The application of AI and DeFi in prediction markets, personal finance, and fraud detection could fundamentally change the financial industry in ways we have never seen before.

Written by: Kava Labs

Previously, we conducted an in-depth exploration of the integration of artificial intelligence and blockchain technology, revealing the immense potential of these two revolutionary technologies, while also pointing out several pitfalls and challenges they face on the path to mainstream success in their journey towards mainstream adoption.

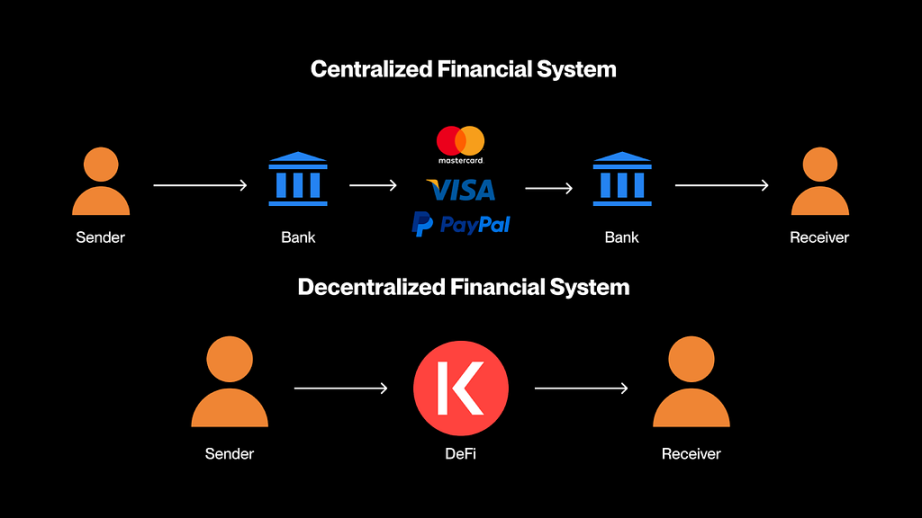

Now, let’s take a look at how AI and DeFi (Decentralized Finance) are colliding and what this means for the future of the financial industry. In this article, we will explore the application scenarios of AI in the decentralized finance space, how to leverage AI, and the issues that must be addressed in this new development of decentralized finance, such as data privacy, security, and scalability.

Since its emergence in 2017, DeFi has begun to consume traditional finance. It has opened banking and essential investment infrastructure to anyone with an internet connection.

Since 2022, the emergence of artificial intelligence and its explosive popularity in mainstream fields have had a similar impact across almost all software domains, although its true potential has yet to be fully realized. We are now beginning to witness the convergence of these two revolutionary technologies, which has the potential to further transform the financial industry and ultimately push the use of DeFi into the mainstream.

However, before the joint application of these two technologies can truly bridge the gap and achieve widespread adoption, certain limitations and challenges must first be addressed. This article will explore how AI is influencing the current state of DeFi, its best use cases, and the urgent challenges they face.

How AI and DeFi are Changing the Financial Industry

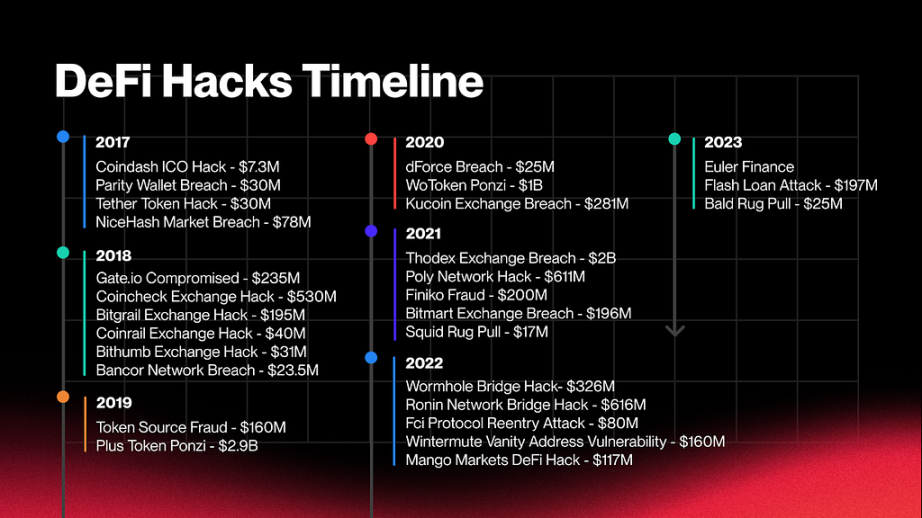

Fraud Detection and Security Enhancement

Fraud remains one of the biggest ongoing issues in DeFi. Since the inception of DeFi, wash trading, fraud, and pump-and-dump schemes have run rampant throughout the industry. They are a troubling part of the open-source technological innovation process, often casting a shadow over the entire industry and causing new users to question the benefits created by DeFi. Chainalysis reported that hackers stole over 1.1 billion dollars in user assets just in 2023.

