The United States is set to release the October CPI and core CPI data in 6 hours, becoming the focus of market participants. These figures will provide important guidance for the Federal Reserve's monetary policy decisions. As a key indicator of inflation, the CPI's impact on the market should not be underestimated.

Market Expectations

The market generally expects the year-on-year CPI for October to rise by 2.6%, an increase of 0.2 percentage points from the previous month's 2.4%, with a month-on-month change of 0.2% remaining flat compared to the previous value. The core CPI is expected to maintain year-on-year and month-on-month increases of 3.3% and 0.3%, respectively.

There is a widespread belief that the Federal Reserve will continue to cut interest rates in December. However, with Trump set to assume the presidency again, uncertainty regarding future policies has increased, particularly as Trump's preferred economic policies may lead to rising inflation, thereby affecting the Fed's rate-cutting plans. This CPI data will be a key factor for the market in assessing the direction of Federal Reserve policy.

Goldman Sachs currently predicts that, with increasing inflationary pressures, the Federal Reserve may slow the pace of rate cuts in the coming months, and may even pause rate cuts early next year. This expectation is primarily based on concerns that Trump's policies could lead to higher inflation. Goldman Sachs analysts believe that under the current inflation situation, the Federal Reserve may cut rates by 25 basis points at the meetings in December, January, and March, rather than in May and June. This adjustment reflects the market's focus on inflationary pressures and expectations for changes in Federal Reserve policy.

Bloomberg economist Scott Johnson stated, "The October CPI data may weaken expectations for a rate cut in December, with overall monthly indicators showing upside risks, while core inflation seems likely to remain relatively high."

Federal Reserve Chairman Powell indicated that although inflation has eased, the fight against inflation is not over, and core inflation remains elevated. Therefore, the Federal Reserve may continue to implement rate cuts, but if inflation cools and the economic situation remains good, it may slow the pace of rate cuts.

Bank of America Merrill Lynch also stated that it expects the U.S. October CPI and core CPI to rise by 0.2% and 0.3% month-on-month, respectively, but this increase is unlikely to have a significant impact on interest rates.

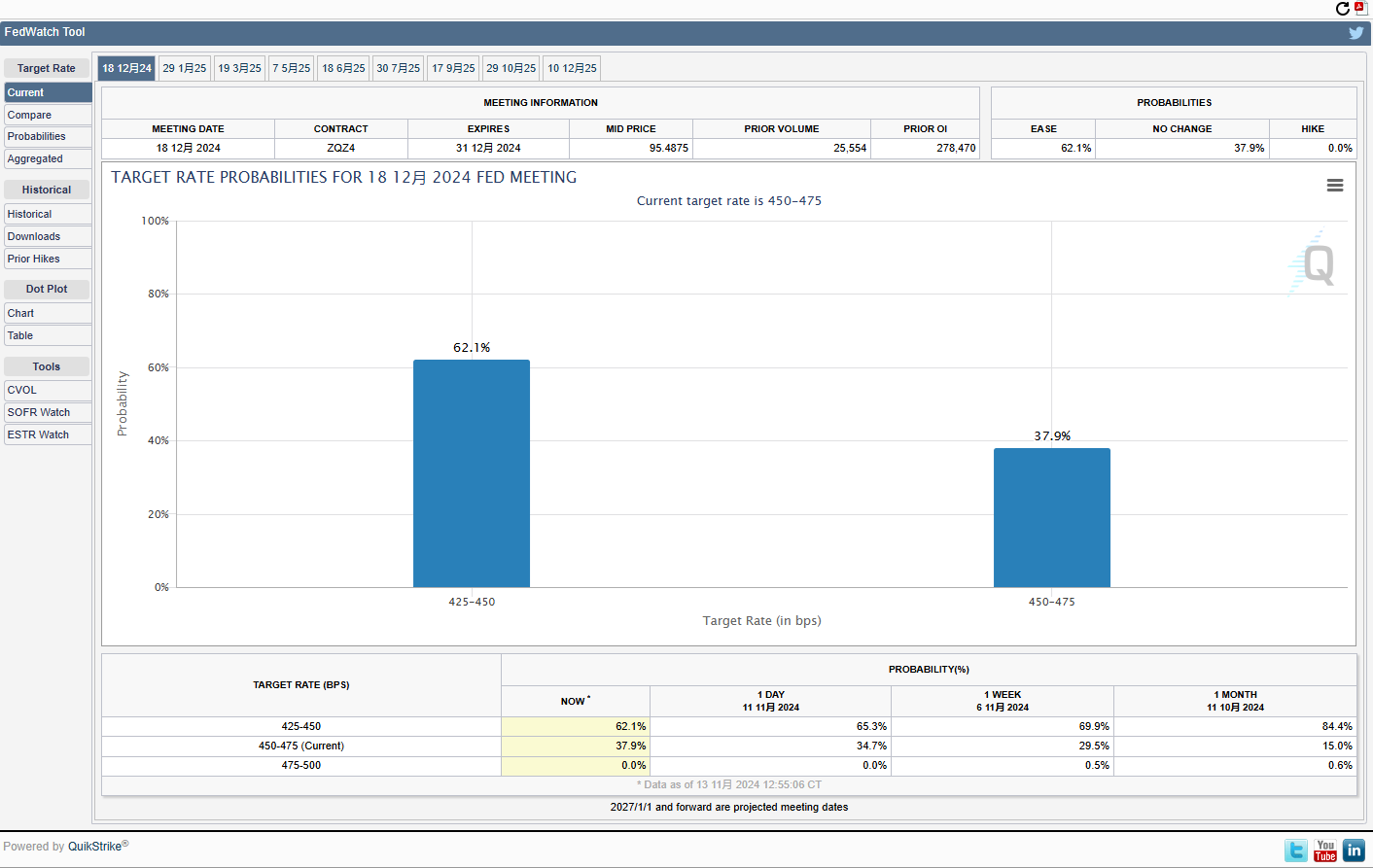

According to tools from the Chicago Mercantile Exchange, the current probability of the Federal Reserve cutting rates by 25 basis points in December is 62.1%, while the probability of maintaining the current rate is 37.9%. The probability of maintaining the current rate in January next year is 26.5%, with a cumulative probability of a 25 basis point cut at 54.9% and a cumulative probability of a 50 basis point cut at 18.6%.

Image Source: CME

Impact of CPI Values on BTC

The CPI has a significant impact on the cryptocurrency market, especially on BTC. If the upcoming CPI data exceeds expectations, it may lead to a temporary pullback in Bitcoin prices. Investors may reassess Bitcoin's value as a safe-haven asset, particularly in light of the Federal Reserve's potential adjustments to its rate-cutting pace. Therefore, the release of CPI data will have an important impact on the short-term trend of the Bitcoin market.

Conversely, if the CPI data falls below expectations, it will further raise rate cut expectations, thereby enhancing Bitcoin's appeal and driving its price up.

According to AICoin tools, if the CPI release value is greater than the expected value, the probability of BTC rising is 30.34%, while the probability of it falling is 69.57%. If the CPI release value is less than the expected value, the probability of BTC rising is as high as 78.57%. For more details, please visit the PC version at https://www.aicoin.com/download

Image Source: AICoin

Conclusion

CPI data is not only a key indicator of inflation levels in the United States but also an important reference for global market participants in assessing the direction of economic policy. With the release of the data, market fluctuations are expected, and investors need to closely monitor the relevant data to adjust their investment strategies. For cryptocurrencies like Bitcoin, the impact of CPI data may be more direct, and investors should respond cautiously to market changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。