Today, there are several macroeconomic data points worth our attention!

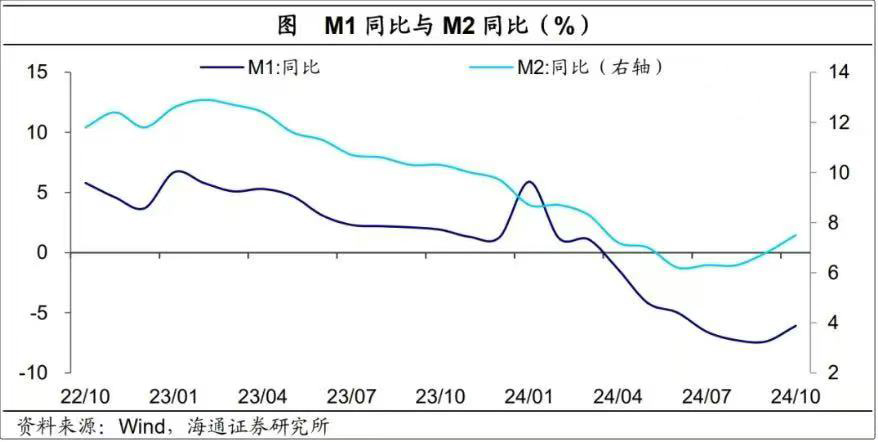

- China's M1 growth rate in October rebounded from -7.4% in September to -6.1%, marking the first rebound this year!

In October, M2 grew by 7.5% year-on-year, compared to an estimate of 6.9%. Social financing increased by 1.4 trillion yuan in October, in line with expectations.

Another point is the change in the market's deposit structure: in October, both residents and enterprises shifted their deposits to non-bank institutions, with bank deposits from residents decreasing by 570 billion yuan and corporate deposits decreasing by 730 billion yuan. Home buying? Stock trading? Factory building? Cryptocurrency speculation? But certainly, a portion of this is the ammunition for the recent Web3 rebound!

The M1 economic data's year-on-year rebound to -6.1% shows a clear turning point, which is a significant signal indicating that the stimulus plan is effective. Will this lead to a reduction in the scale of monetary easing? This might explain why only a 6 trillion yuan debt relief plan was introduced on the 8th, without the 4 trillion yuan consumption and real estate stimulus.

- The 10-year U.S. Treasury yield surged to 4.39%, and the U.S. dollar index soared to 106. This is still quite an exaggerated situation.

In the coming days, there are three events:

- On Wednesday, the U.S. October CPI inflation data will be released.

- On Thursday, the U.S. October PPI inflation data will be released.

- On Thursday, Federal Reserve Chairman Powell will speak.

So, is the market pricing in expectations for CPI inflation in advance? From the current market trends, tomorrow's inflation data is likely to be pessimistic!

Just a reminder!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。