In the past week, the Air Force has become fuel, and the military has indeed made a fortune! According to AICoin (aicoin.com) data, BTC has shown a strong breakout trend, violently surging over 30% and hitting a new all-time high, approaching the $90,000 mark, single-handedly igniting the entire market, with a total market capitalization increasing by over $800 billion.

According to AICoin's analysis, this round of explosive growth is driven not only by macroeconomic stimuli but also by multiple data and indicators that have assessed the opportunity for a price increase.

Reasons for BTC's New High

1. Macroeconomic Stimuli

1. Trump Wins the U.S. Election

Trump's victory is the main reason for BTC's sharp rise recently. During his presidential campaign, Trump promised that if elected, he would establish a strategic national Bitcoin reserve, creating a world-class Bitcoin superpower. If Trump takes office next year, Bitcoin is expected to soar in an unprecedented manner. The significant positive expectations have triggered the "Trump trade" effect, with BTC, DOGE, and SOL leading the market.

2. Federal Reserve Cuts Interest Rates Again

Last Friday, the Federal Reserve cut interest rates by 25 basis points as expected, increasing market liquidity, while expectations for economic growth and fiscal spending have risen, leading to capital inflows into high-risk, high-return markets such as stocks and cryptocurrencies.

2. Bullish Sentiment from Major Players

The long-to-short ratio of BTC on OKX has remained below 1.0 for a week, indicating a larger number of bearish positions in the market, while the major players, as a minority, are bullish.

