In a bull market, the best strategy is to hold assets and wait for a surge. If you can also earn financial returns while holding, that’s even better.

BounceBit is a great choice for this. First, it is secure; users' on-chain assets are entrusted to Ceffu (Binance's custodian), ensuring the safety of users' assets. Secondly, it offers multiple rewards in $BTC and $BB, providing higher returns.

A significant recent development for BounceBit is the upgrade to version V2. It has undergone a comprehensive upgrade from the original V1 Bitcoin asset management to create a full-chain, multi-asset, multi-strategy #CeDeFi asset management platform, and it is equipped with on-chain rewards and a rebate system in conjunction with BounceClub @BounceBitClub. Here are some key features of BounceBit V2:

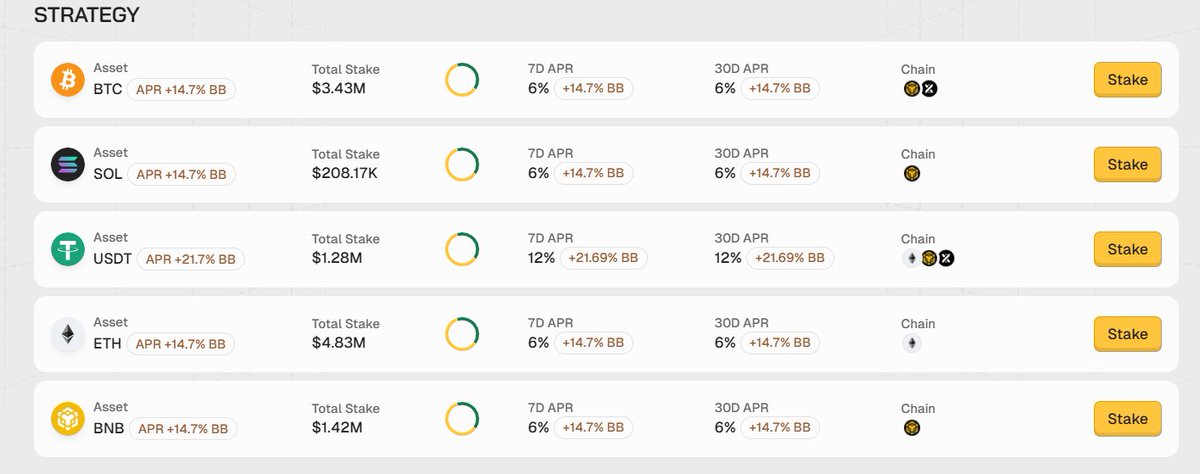

Full-chain multi-asset: BounceBit V2 supports full-chain and multi-assets, expanding the supported assets from BTC to include BNB, ETH, SOL, and more. Users can diversify their asset allocation, enhancing the stability and potential of investment returns. Additionally, users can operate directly on the original chain without needing cross-chain transactions.

More product options: V2 introduces more strategic products, including automated strategies, fixed income products, and manual strategies, allowing users to choose asset management institutions directly.

More user-friendly operation experience: V2 optimizes contracts and the user interface, enhancing the user experience and focusing on addressing the core needs of users in asset management.

From the content of the upgrade, BounceBit V2 is actually a better deepening of the CeDeFi experience. The logic of CeDeFi is a very good choice for long-term holders. It is safer for on-chain Dapps, and the core advantage of CeDeFi is that funds are not stored on-chain but kept on centralized platforms like Binance, which have reserve proof and over $100 billion in reserves. This allows ordinary users to enjoy the professional asset management team services that are typically available only to professional institutions.

In terms of returns, BounceBit offers more stable earnings, including automatic, manual, and fixed functions that can be followed without much thought. Returns come from $BB token subsidies as well as arbitrage profits provided by market makers. Through collaboration with Ethena, the annual yield for staking USDT has reached up to 20%.

In summary, BounceBit has become a great place to long-hold and earn extra returns. The new V2 upgrade offers a better experience, with richer products and more choices. Overall, the market capitalization of $BB is still relatively low, with low circulation, and a large amount of funds remain locked, with no selling pressure. Currently, this sector has not received much attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。