Author: Charlotte

As the price of BTC breaks through $89,000, the market has seen a long-awaited bullish atmosphere, with altcoins experiencing significant increases, including several public chain tokens that have nearly doubled in value. The market's recovery has not led to the emergence of mainstream sectors, and currently, there is a lack of mainstream narratives, which may continue in the near future. In the absence of a main narrative, seeking Beta and Alpha through the public chain ecosystem may be a feasible trading strategy for the upcoming period. Therefore, we have explored a set of analytical frameworks and conducted an analysis and comparison of Sui and Aptos, which have recently performed well.

1 Analytical Framework: How to Evaluate Public Chain Ecosystems?

The most direct influencing factor for the explosion of public chains will be a massive influx of capital. A large amount of liquidity entering will drive the development of the entire ecosystem, and the wealth effect brought by liquidity overflow will attract more market attention and capital into the ecosystem, continuously boosting the ecosystem's activity. Therefore, when evaluating public chain ecosystems, we will focus on factors that may cause significant capital inflows and the ability of public chains to absorb liquidity, as well as data indicators that can reflect the inflow of capital and users.

(1) Activity of Base Trading: Whether it is ETH during the ICO and NFT periods, SOL during the Memecoin period, or BTC during the inscription period (which promotes demand and consumption of BTC through both mining and purchasing), these are all base tokens for trading. When NFTs, Memes, etc., generate a strong wealth effect, users need to purchase base tokens to enter the new Crypto Casino, creating a significant native demand for public chain tokens, thereby driving price increases and ecosystem prosperity. These large Casinos are part of the ecosystem, directly promoting the growth of public chain tokens through the prosperity of the ecosystem, while also attracting a large amount of capital onto the chain. The liquidity overflow will enrich other ecosystem projects, thus revitalizing the entire ecosystem. In this dimension, public chains and exchanges actually have conflicts, as many quality projects' TGE directly enter exchanges without benefiting the public chain itself. To form native trading of public chain tokens, it must rely on new assets that only exist (or initially only exist) on-chain, such as NFTs, inscriptions, and Memes. We will closely monitor the issuance of new wealth-generating asset play methods on different public chains, but currently, we have not seen significant innovations. Therefore, in the short term, we will focus on which public chain will absorb more liquidity overflow from Solana in the Meme track.

(2) Completeness of Ecosystem Infrastructure and Whether There Are Windows and Incentives to Attract Liquidity: The completeness of infrastructure determines whether capital is willing to stay after entering. A user-friendly experience and rich capital earning strategies will be more conducive to user and capital retention. Windows and incentives to attract liquidity will be more beneficial for promoting capital inflow. There are three main channels for capital inflow: other public chains, CEX, and Web2. The friction of capital migration increases step by step; the more layers of capital that can be attracted, the more beneficial it is for the development of public chains. For example, Base, backed by Coinbase, has opened a direct path from the exchange to the chain, and the issuance of cbBTC and liquidity guidance incentives has attracted more TVL to the ecosystem. Solana is promoting the development of Payment and Payfi, hoping to attract Web2 capital onto the chain.

(3) Development Strategy and Positioning of Public Chains: This includes the public chain's planning for development paths, main markets, and core tracks. For example, the Solana team has a very clear development path in this round, starting from promoting the Meme track, attracting a large number of users and liquidity through it, and then vigorously promoting Payfi, DePIN, and other tracks to leverage the advantages of high-performance public chains, attracting leading projects like Render, Grass, and IO.net. In contrast, Ethereum lacks a core development strategy in this round, and its Rollup-centric roadmap has also been criticized.

(4) Changes in Capital and User Data: The TVL of public chains is often used as a measure of the capital volume in the ecosystem, but TVL itself is mainly composed of public chain tokens and ecosystem tokens, which are greatly affected by token prices and cannot accurately reflect capital inflow. Additionally, platforms like Defillama directly sum the TVL of various DeFi protocols when calculating public chain TVL, and circulating tokens are not counted as TVL. However, the fact that tokens are in circulation may indicate a stronger trading demand. Therefore, this article will focus on the growth of stablecoin market capitalization, net inflow of ecosystem funds, and DEX trading volume as indicators of changes in capital and liquidity, while also monitoring user activity.

(5) Chip Structure and Price Trends of Public Chain Tokens: The growth potential of public chain ecosystems and token prices are generally complementary. The rise in public chain token prices will attract more market attention. After a significant increase in public chain tokens, the market will seek to invest in projects within the ecosystem in hopes of obtaining higher returns. This liquidity overflow will promote the prosperity of the ecosystem and enhance the overall wealth effect of the ecosystem. Token economics and chip structure will determine the upward resistance and time window of public chain tokens. Tokens with smaller upward resistance and larger space are more likely to drive the prosperity of the entire ecosystem.

2 Analysis of the Sui Ecosystem

2.1 Basic Information and Recent Developments of the Public Chain

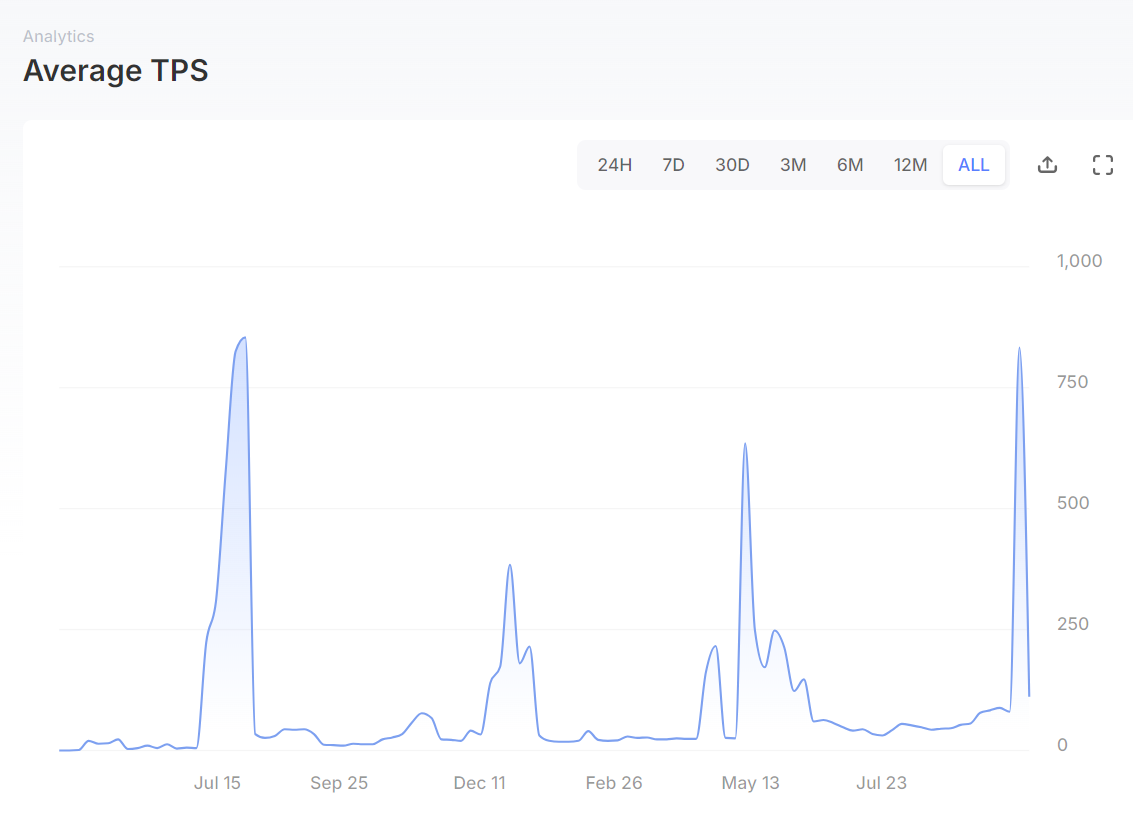

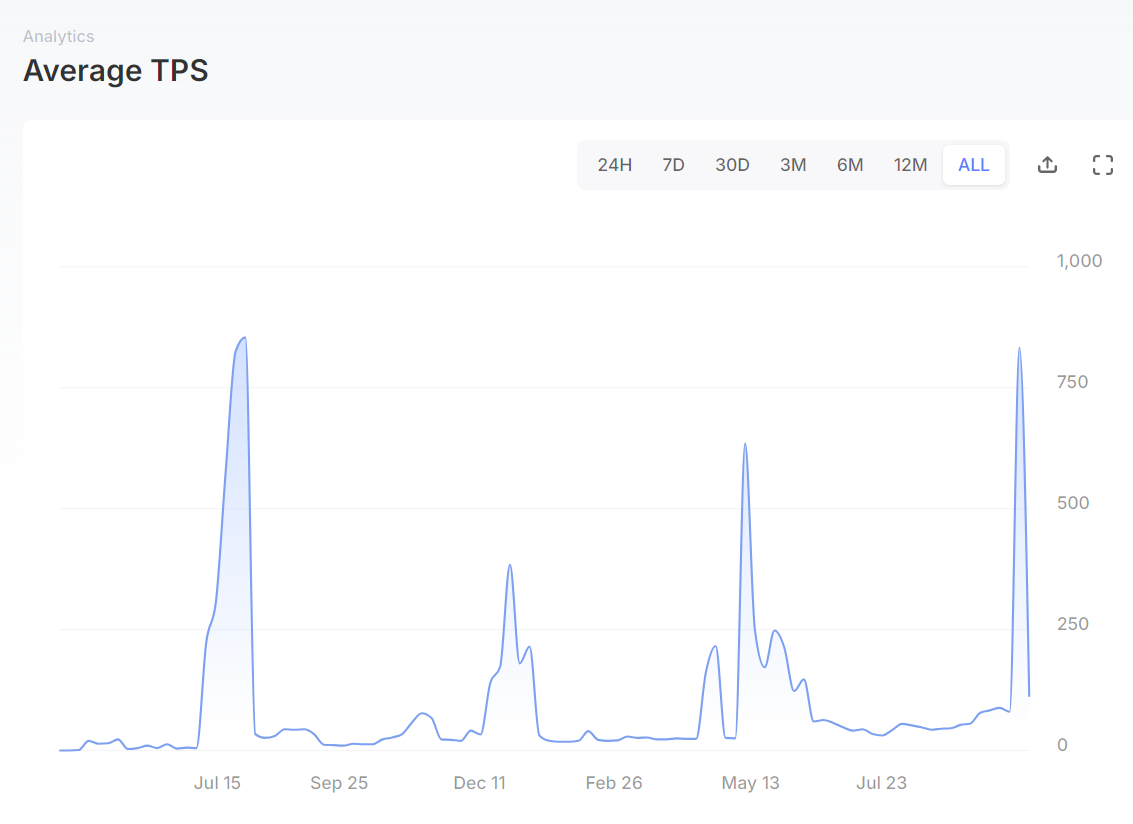

Sui is a high-performance Layer 1 public chain based on the Move language, developed by Mysten Labs. In terms of performance, according to data released by the Sui Foundation, Sui's maximum TPS can reach 297,000, and in actual operation, Sui's highest TPS currently reaches around 800.

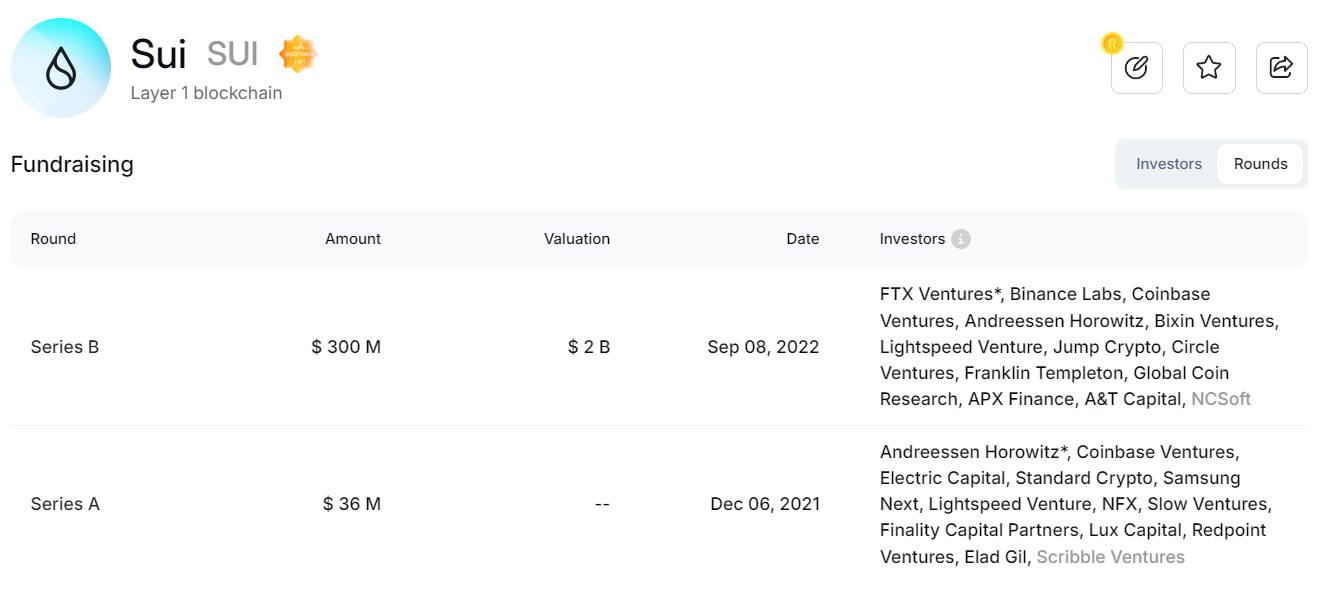

In terms of financing background, Sui has announced Series A and B financing, completing a total of $336M, with a valuation of $2B in the Series B round. The investors include strong backgrounds, with top funds such as A16z, Coinbase Ventures, and Binance Labs participating.

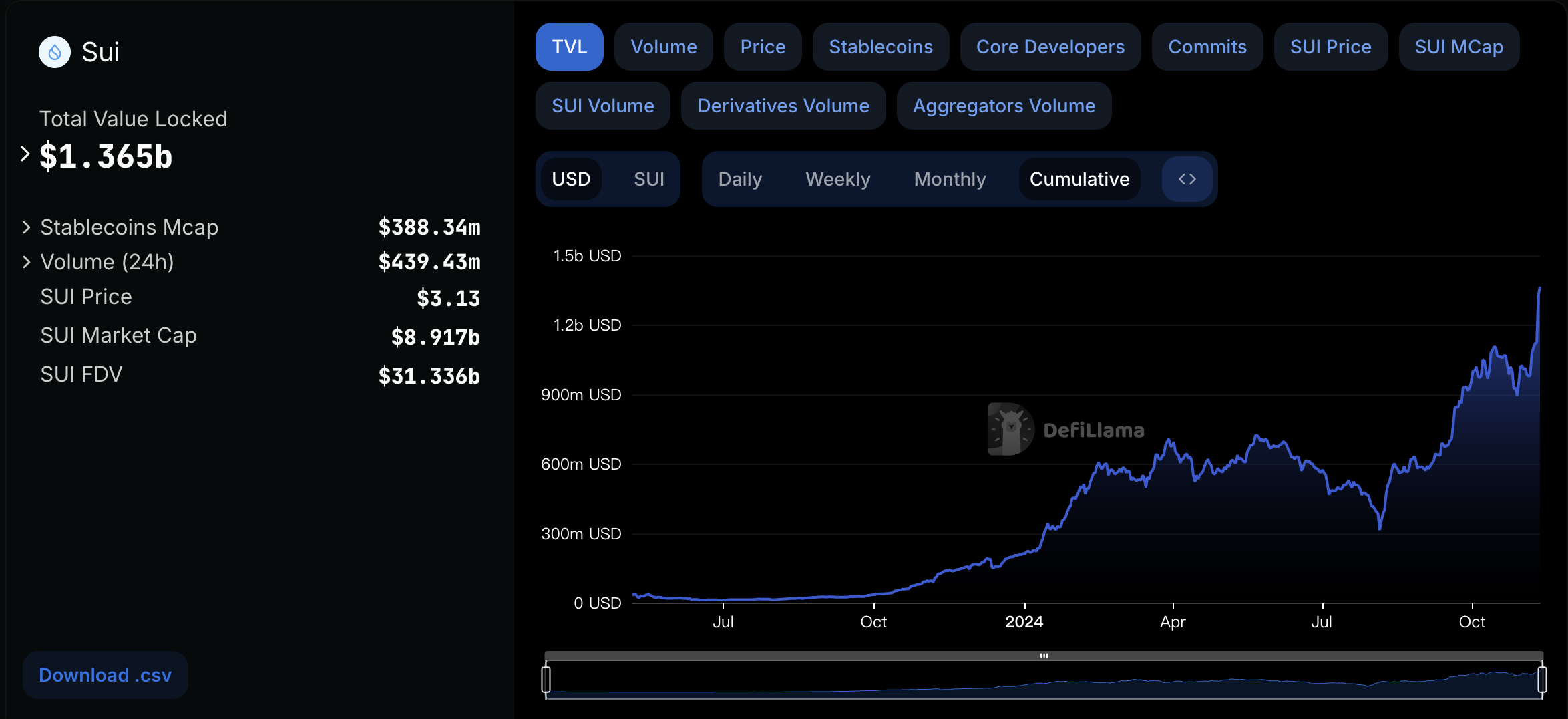

The Sui mainnet went live on May 3, 2023. Over the past year and a half, the TVL of the Sui ecosystem has rapidly climbed, currently ranking 5th among all public chain ecosystems, forming a DeFi infrastructure ecosystem that includes DEX, lending, stablecoins, and liquidity staking. In the early stages of development, the Sui ecosystem did not attract many stable daily active users until May 2024, when it began to attract a large number of users, currently stabilizing at around 1M daily active users.

