Due to the anticipated regulatory easing environment brought about by Republican control of Congress, market FOMO sentiment is high, and analysts generally believe that cryptocurrencies will continue to be bullish in the short term.

Written by: BitpushNews

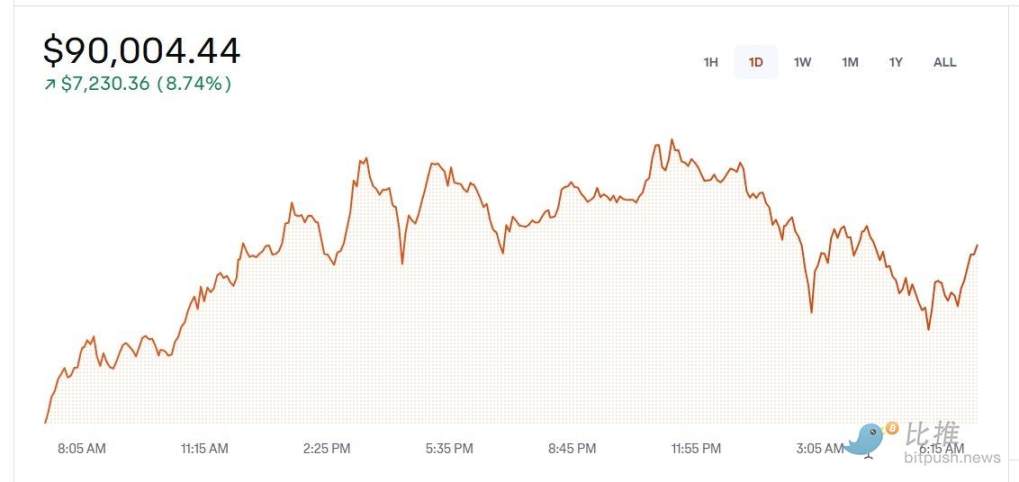

Bitcoin broke through $90,000 on November 12, once again setting a new historical high.

According to TradingView data, at 12:56 PM Pacific Standard Time on November 12, Bitcoin surged past $90,000 on Coinbase, with a 24-hour increase of 11%, just one step away from entering the $100,000 range.

It is worth noting that the trading price of Bitcoin on the Coinbase platform is often slightly higher than on other platforms, which is referred to as "premium trading." This means that even when Bitcoin prices are already high in the overall market, there are still a large number of buyers willing to purchase at higher prices on Coinbase, further indicating strong market demand for Bitcoin.

As of the time of writing, the trading price of Bitcoin has retreated to $88,223, with a 24-hour increase of 0.4%.

Altcoins are mixed, with Bonk (BONK) showing the largest increase among the top 200 altcoins, rising by 27.7%, followed by AIOZ Network (AIOZ) up 23.2%, and Akash Network up 18.8%. EigenLayer (EIGEN) led the decline, falling by 12.8%, followed by DOGS (DOGS) and Artificial Super Alliance (FET), which dropped by 11.6% and 11.5%, respectively.

The overall market capitalization of cryptocurrencies is currently $2.98 trillion, with Bitcoin's market share at 59.5%.

CoinGlass data shows that in the past 24 hours, severe price fluctuations have led to nearly $940 million in liquidations across the crypto market, the largest single-day liquidation amount since August 5.

In the U.S. stock market, at the close, the S&P 500, Dow Jones, and Nasdaq indices all closed lower, down 0.29%, 0.86%, and 0.09%, respectively.

Analysts: Some Indicators Worth Noting

Due to the anticipated regulatory easing environment brought about by Republican control of Congress, market FOMO sentiment is high, and analysts generally believe that cryptocurrencies will continue to be bullish in the short term.

However, Shubh Varma, co-founder and CEO of Hyblock Capital, pointed out: "A noteworthy indicator is the True Retail Long percentage, which is abnormally low at only 40%, sitting in the 20th percentile over the past 90 days. Additionally, the Open Interest (OI) is in the 99th percentile. This dynamic echoes the situation on November 7, when the True Retail Long percentage was even lower, at the 12th percentile, while OI was also high. Historically, when OI is high and retail long positions are low, it often leads to short positions being squeezed out, resulting in significant upward movement."

Furthermore, in the derivatives market leverage data, top traders continue to favor long positions, with the average leverage difference between longs and shorts exceeding +10 again, which is a strong bullish indicator.

Analysts explain that typically, this leverage pattern appears after a price decline, but this time, it has emerged after a significant price increase. If long leverage continues to increase following Bitcoin's recent surge, this deviation may indicate sustained bullish momentum.

Varma suggests using pullbacks as buying opportunities and states that given the strength of this rebound, buying on dips may provide favorable entry points. However, he warns traders to closely monitor indicators such as retail long positions and leverage imbalances, which can help investors assess market risks and potential turning points. Additionally, other factors such as fundamentals and policy considerations should also be taken into account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。