In the Bitcoin (BTC) market, the arrival of a bull market always excites investors, but the accompanying market volatility and price adjustments also pose significant challenges. How to exit at the peak of a bull market in a timely manner to avoid losses from price declines is a question that every Bitcoin investor needs to consider seriously. This article will explore the importance of exiting at the peak and how to effectively implement an exit strategy.

The Importance of Exiting at the Peak

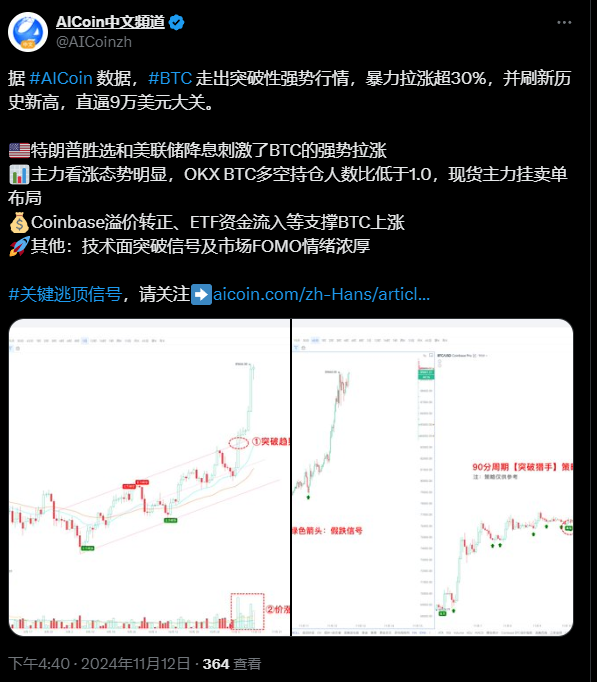

Every bull market is accompanied by extreme excitement in the market and rapid price increases. Today, Bitcoin has once again broken its historical high, surpassing $90,000, ushered in by favorable conditions from the U.S. elections and the Federal Reserve's interest rate cuts. However, behind this market prosperity lies potential risks, especially the rapid pullback that may occur after prices reach their peak.

Exiting at the peak refers to selling assets at the highest point or relative high point of a bull market to lock in profits and avoid losses from subsequent market declines. In the cryptocurrency market, the volatility of prices is significant, making the importance of exiting at the peak self-evident. Exiting at the peak can lock in gains; selling when prices are high can convert paper profits into actual profits, avoiding being trapped when prices fall, and reducing potential losses. By selling at high levels, investors can re-enter the market during adjustments at a lower cost to increase their positions.

How to Exit at the Peak: Indicator-Based Exiting

Investors need to rationally rely on data and technical indicators to exit at the peak, rather than emotions or market noise. There are various technical indicators that can help investors determine market tops.

Ahr999 Index

The Ahr999 Index is a value investment indicator created by Bitcoin believers. This indicator helps investors determine market buy and sell timing through the 200-day average cost of Bitcoin and its growth valuation.

Above 1.2: The market is in a bull market phase with high risk of being trapped, suitable for considering selling.

Between 0.45 and 1.2: Investment costs are reasonable, suitable for dollar-cost averaging.

Below 0.45: The market is undervalued, a good time to buy the dip.Two-Year MA Multiplier

Designed by Philip Swift, the two-year MA multiplier assesses market sentiment to determine buy and sell timing.

Above two-year moving average x5: The market is overly excited, signaling to exit at the peak.

Below the two-year moving average: The market is pessimistic, with lower risk, suitable for buying the dip.Relative Strength Index (RSI)

RSI measures the speed and magnitude of price changes, reflecting the market's overbought and oversold conditions.

RSI ≥ 80: The market is overbought and may face a decline, suitable for considering selling.

RSI ≤ 20: The market is oversold, suitable for buying the dip.Net Unrealized Profit and Loss (NUPL)

The NUPL indicator is used to track market sentiment.

NUPL > 75%: The market is overheated, suitable for selling.

NUPL ≤ 0: The market is in panic, suitable for buying the dip.Market Value Realized Indicator (MVRV Z-Score)

The MVRV Z-Score assesses market overvaluation or undervaluation by comparing market capitalization to realized market capitalization.

MVRV-Z Score > 6.9: Price is overvalued, suitable for selling.

MVRV-Z Score < 0: Price is undervalued, suitable for buying the dip.

Principles of Exit Strategy

When formulating an exit strategy, investors should adhere to the following principles:

Data-Driven Decisions: Rely on data and technical indicators rather than emotions or market noise.

Risk Management: Always keep the importance of risk management in mind, setting profit-taking and stop-loss points.

Gradual Exit: Gradually realize profits rather than selling everything at once to reduce risks from market volatility.

For more specific technical indicator analysis information, you can follow https://www.aicoin.com/zh-Hans/article/428778

Image Source: x

Conclusion

In a Bitcoin bull market, timely exiting at the peak is an important means for every investor to enhance returns and reduce risks. Through rational analysis, gradual implementation, and flexible response, investors can better seize market opportunities and avoid losses due to excessive greed. Although the market is full of uncertainties, through scientific methods and strategies, investors can maintain an undefeated position in the highly volatile cryptocurrency market. Remember, any investment decision should be based on thorough research and reasonable judgment, rather than blindly following trends or acting on feelings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。