Author: DefiSolar

Compiled by: BlockBeats

Editor's Note:

With the recent "value discovery" of projects like Raydium, Kamino, and Drift, Solana DeFi has become the focus of market attention.

According to incomplete statistics, over the past three years, more than 60,000 developers have participated in Solana's hackathons, with over 4,000 projects launched and a total funding exceeding 600 million USD, giving rise to star projects like Jito, Tensor, io.net, Marinade, and Solend.

In search of the next Solana ecosystem star, this article reviews the quality DeFi projects from the latest Solana hackathon, Solana Radar. Below is the full text of the article.

There are many treasures hidden in the DeFi track. I have browsed every application from the Solana Colosseum Radar hackathon, so you don't have to.

Here are my top 7 picks:

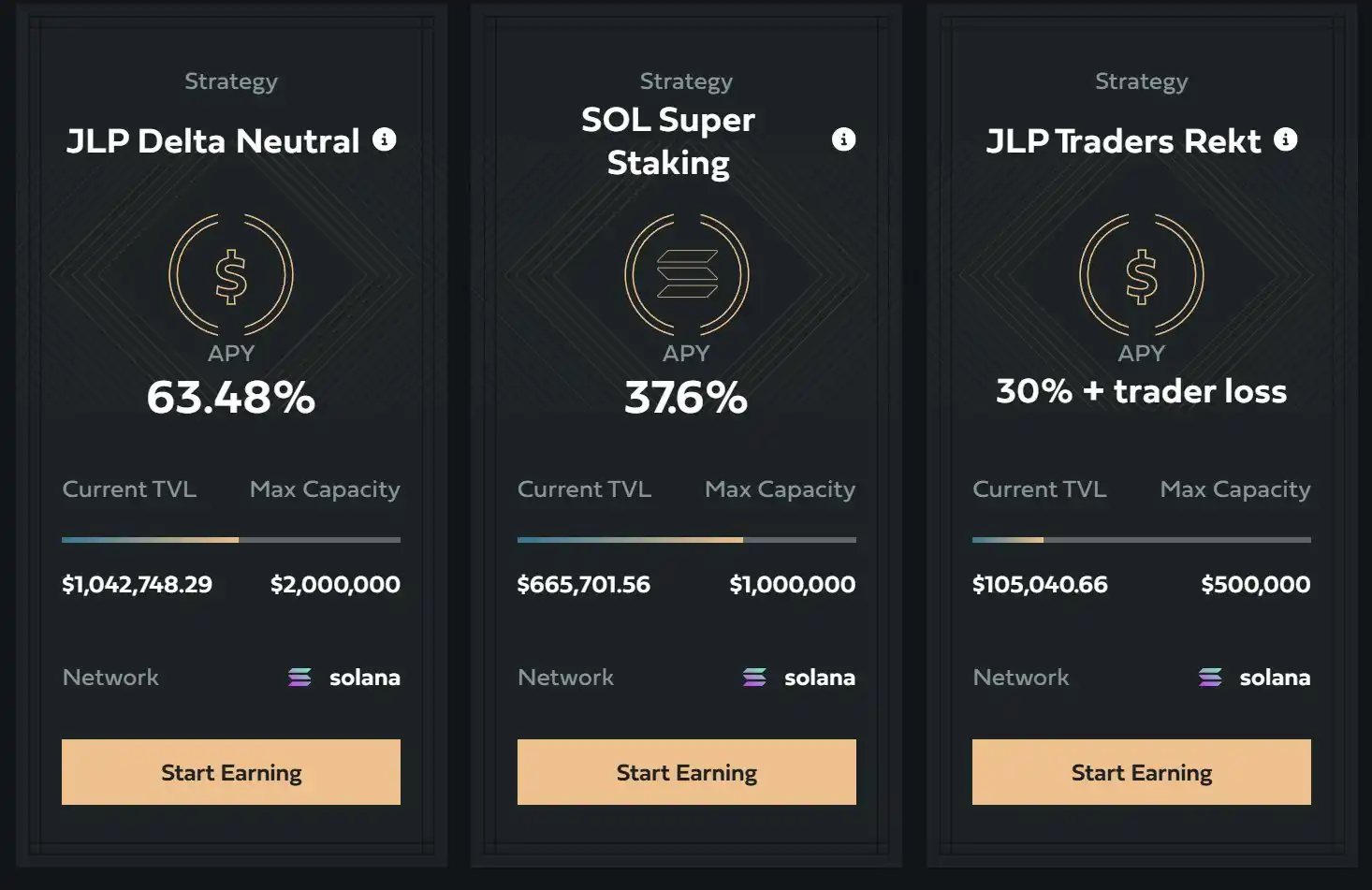

1. Neutral Trade

Created by experienced quantitative experts and traders, they make complex strategies accessible to everyone. One of the most popular strategies is "SOL Super Staking," based on Drift and Jupiter's JLP, with an annual yield of up to 37%.

