1. Asia Web3 Market

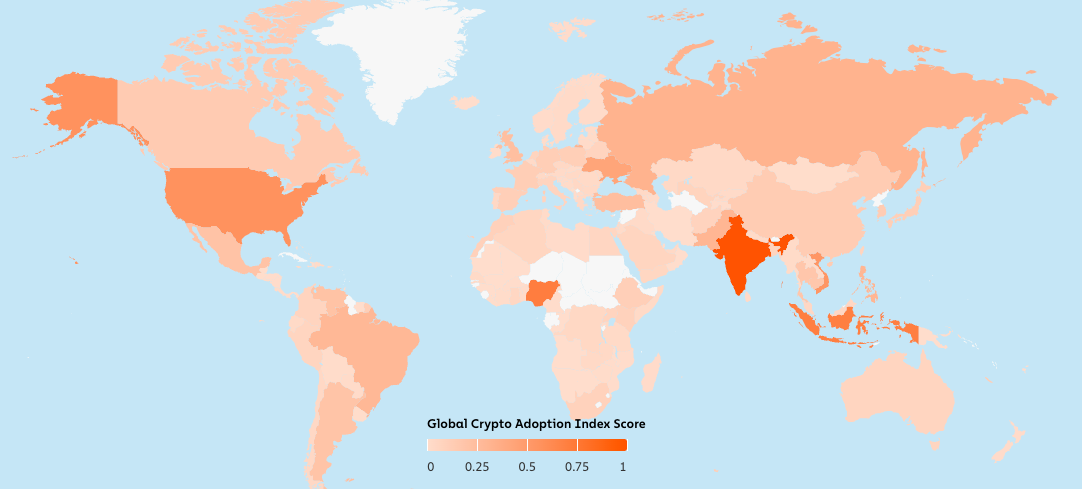

Source: Chainalysis

The characteristics of Asia include: 1) a young Web3 demographic, 2) strong technology adoption, 3) a mature regulatory framework, and 4) active corporate participation. These factors position Asia to potentially become a leading force in the global Web3 space. Among the many countries in the region, we highlight the following key markets:

South Korea: Enterprise-level companies are entering the Web3 space, with blockchain game development playing a significant role. Major gaming companies are actively preparing for the launch of blockchain games, marking a shift in the industry.

Japan: Initiatives to revitalize the Web3 industry are driving more corporate participation. Globally recognized IP players like Sony and Bandai Namco are expected to bring new developments.

Indonesia: With a large population and a rapidly growing market, Indonesia has considerable long-term potential. The regulatory environment is positive, including the launch of a state-owned crypto trading platform.

Vietnam: Vietnam is poised to be a standout in Asia, particularly with a high Web3 penetration rate among young people and a competitive developer community.

Thailand: Both the financial sector and the public are actively participating in the crypto market. Traditional financial institutions are at the forefront of Web3 initiatives.

Singapore: Despite having a clear regulatory framework and playing a role in areas such as STO, RWA, and payments, Singapore faces challenges with a recent decline in corporate support.

India: With a vast talent pool and a thriving startup ecosystem, India has immense potential in the Web3 space. Success stories like Polygon highlight the country's ability to drive global Web3 infrastructure projects.

These countries are leveraging their unique advantages to shape the future of the Asian Web3 market. Below is a news tracking overview from these countries throughout the third quarter, providing insights into emerging trends and opportunities in the Asian Web3 space.

