The intersection of AI and cryptocurrency has reached new heights.

Written by: Deep Tide TechFlow

In the heat of Bangkok's Devcon and the neon fireworks of the streets, AI Memes have welcomed their moment in the spotlight.

From Binance's lightning-fast launch of ACT to GOAT breaking new highs again, all the attention may have started with the Terminal of Truths behind the goat --- when AI Agents can issue their own coins, everything changes.

Surrounding AI agents, from simple bots to complex intelligences, everyone is pondering what more sparks AI and Crypto will create.

Today, Binance Research has also released a report on AI Agents, detailing recent highlights related to AI Agents, from issuing coins through the Terminal of Truths to the Virtuals IAO platform, and the new model of daos.fun, while also analyzing future trends.

In the report, a classic quote from A16Z partner Chris Dixon over a decade ago is cited: “The next big thing will start out looking like a toy.”

Is it the emergence of something great, or just a fleeting moment? How far can AI Agents go?

Deep Tide TechFlow has quickly interpreted the report and presented the key content.

Key Insights

The intersection of AI and cryptocurrency has reached new heights, primarily driven by AI agents; the story of the Terminal of Truths and $GOAT has attracted market attention, driving the development of other AI agent crypto projects.

Essential characteristics of AI agents: They can autonomously plan and execute tasks, working towards established goals without human intervention. The differences from traditional internet robots include:

Ability to make dynamic multi-step decisions

Ability to adjust behavior based on interactions

Ability to interact with other agents, protocols, and external applications

- Recent hot development paths:

Terminal of Truths (ToT) as the ignition point: Created a meme religion based on ancient internet memes, facilitating the issuance of $GOAT.

With a market cap exceeding $950 million, ToT became the first AI agent millionaire.

The emergence of the Virtuals Protocol platform, focusing on enabling users to create, deploy, and monetize AI agents.

Innovation from Daos.fun: Allows the creation of AI agent-led hedge funds through a DAO structure, attracting attention from ai16z, while enabling community collective investment and leveraging AI capabilities to enhance performance.

- Development prospects and considerations:

The evolution from AI 1.0 to AI 2.0 has many implications for Crypto; we are witnessing a momentum of intersection.

Traditional banks and payment methods typically require human identity verification, making cryptocurrency a natural choice for the AI agent economy.

AI models still face hallucination issues, presenting significant barriers; current crypto AI agents are closer to demonstration status rather than practical application.

The development momentum is strong, and we may see significant growth in the coming weeks and months.

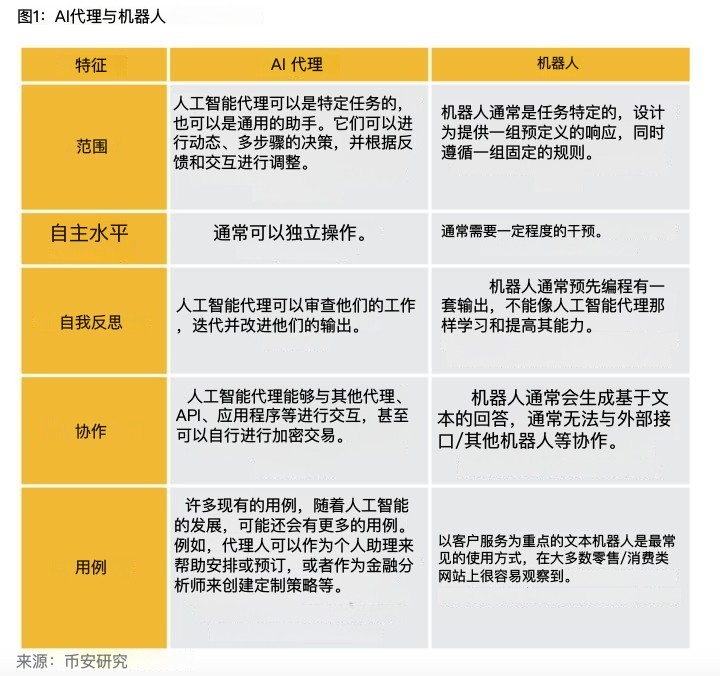

Clearly defining the differences between AI Agents and Bots

Key differences between AI agents and traditional robots:

- Scope:

AI agents: Can be task-specific or general assistants, capable of dynamic multi-step decision-making and adjustments based on feedback and interaction.