The price of SUI entered a rapid rise phase in September, becoming one of the best-performing crypto assets of the month, significantly outperforming BTC and SOL, with recent price peaks approaching previous highs. Along with the rise in price, Sui has recently announced several ecosystem developments:

- On September 2, 2024, Sui announced the launch of the handheld game console SuiPlay0X1, which natively supports Sui ecosystem games and the Steam and Epic game libraries. The console is priced at $599 and will be delivered in 2025.

- On September 12, 2024, Grayscale announced the launch of the Grayscale SUI Trust Fund, officially opening to qualified investors. As of October 8, the fund's AUM has exceeded $2.7M.

- On September 17, 2024, Sui partnered with Circle to expand USDC to the Sui network. As of October 8, native USDC has been launched on the Sui mainnet.

- On October 1, 2024, Sui Bridge went live on the mainnet, currently supporting ETH and WETH bridging between Sui and Ethereum, protected by Sui network validators.

2.2 Activity of Base Trading

The Sui ecosystem has not birthed many new asset play methods, but trading in Memecoins was relatively active in early October, with tokens like HIPPO, BLUB, FUD, AAA, and LOOPY performing well, especially HIPPO, which has brought a very good wealth effect. It is currently the third-largest token in the Sui ecosystem, following CETUS and DEEP. This token has risen over 50 times from its low and has seen a significant rebound after dropping over 70% from its peak. The enthusiasm for Memecoin trading is also reflected in the rapid increase in the number of new tokens, with the number of newly created tokens on Sui maintaining over 300 daily since mid-September, and on several days in October exceeding 1,000, though it has now fallen back to a lower level.

In terms of Meme trading infrastructure, Cetus serves as the main AMM, with trading bots typically using PinkPunkBot. Movepump is similar to Pump.fun as a Memecoin launchpad, where tokens will go live on BlueMove Dex after liquidity reaches a threshold, leading to a significant increase in its TVL and trading volume data in early October.

2.3 Ecosystem Overview

According to Sui Directory statistics, there are a total of 86 projects in the Sui ecosystem, with the majority being games (23) and DeFi (16) aside from infrastructure. According to CoinGecko data, the market capitalization of Sui ecosystem projects is relatively low, with only HIPPO emerging recently among the top 500 projects, and among the top 1000 projects, only FUD, CETUS, BLUB, and NAVX exist aside from stablecoins, indicating that there are few investable targets, primarily consisting of Meme and DeFi leading projects.

According to DeFillama statistics, there are 40 DeFi protocols in the Sui ecosystem, with the top three protocols being: NAVI Protocol (lending), Cetus AMM (DEX), and Suilend (lending). Scallop Lend (lending) and Aftermath Finance (trading aggregation and liquidity staking) follow closely in terms of TVL. Additionally, there are yield aggregation protocol AlphaFi, stablecoin protocol Bucket, and derivatives trading protocol Bluefin.

NAVI Protocol: The leading lending protocol in the Sui ecosystem, with a TVL of $314.8M, a total loan amount of $464.63M, and a total borrowed amount of $149.83M. The composition of the TVL is mainly WUSDC, SUI, and derivatives of SUI, with the total amount of WUSDC on the Sui chain being $283.05M. WUSDC accounts for about $900M of the TVL in NAVI Protocol, exceeding 30%. NAVI Protocol is building Volo, a liquidity staking protocol for SUI. The protocol token NAVX has recently performed well, rising more than six times from its low of $0.003 on August 5 to the current price of $0.19. On October 4, NAVX was listed on Bybit and launched on Launchpool.

Cetus AMM: A DEX built on both Sui and Aptos, and the most mature DEX in the Sui ecosystem. It supports trading strategies such as AMM Swap, limit orders, and DCA, using a concentrated liquidity (CLMM) strategy in AMM. Additionally, Cetus integrates the Wormhole SDK to establish a cross-chain bridge interface on its front end to enhance user experience. The price of CETUS has also performed excellently, rising from a low of $0.038 on August 5 to nearly $0.02, an increase of over five times. With its recent listing on Binance, the price of CETUS has risen again by more than 100%, currently with a market cap of about $260M. On September 23, Cetus launched its first Meme Season, aimed at providing grants for Meme tokens traded on Cetus. Since October, Cetus's trading volume has significantly increased, exceeding $100M daily, surpassing the peak levels of March-April this year.

Suilend: The second lending protocol in the Sui ecosystem, with a total loan amount of $227.58M and a total borrowed amount of $57.69M, both lower than NAVI Protocol. The composition of the TVL is also mainly SUI and WUSDC, with the total TVL composed of SUI and WUSDC being comparable to NAVI Protocol, but it has not yet introduced derivatives of SUI. This project is built by the Solend team, allowing SOL to be wrapped into the Sui ecosystem for yield generation. It is worth mentioning that both Suilend and NAVI Protocol provide incentives for lending activities using SUI or its derivatives, with Suilend using SUI and NAVI Protocol using vSUI. In May 2024, Suilend launched a points program to reward users who deposit assets onto the platform.

2.4 Ecosystem Development Strategy

Web3 Gaming has always been a crucial part of Sui's ecosystem strategy. The Move language used by Sui adopts an object-oriented architecture, treating objects as the basic unit of data storage, rather than using an account model like other blockchains. This allows for the definition of richer and more composable on-chain game assets on Sui. Additionally, Sui's scalability and zkLogin provide a gaming experience closer to Web2 for game users.

In the early development of the Sui ecosystem, the flagship game Abyss World attracted significant market attention, supported by AMD and Epic Games. On June 24, 2023, the Japanese social gaming giant announced it would become a validator node for Sui and develop games on Sui. On September 22, 2023, South Korean game developer NHN was reported to be developing a blockchain game based on Sui. On September 28, 2023, Sui launched the Web3 game portal Play Beyond, facilitating a one-stop exploration of games on Sui. However, due to the poor performance of the blockchain gaming sector in this cycle, no breakout games have emerged on Sui. Data shows that while gaming and social projects were the main sources of users in Sui in 2023, the ecosystem fell into silence as it entered 2024.

Recently, the Sui ecosystem has begun to make joint efforts in multiple areas, seemingly mirroring Solana's early strategy: the rapid rise in SUI token prices, the emergence of wealth-generating Memes, and the overall surge of ecosystem tokens. Additionally, supported by Grayscale's establishment of the Sui Trust Fund, the native USDC's entry into the Sui ecosystem, the listing of ecosystem project tokens on core CEXs, and the Sui Foundation's announcement of investments in ecosystem projects, a series of positive news has quickly attracted market attention to Sui, with increasing mentions of it as a "Solana Killer." At the same time, it is evident that the Sui ecosystem continues to prioritize gaming as one of its main lines, including the launch of SuiPlay0X1 and promotional videos for Sui games by Grayscale.

Moreover, in terms of market selection, the South Korean market has shown a high level of interest in Sui, with the SUI token consistently ranking among the top trading volumes on Upbit. In the spot trading volume of the SUI token, Upbit ranks second only to Binance, indicating the importance of the South Korean market to the Sui ecosystem.

2.5 Changes in Capital and User Data

In terms of capital data, the TVL of the Sui ecosystem has rapidly increased since August 5, rising from around $300M at its low to over $1B. However, since the TVL is mainly composed of SUI and ecosystem tokens, this data does not accurately reflect the true capital inflow into the Sui ecosystem.

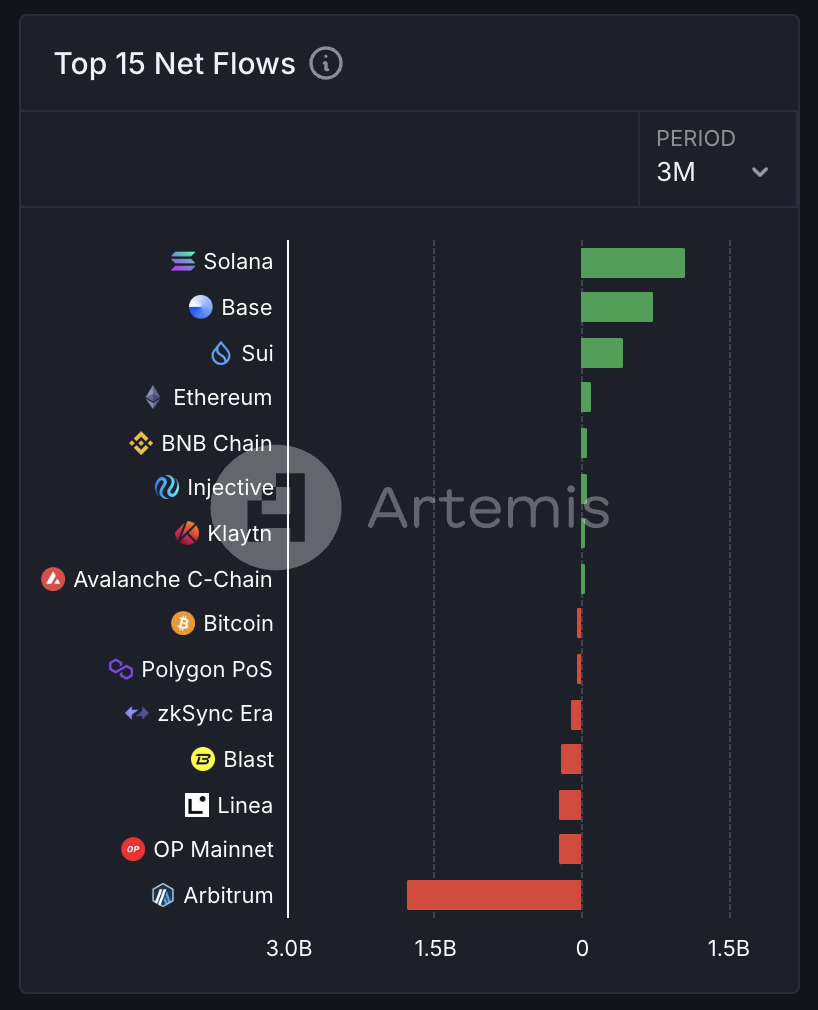

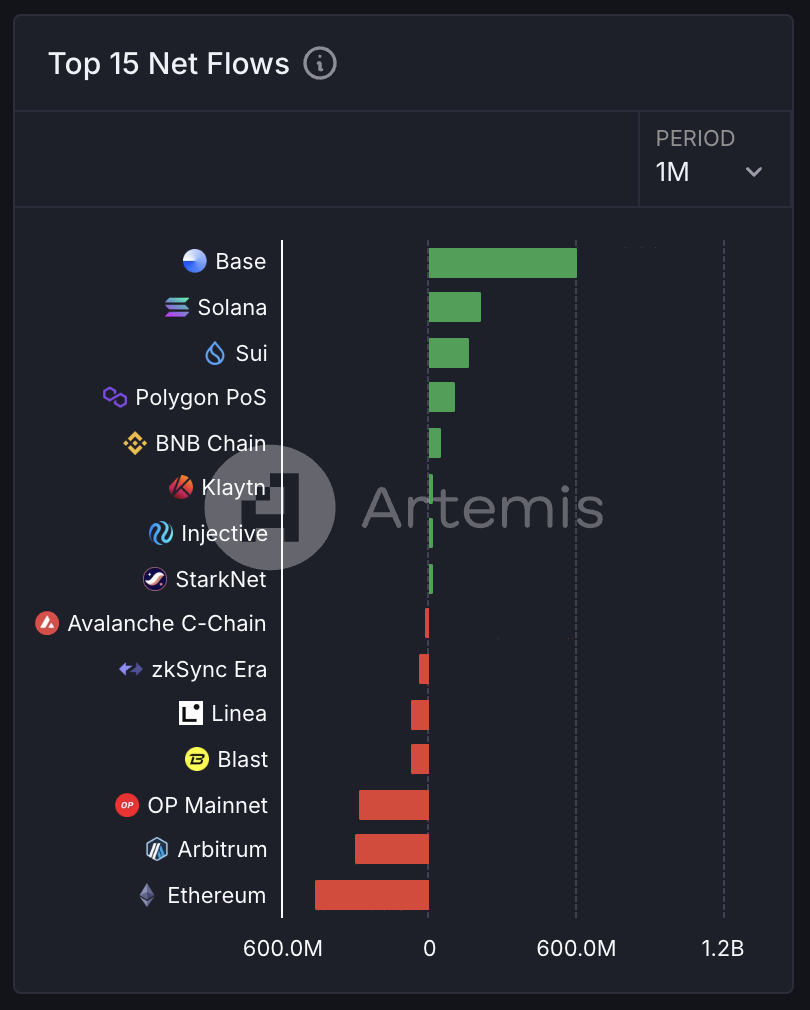

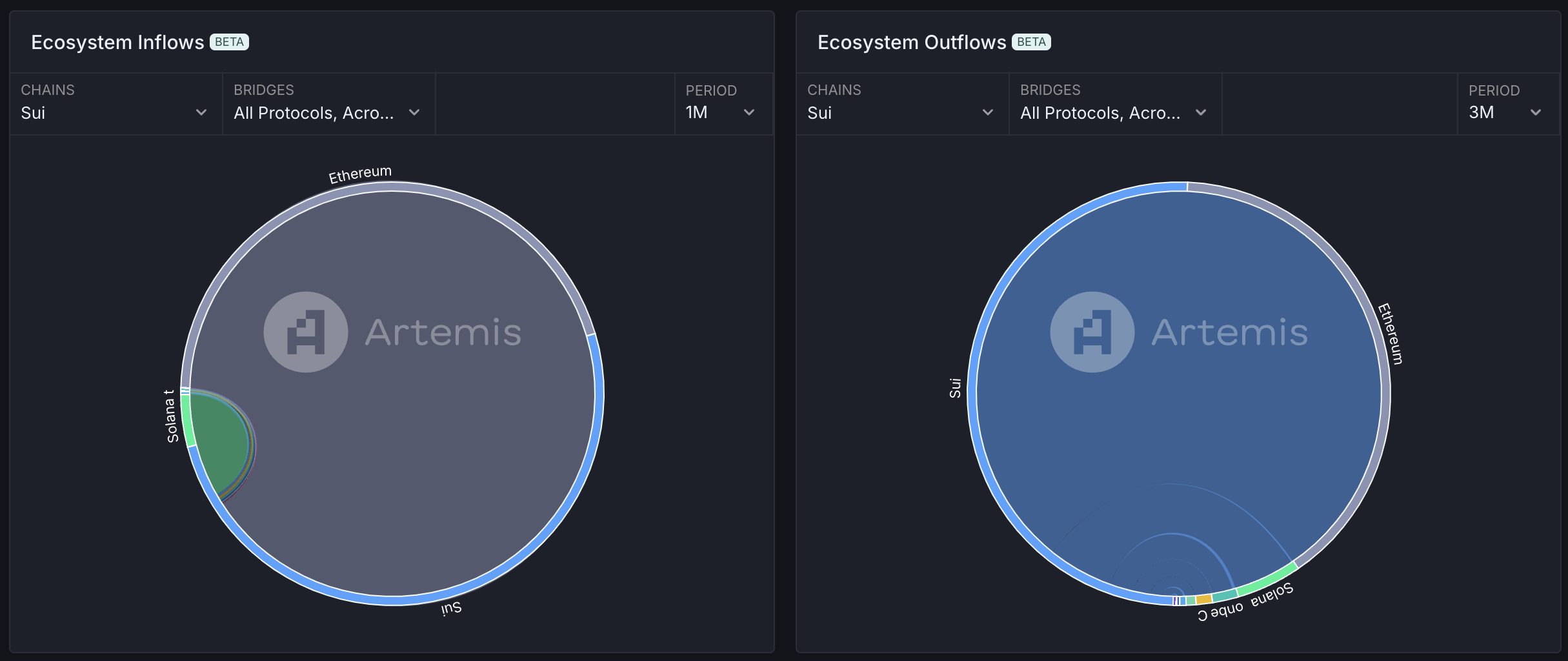

A more accurate indicator may be the market capitalization of stablecoins and capital inflow. Currently, the market capitalization of stablecoins in the Sui ecosystem is about $380M, having grown to $437M after August 6, but then quickly declined. In terms of capital inflow, Sui has seen positive net inflows over the past month and three months, ranking third among all public chain ecosystems, indicating good capital inflow conditions. The main sources of inflow and outflow for Sui are primarily Ethereum.

