Analysis suggests that "Trump 2.0" may lean more towards the "small government" ideology, which is favorable for decentralized assets like Bitcoin. This cautious fiscal style also diminishes gold's appeal as a safe-haven asset.

Written by: Zhu Xueying

Source: Wall Street Insights

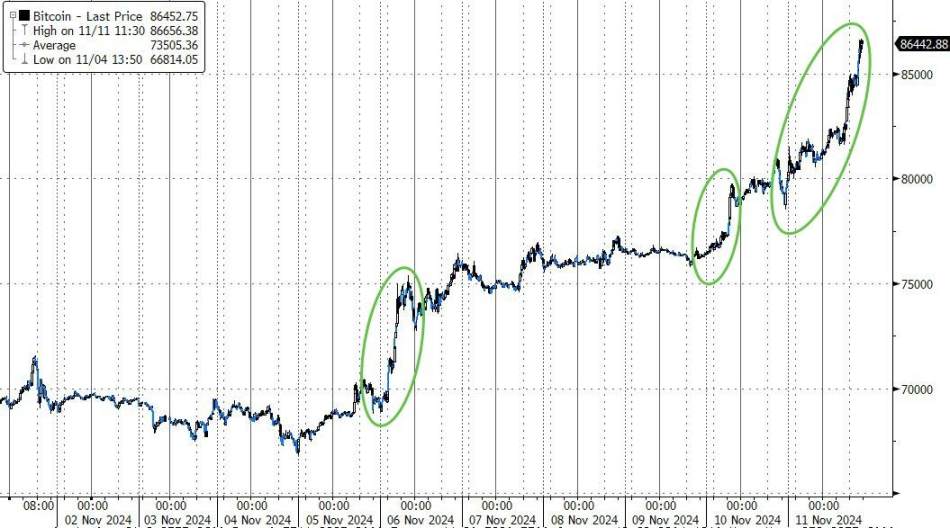

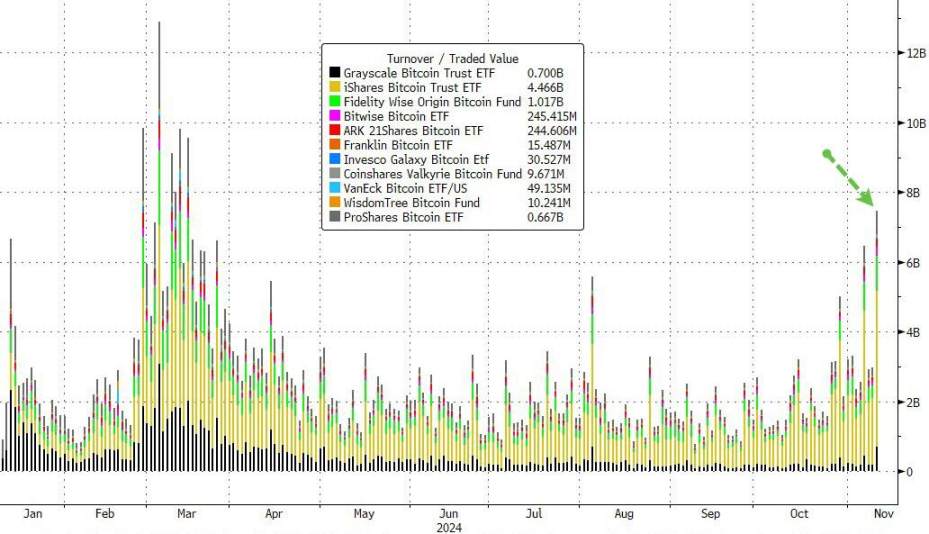

The "Trump trade" continues to explode, with Bitcoin emerging as the biggest winner! This Monday, Bitcoin surged directly past $88,000, soaring over 11% in a single day, and Bitcoin ETF trading volume skyrocketed. Confidence in the crypto market has significantly increased, betting that this wave of growth is just beginning and may continue until Trump's inauguration.

Since Trump showed signs of victory, Bitcoin has risen over 25%

Bitcoin ETF trading volume surged on Monday

In contrast, gold, which previously shone brightly, has performed poorly. Since the election, gold prices have plummeted, currently falling below the 50-day moving average and approaching the significant $2,600 mark, dampening the market's excitement from gold prices hitting new highs earlier this month.

$2,600 is a critical price level for gold

The Bitcoin/Gold ratio is nearing recent highs

Why has there been a dramatic rise in Bitcoin and a significant drop in gold within just a few days? Analysts believe that "Trump 2.0" may lean more towards the "small government" ideology, benefiting decentralized assets like Bitcoin, while this cautious fiscal style also weakens gold's appeal as a safe-haven asset.

Bloomberg analyst John Stepek stated that the primary reason for Bitcoin's rise is that many believe Trump's governance style may favor "small government" principles, which involve reducing government intervention and spending, rather than the "big government" approach supported by Modern Monetary Theory (MMT), which advocates for expansionary fiscal policies to increase spending and stimulate economic growth. In this scenario, Bitcoin, as a decentralized asset, may benefit.

The significant drop in gold can also be explained by similar reasoning. Previously, the market expected that Trump's presidency would automatically mean higher fiscal spending and larger deficits, which had been a strong support for gold prices for some time. However, market expectations have changed; Trump may not aggressively expand government spending and may even adopt a more cautious approach, which suppresses gold's safe-haven attributes and diminishes its appeal as a hedging tool.

Additionally, according to Spectra Markets analyst Brent Donnelly, this round of the U.S. election has made politicians realize the importance of addressing public dissatisfaction with inflation. Therefore, "Trump 2.0" may also place greater emphasis on inflation management, further weakening gold demand and enhancing Bitcoin's appeal as an emerging asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。