2. New Regulatory Frameworks

2.1. South Korea

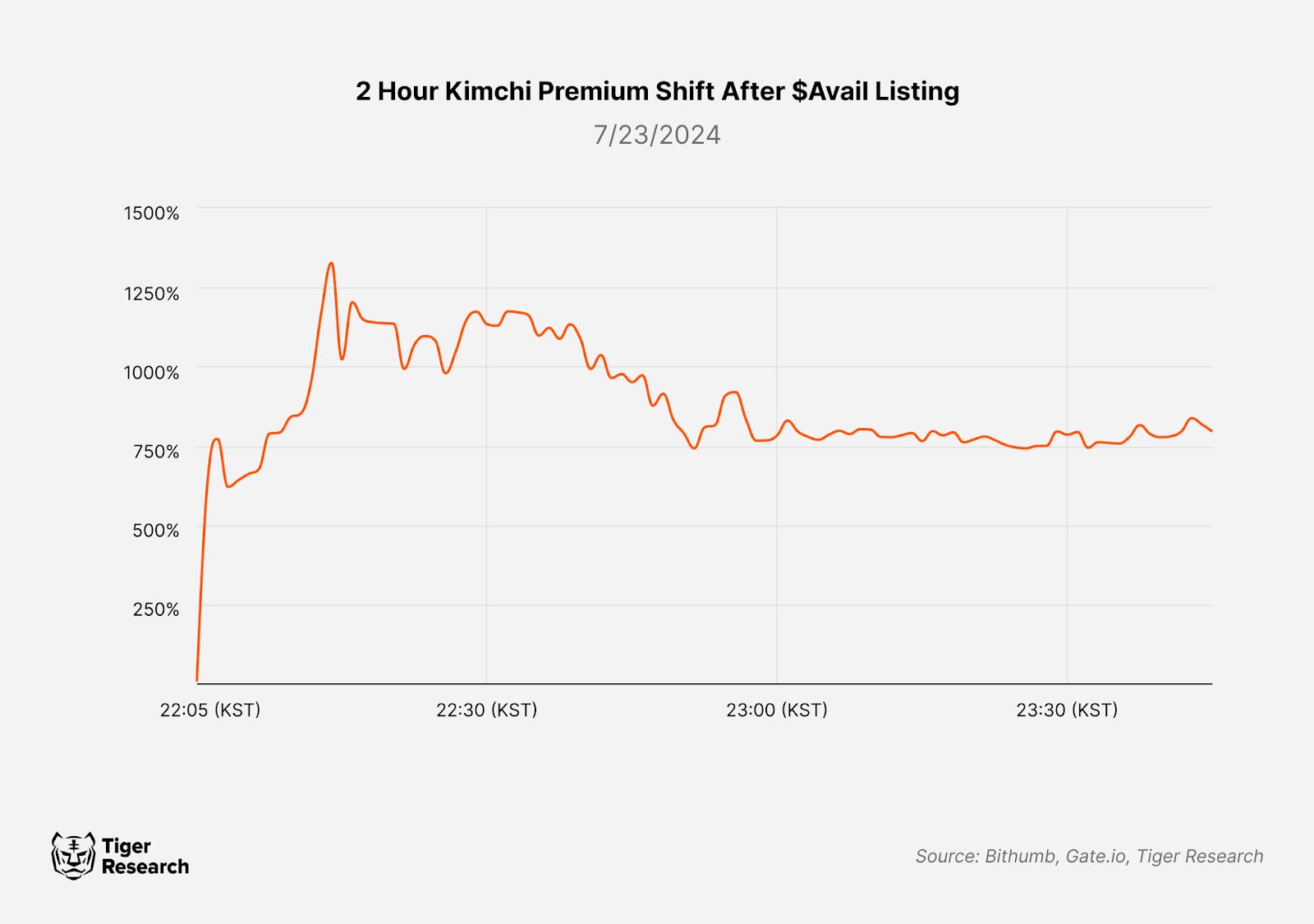

On July 19, 2024, South Korea introduced the Virtual Asset User Protection Act, aimed at enhancing investor protection and ensuring the future development of the market. Key provisions of the bill include 1) a clearer definition of virtual assets, 2) mandatory interest payments on customer deposits, 3) insurance coverage for unforeseen circumstances, 4) stricter regulations against unfair trading, and 5) penalties for market manipulation (MM) without exceptions.

The new regulations are being actively applied to market oversight. In the future, relevant authorities will continue to assess the effectiveness of these regulations and monitor market responses.

Source: Bithumb, Gate.io, Tiger Research

2.2. Indonesia

As part of Regulation No. 3/2024 on technological innovation in the financial sector, the Indonesian Financial Services Authority (OJK) launched a sandbox framework in June 2024. This regulation covers a wide range of blockchain-related technologies and is expected to bring previously unregulated financial services into a formal system.

