How Solana Became the Most Popular Blockchain in 2024?

Author: Joyce | Plain Language Blockchain

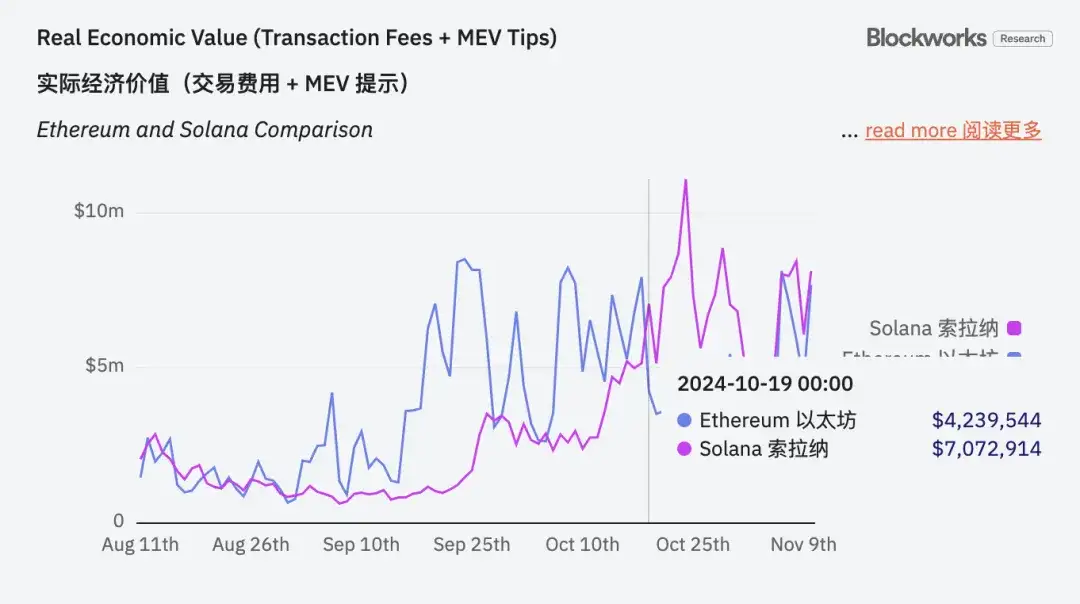

Recently, with the launch of memes like Goat, Pnut, and Act on BN, the Solana ecosystem has experienced a new wave of excitement. According to Blockworks Research statistics, after October 19, 2024, Solana's on-chain daily fees have consistently exceeded those of Ethereum for several days, with revenues even surpassing ten million dollars on October 24. The popularity of the meme sector has led to continuous influx of capital into the Solana ecosystem, making it the hottest ecosystem in the industry right now.

It must be said that Solana is indeed the hottest chain in this bull market, with more than half of the star projects emerging from the Solana ecosystem during the DePin craze, followed by waves of meme excitement, making it quite lively.

So, where do the high returns of the Solana ecosystem we see now primarily come from? How long can this explosive state be sustained?

01

Overview of Solana's On-Chain Fees

Similar to Ethereum, Solana's on-chain revenue includes base transaction fees, MEV tips, and more. After the EIP1599 proposal, Ethereum burns all base fees, while MEV tips are directly rewarded to validating nodes. Solana has a similar burning mechanism, where a fixed percentage of the base fees (initially set at 50%) is burned, and the remainder is distributed to validators.

Therefore, when comparing the on-chain revenue of Ethereum and Solana, all burned base transaction fees are also included.