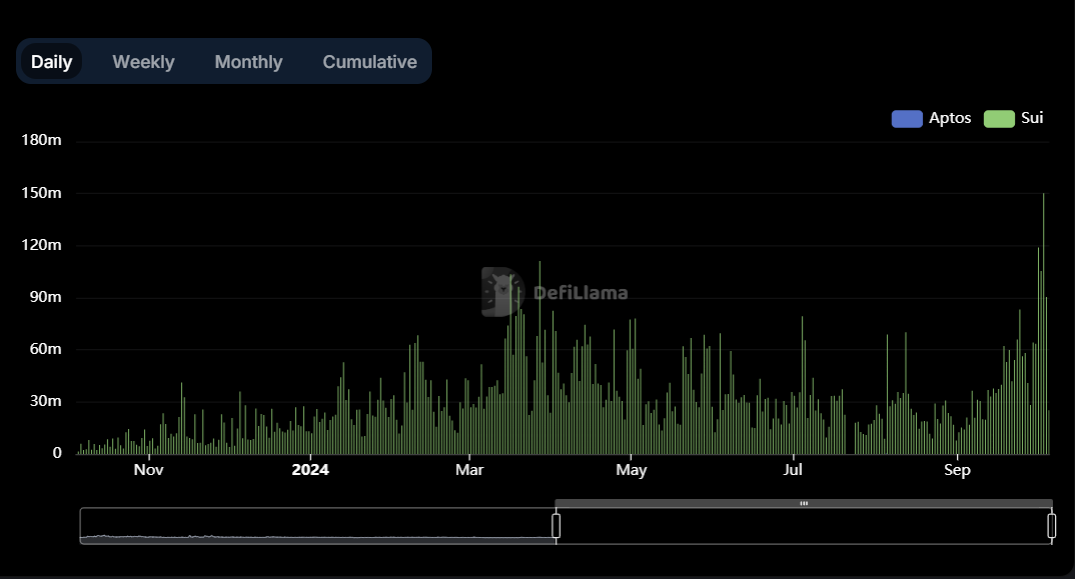

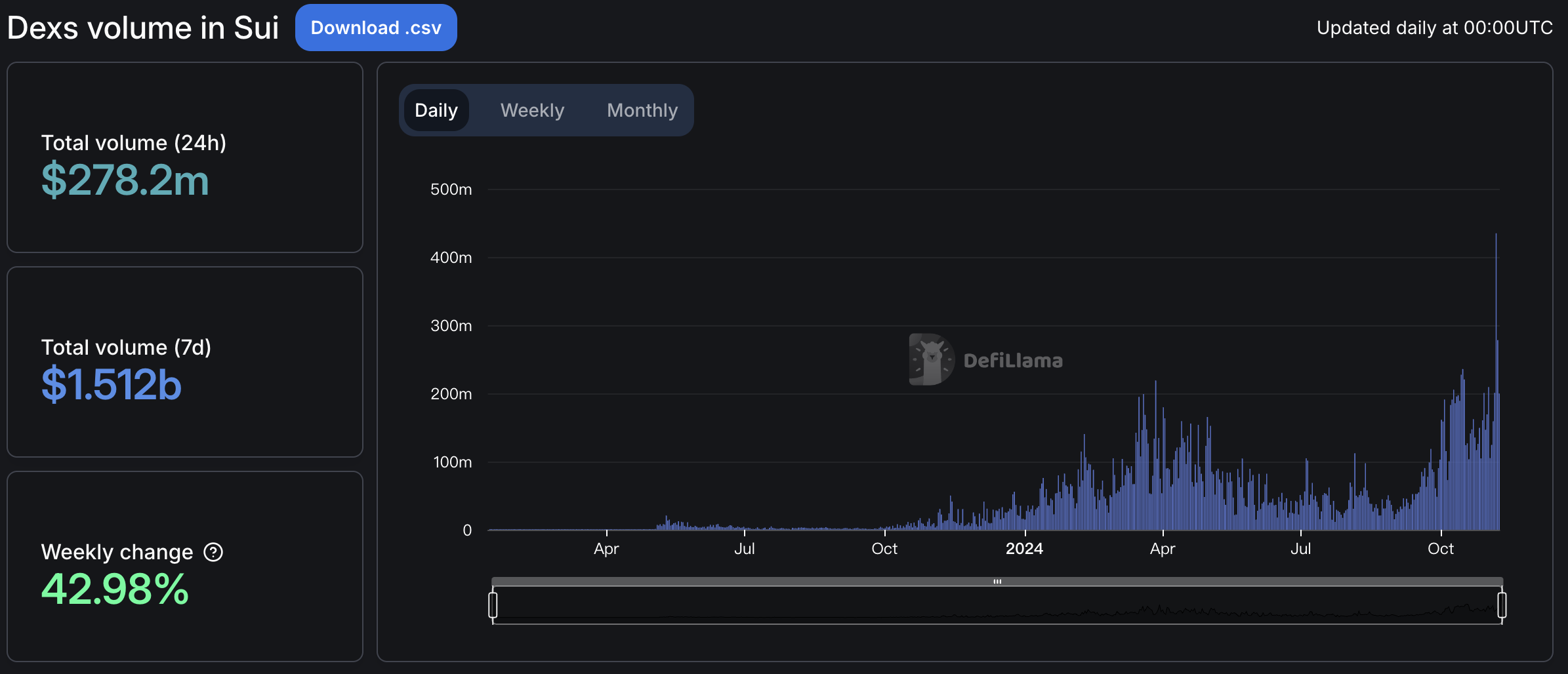

Additionally, in terms of trading activity, Sui's DEX volume ranks sixth among all public chain ecosystems, with trading volume significantly recovering since September, currently exceeding the peak levels of March-April, with daily trading volume surpassing $200M. Cetus contributes over 85% of the trading volume, with the main trading pairs being SUI-USDC, SUI-wUSDC, HIPPO-SUI, and CETUS-SUI.