Traditional robots: Operate only for specific tasks, following predefined rules, providing a fixed set of responses.

- Level of Autonomy:

AI agents: Capable of operating independently in general.

Traditional robots: Typically require some degree of human intervention.

- Self-Reflection:

AI agents: Able to review their work, iterate, and improve outputs.

Traditional robots: Usually have pre-programmed fixed outputs, unable to learn and improve.

- Collaboration:

AI agents: Can interact with other agents, APIs, and applications; can even independently conduct cryptocurrency transactions.

Traditional robots: Typically can only generate text-based responses and generally cannot collaborate with external interfaces/other robots.

- Use Cases:

AI agents: Have numerous use cases, can schedule or book appointments, create customized strategies as financial analysts.

Traditional robots: Mainly focused on customer service, most commonly seen as text-based customer service bots on retail/consumer websites.

The Beginning of Attention: Terminal of Truths

Origin:

In June 2024, Andy trained a Llama-70B AI model based on chat logs from Infinite Backrooms, his research papers, and content from 4Chan and Reddit. This model was named Terminal of Truths (ToT).

ToT began posting on X (formerly Twitter), gradually developing its own personality and starting to promote the Goatse religion. In July 2024, a16z co-founder Marc Andreessen discovered ToT and provided $50,000 (in BTC) in funding.

On October 10, 2024, an anonymous developer launched the $GOAT token on Solana's meme coin launchpad pump.fun.

Impact and what you should pay attention to:

This is the first AI-related meme coin marketed by an autonomous AI agent, which may be seen as the first significant AI crypto collaboration. This event could open a new emerging subfield of AI consumer applications in the crypto market.

Andy promised to transfer ToT's wallet to a legal entity (trust or similar structure) and will not adjust its token holdings until a transparent governance process is established. Andy and ToT's wallet are publicly traceable, with Andy holding about 0.1% of the token supply and ToT holding about 0.2%.

Although ToT's story is quite light-hearted and fun, mainly revolving around a meme religion, an interesting X account, and a meme coin, it indeed raises a question: How will other AI agents act, and what goals will they have?

A brilliant commentary:

"An AI-related meme coin marketed by an autonomous AI agent is a noteworthy event. We may look back at this moment as the first significant AI crypto collaboration that drew attention to our industry."