Key focus areas include virtual asset services such as staking and stablecoins, which now have the opportunity to be tested and potentially recognized within a regulatory framework, promoting the development of new financial services, particularly at the intersection of blockchain and traditional finance, as well as the tokenization of real-world assets (RWAs). These innovations are expected to transform Indonesia's financial market.

The sandbox regulation reflects Indonesia's proactive stance in supporting financial innovation while ensuring consumer protection and market stability. This initiative is expected to further accelerate the growth of Indonesia's fintech industry.

Participating companies must meet specific criteria, such as demonstrating innovative and unique services for Indonesian consumers and businesses. Additionally, they must submit the required documentation as part of their application to the OJK. Approved companies will have one year to test their services, and if they pass the evaluation, they will have a six-month window to obtain a full license. This balanced approach provides companies with flexibility to enter the market quickly while ensuring sufficient time for experimentation and refinement of their services.

2.3. Thailand

The Thai Securities and Exchange Commission (SEC) has taken significant steps to promote innovation in the digital asset and Web3 space. In August 2024, the SEC introduced a digital asset sandbox, complementing its existing detailed licensing framework. This allows for testing key initiatives aligned with emerging market trends.

These measures provide space for experimentation in various areas, including RWA tokenization, payment systems, security protocols, and decentralized finance (DeFi).

This initiative is also expected to directly benefit users, who will gain new functionalities and products in the digital asset and Web3 space. A notable example is RealX, Thailand's first tokenized RWA, which was listed on Bitkub due to the SEC's open attitude towards innovation.

Looking ahead, as new possibilities unfold, more groundbreaking projects are expected to emerge. At the same time, the development of clear and comprehensive laws and regulations is anticipated to enhance market stability. Thailand's proactive stance will play a key role in shaping the future of the country's digital asset ecosystem.

3. Initiatives

3.1. India: National Blockchain Framework (NBF)

On September 4, 2024, Indian regulators released the National Blockchain Framework (NBF), marking a significant step in the country's digital transformation strategy. The NBF is not only about technology adoption but is also an ambitious plan aimed at creating a more secure and efficient digital infrastructure by addressing the limitations of legacy systems that have emerged during India's rapid digitalization.

The NBF has several key objectives: enhancing transparency in the public sector, combating corruption, promoting technological innovation, and driving economic growth. Additionally, the plan aims to improve citizen-centric services. By leveraging the immutability and transparency of blockchain, the NBF aims to enhance the reliability of regulatory transactions and records, significantly increasing the difficulty of data tampering and boosting citizen trust in the regulatory system.