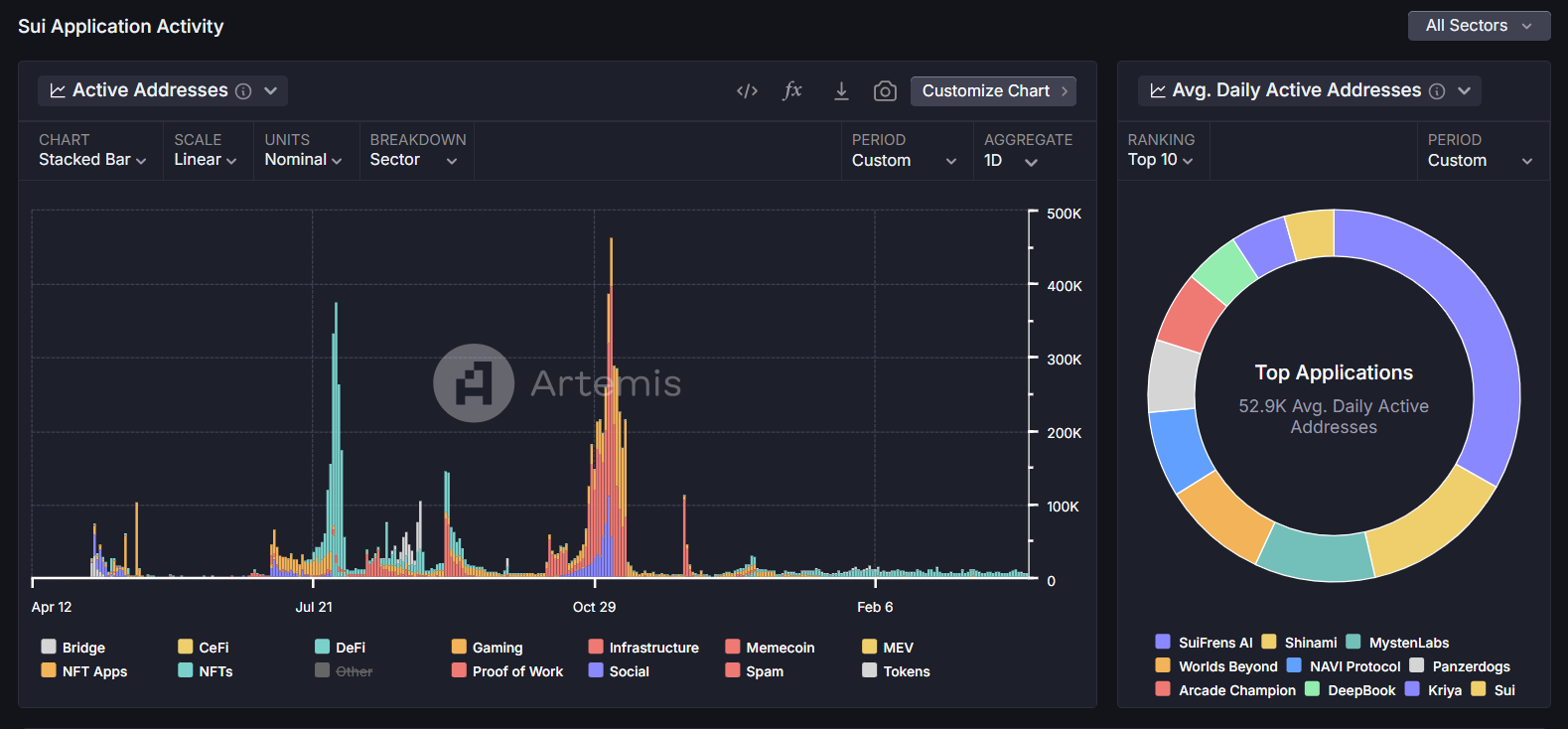

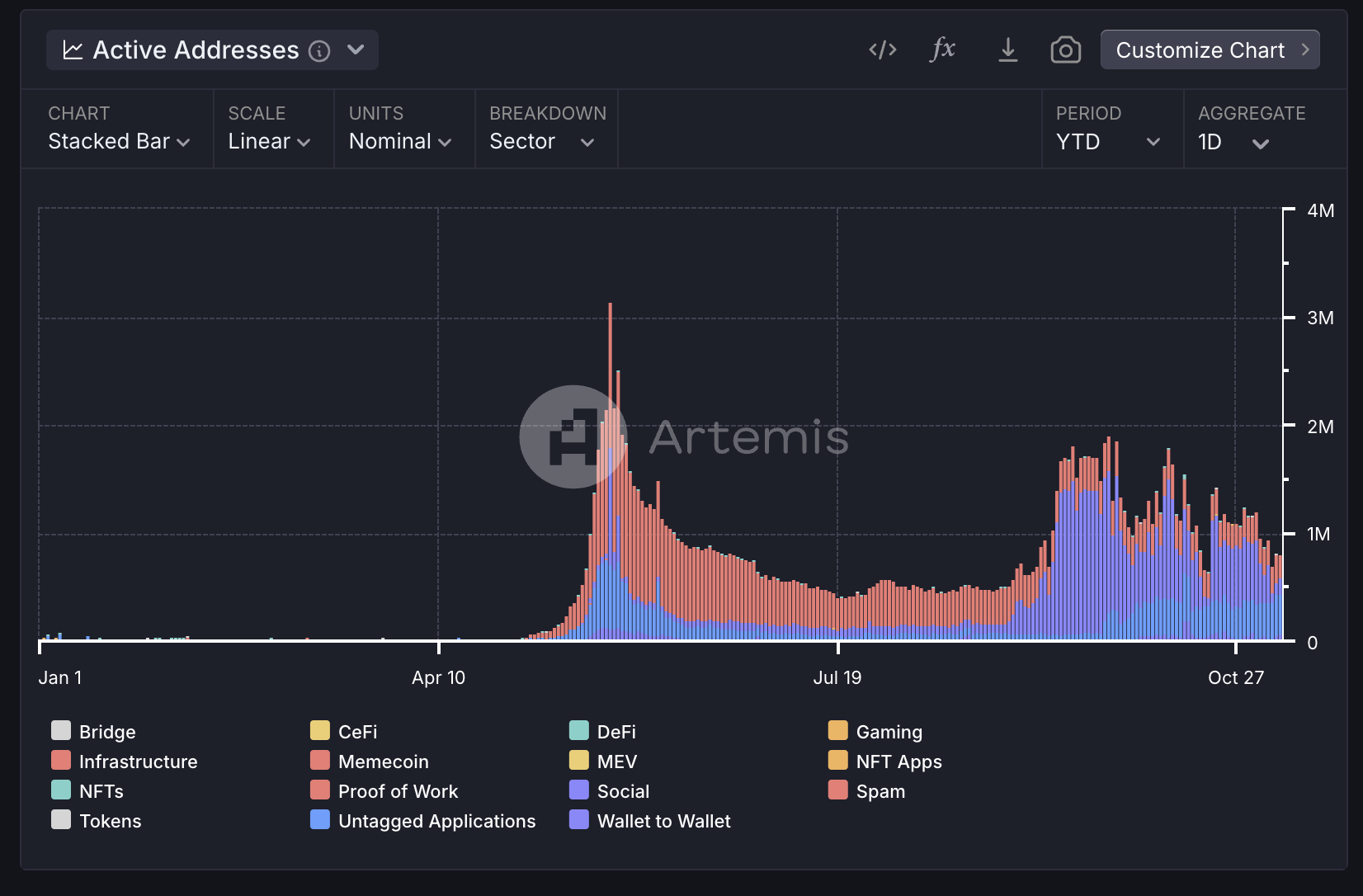

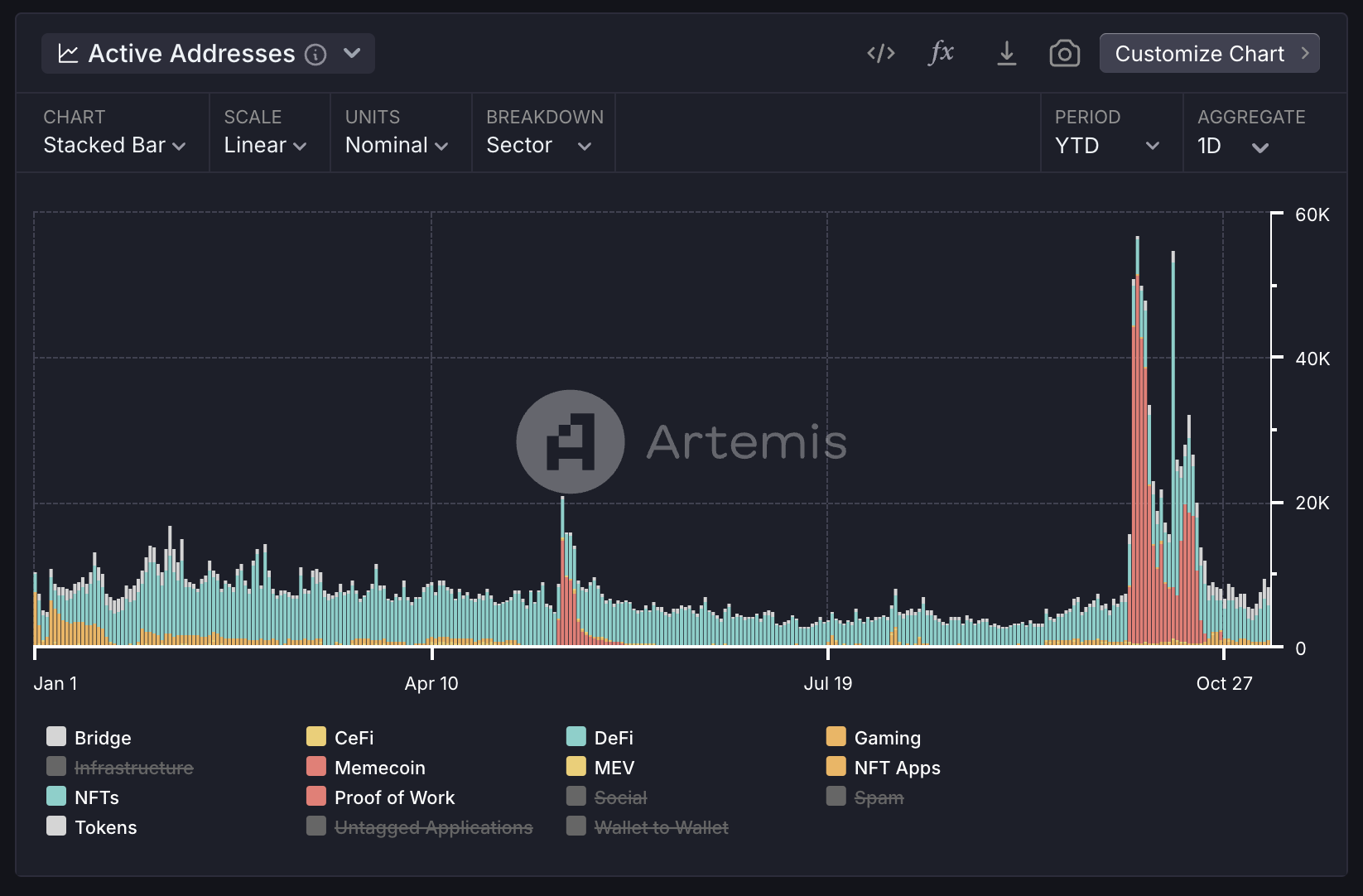

In terms of user data, the total number of active users in Sui has increased, but active users are mainly concentrated in the social sector, with the most active DApps being RECRD, BIRDS, and FanTv. The discussion volume of these DApps in the market has not risen correspondingly, leaving the actual number of real users in question. Excluding the social sector and the Other sector to which BIRDS belongs, the user activity in the Sui ecosystem has not seen significant increases, especially in the DeFi sector, where the daily active wallet count is only 1-5K. Compared to Ethereum and Solana, which have a user structure primarily focused on DeFi, the DeFi activity in the Sui ecosystem is relatively weak, and the user structure is not healthy, raising doubts about the actual number of active users. October 2024 witnessed a peak in Memecoin activity in the Sui ecosystem, with related daily active user peaks exceeding 50K, but this enthusiasm did not last, and the activity of Memes has once again fallen to a low point.

2.6 Token Economics and Price Trends

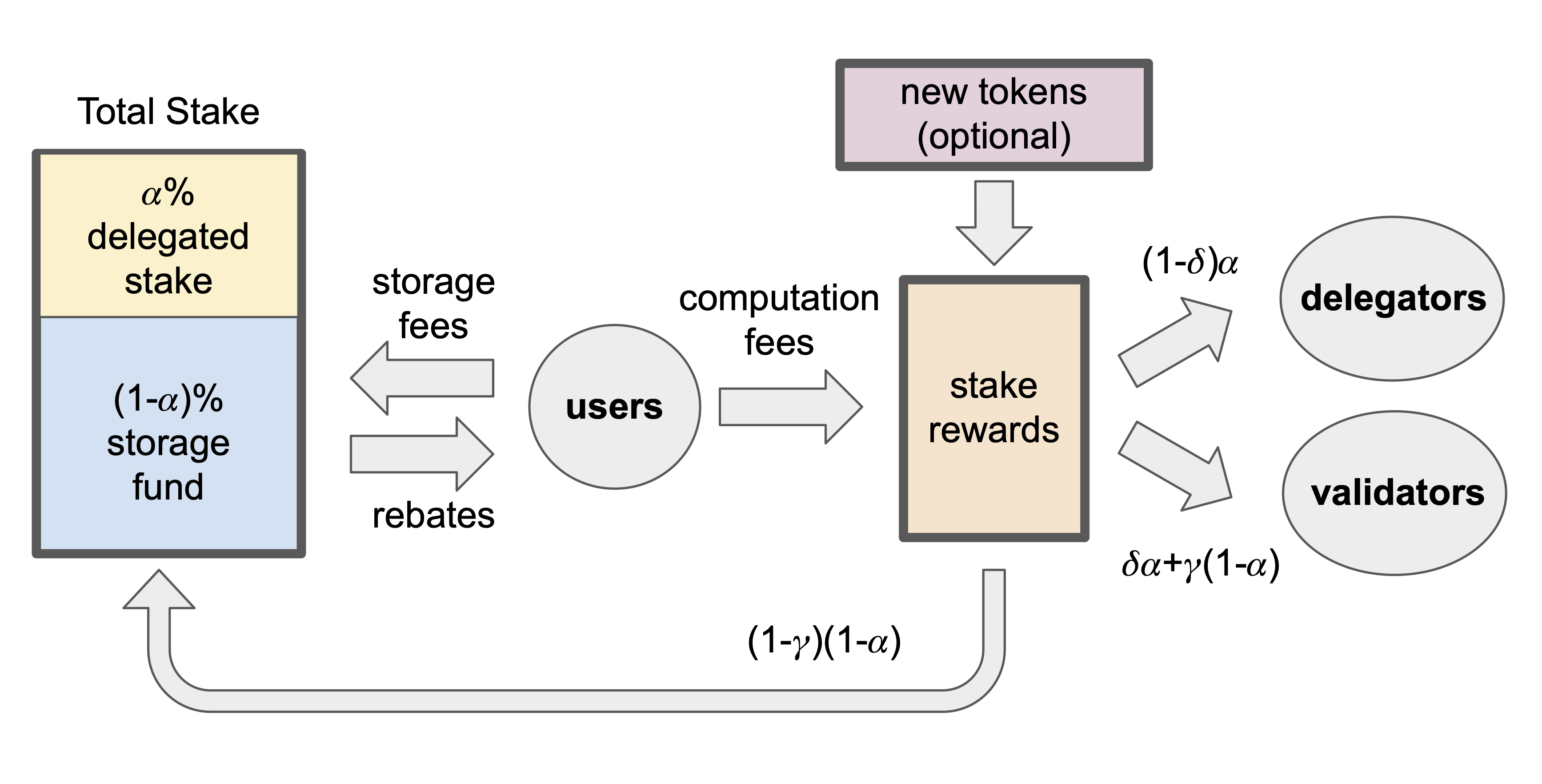

The circulation process of SUI within the entire system is illustrated in the diagram below. Sui has established a Storage Fund, which will simultaneously acquire a portion of the Storage fees paid by users and a part of the Stake Rewards. The flow of funds for each Epoch is as follows:

- Users submit transactions and pay the corresponding Computation fees and Storage fees, with the Storage fees going directly into the Storage fund.

- New SUI token inflation and Computation fees together constitute the Stake rewards.

- The total staking amount for each round includes two parts: the user's staking amount * α% * and the proportion of the Storage fund (_1-α)%.

- The γα proportion of Stake rewards is distributed to stakers and delegated stakers.

- The remaining (1-γ)(1-α) of the Stake rewards is transferred to the Storage fund.

- If a user deletes stored data, the Storage fund will refund a portion of the storage fees to the user.

Therefore, in the early development of the Sui ecosystem, the Storage fund did not have any outflow of funds apart from refunding storage fees for deleted data, creating a locking mechanism for SUI. When the locked portion exceeds token inflation, the SUI token enters a deflationary mode.

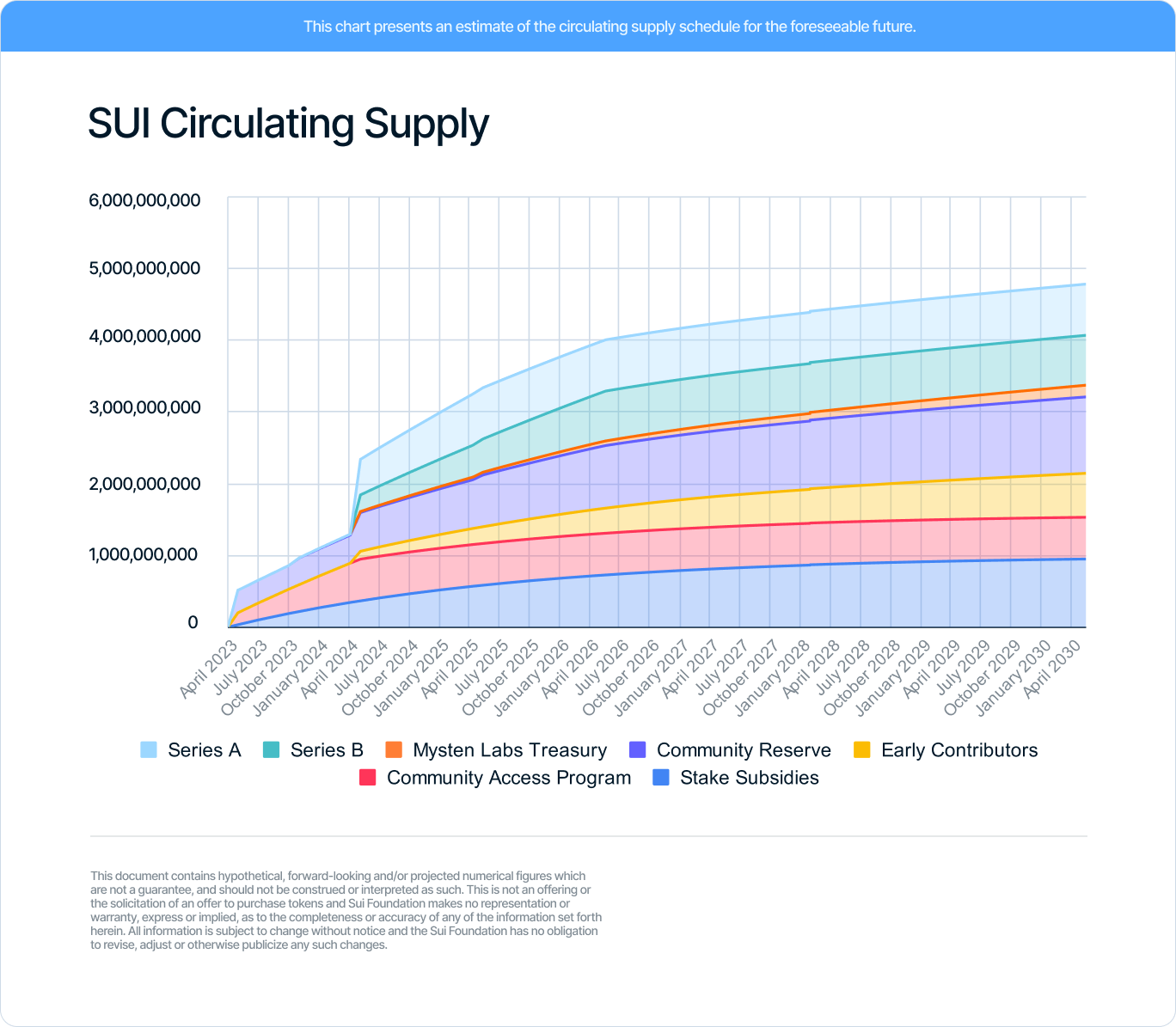

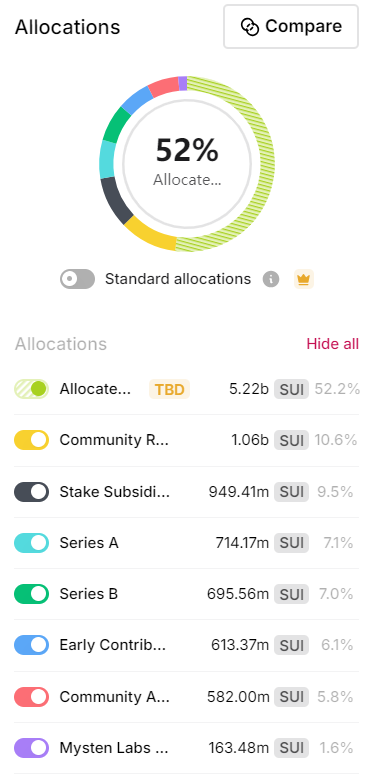

In terms of token distribution, the total supply of SUI is 10B, and the token unlock schedule announced by Sui on June 29, 2023, is shown in the diagram below. According to Token Unlock data, the distribution of SUI tokens is illustrated in the pie chart. The circulating supply of SUI is 2,763,841,372.61, accounting for 27.64%. Currently, the main inflationary pressure on SUI comes from staking rewards and token unlocks. Starting in April 2024, tokens for investors, early contributors, and the team will begin to unlock monthly, with a total of 64.19M SUI tokens unlocked on November 1, 2024, accounting for 2.32% of the circulating supply. Ongoing token unlocks and inflation may become a pressure point for SUI's price increase.

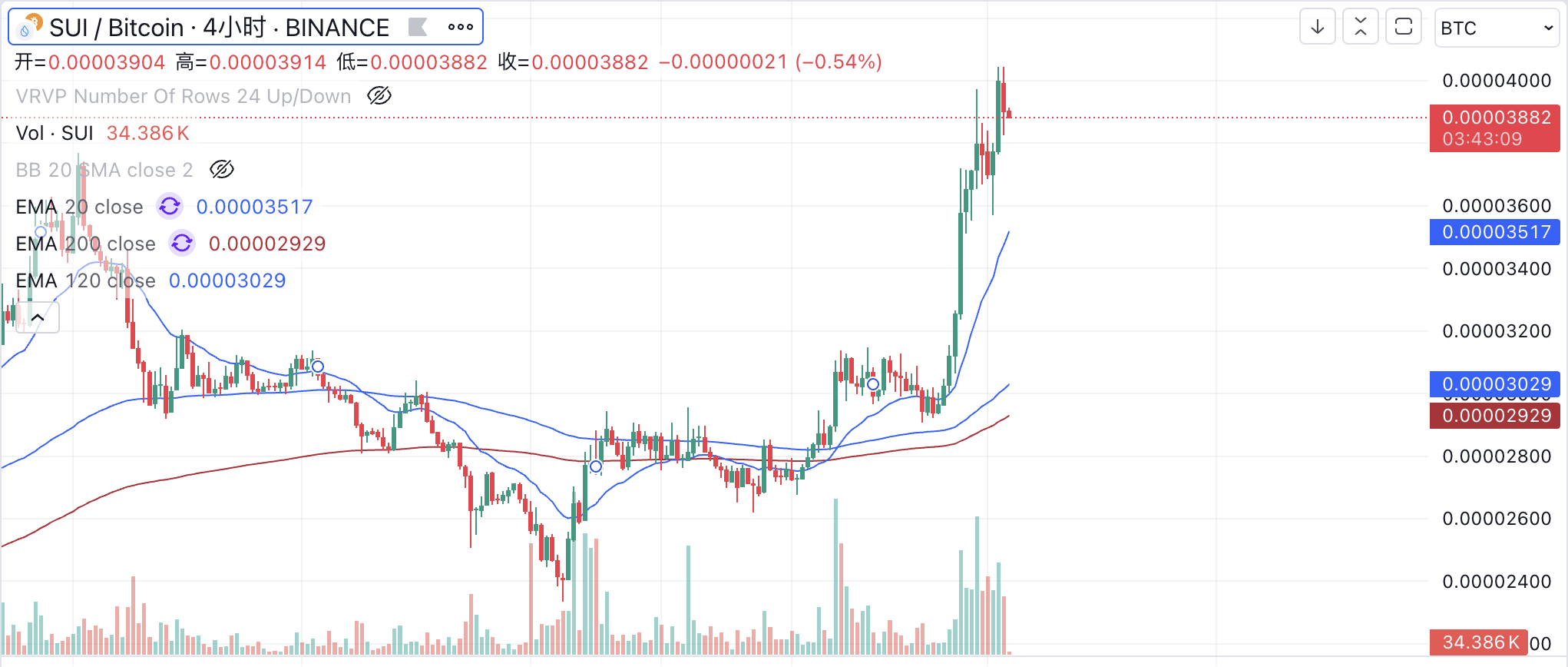

From a price performance perspective, the exchange rate of SUI against BTC has shown strong trends, quickly rebounding after a drop to a low on October 29. After a period of adjustment, it continued to rise, experiencing a significant increase after November 9, breaking through the highs of early this year.