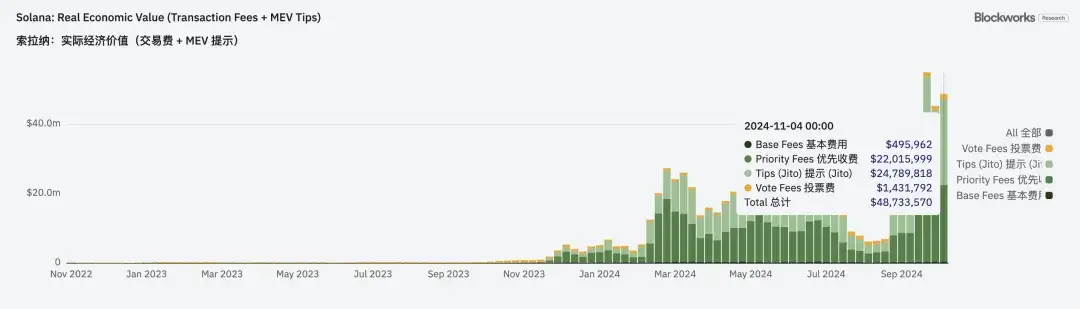

Specifically, Solana's on-chain revenue includes base fees, limited transaction fees, tips (Jito), and voting fees, as shown in the figure below.

From the trend of daily fees on the Solana chain shown in this chart, compared to the other two items, the changes in base transaction fees and voting fees are not significant, but priority transaction fees and tips have seen rapid growth since March of this year.

So, what are these two fees? Priority transaction fees are easy to understand; they are the fees users pay to speed up transaction processing, usually added directly during the transaction. Tips (Jito) are additional fees paid by users to validators, generally used for MEV-related transactions and directed payments.

The rapid growth of both indicates an increase in the activity of the Solana network, with more DeFi activities leading to increased network congestion. Users are more willing to pay higher priority transaction fees to enhance transaction speed, while validators have more opportunities to capture MEV by optimizing transaction order.

So, what specific DeFi transactions are happening on the Solana chain? Are they entirely meme-driven?

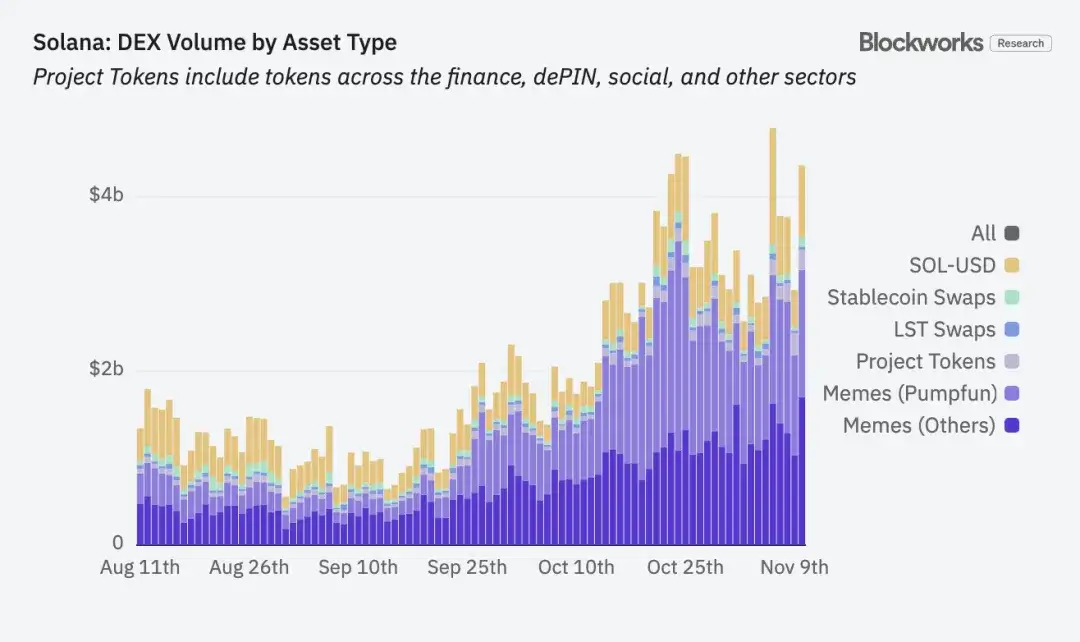

From the data in the above chart, it is clear that transactions on the Solana chain mainly include memes (Pumpfun), memes (others), project tokens, LST tokens, stablecoins, and SOL transactions. Among these, project tokens include all categories listed above, as well as DePin, SocialFi, and more.

