Preface

In the Three Kingdoms, it was said that what has been united for a long time must be divided, and what has been divided for a long time must be united. This reflects the ancient long-term wars that made the people's hearts yearn for stability, so the stronger party that aligns with the people's sentiments rises to power and re-establishes rules and regulations! The cryptocurrency market is no different! There is no perpetual rise, nor is there a perpetual fall.

As for now, it reflects the truth that nothing remains unchanged. Just like in the cryptocurrency market, last year BTC soared, with the lowest point around 16,000 at the beginning of last year. At that time, how many friends thought BTC would go to zero? While the market was active, how many people emptied their wallets? For new friends entering the market now, doesn’t it feel out of reach?

However, in the following time, BTC continued to rise, reaching a peak of around 89,780. When it finally broke through the 80,000 mark and approached 90,000, almost all market analysts exclaimed that a bull market had arrived, which is truly astonishing. It is often said that it is easy to go from frugality to luxury, but difficult to go from luxury to frugality. The market is unpredictable, which is something most people can never grasp. One point that the king of coins has always emphasized is that what we can do is to take just one scoop from the vast waters.

Analyzing the Logic Behind Bitcoin's Historical New Highs and Future Market Fluctuations

First of all, Bitcoin has once again broken through new highs, and discussing market trends and analyzing operations at this point has no significance.

Why?

Because the data for Bitcoin has no reference value anymore; it is all about breaking new highs, so the technical analysis at this moment appears particularly weak. To analyze whether the future market will continue to rise or peak and fall back, we need to consider what the current market situation is. Regarding the current market price, actually, about 90% of friends in the market have already sold off their long positions and spot holdings. So why can the market price continue to rise?

In fact, the product itself does not have enough market value to support its current price. The reason the price can keep climbing is clear to everyone: it is mainly driven by the winners of the elections and the parties and financiers behind them. For retail investors in the current market, most no longer hold long positions, or those who do are hoping to reach 100,000+. So why are the market makers pushing up the coin price?

There is only one explanation: to make money. How to make money? By pushing the price up to a level you can't believe, then crashing it. In the future, it may happen today, tomorrow, or this weekend. The market will definitely experience a spike upward, which is understood as a K-line pattern of explosive growth and selling. After such a pattern appears in the market, this round of rising will slowly come to an end.

Market makers want to make money, institutions want to make money, large retail investors want to make money, and small retail investors want to make money. In such a market where prices are rising, everyone is holding spot or futures contracts, and everyone is making money. So who is losing money? Because of the unique nature of the trading market, which is blockchain trading, both long and short sides are direct opponents. In a situation where most people are going long, who is losing money? The stronger this thought becomes, the closer we may be to a collapse.

Future Market Judgments and Operational Suggestions

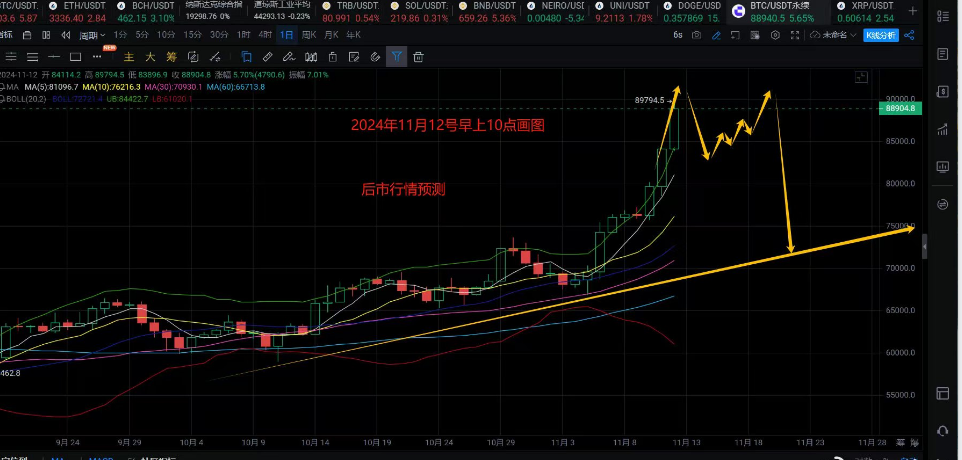

In summary: my personal judgment is that the market may have at most 1-2 more waves of rising, or it may directly end the rise after a spike, then hover at a high level to accumulate before the next rise, returning to its original form. This will trap retail investors and institutions, achieving the goals of the behind-the-scenes players. It is expected that the price will absolutely not exceed 100,000+ before a sharp drop occurs, so everyone should operate cautiously.

Operational suggestion: I recommend that friends who currently hold spot assets can gradually exit their positions in Bitcoin within the range of 89,000-92,000. The assets sold can be partially reinvested in 1-2 quality small cryptocurrencies for long-term holding, such as BCH, SOL, or BNB, which have the potential to grow into the next ETH.

Additionally, for those trading contracts, based on personal judgment, I suggest that those with a broader perspective can start to lay out short positions above 89,000. The potential range may be quite large; my suggestion is to add to short positions every 1,000 points within the range of 89,000-94,000. Then aim for a mid to long-term target of at least around 75,000!!!

Conclusion

Based on the current market situation, I personally feel that a market shift is approaching, but the market still needs some momentum. From today’s market, although the price continues to break new highs, the magnitude of the pullbacks is increasing, and the number of spike patterns is rising, indicating that a shift is not far off.

Although the shift should not be far away, you should never think that you can predict every market fluctuation, nor should you think you can grasp every profit from operations. The market is highly volatile, and the profit margins are also very large, but with profit often comes risk. There is no zero-risk investment, nor is there a constant profit; even the most skilled analysts can make mistakes, and in a large market, profit-seeking players can also suffer losses on both sides.

Saying all this is not just to make everyone aware of the importance of trends, but to tell everyone that there is no unchanging market; dramatic fluctuations between long and short are completely normal. In such a situation, the first thing to do is to protect your capital. Only under the premise of capital safety can we operate for profit. The era of unchanging upward trends has ended; the current market is a battleground for capable players. After enduring, the next spring will surely come!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。