2.7 Summary

In the past month, market attention towards the Sui ecosystem has significantly increased, primarily driven by the wealth-generating effects of Sui and its ecosystem tokens. We can see that Sui and its ecosystem are forming a synergy, quickly attracting attention through price surges and positive news releases. So, has the Sui ecosystem formed a "new Solana" momentum?

- On the positive side, we are seeing capital inflows into the Sui ecosystem. Although the TVL data has significant discrepancies, Sui's net inflow of bridging funds ranks third, indicating Sui's attractiveness to on-chain capital.

- A decent Memecoin was born in the Sui ecosystem in early October, gaining some market attention, but the momentum and volume are clearly insufficient compared to Solana and Ethereum. We have not seen signs of speculative funds for Memes shifting from Ethereum and Solana to Sui, and the development momentum of Memecoins is not sustainable, with user activity once again dropping to a low point.

- Sui continues to prioritize Web3 Gaming as one of its main strategies, but the gaming sector is not optimistic in this cycle. Even the TON ecosystem's mini-games, which were seen as a path to mass adoption, are gradually being disproven. If Sui's ecosystem projects cannot sustain momentum after this round of hype, the Sui ecosystem may still face the fate of being forgotten by the market.

- The total number of daily active users in Sui has significantly increased, but when broken down, it appears unhealthy and may even contain inflated numbers. Similar to the ecosystem strategy, this raises cautious concerns about the health and sustainability of the Sui ecosystem.

- In terms of tokens, SUI faces long-term, continuous inflationary pressure, which will exert significant pressure on its price increase. Many people compare SUI to the new SOL, but SOL had basically completed its unlocks during this round of price increases, facing little inflationary pressure. Continuous monitoring of SUI's chip structure and unlocking situation is necessary; if the public chain's native token faces resistance in breaking through, it will create considerable pressure on the ecosystem's sustainable development.

3 Aptos Ecosystem Analysis

3.1 Basic Information and Recent Developments of the Public Chain

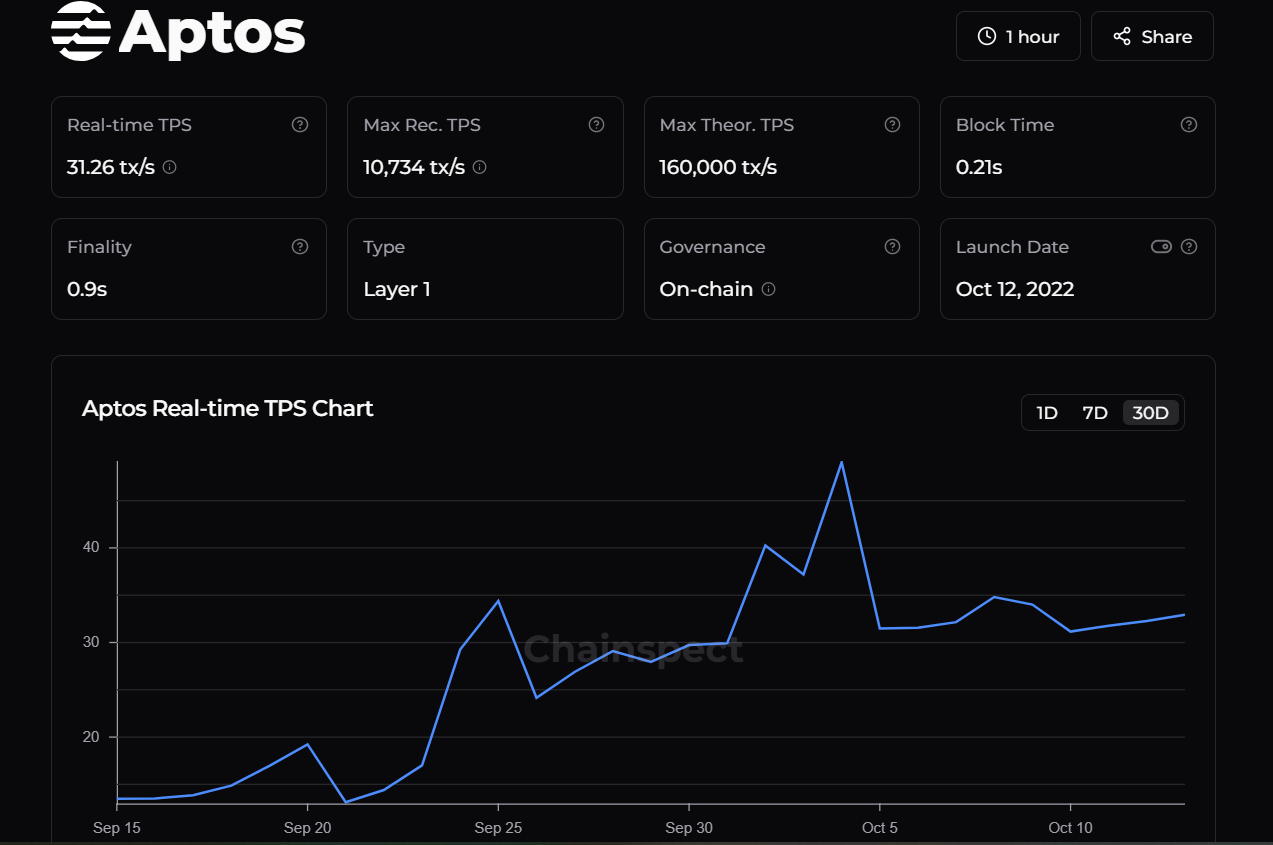

Aptos is also a high-performance Layer 1 public chain based on the Move language, but compared to Sui, Aptos retains more of Diem's core, while Sui has introduced more modifications. The biggest difference between the two is that Sui has introduced an object-based model, while Aptos uses an account-based model. Additionally, there are certain differences in the parallel execution strategies for transactions. In summary, Aptos focuses more on modular involvement and optimization of traditional blockchain structures, while Sui proposes greater innovation in its architecture. In terms of performance, according to Chainspect data, Aptos's theoretical maximum TPS can reach 160,000, with a recorded maximum TPS of 10,734 in actual operation, and daily TPS maintaining between 500-1000.

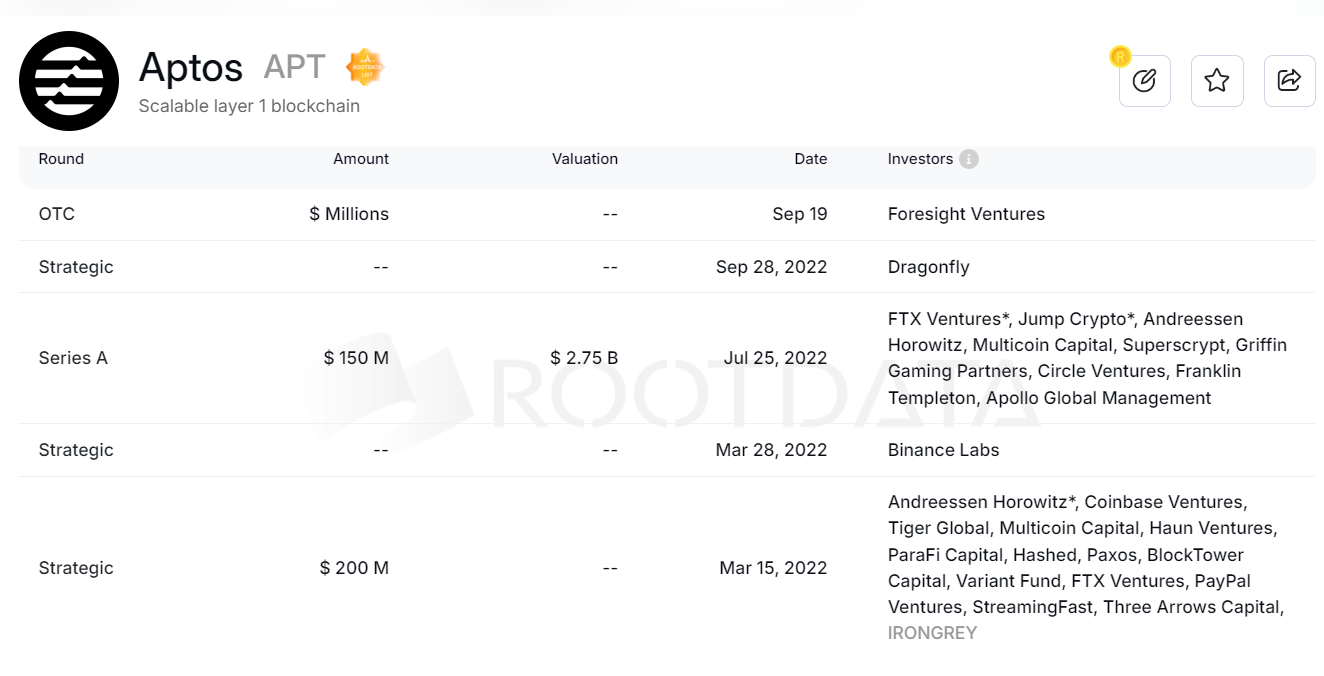

In terms of financing background, Aptos announced multiple rounds of financing in 2022, with a Series A valuation of $2.75B, also supported by top funds such as A16z, Binance Labs, and Coinbase Ventures. On September 19, 2024, MEXC Ventures, Foresight Ventures, and Mirana Ventures jointly launched a fund to support projects initiated in the Aptos ecosystem.

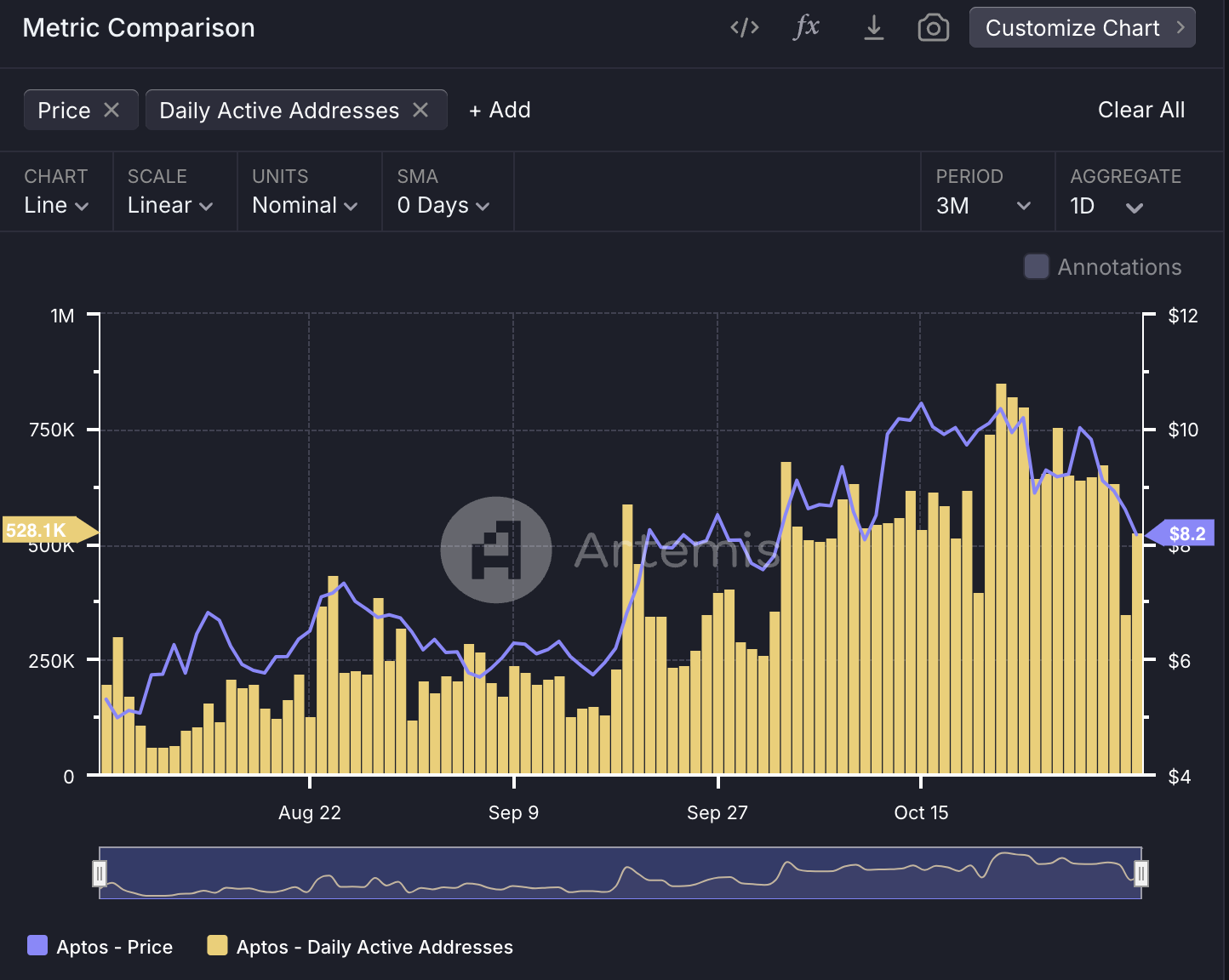

The Aptos mainnet went live on October 17, 2022, and after 2024, the TVL began to rise rapidly, increasing more than threefold since the beginning of this year. It currently ranks 12th among all public chain ecosystems, forming a relatively complete DeFi infrastructure ecosystem. In the month following the mainnet launch, there were many daily active users, but it then fell into a period of over six months of silence, only recovering a certain level of user activity after August 2023. The current number of daily active addresses is around 500-600K.

APT has risen more than double since its low on August 5, 2024, but it still has a distance of one fold from its ATH price. Recently, Aptos has not had any particularly sensational positive news, with the main ecosystem developments including:

- On September 19, 2024, MEXC Ventures, Foresight Ventures, and Mirana Ventures jointly launched a fund to support projects initiated in the Aptos ecosystem.

- On October 3, 2024, Aptos Labs announced a strategic expansion into the Japanese market through the acquisition of HashPalette, a chain developer, which will promote the adoption of Web3 in Japan's entertainment, gaming, and digital asset sectors.

- On October 2, 2024, Franklin Templeton expanded its on-chain money market fund to the Aptos network.

- On October 28, 2024, native USDT was launched on the Aptos mainnet.

3.2 On-Chain Trading Activity

Aptos has almost no means of implementing on-chain trading, lacking active and leading Memecoins, and the entire ecosystem is still relatively early.

3.3 Ecosystem Overview

According to the official Aptos website, there are currently 192 projects, far exceeding the data for Sui. Among these, according to DeFillama data, there are 49 DeFi protocols, which is roughly equivalent to the Sui ecosystem. However, there are relatively few projects in the Aptos ecosystem that have issued tokens, with only Propbase (an RWA platform) and Thala among the top 1000 by market cap. Additionally, the token CELL from Cellana ranks only around 1300 in market cap.

