cost reduction and efficiency improvement, as well as a smoother user product experience. On the other hand, Stripe can build a stablecoin payment path through Bridge that extends beyond the existing banking, card organization, and SWIFT payment systems, while also being compatible with DeFi.

We have already seen that Bridge can help clients issue stablecoins through the Issuance API and invest balances in U.S. Treasury bonds to improve capital efficiency. We believe that soon we will see Bridge, based on its stablecoin payments, combine with DeFi to create more PayFi applications.

Thus, with the integration of Bridge, Stripe's network effects are no longer limited to its ecosystem but extend to the entire stablecoin market. Similarly, the PayFi ecosystem built in conjunction with DeFi can break through the geographical limitations of traditional financial services, achieving free flow of value and financial inclusion for global users. This is also the direction that PayPal, which has issued stablecoins, is striving to achieve.

Both Stripe and PayPal have significant global network effects and have integrated existing networks into stablecoin payment networks through different paths. The subsequent integration with DeFi to build new PayFi scenarios will seem natural.

If Stripe & Bridge or stablecoins are a game between Web2 giants, then PolyFlow is helping PayFi projects land by providing PayFi infrastructure, participating in the construction of the global payment network.

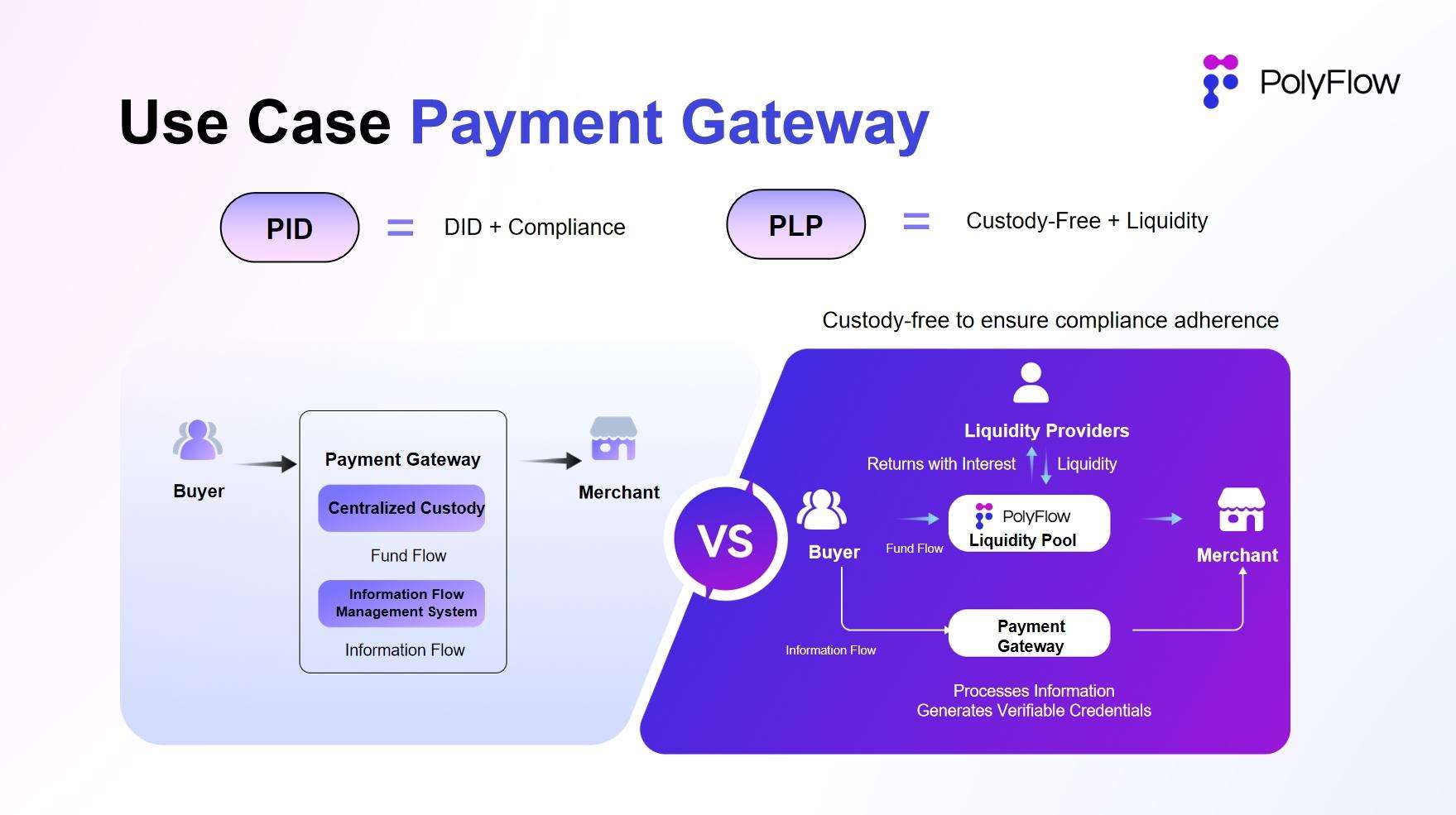

The core idea of PolyFlow is to use a modular design to better align the various processes of transactions with regulatory compliance standards, eliminate custodial risks, and leverage the characteristics of blockchain to connect the DeFi ecosystem, promoting the large-scale landing of PayFi applications.

PolyFlow has launched two key components: Payment ID (PID) and Payment Liquidity Pool (PLP):

PID is associated with payment information flow, serving as a powerful tool for user identity verification and compliance access, privacy protection and data sovereignty, AI data processing, and X to earn functionalities;

PLP is associated with payment capital flow, managed by smart contracts for payment transactions, providing a secure and compliant framework for the circulation, custody, and issuance of digital assets, while also introducing the composability and scalability of the DeFi ecosystem.

Thus, PolyFlow builds a business architecture for PayFi applications that is lightly regulated, custodial risk-free, and compatible with the DeFi ecosystem, as well as a secure and compliant framework for the circulation, custody, and issuance of digital assets.

The crypto payment gateway built through PolyFlow can also realize the advantages of Stripe & Bridge after integrating stablecoin payments:

Cost reduction and efficiency improvement. Peer-to-peer transactions between buyers and sellers eliminate intermediaries, avoiding fees paid to banks and card organization settlement networks.

No custodial risk. Transaction funds are fully managed on-chain by smart contracts, ensuring transparency and eliminating the risks associated with centralized custodial institutions.

Compatibility with DeFi. On-chain Payment Liquidity Pools can combine with DeFi to create PayFi scenarios based on lending, staking, etc.

Global network reach. Provides merchants with the option to accept cryptocurrency payments, opening up to 600 million crypto users worldwide.

As the PayFi infrastructure, PolyFlow is integrating the transformative power of cryptocurrency and blockchain technology to create a new PayFi crypto payment network, accelerating the landing of PayFi applications, promoting a shift towards innovative financial paradigms, and unlocking the true value of Web3. Ultimately, it aims to make the grand vision of the Bitcoin white paper a reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。