In the global financial market, Bitcoin is now regarded as a highly volatile and speculative asset, attracting the attention of many governments and large institutions. The purpose of institutional holdings in Bitcoin is to achieve a diversified investment portfolio, hedge against inflation risks, and obtain potential high returns. This article will explore the governments and large institutions that currently hold Bitcoin directly and indirectly, as well as their strategies and profitability regarding Bitcoin holdings.

Institutional Whale Holdings Led by MicroStrategy

MicroStrategy

Some large companies and institutions hold Bitcoin directly as part of their strategic asset allocation. A prominent example is MicroStrategy, which currently holds the most Bitcoin among publicly available data.

As of now, MicroStrategy holds approximately 279,420 Bitcoins, with a total value exceeding $25 billion and a current unrealized gain of over $11.7 billion. The company has raised funds through stock issuance and used these funds to purchase Bitcoin, thereby increasing its influence in the Bitcoin market.

In its Q2 2024 earnings report, MicroStrategy introduced "BTC Yield" as a key performance indicator for investors, emphasizing the quarter-over-quarter growth in Bitcoin held per share.

MicroStrategy's CEO, Michael Saylor, believes that Bitcoin is "digital gold" with significant long-term investment potential. He tweeted yesterday (November 11) that Bitcoin has already brought high returns to the company in the first ten days of November, with a "BTC Yield" of 7.3%.

Image Source: x

Marathon Digital

Marathon Digital has also adopted a comprehensive holding strategy in 2024. Marathon Digital is one of the largest Bitcoin miners in North America. It has decided to retain all the Bitcoins obtained through its mining operations and plans to sell some Bitcoins in the future to support operations and manage finances. This indicates the company's optimistic view of Bitcoin's long-term value and its intention to enhance its Bitcoin holdings through strategic acquisitions and investments.

As of now, Marathon Digital Holdings holds 12,057 Bitcoins, with a total value exceeding $1 billion.

Riot Platforms

Riot Platforms is a company focused on Bitcoin mining and related infrastructure, currently holding 11,034 Bitcoins, with a total value exceeding $900 million.

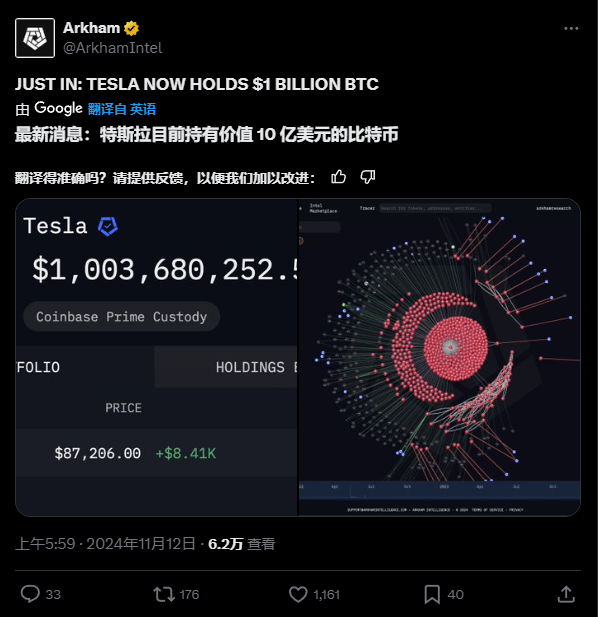

Tesla

According to the latest news released by Arkham today (November 12), Tesla currently holds over $1 billion in Bitcoin, with an average cost of $34,722, holding approximately 11,509 Bitcoins.

Image Source: x

Coinbase Global

Coinbase Global is the first publicly listed cryptocurrency company in the United States. According to Bitcoin Treasuries data, as of now, Coinbase Global holds a total of 9,480 Bitcoins, with a total value exceeding $800 million, and an average purchase cost of $12,342, resulting in an investment return rate of over 620%.

Bhutan Government Holds $1 Billion in Bitcoin

Some governments have also begun to explore the possibility of directly holding Bitcoin. This trend reflects an increasing recognition of Bitcoin as a potential reserve asset.

Arkham disclosed data yesterday (November 11) stating that the current market value of the Bhutan government's Bitcoin holdings has surpassed $1 billion.

Image Source: x

BTC Spot ETF

In addition to directly holding Bitcoin, many institutional investors hold Bitcoin indirectly through Bitcoin spot ETFs. These ETFs provide investors with a convenient way to gain exposure to Bitcoin's value fluctuations without the need to directly purchase and store Bitcoin.

As demand for Bitcoin in the market increases, the inflow of funds into ETFs is also growing. As of now, U.S. BTC spot ETFs currently hold $84 billion, accounting for two-thirds of gold ETF assets. BTC spot ETFs may surpass gold ETFs before reaching their first-year target.

BlackRock's IBIT saw an inflow of over $760 million yesterday (November 11), with a cumulative net inflow of $27.3 billion. In terms of trading volume, it reached $4.47 billion yesterday, while FBTC exceeded $1 billion, and BITB and ARKB each reached $245 million.

The popularity of these ETFs not only reflects institutional investors' interest in Bitcoin but also marks the gradual legitimization of Bitcoin in mainstream financial markets. Through ETFs, investors can enjoy potential returns from price fluctuations without directly holding Bitcoin. This investment method is particularly attractive to institutions looking to invest without directly engaging with the cryptocurrency market.

As the Bitcoin market matures, it is expected that more governments and large institutions will incorporate Bitcoin into their balance sheets. This will not only drive further increases in Bitcoin prices but also enhance its status as a global reserve asset.

With advancements in technology and improvements in market infrastructure, the convenience of holding and trading Bitcoin will be greatly enhanced. This will enable more investors to easily enter the Bitcoin market, promoting its wider adoption and marketization.

Conclusion

Institutional holdings of Bitcoin are not only an investment strategy but also a reflection of trust in the future value of cryptocurrencies. As the market continues to evolve, the scale and methods of Bitcoin holdings by institutions and governments will continue to change, which will have a profound impact on the global financial market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。