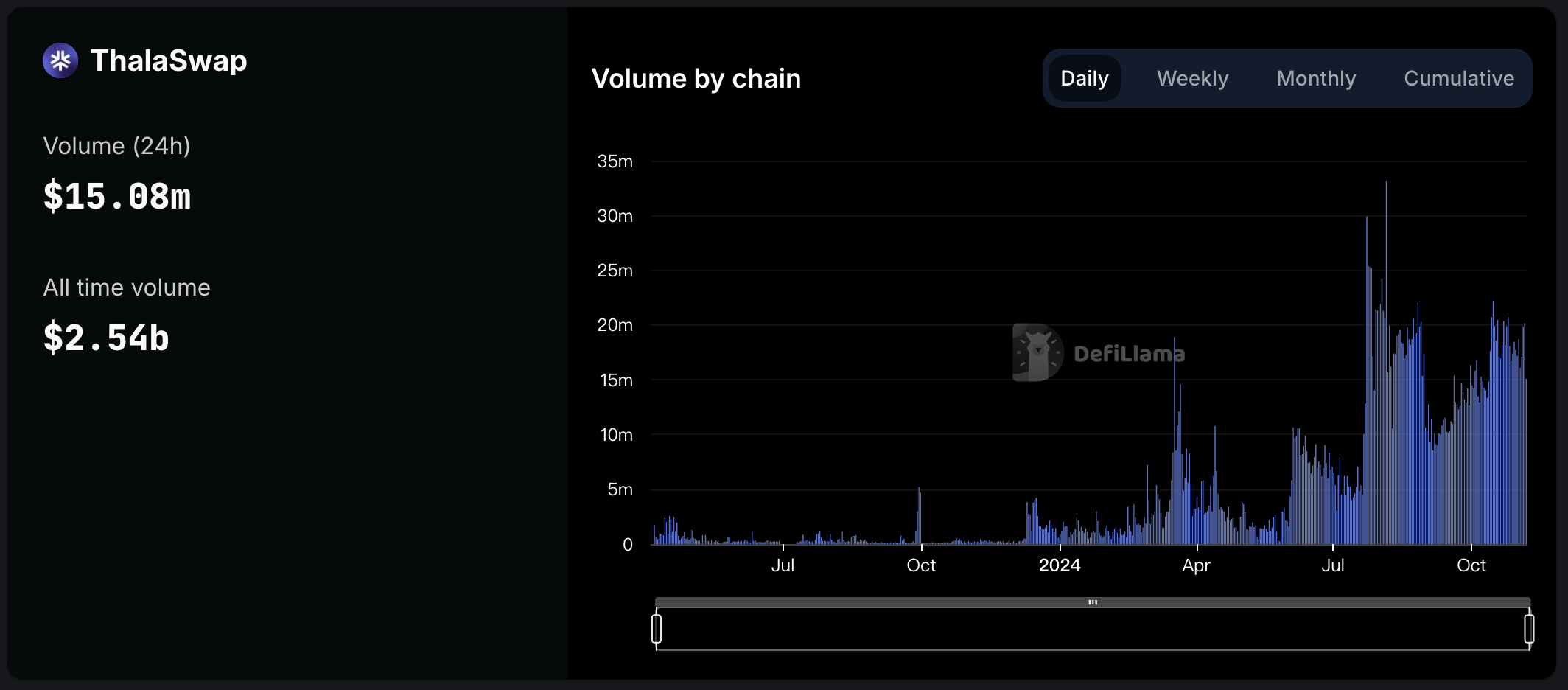

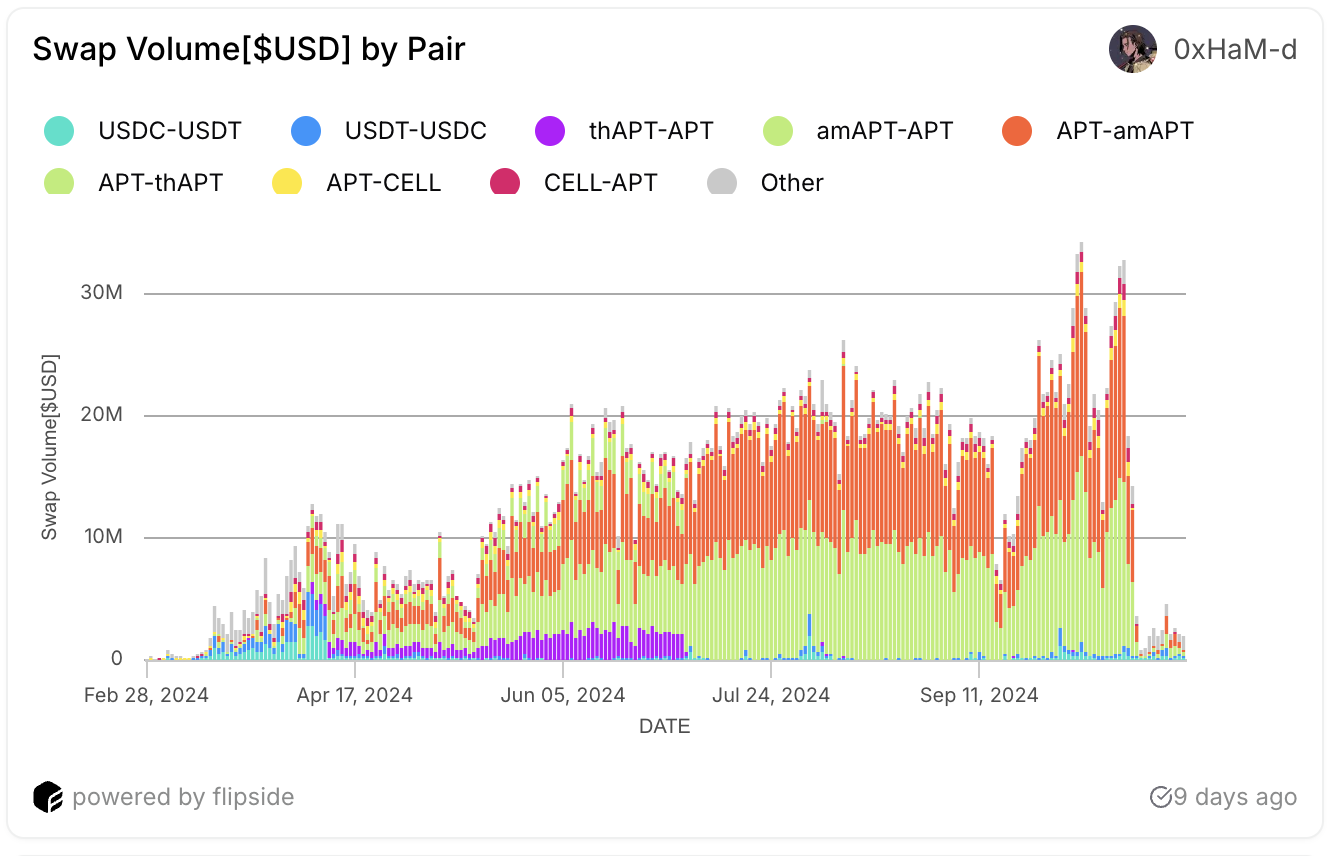

Thala: The leading DEX on Aptos, accounting for 50% of the trading volume on the Aptos chain. Its core products include Swap, liquid staking, and over-collateralized stablecoins. Currently, Thala's trading functionality is relatively simple, primarily focused on AMM trading, and it has also opened liquid staking, allowing users to obtain liquidity tokens thAPT and stake them for about 8% APR. Thala is the issuer of the native stablecoin MOD on Aptos, where users can mint MOD by over-collateralizing APT, thAPT, and sthAPT. In terms of trading volume, Thala has recently outperformed the other two DEXs (LiquidSwap and Cellana Finance), with the main trading pair contributing to its volume being MOD/zUSDC (LayerZero’s USDC), with a 24-hour trading volume of about $6M, demonstrating the empowering effect of the MOD stablecoin on Thala. The THL token was launched in June 2023, initially listed on MEXC and Gate exchanges, with the main trading volume concentrated on the THL/MOD trading pair. The price of THL peaked at around $3 in March-April 2024 and has since fallen to about $0.8.

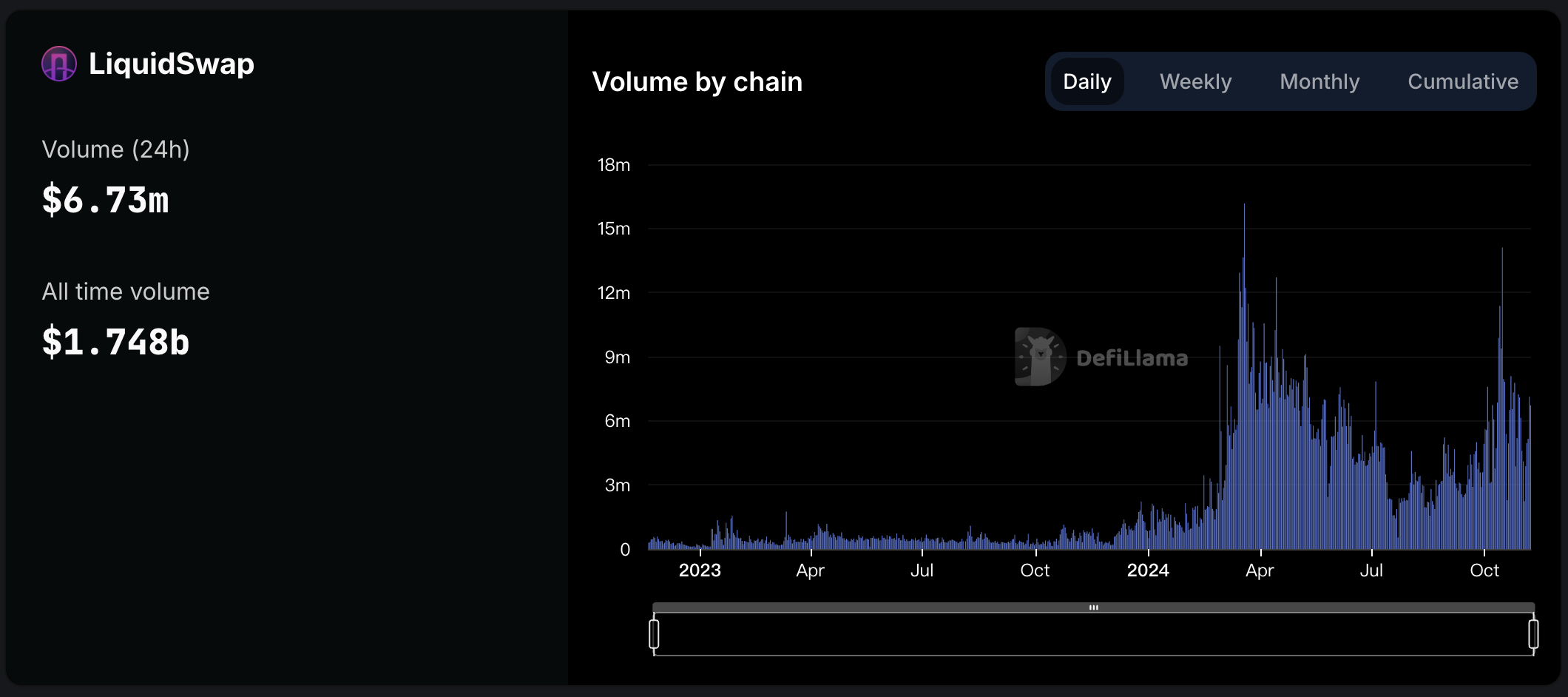

LiquidSwap: The second leading DEX on Aptos, accounting for 22% of the trading volume on the Aptos chain. This DEX was developed by Pontem Network, with its main trading pair being USDC-APT, and a 24-hour trading volume of $3M, with a TVL of about $20M, which constitutes half of LiquidSwap's trading volume and TVL.

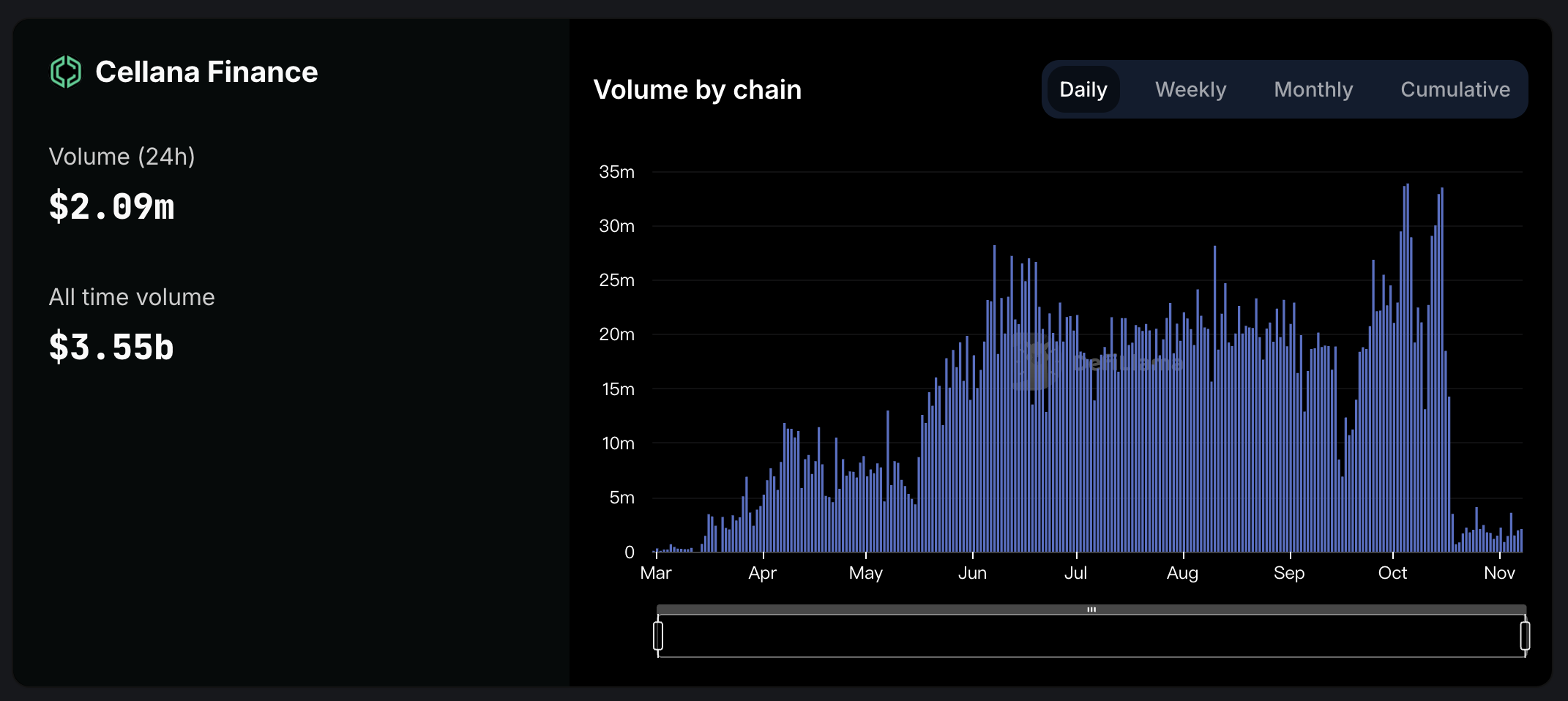

Cellana Finance: Launched in February 2024, Cellana has already become the DEX with the highest cumulative trading volume on Aptos. From January to October 2024, it maintained a daily trading volume exceeding $25M, but after October 18, the trading volume plummeted, currently down to about $2M per day. Previously, its trading volume mainly came from the mutual exchange between amAPT and APT, but this trading pair's volume significantly decreased after October 18. Cellana is one of the few protocols on Aptos that has issued tokens, with its token CELL being stakable to obtain veCELL. Depending on the staking duration, users can gain certain voting rights to determine the distribution of the next round of CELL liquidity incentives across different pools. veCELL voters will receive 100% of the trading fees from the liquidity pool they voted for during that period. Currently, CELL can only be traded on Cellana, with the CELL-APT trading pair accounting for 88% of its total trading volume.

Aries Markets: Aries is the largest lending protocol in the Aptos ecosystem and also the DeFi protocol with the highest TVL. The total amount of loans supplied is $664M, with $402M borrowed. The TVL has seen significant growth over the past two years, with the main asset types being zUSDT, zUSDC, stAPT, and APT. Deposits of zUSDT and zUSDC can earn a 12% annualized yield, primarily from APT subsidies, making it one of the main earning venues for stablecoins on Aptos. In addition to lending functions, Aries integrates AMM, limit order trading, and cross-chain bridges. Aries has not yet issued a token but is conducting a points program to reward users for deposits and loans.

Amnis Finance: Amnis is the largest liquid staking protocol on Aptos, where users deposit 1 APT to receive 1 amAPT. Staking amAPT yields stAPT, providing corresponding staking rewards of about 9%. This protocol launched in October 2023 and has seen steady growth in TVL, making it the second DeFi protocol by TVL on Aptos. amAPT and stAPT have been widely integrated within the Aptos ecosystem. Starting in November 2023, Amnis will launch a points and retroactive airdrop program, clearly stating that points will be directly related to the airdrop of the AMI token.