While whitelisting addresses and locking new transactions can help prevent fraud to some extent, they are insufficient to cope with the increasingly complex cybersecurity vulnerabilities on digital asset platforms.

AI helps reduce fraud and hacking because AI algorithms can analyze data, identify patterns, and detect anomalies in decentralized ecosystems more efficiently. Uniswap has already begun implementing AI to identify and block fraudulent transactions.

AI-Driven Trading Algorithms

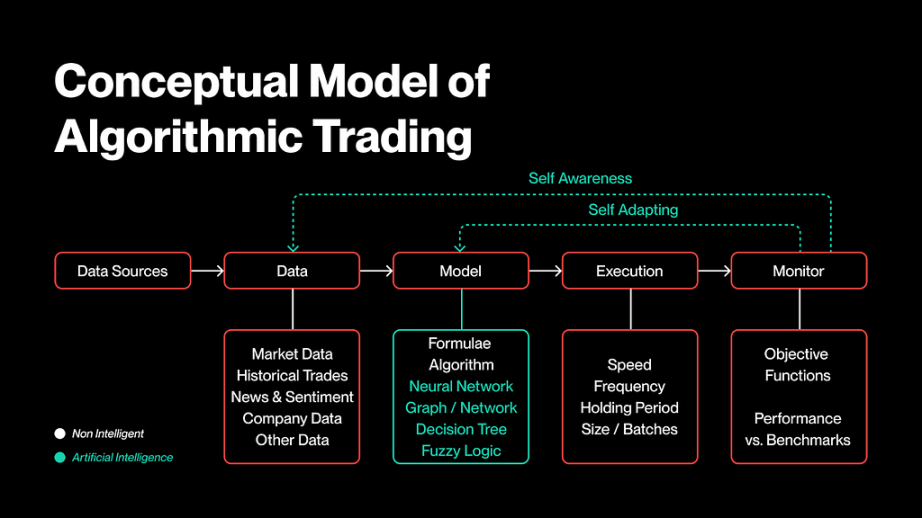

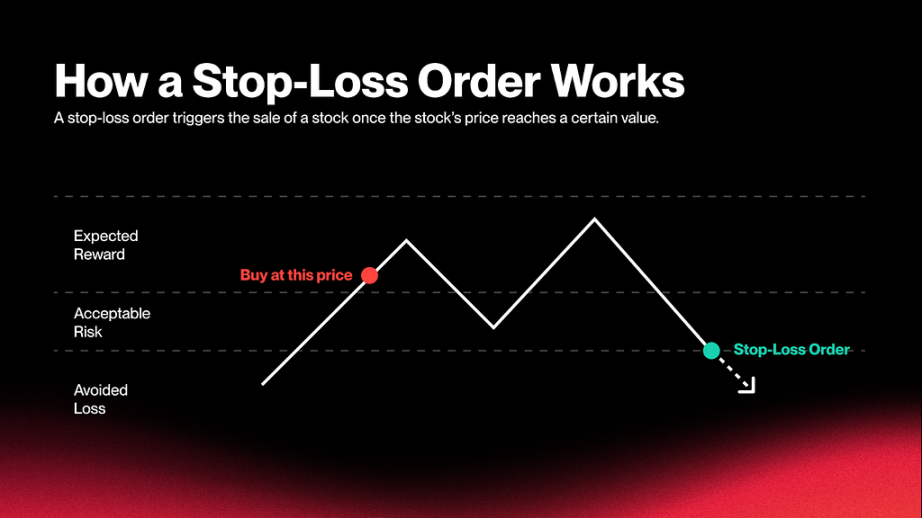

Before DeFi, automated trading bots existed that could execute trades for traders once certain parameters were met. As early as 2014, centralized exchanges like Shrimpy, 3Commas, Cryptohopper, and Kucoin were already offering these services.

The parameters for these early trading bots mostly needed to be manually set by the owners and were primarily used for stop-loss trading. AI-driven trading algorithms have expanded on these early models by adopting deep learning techniques and integrating self-correcting AI models with natural language processing (NLP). These new deep learning-based AI-driven algorithms can self-correct in real-time, integrating market sentiment through natural language processing from news sources and adjusting strategies based on previous trading history, rather than just simple stop-loss parameters.

Improving User Interfaces

Improving user interfaces may be the least technically impressive aspect of AI capabilities. However, from the end-user's perspective, it is the most important.

