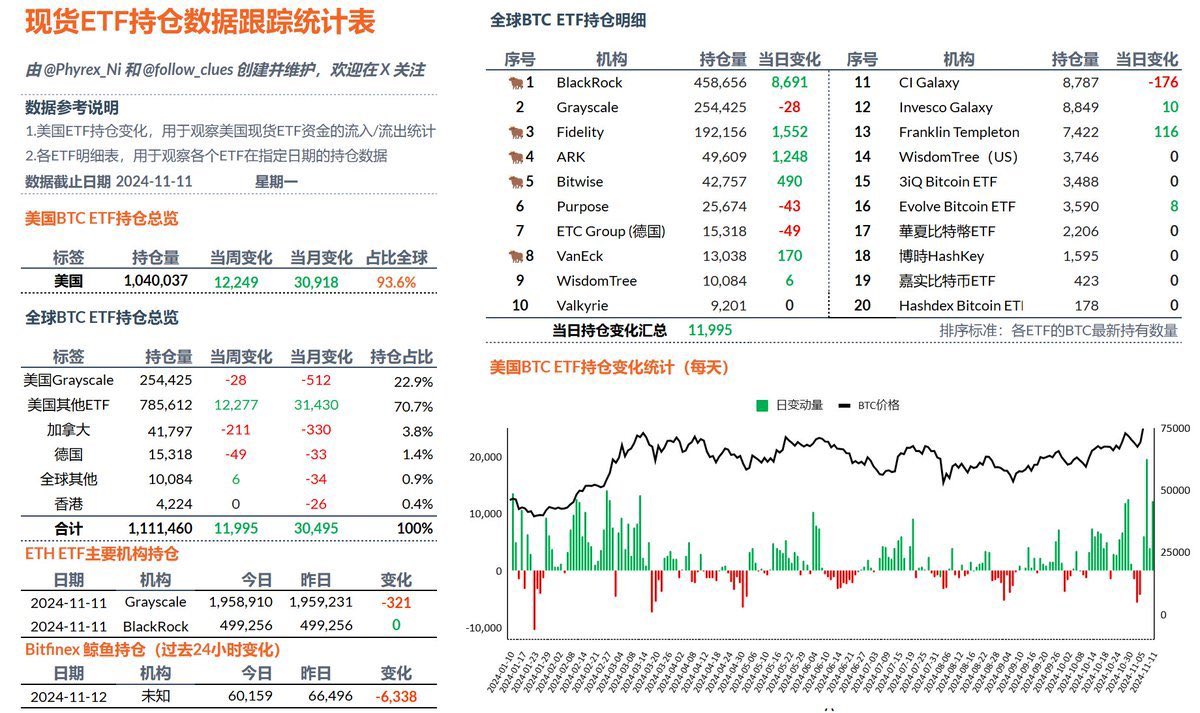

Yesterday, the data for the ETH spot ETF once again refreshed the historical record for the highest single-day net increase. Although the BTC data wasn't as dramatic, it was still quite good. Yesterday, twelve U.S. spot ETFs collectively increased their holdings by 12,249 BTC, which is also a relatively high level over the past two weeks. Looking at the data for #ETH and #BTC, while it may not be a full-blown FOMO from U.S. investors, it is clear that BlackRock and Fidelity's fund managers have communicated some information to investors.

In the past 24 hours, BlackRock net increased its holdings by 8,691 BTC, while Fidelity and ARK also added over 1,000 BTC each. The rest can be ignored, and the only reduction was from Grayscale's GBTC, which saw a sale of 27 BTC, not a significant amount and considered normal data.

As mentioned earlier with the ETH data, although there have been some pullbacks, there is essentially no negative information, and there has been no change in the trend. The most likely scenario is that U.S. stock investors have shed their FOMO emotions. At least personally, I don't have much to worry about regarding the current market situation. Unfortunately, it seems that the previous Tuesday, which was used for testing, did not pass, meaning that the altcoin season may not arrive that quickly.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。