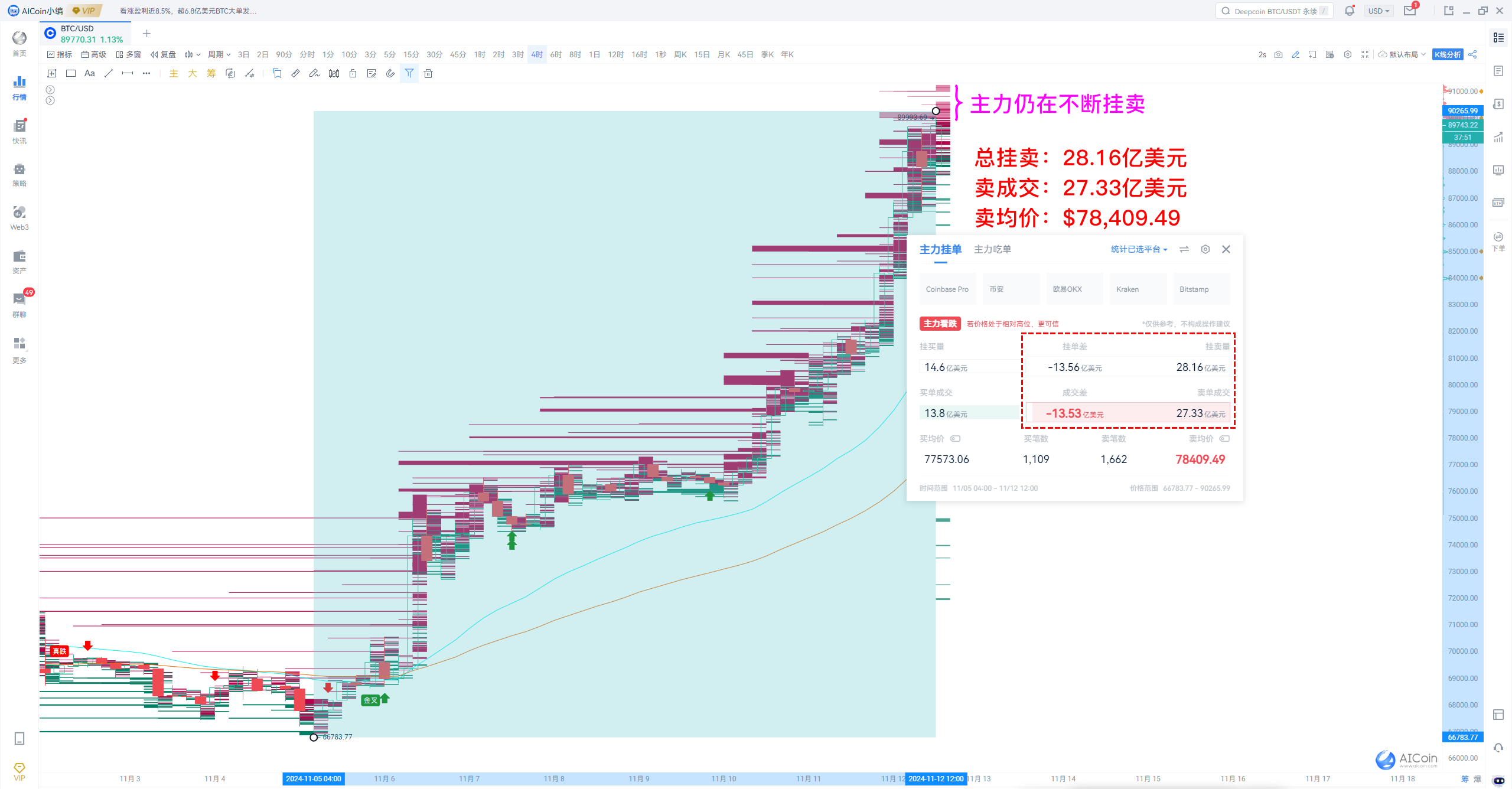

According to AICoin's data on large orders, the spot market is primarily bullish. As the price approaches new highs, major players continuously place sell orders at higher prices, indicating clear bullish intent.

Statistics show that from the 6th to now, the cumulative sell orders from major players on Coinbase, Binance, OKX, Bitstamp, and Kraken platforms have reached $2.816 billion, with $2.733 billion executed at an average selling price of $78,409.49.

Usage of Major Sell Orders: Before execution, large units are placed above the current price, requiring the price to rise to execute, indicating bullish sentiment; after execution, it creates selling pressure, indicating bearish sentiment. Experience it now: https://www.aicoin.com/vip

3. Capital Inflows

1. Premium Turns Positive

The Coinbase premium has turned positive, enhancing buying power in the U.S. market and injecting capital into the market, driving prices up. Historical performance shows that when the Coinbase premium is positive, BTC tends to rise more steadily.