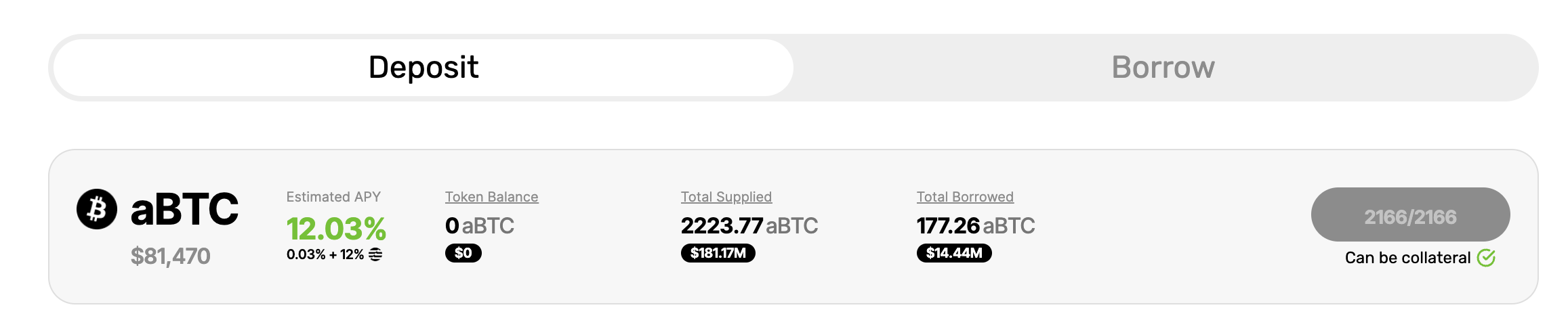

Echo Lending: Echo introduces BTC assets into the Move ecosystem by bridging BTC assets from the Bsquared Network to Aptos, allowing for multi-layered earnings. Specifically, Echo bridges uBTC from BTC L2 to Aptos, obtaining aBTC, which users can lend in the Echo protocol to earn APT subsidy rewards. In this process, users can achieve multiple benefits: Bsquared points, Echo points, and APT rewards. Currently, lending aBTC can yield an annualized 12% APT subsidy, but it has already reached the deposit limit. Since its launch on Aptos, Echo's TVL has rapidly grown, now exceeding $170M, making it the fourth-ranked protocol by TVL on Aptos.

3.4 Ecosystem Development Strategy

In terms of ecosystem strategy, Aptos and Sui have different focal points. Aptos's recent efforts include RWA, the Bitcoin ecosystem, and AI.

RWA: Aptos is actively promoting the tokenization of real-world assets and institutional financial solutions. In July 2024, Aptos officially announced the introduction of Ondo Finance's USDY into its ecosystem, integrating it with major DEXs and lending applications. As of November 10, USDY's market cap on Aptos is approximately $15 million, accounting for about 3.5% of USDY's total market cap. In October 2024, Aptos announced that Franklin Templeton had launched a Franklin on-chain U.S. government money market fund (FOBXX) represented by the BENJI token on the Aptos Network. Additionally, Aptos has partnered with Libre to promote the tokenization of securities.

Bitcoin Ecosystem: Aptos is actively entering BTCFi by integrating Bitcoin assets from BTC L2 into the Aptos ecosystem to enhance asset diversity and increase TVL. In September 2024, Aptos announced a partnership with Stacks to bring sBTC into the Aptos network, but sBTC has not yet been effectively integrated with mainstream DeFi protocols, and the impact of this strategy on Aptos remains to be seen. Furthermore, Aptos has achieved integration with the Bsquared Network through the Echo protocol, with over $170M in BTC assets introduced. Aptos is offering high APT incentives (annualized 12%) to stimulate cross-chain and deposit activities for BTC assets, demonstrating the importance of attracting BTC assets to the Aptos ecosystem. The introduction of BTC assets will enhance the growth of TVL on Aptos and the development potential of DeFi protocols, necessitating continuous monitoring of related asset TVL and changes in Aptos's official incentive measures.

AI: Aptos's development in AI is still in its early stages. In September 2024, Aptos announced a partnership with NVIDIA, Tribe, and the DISG-supported Ignition AI accelerator to promote the development of AI startups in the Asia-Pacific region and beyond.

3.5 Changes in Funding and User Data

In terms of funding data, Aptos's TVL and stablecoin market cap have maintained a relatively healthy growth trend. The TVL in USD reached a peak in early April but declined due to a significant drop in the prices of APT and its ecosystem tokens. However, the TVL measured in APT has continued to rise. From September 18 to the peak on October 22, the TVL in USD doubled, but has recently seen a slight decline due to the drop in APT prices. The TVL in APT grew from 70M APT to 90M APT. The reasons for the increase in TVL over the past month can be attributed to two main factors: first, the rise in APT prices, as APT is the primary asset of its ecosystem's TVL; second, the launch of Echo Lending, which quickly attracted 14.7M APT in TVL, constituting a significant portion of the incremental $20M. Therefore, while Aptos's TVL appears to have surged this month, its contribution to ecosystem liquidity is limited.

The stablecoins in the Aptos ecosystem are primarily dominated by USDC, with the stablecoin market cap steadily rising from $50M at the beginning of 2024 to the current $292.41M, an increase of over four times, and it continues to maintain an upward trend.

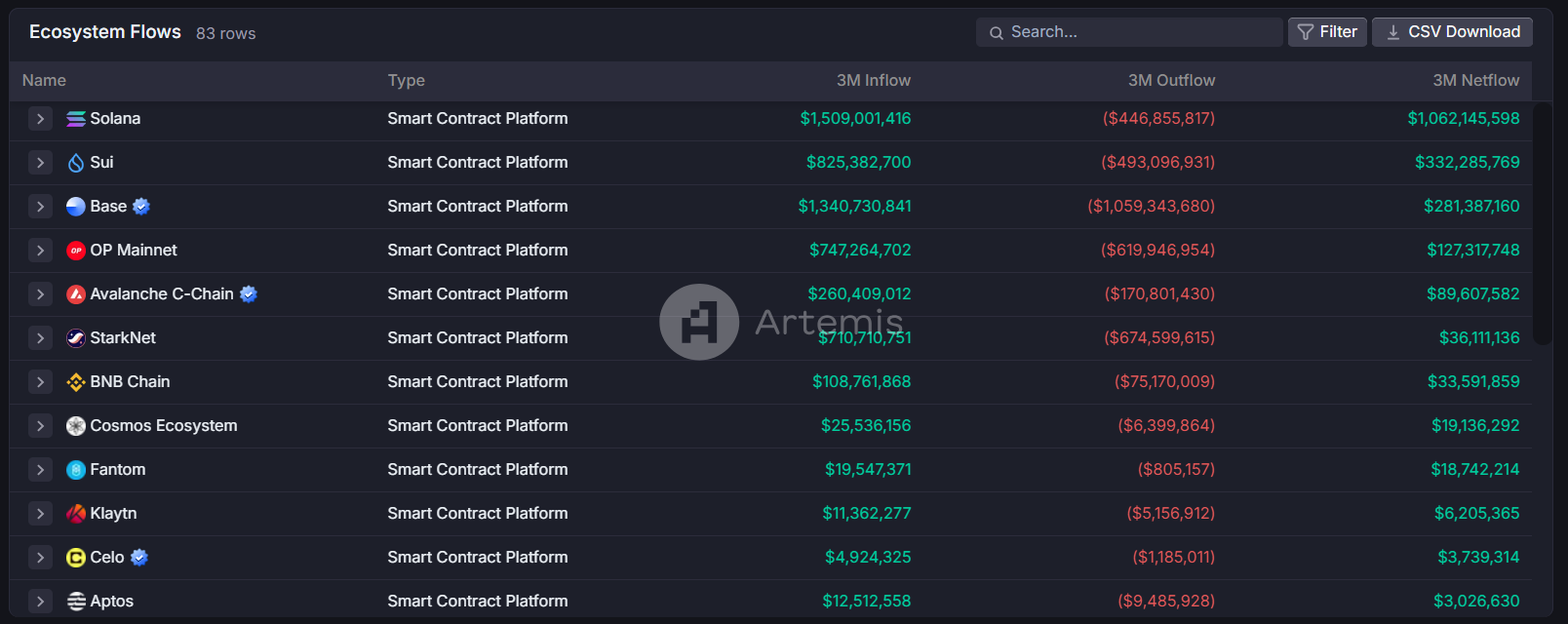

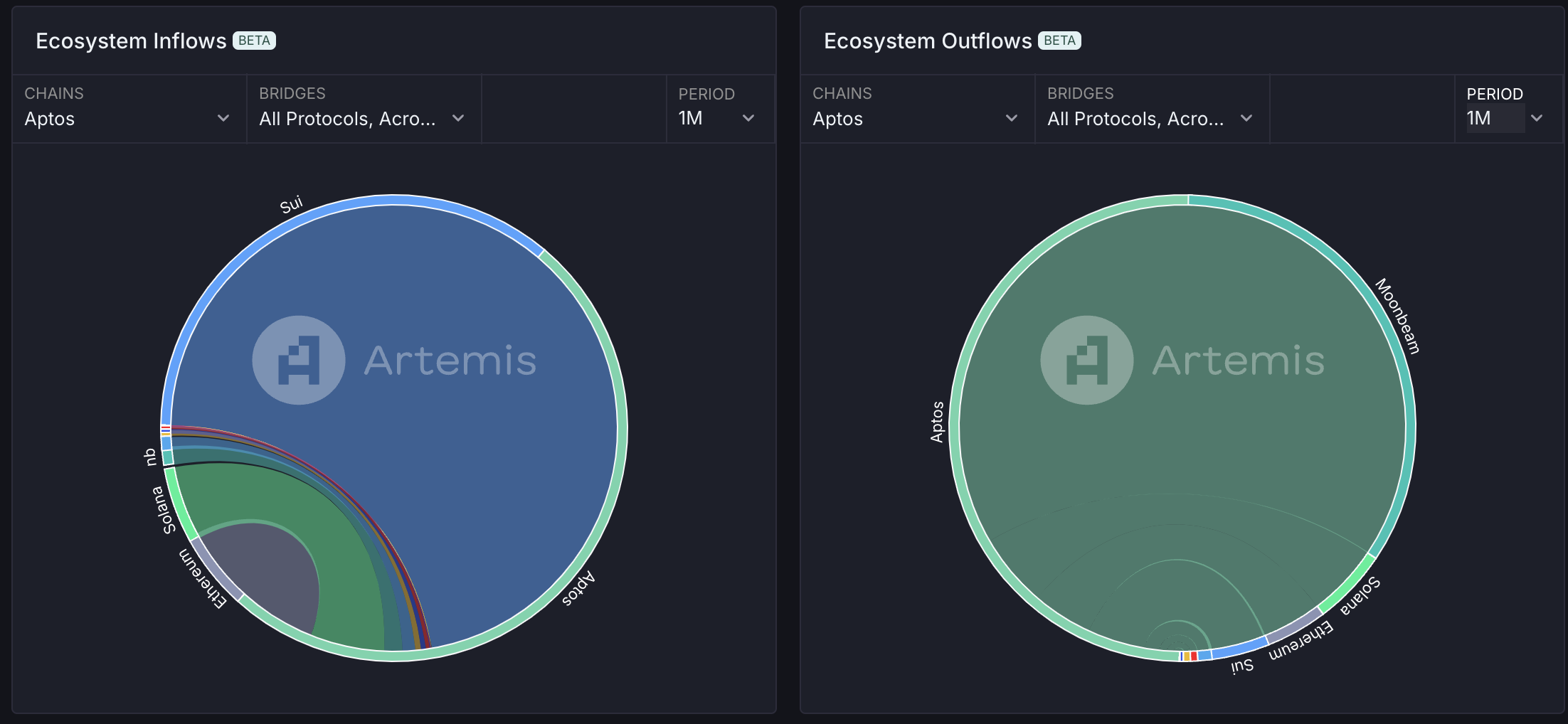

In terms of capital inflow, Aptos has shown a net inflow of funds over the past three months, with approximately $3M flowing in. In the past month, the main sources of capital inflow for Aptos have been Sui, as well as Solana and Ethereum, while the primary destination for capital outflows has been Moonbeam. Overall, Aptos appears to be in a healthy financial position, with an increasing amount of funds within the ecosystem, but there is no trend of absorbing capital overflow from other ecosystems, especially Ethereum and Solana.

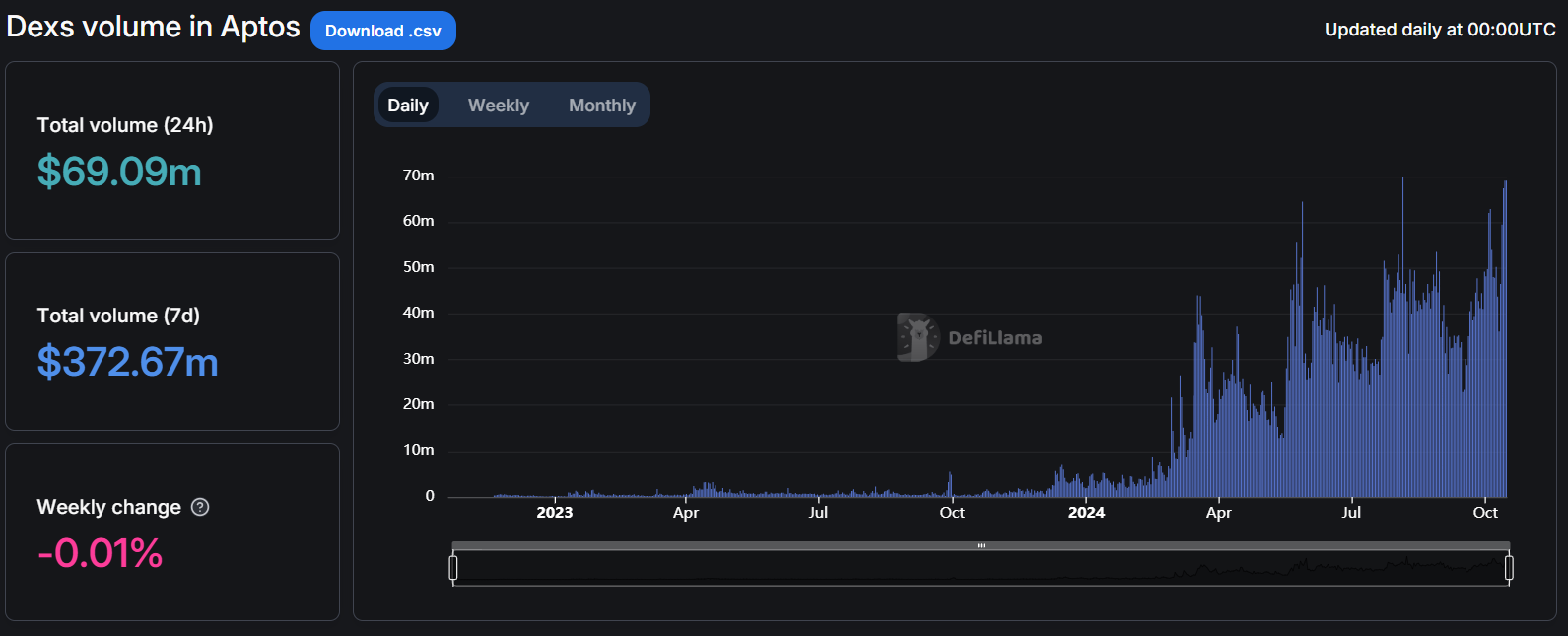

In terms of trading activity, Aptos's DEX trading volume ranks 12th among all public chain ecosystems. The trading volume began to increase significantly after April 2024 and remains at a relatively high level, with trading primarily concentrated on Thala and LiquidSwap.