DeFi has largely been a niche aspect of the financial sector, navigable only by those technically skilled enough to handle its complex interfaces. By simplifying processes and making them accessible through chatbots and virtual assistants, DeFi can immediately become more user-friendly for the average user. These new chatbots can provide information, write basic code, and create agents to execute cross-chain transactions. Combined with AI-based DeFi trading algorithms offered on platforms like 3Commas, Cryptohopper, and Shrimpy, any user can instantly execute complex trading techniques.

OpenAI’s general chatbot ChatGPT and Anthropic’s Claude can provide knowledge, write simple code, and offer insights for DeFi. However, if users truly want to leverage the powerful capabilities of these new AI chatbots, they should focus on protocols like ChainGPT and Kava AI that can write and deploy smart contracts, create NFTs, and provide algorithmic trading assistance.

Limitations and Challenges of AI Modeling in DeFi

AI modeling is primarily driven by high-integrity quality datasets that accurately reflect what they report. Unfortunately, most data in DeFi is isolated within different ecosystems, and interoperability between chains remains a difficult barrier to overcome. This leads to fragmented datasets that can only reflect snapshots of different areas within DeFi, making it challenging to create comprehensive AI protocols.

Data Privacy and Security

Data privacy and security are another concerning area for AI protocols looking to deploy on DeFi. One of the reasons DeFi attracts many users is the privacy and anonymity provided by decentralized protocols. Many DeFi users prefer protocols that allow for data verification while reducing the necessity of KYC policies that are prevalent in traditional finance (TradFi) and centralized exchanges (CEXs).

AI protocols need to maintain the quality and integrity of data while respecting the legal boundaries of data owners as they build datasets. Historically, the consistent practice has been that “companies must inform individuals about the types of data they collect, how it will be used, and who will have access to that data.” Since AI protocols do not directly acquire individual user data for use cases but instead create models to predict consistent responses, the execution of this approach becomes difficult. When other users issue commands, the data relied upon by the model may inadvertently expose sensitive user data.

Scalability and Computational Demands

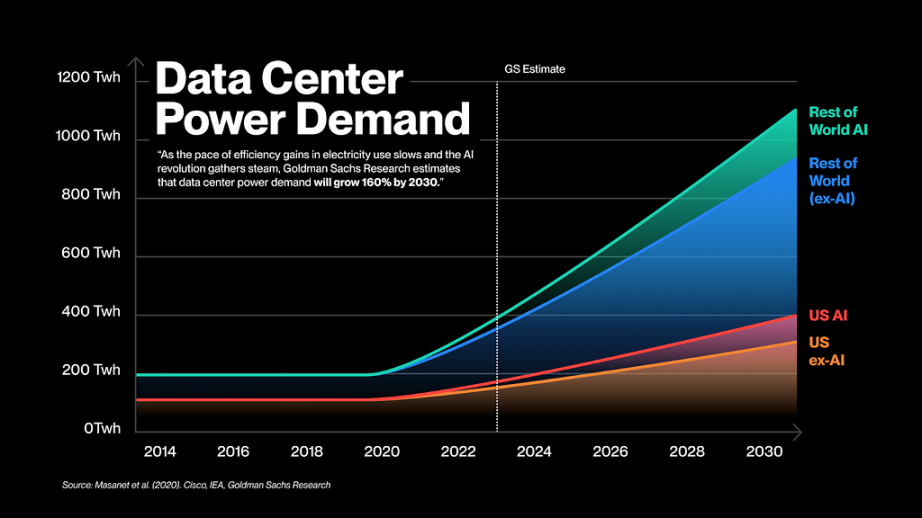

The blockchain community has witnessed traditional media's fierce reporting on the energy consumption of consensus mechanisms like PoW. While PoW is indeed energy-intensive, the scale and scope required to power AI operations are an order of magnitude larger than the entire crypto industry.

A report from Wells Fargo and Morgan Stanley indicates that by 2026, energy consumption for AI demand will surge by 550%, increasing from 8TWh in 2024 to 52TWh, and will grow an additional 1,150% by 2030, reaching 652TWh. The pace of this innovation and energy demand is putting immense pressure on the GPU supply chain and the available power supply across the energy grid. Governments, energy producers, and chip manufacturers need to adjust their current approaches to keep pace with AI; failure to do so could strain relationships between these industries.

Summary

While introducing AI into DeFi may represent the next paradigm shift in the financial sector, the harsh reality is that AI protocols are still limited by their training data. Protocols that already have access to large amounts of reliable ecosystem data and possess deep financial reserves in the competitive microchip supply chain may become the most powerful AI companies.

Regulation, data security, and computational demands are just some of the obstacles that AI companies must navigate in the coming years. However, the application of AI and DeFi in prediction markets , personal finance, and fraud detection could fundamentally change the financial industry in ways we have never seen before.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。