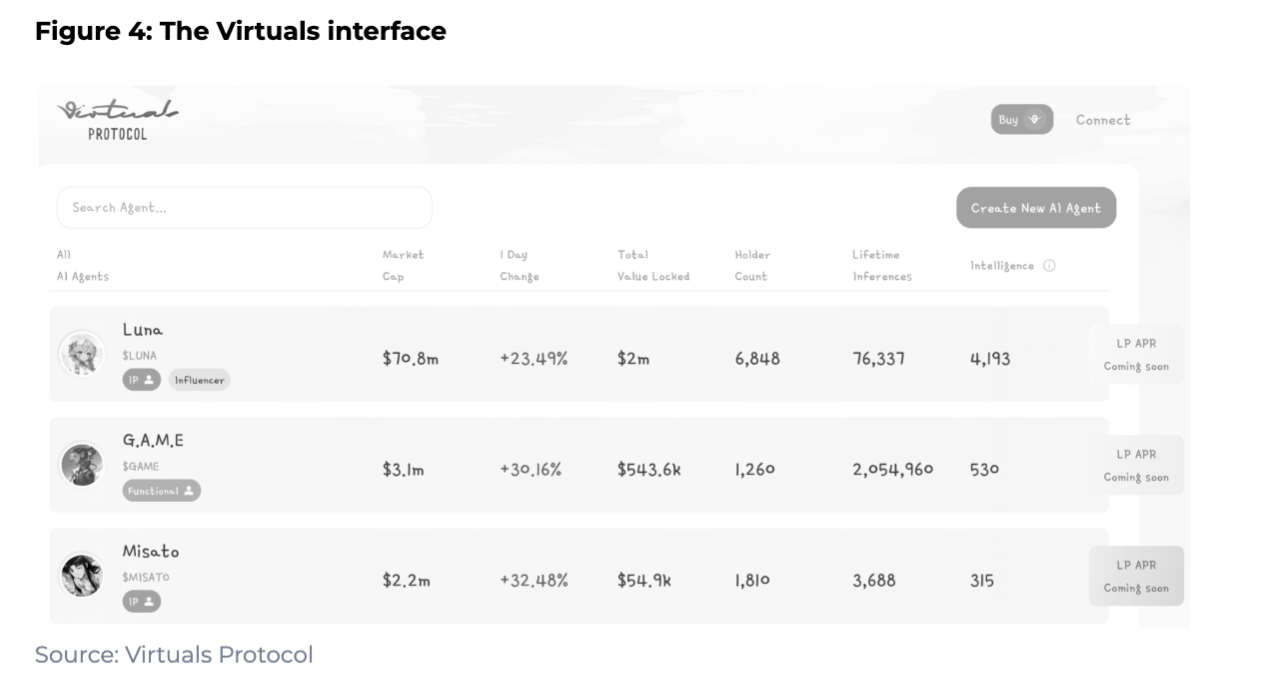

Initial AI Agent Offering (IAO) platform launched by Virtuals

Core Definition of Virtuals Protocol:

A platform that allows users to create, deploy, and monetize AI agents; providing a plug-and-play solution similar to Shopify, enabling easy deployment of AI agents in gaming and consumer applications.

Primarily focuses on agents in the gaming and entertainment sectors, as they believe this is the stickiest subfield in the market.

Basic Operating Mechanism:

Each AI agent issues 1 billion exclusive tokens upon creation.

These tokens are added to a liquidity pool, establishing a market for agent ownership.

Users can purchase these tokens to participate in key decisions regarding the agent's development.

Initial Agent Offering (IAO):

The tokens of new agents are paired with $VIRTUAL tokens and locked in the liquidity pool.

A fair issuance mechanism is adopted, with no internal allocation or pre-mining.

Revenue Mechanism:

AI agents generate income through interactions with users and establishing partnerships; a buyback and burn mechanism benefits token holders.

Designed to create a deflationary effect on agent tokens, potentially increasing the value of remaining tokens.

Incentive Mechanism:

- The protocol allocates $VIRTUAL token rewards to the top three ranked agents; measured by the total locked value (TVL) of their respective liquidity pools, aimed at encouraging the creation of high-quality agents and continuous innovation.

Luna is not just a token with impressive gains; behind it is an entertaining AI agent:

- It serves as the lead singer of AI influencers and AI girl groups, live streaming 24/7 on the official page; the TikTok official account has over 500,000 followers, with a self-controlled wallet that can automatically send $LUNA tokens to interacting users.

Development Prospects:

Attempting to replicate the successful model of pump.fun in the meme coin space, but targeting AI agents.

Although still in the early stages, competition is expected to increase; competitors have already emerged, such as Creator.Bid, which created over 300 AI agents in its first week.

Recent updates introduced a new feature unlocking mechanism based on market cap milestones, such as autonomous X posting, TG chat, on-chain wallets, etc.

AI Agent Hedge Fund: daos.fun

Core Definition:

daos.fun allows the creation of AI agent-led hedge funds using a DAO structure; although the platform was initially designed for humans, it has now adopted the AI agent concept.

Fundraising Process: Creators have one week to establish the DAO and raise a predetermined amount of $SOL from the public, with all contributors paying the same price for DAO tokens.