In the past two months, the proportion of all meme transactions has increased from 48% to 74%. Of course, the significant shrinkage in the proportion of other transaction volumes does not mean a decline in transaction volume; during the market uptrend, the transaction volumes of project tokens, LSTs, stablecoins, and SOL on the Solana chain have all seen substantial growth. However, the increase in meme transactions has been so exaggerated, growing by 667% in the last two months, that the proportion of other transactions has significantly decreased in comparison.

This also confirms the data above, as the rapid growth of meme transaction volume, driven by the belief that "time is money" in meme trading, users are naturally more willing to pay priority transaction fees. The more active the on-chain transactions, the more MEV opportunities arise.

02

Active Dapps on the Solana Chain

1) DEX

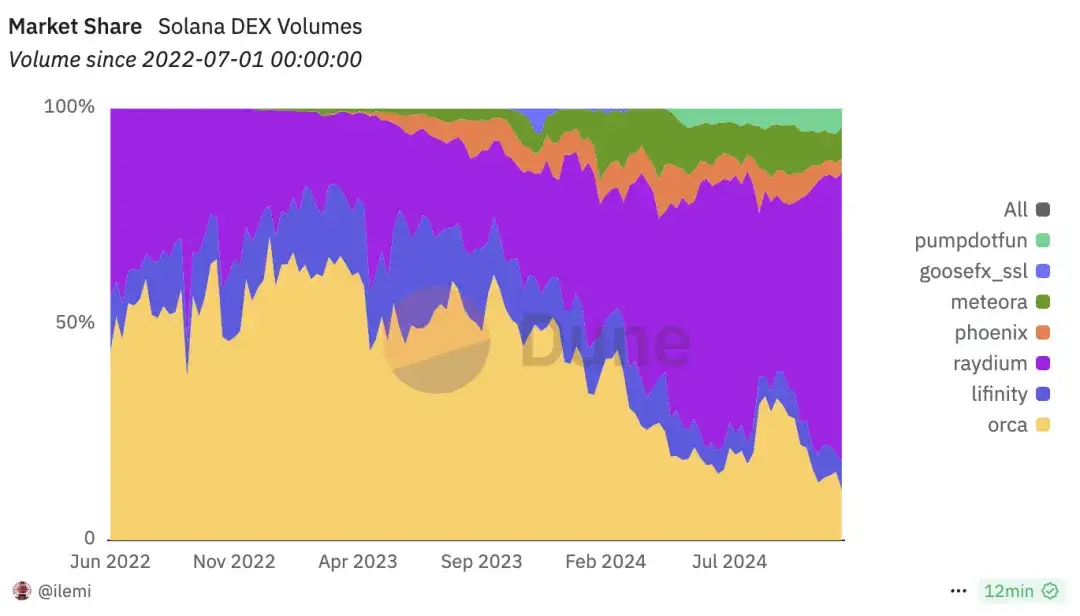

Currently, meme trading dominates the Solana chain, making various DEXs the most active Dapps. Among the many DEXs in the Solana ecosystem, Raydium is the hottest, with the latest data showing that, thanks to the meme explosion, Raydium, which is deeply tied to memes, now accounts for 63.5% of the total trading volume in the Solana ecosystem. Meanwhile, Orca, which initially held an absolute advantage in the Solana ecosystem, has seen its market share squeezed down from over 60% to around 15% due to the explosion of meme trading.

PumpFun, as a meme launch platform, has its own meme trading function, which has also captured nearly 5% of the trading volume in this wave of meme explosion, and it shows a trend of gradual increase.