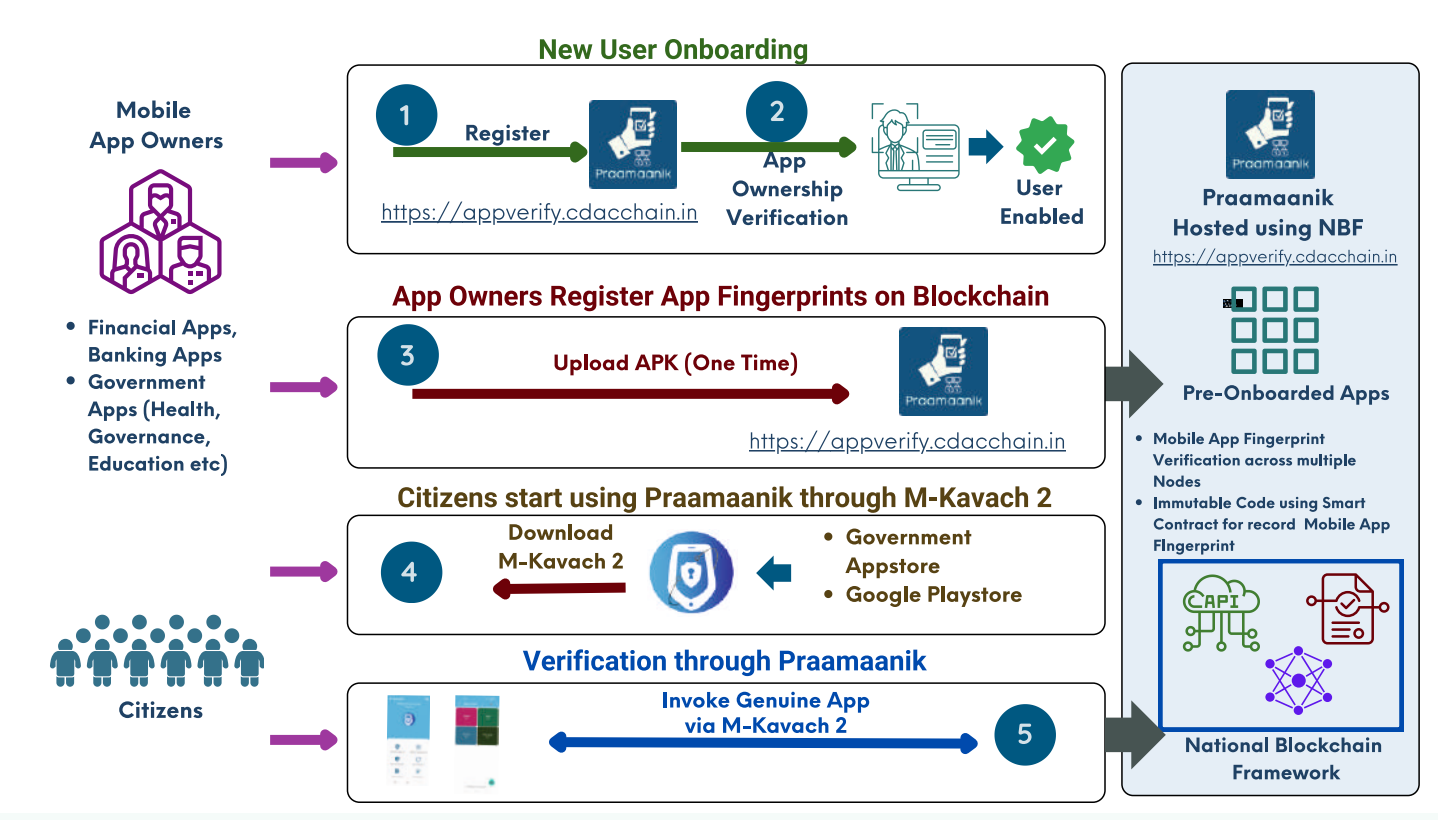

Source: NBF-brochure

Key components of the NBF include:

Vishvasya Blockchain Technology Stack: This blockchain-as-a-service (BaaS) product provides decentralized infrastructure, enabling startups and enterprises to rapidly develop new blockchain services. By leveraging data, this technology stack aims to accelerate the application of blockchain in both the public and private sectors.

NBFLite: A lightweight blockchain platform designed for startups and academia, supporting rapid prototyping, research, and education. It aims to drive blockchain innovation and talent development.

Praamaanik: A blockchain-based mobile application source verification solution, Praamaanik enhances the security of India's mobile ecosystem by preventing the spread of malicious or counterfeit applications, thereby increasing user trust and system integrity.

National Blockchain Portal: This comprehensive platform provides the latest information on blockchain technology, including news, events, and educational resources. The portal aims to raise public awareness and increase accessibility to blockchain knowledge.

India's NBF is one of the few state-led initiatives globally aimed at supporting multi-industry blockchain technology. It views blockchain as critical infrastructure and is expected to transform the country's digital landscape. If successful, the NBF could serve as a model for other countries, demonstrating how blockchain can be integrated into national infrastructure.

4. Enterprise-Driven Market

4.1. Japan

Japan's blockchain ecosystem continues to be shaped by the financial sector. A recent significant development is Sony's entry into the blockchain space, collaborating with blockchain company StarTale to launch its new Ethereum Layer 2 solution, Soneium. Announced in August 2024, Soneium aims to provide scalable infrastructure for Web3 applications by leveraging Sony's global presence and user base.

Source: Soneium

Sony has also launched an incubation project, Soneium Spark. This project supports developers by providing access to infrastructure, mentorship, industry partnerships, and funding opportunities of up to $100,000. This move further indicates Sony's deepening involvement in the Web3 ecosystem and its exploration of new opportunities in blockchain technology, following Sony Bank's announcement of plans to launch a yen-based stablecoin.