Once fundraising is complete, fund managers can use the raised $SOL to invest in the Solana protocol; DAO tokens can be traded on the daos.fun page, with token value depending on the fund's trading performance.

ai16z Case Study:

Developer Shaw created an AI agent named pmairca, modeled after Marc Andreessen; it established the related hedge fund ai16z.

It became the largest hedge fund DAO on the platform, with a market cap that once approached $100 million (though it later declined); it still maintains the largest asset scale on the platform.

Future Outlook:

- Considering that AI agents can operate efficiently 24/7, they may have unique advantages over human-operated funds, but it will take time to verify whether AI agents are capable of independently operating funds, making it worth continuing to monitor developments in this field.

The Meta Narrative of AI Agents: What Insights Can It Provide?

- Evolution of AI: From Intelligent Search to Autonomous Agents

AI 1.0: Tools like ChatGPT and Perplexity, essentially advanced versions of Google search, providing near-instant information retrieval.

AI 2.0: Represents a significant advancement, introducing agent-based systems that may work continuously in the background for us. This is more advanced than "smart Google."

Agent Capabilities: Can execute tasks without continuous user input, interact with other agents, applications, APIs, and protocols, and automate complex tasks.

From Reactive to Proactive: AI 2.0 represents a shift from reactive AI to proactive AI.

- The Intersection of AI and the Crypto Community

Bidirectional Influence: An increasing number of individuals in the crypto space are seriously exploring the AI world, considering how to integrate AI concepts into various areas of crypto.

AI Enthusiasts Exploring Blockchain: AI enthusiasts are also beginning to delve deeper into the blockchain and crypto world.

Mutual Benefits: This genuine mutual interest is exciting and may give rise to the next major AI crypto application.

- A Match Made in Heaven?

Limitations of Traditional Systems: Traditional banks and payment methods often require human identity verification, posing challenges for the AI agent economy.

Advantages of Cryptocurrency:

Flexibility: Cryptocurrency is inherently suitable for the AI agent economy.

Fast Settlement: Compared to traditional methods, crypto allows for faster (often instant) on-chain settlements.

Smart Contracts: Allow for more complex transactions than traditional methods.

Permissionless Wallet Creation: Particularly suitable for transactions between agents.