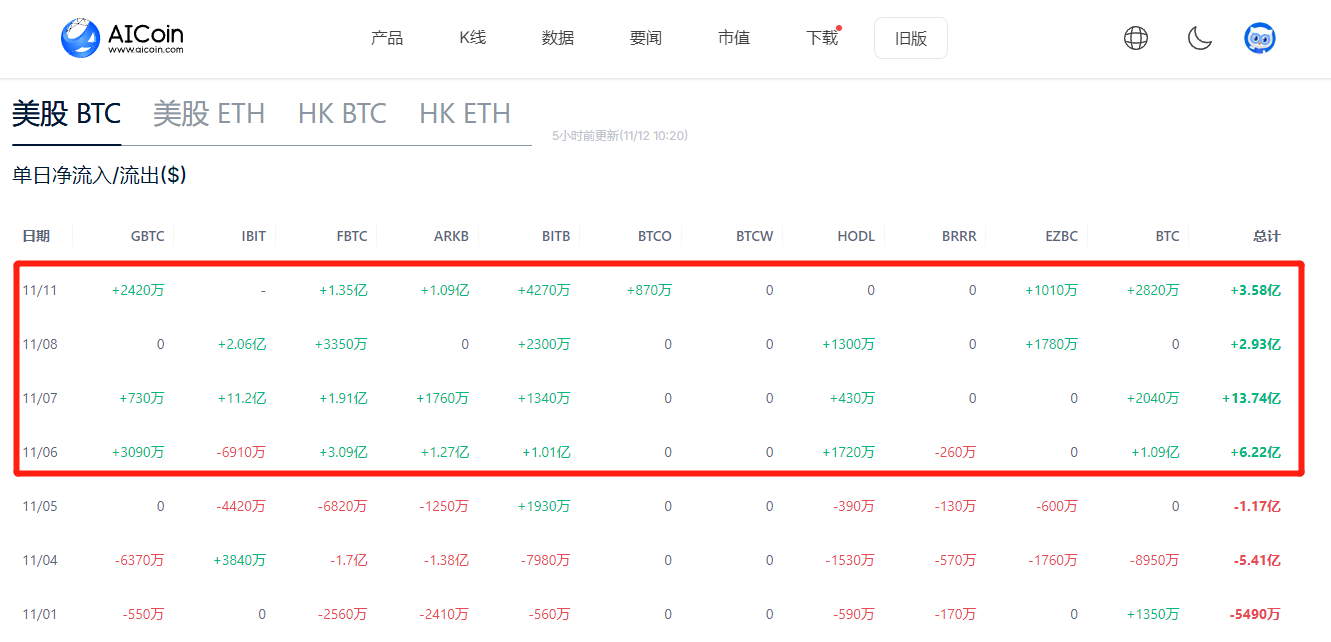

2. ETF Capital Inflows

According to AICoin's tracking, there has been a significant inflow of capital into the U.S. spot Bitcoin ETF market over the past five trading days, totaling $3.403 billion, especially after the election, with a single-day inflow reaching a new high of $1.374 billion. The most inflow during this period was into IBIT, totaling $2.014 billion, followed by FBTC with over $668 million.

ETF Tracking Data: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

3. Continuous USDT Issuance

Data on USDT issuance shows that from November 6 to now, over $3.51 billion in USDT has been issued, injecting liquidity into the market and supporting Bitcoin's rise.

4. Technical Breakthroughs

90-Minute Cycle

On November 5-6, BTC found support at the convergence of the 45-minute and 90-minute moving averages, and after the surge, even with a pullback to the EMA24 or EMA52 moving averages of the 45-minute cycle, it never broke below the EMA24 of the 90-minute cycle.

12-Hour Cycle

The MACD is at the zero axis, while the price consistently stays above the EMA52 moving average. Typically, the combination of these two technical indicators makes the market prone to rebound.

The OBV has crossed above the MAOBV, while the volume moving average MA10 remains above the volume moving average MA40, further highlighting the upward trend.