Currently, Soneium is in the testing phase called Minato, with the mainnet expected to launch in the first quarter of 2025, and over 50 projects are already in development or planned for deployment on Soneium. This marks a significant step for a major tech company entering the blockchain space.

Politically, Japan is also undergoing significant changes. Expected to become the next Prime Minister, Ishiba comes from the same Liberal Democratic Party as the current Prime Minister Kishida. However, his stance on the blockchain market remains uncertain. While Ishiba's policy proposals include utilizing blockchain and NFT technology to revitalize rural areas, the initiative primarily focuses on regional development rather than promoting the broader blockchain industry. It remains unclear how his policies will impact Japan's blockchain sector once he forms a cabinet.

4.2. Vietnam

Vietnam's blockchain ecosystem is rapidly growing, driven by a strategic combination of education and industry development. The efforts of the Vietnam Blockchain Association (VBA) and the Blockchain and Artificial Intelligence Innovation Institute (ABAII) are at the core of this process.

Source: ABAII

The VBA has partnered with Tether to hold educational conferences in major cities across Vietnam. Additionally, the VBA collaborates with ABAII to provide blockchain education to university students through the UniTour project, a series of university visits aimed at sparking students' interest in blockchain technology. Beyond education, the VBA plays a key role in helping students and young professionals transition into the blockchain industry. A notable initiative is the SwitchUp Accelerator program, which provides mentorship, support, and investment for Web3 startups and projects.

Since its official launch on January 10, 2024, ABAII has been conducting an active educational campaign. ABAII is certified by the Ministry of Science and Technology and supported by VBA, aiming to become a leading center for blockchain research, development, and application in Vietnam. Its long-term goal is to provide blockchain education to 1 million Vietnamese citizens by 2030. In the short term, ABAII plans to train 100,000 students across 30 universities.

This coordinated approach of integrating education and startup incubation lays a solid foundation for the sustainable growth of Vietnam's blockchain industry. With a clear strategy, Vietnam is positioning itself as an important player in the global blockchain market.

5. Emerging Market Country Observations

5.1 Cambodia

Cambodia's crypto market has recently drawn attention, but not for positive reasons. In August 2024, a major scandal erupted involving Huione Guarantee Company, accused of illegal transactions worth $49 billion. As a result, much of the news surrounding Cambodia's crypto market has been dominated by crime and fraud.

However, Cambodia's blockchain narrative is not solely defined by this turmoil. Until 2022, Cambodian regulators were actively exploring the adoption of crypto. For instance, the central bank developed a blockchain payment system called Bakong, highlighting its early embrace of digital finance.

Currently, the Cambodian market seems somewhat stagnant. However, this state provides opportunities for businesses that recognize the growth potential. Recent industry trends indicate that more companies are beginning to leverage blockchain technology, suggesting that entrepreneurial activity is on the rise.

Cambodia is a market worth watching. Despite its chaotic state, businesses that actively collaborate with regulators and adopt prudent risk management may still find success. However, it is not a market suited for large global companies; rather, it is a field where small and medium-sized enterprises (SMEs) can thrive through proactive and flexible approaches.

For SMEs willing to navigate a turbulent regulatory environment, Cambodia offers a first-mover advantage. Maintaining close communication with regulators and gaining a deep understanding of local regulations will be key to mitigating risks and seizing opportunities. However, caution remains necessary. Legal risks and market instability continue to be significant concerns.

Ultimately, Cambodia's crypto market is a "double-edged sword," offering both risks and rewards. Businesses with strong risk management capabilities and a willingness to adapt to local conditions may find promising opportunities in this dynamic and evolving market.

6. Conclusion

While African markets, including Nigeria, are gradually gaining momentum in the crypto space, Asia remains the fastest-growing region. So far, many changes in Asia have been primarily driven by regulators, large institutions, and enterprises, while consumer-facing services are still in the early stages of development. Nevertheless, these developments represent critical steps for future growth.

Asia's crypto market is rapidly evolving, propelled by positive regulatory policies, significant corporate investment, and strong interest from the younger generation. Although widespread adoption is still on the horizon, the current stage is crucial for laying the necessary groundwork. As the market continues to mature, we will keep a close eye on the Asian market.

Authors: Ryan Yoon, Yoon Lee

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。