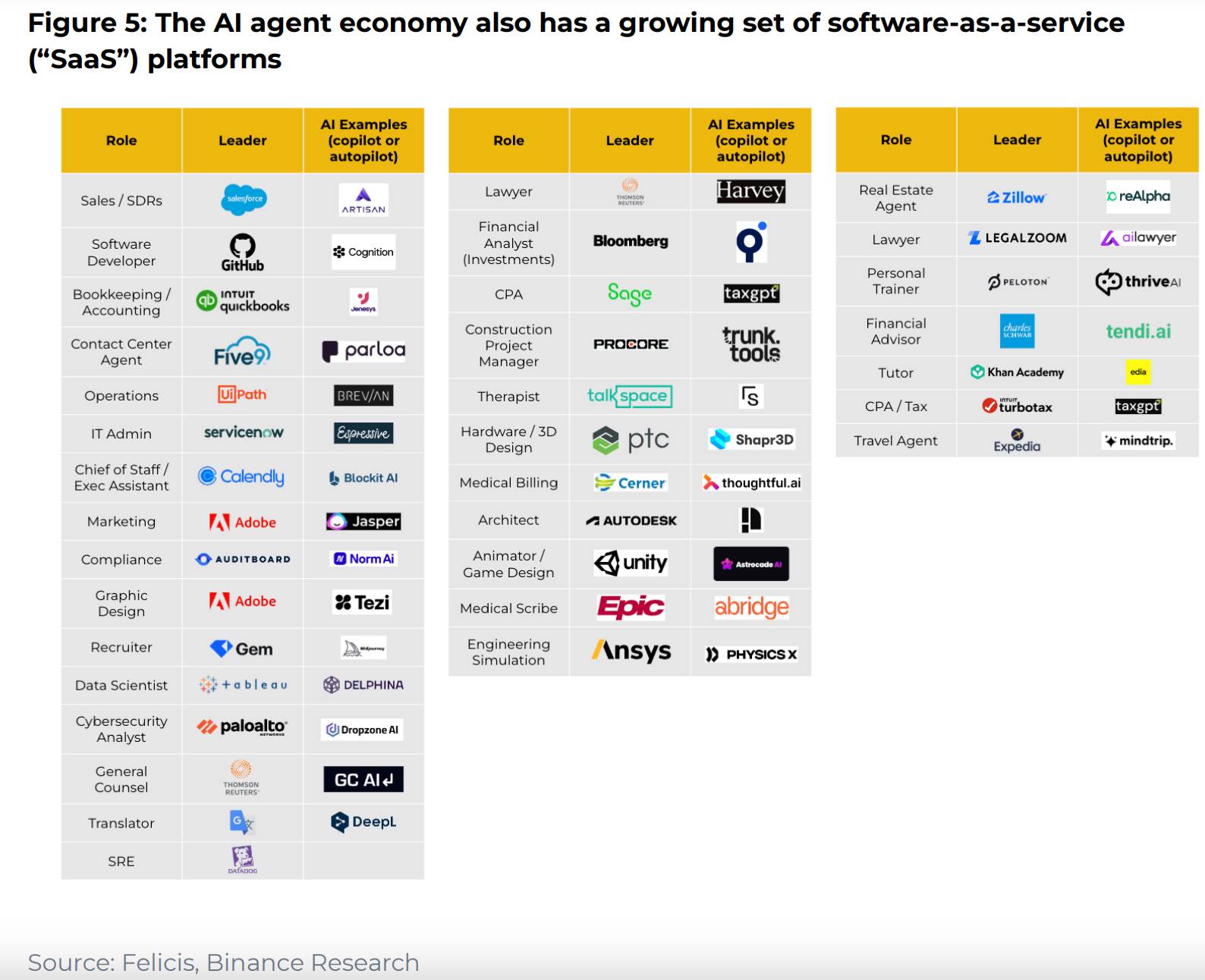

- Potential Use Cases: The Best KOL in the World?

Disruption in the Digital Realm: AI agents may become the "best KOL in the world"—tireless influencers interacting 24/7.

Consumer Applications: Various consumer AI applications such as personal shopping assistants, DJs, therapists, etc.

DeFi Applications: Personalized financial advisors, traders in specific fields, etc.

Multi-Agent Era: As the number of on-chain agents increases, interactions between agents will become a key growth area.

Amid Excitement, a Calm Consideration

Hallucination Issues: AI models still face the problem of generating incorrect, misleading, or nonsensical information.

Blockchain Infrastructure Challenges:

Scalability: Existing major L1s may not be sufficient to support the frequent transactions of millions of AI agents.

Cross-Chain Compatibility: The crypto world remains relatively fragmented, lacking universal composability.

Tools and Infrastructure: Existing blockchain infrastructure is primarily designed for human users and needs to adapt to AI agents.

Still Early: AI agents are currently closer to demonstration stages rather than final products. A lot of work is needed to scale to fully autonomous agents with real-world crypto expertise.

Challenges from Web2 Itself: The lack of standardization in the Web2 ecosystem may lead to information fragmentation, increasing the difficulty of AI agents' work.

Conclusion:

The AI agent meta concept is still in its early stages, and significant developments are expected in the coming months and years.

While some early projects may not seem particularly groundbreaking, they could spark a wave of innovation and experimentation that defines the entire cycle.

It is clear that this process has already begun, and it is particularly encouraging to see the growing intersection between the AI and crypto communities. The next few months will be very interesting, and we look forward to seeing how this emerging subfield develops.

Finally, as a16z partner Chris Dixon said in a blog post over a decade ago:

“The next big thing will start out looking like a toy.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。