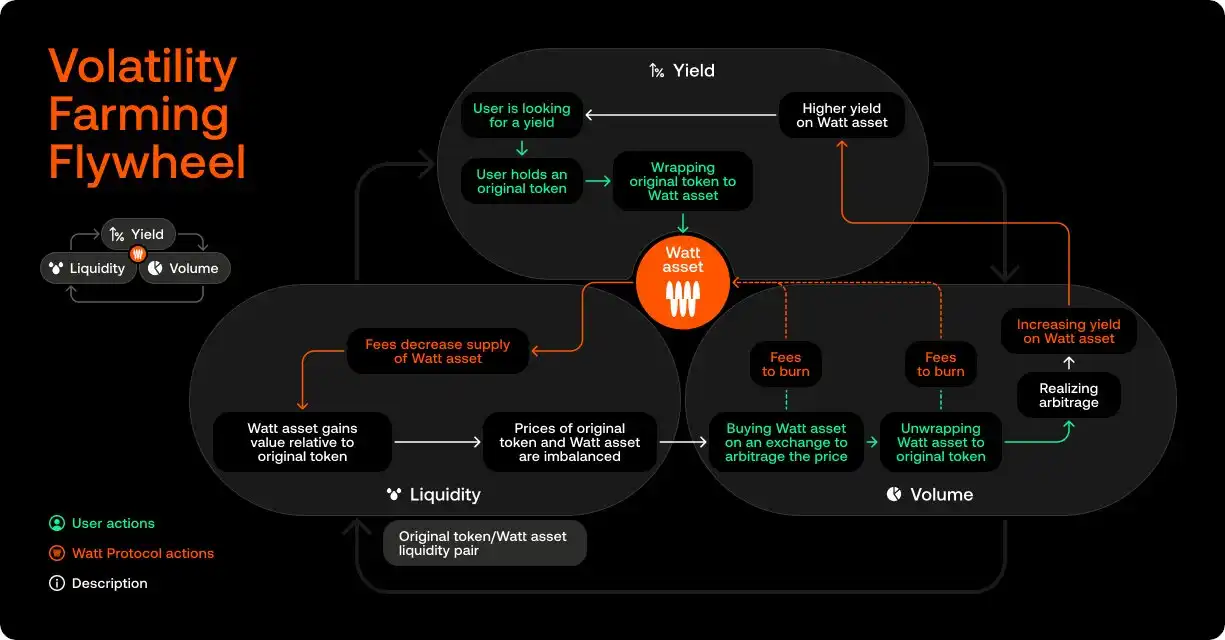

2. Watt Protocol

This is unprecedented on Solana; it is essentially a volatility mining protocol that generates yields for staked assets using different strategies. You can use any token, such as popcat or retardio, to earn returns. It has not yet launched.

3. Titan

A direct competitor to Jupiter, it has raised 3.5 million USD and claims to offer better exchange rates. Tests show that Titan can provide users with better exchange paths 81% of the time. Let's wait for the mainnet launch.

4. Oro

- Tokenized gold.

- Annual yield of 4%

- Usable in Solana DeFi

Regulatory approval has been obtained, and partnerships have been established with leading gold suppliers.

5. Hylo

This is a next-generation stablecoin backed by SOL, expected to succeed on Solana. It consists of two parts: hyUSD (stablecoin) and xSOL (a tokenized SOL leveraged long position). The synergy between the two is very appealing.

6. Squeeze

This is one of the most innovative ideas I've seen in the memecoin/DeFi space. It is similar to pump fun, but whenever a new token is launched, the liquidity of the initial token can be borrowed to allow for long and short operations from the start. This will enable short squeezes on small-cap tokens.

7. Moose Capital

After discussing on-chain gold, let's delve into more real-world assets (RWA), such as stocks and government bonds. Moose allows you to purchase stocks/bonds from traditional financial markets on the same application and then tokenize them for use in DeFi. It has received regulatory approval, so get ready.

Other projects like @reflectcx, @bulktrade, @robotterai, and @TheArenaDotFun have also caught my attention, but I cannot list all projects. I encourage you to research these projects on your own.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。