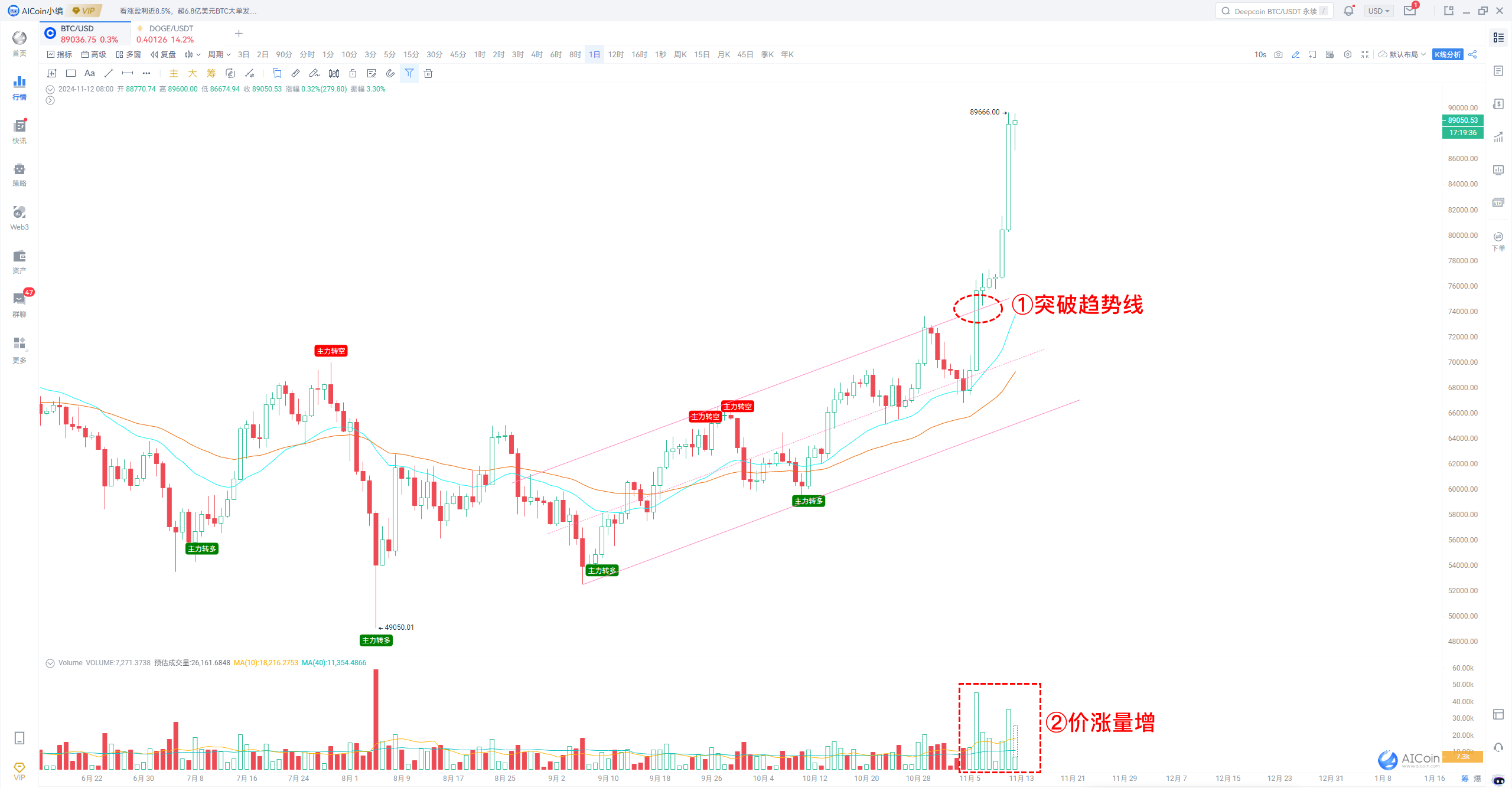

Daily Level

BTC has broken through and stabilized above the upper trend line of the rising parallel channel, and during the upward movement, the trading volume has consistently increased.

Note from the editor: The technical breakthrough signals are also applicable for finding re-entry opportunities after BTC's pullback!

5. Strong Market FOMO Sentiment

After Trump's victory, the crypto community generally expects Bitcoin prices to break through levels of $80,000 and $100,000, further driving the buying frenzy in the market.

Key Signals for Market Top

1. Major Player Positioning

Observe the direction of major player large orders; if the number of buy orders starts to exceed sell orders, it likely indicates that the market is about to peak. This can be captured through cross-platform large order statistics and alert monitoring to detect changes in market trends.

2. Major Player Sentiment

Judgment 1: The long-to-short ratio on OKX rises to 0.9-1.0, indicating an increase in bearish sentiment among major players.

Judgment 2: LUSR rises while contract open interest decreases, meaning major players are reducing positions, indicating downside risk.

3. Selling Pressure in the U.S. Market

A negative Coinbase premium indicates that major players in the U.S. market may start to offload, increasing market selling pressure and making it easier for upward movements to encounter resistance.

4. Insufficient Momentum

In larger time frames, although the MACD fast and slow lines diverge upwards, they have not broken through previous values, and the price has not surpassed previous highs, indicating insufficient market momentum, which may lead to a trend reversal (MACD fast and slow lines crossing below the zero axis). Also, pay attention to multi-timeframe divergence; if multi-timeframe top divergence resonates, it can also signal shorting opportunities.

5. Periodic Breakdowns

Focus on the signal conditions of the 45-minute and 90-minute custom cycles; if both cycles show high-level hidden divergence and one of the cycles breaks below the EMA24 or EMA52 moving averages, it can be seen as a bearish signal. Specific monitoring can be done in the community indicators by subscribing to AICoin's editor's published strategies like Fake Strategy or Breakout Hunter Strategy to monitor breakout situations in real-time.

Fake Strategy (suitable for 45-minute cycle): https://www.aicoin.com/link/script-share/details?shareHash=l3P2876OdlgPWxdZ

Breakout Hunter Strategy (suitable for 90-minute cycle): https://www.aicoin.com/link/script-share/details?shareHash=7dOMvoJPObMdyqaX

Data and strategies are for reference only and do not constitute any investment advice. If you have any questions, you can join the PRO CLUB group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。