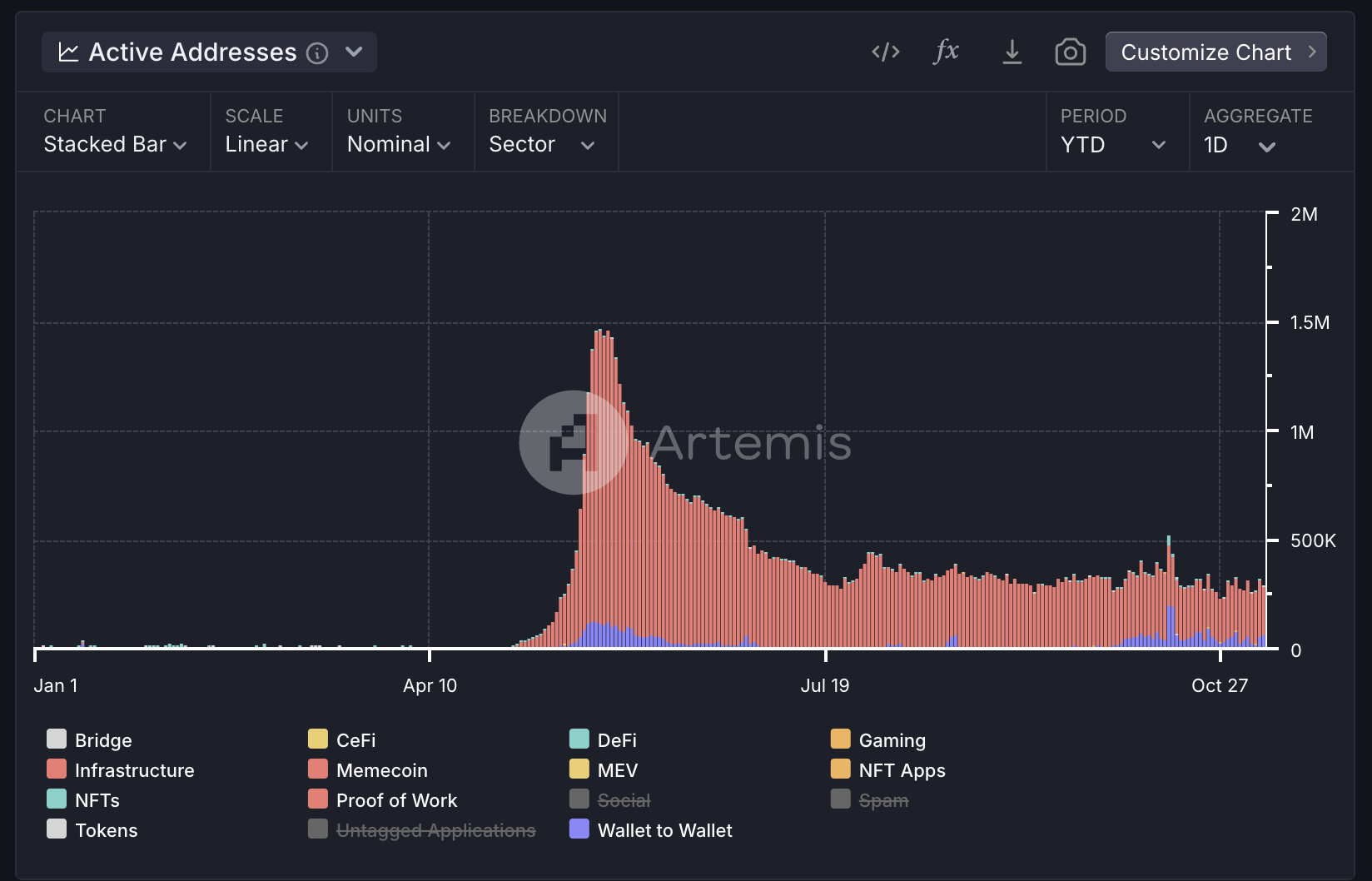

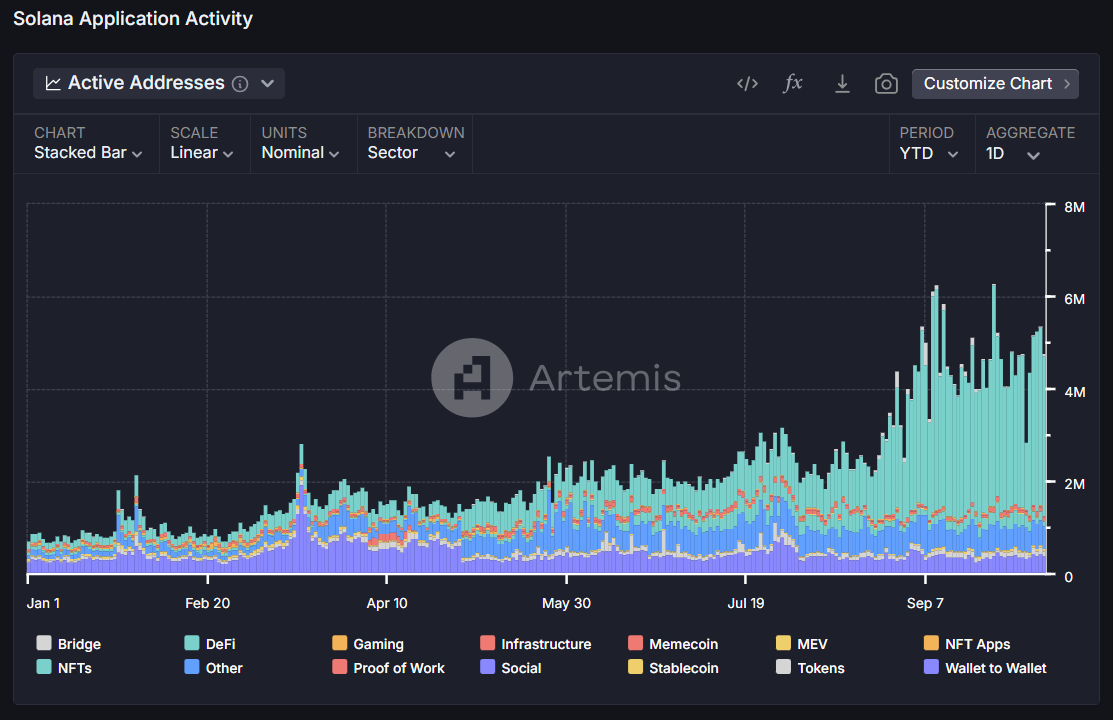

Regarding user growth, Aptos reached a peak in daily active users at the end of October, with daily active wallets exceeding 800K. According to DappRadar data, the most active applications in the Aptos ecosystem include Kana Labs, Chingari, STAN, KGeN, and ERAGON, while the DeFi infrastructure project Aminis has only 6k UAW (in contrast, Kana Labs has over 150k active users), and the DEX has even fewer active users at only 1k. This indicates that Aptos has not entered a healthy stage of ecosystem development, with very low on-chain trading users and a lack of demand for trading and speculation within the Aptos ecosystem. (Comparatively, Solana's user data shows that the top project Raydium has over 3M UAW, and the second project Jupiter has 251K UAW, far exceeding other projects.)

3.6 Token Economics and Price Trends

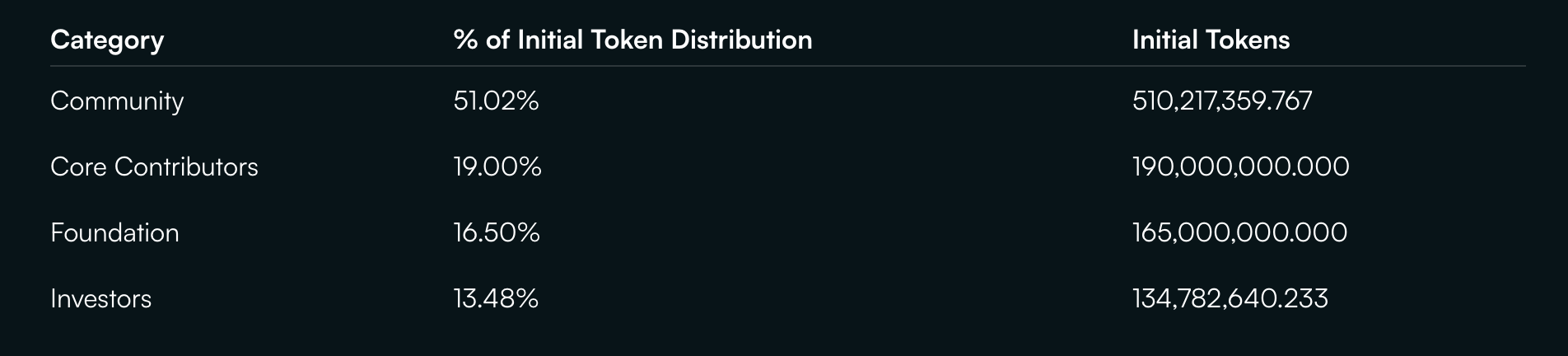

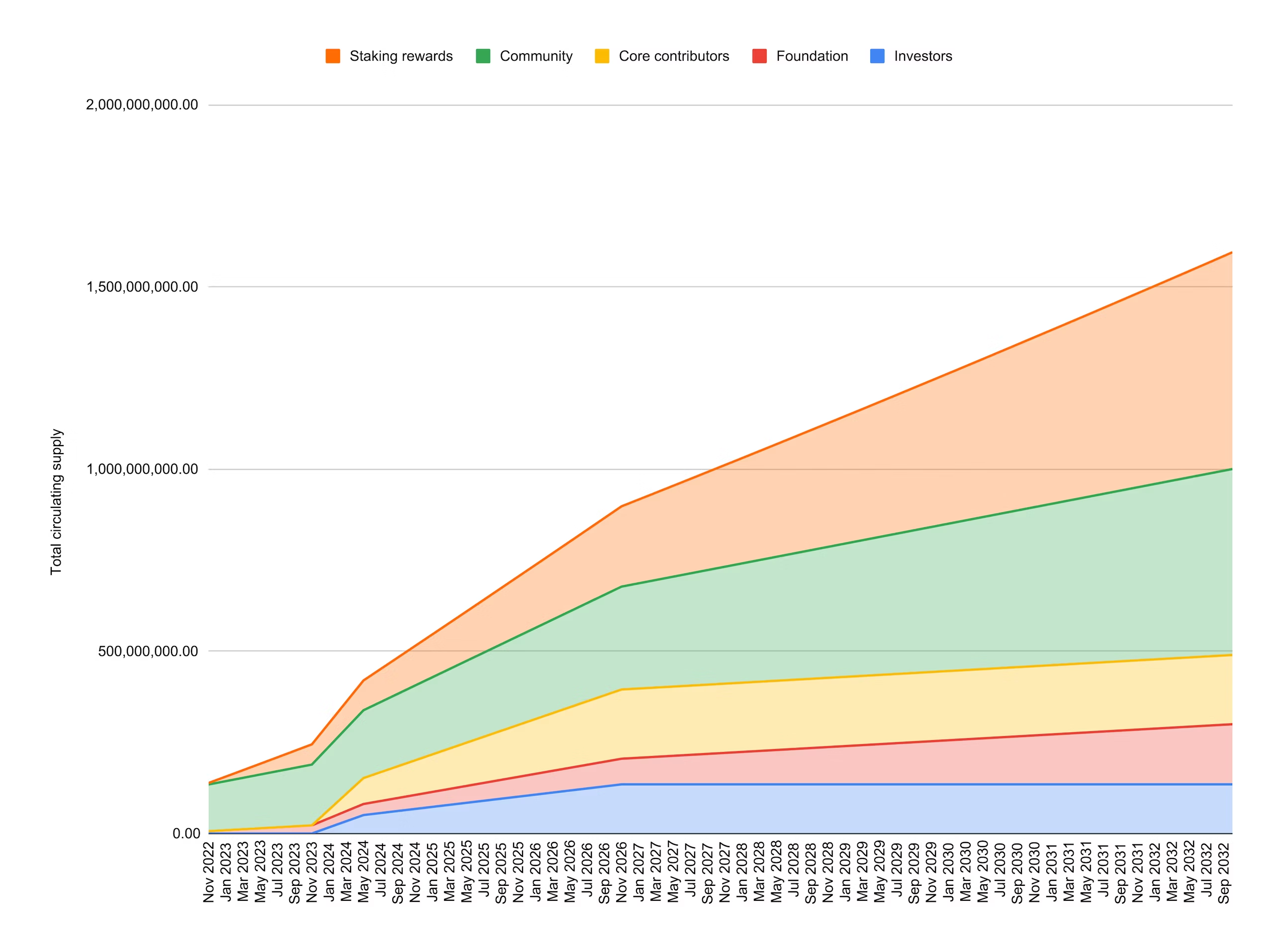

The initial token supply of APT is 10B, with the allocation ratio and schedule shown in the figure below. Although 51.02% of the tokens are allocated to the community, these tokens are initially concentrated in the hands of the foundation, with 410,217,359.767 managed by the foundation and 100,000,000 held by Aptos Labs, of which 125,000,000 will be used for ecosystem project incentives, while the distribution of the remaining tokens is relatively unclear. For core contributors and investors, there will be a linear unlock after a one-year lock-up period. Currently, the main token unlocks come from the community, foundation, investors, and core contributors, with 11.31M tokens unlocked monthly, resulting in relatively high selling pressure.

In terms of price trends, APT has shown a slightly weaker performance against BTC, remaining at a low level since its decline at the beginning of 2024. After experiencing some increase in September-October, it sharply fell on October 29 and has seen a slight rise since, but has not broken through the early October high against BTC, and there remains a significant gap from the highs earlier this year.

3.7 Summary

As a counterpart to Sui in the Move ecosystem, Aptos has gained significant market attention over the past period. The debate over which can become the "Solana Killer" continues. Here is a summary of the development of the Aptos ecosystem:

- Aptos's TVL is significantly increasing while maintaining positive capital inflow, but the inflow amount is much smaller than that of Sui.

- The development of the Aptos ecosystem is still in its early stages, with few on-chain trading targets and no high-market-cap Memecoins, resulting in very low on-chain trading volume and activity.

- Aptos has positioned RWA and BTCFi as core strategies for ecosystem development, hoping to open new capital channels to increase ecosystem TVL. It is advisable to track the market cap growth of related assets and their integration with Aptos DeFi applications.

- Similar to Sui, Aptos's user structure also exhibits unhealthy characteristics, with a low number of DeFi users.

- In terms of tokens, APT faces significant unlocking selling pressure, which may pose resistance to price increases. Additionally, in terms of price performance, APT's short-term price trend is not as strong as SUI's, instead showing a trend of following SUI.

4 Summary: Comparison of Sui and Aptos Ecosystems

| Public Chain | Sui | Aptos | |--------------|-----|-------| | MC | $8,963,108,373 | $5,577,149,571 | | FDV | $31,496,463,786 | $12,068,813,424 | | TVL | $1.383B | $996.28M | | Stablecoin Market Cap | $388.29m | $292.6m | | DEX Trading Volume (7d) | $2.019b | $208.58m | | Recent Capital Inflow | $168,226,279 | $1,162,500 | | Capital Inflow Source | Ethereum | Sui | | Capital Outflow Destination | Ethereum | Moonbeam |

| Protocol | Ecosystem | TVL | DEX Volume (7D) | MC | FDV | |----------|-----------|-----|------------------|----|-----| | Thala | Aptos | $238.36m | $107.28M | $41,772,087 | $84,660,614 | | Aries Markets | Aptos | $275.95m | - | - | - | | Cetus AMM | Sui | $251.77m | - | $244,998,242 | $405,278,557 | | NAVI Protocol | Sui | $453.36m | $1.688B | $61,801,250 | $194,312,795 | | Suilend | Sui | $402.82m | - | - | - |

The table above lists the main data comparisons between the Sui and Aptos ecosystems, as well as the data comparisons of their major DeFi protocols. Here is a summary of the comparative study of the two ecosystems:

- In terms of TVL, the gap between the two is not large, and the recent price increase of SUI has far exceeded that of APT. The higher market cap of ecosystem tokens is also an important reason for Sui's lead in TVL over Aptos. Both Sui and Aptos have recently achieved new highs in TVL, but this is mainly due to the price increase of ecosystem tokens, with very limited organic growth behind it.

- Regarding capital flow, the Sui ecosystem continues to see significant net inflows of capital, currently ranking just behind the Base and Solana ecosystems. Sui primarily absorbs funds from Ethereum, while Aptos has very limited net inflows, accounting for less than 1% of Aptos's total, with most funds coming from Sui. This indicates that Sui is currently the main entry point for the Move ecosystem, while Aptos mainly absorbs capital overflow from Sui, and this overflow effect is very weak.

- In terms of on-chain activity, the DEX trading volume in the Sui ecosystem is ten times that of Aptos, indicating higher trading activity in the Sui ecosystem. However, in terms of user activity, both ecosystems have relatively low DeFi user activity, and compared to mature public chains like Solana, the health of the user structure is still far from adequate.

- In terms of ecosystem development, Sui experienced a strong rally in its native and ecosystem tokens in October and actively promoted ecosystem projects, with NAVX launching on Bybit and Cetus launching on Binance, enhancing market attention and opening up the imagination for the Sui ecosystem. The rally in native and ecosystem tokens has also formed a strong momentum for rapid short-term development of the entire ecosystem. The ecosystem development on Aptos is weaker, with no core ecosystem tokens besides THL and CELL, and no development of Memecoins. Although APT's price has rapidly increased, ecosystem tokens have not seen significant rises.

- In terms of ecosystem development strategy, Sui attracted some on-chain funds in the short term through Memecoins, but the trend did not last. Its long-term focus is on Web3 Gaming, while Aptos aims to introduce more assets into the ecosystem through RWA and BTCFi to increase ecosystem TVL. Echo has achieved good results in the short term.

- Regarding token unlocks, both SUI and APT face significant monthly unlocking selling pressure. SUI unlocks 64.19M monthly (approximately $2 million), accounting for 2.32% of the circulating supply, while APT unlocks 11.31M monthly (approximately $120,000), accounting for 2.17% of the circulating supply.

- In terms of price trends, during this election trading period, SUI's upward momentum has been stronger, quickly breaking through the previous high and surpassing this year's high against BTC, while APT has been relatively weak and has not returned to the exchange rate level against BTC seen at the end of October.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。