Market share of Solana ecosystem DEXs, source: Dune.com

2) Aggregated DEX and Trading Bots

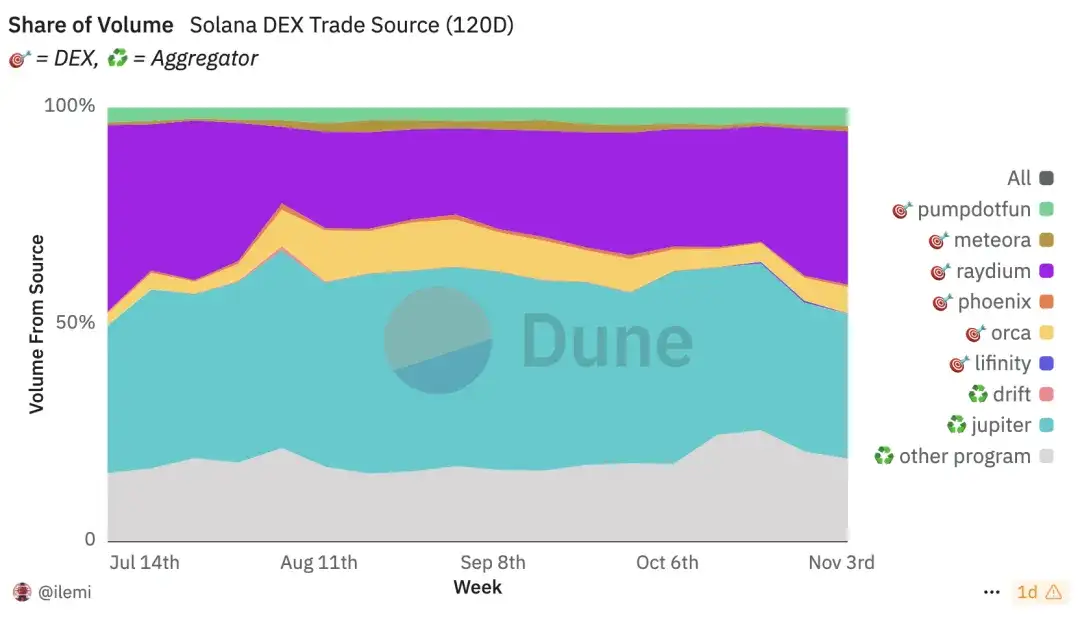

In addition to direct trading on DEXs, aggregated DEXs and trading bots in the Solana ecosystem are also very active. The chart below shows the market share of Solana ecosystem DEXs divided by trading source, with the latest data indicating that Jupiter accounts for 33%, while other protocols (including trading bots) account for 19%.

Market share of Solana DEXs by trading source, source: Dune.com

As the largest aggregated trading DEX in the Solana ecosystem, Jupiter's TVL has surpassed $1.57 billion, setting a new high, and recently, Jupiter has been very active:

· On October 2, the proposal to "Use the unclaimed 230 million JUP to extend and fund ASR" was approved, allowing the active staking rewards (ASR) to continue for another year;

· On October 8, it launched a mobile application that supports various payment methods such as Apple Pay and credit cards, considered a new fiat on-ramp;

· On October 17, it launched the Solana MemeCoin terminal "Ape Pro," focusing on MEV protection and improving the sandwich attack phenomenon in transactions.

With a series of actions, the price of Token JUP has also been very strong.

In addition to aggregated trading platforms, trading bots in the Solana ecosystem are also very active, contributing over 10% of the trading volume, with the top four in terms of revenue being Photon, Trojan, BONKbot, and Banana Gun. Photon has generated $29.85 million in revenue over the past thirty days, making it the second-highest protocol in the Solana ecosystem after the Solana main chain. Apart from the Solana main chain and Pump protocol, the other three of the top five revenue-generating protocols in the Solana ecosystem are all trading bots, showcasing their strong capital-raising capabilities.

Revenue ranking of Solana ecosystem protocols, source: DefiLlama

Revenue ranking of Solana ecosystem protocols, source: DefiLlama

3) Other Dapps

Although DEXs, aggregated DEXs, and trading bots around memes are very popular during the entire meme season, with the heat on the Solana chain, the price of SOL has also risen significantly, driving protocols related to staking, re-staking, borrowing, and leverage in the ecosystem. Here are some currently popular Dapps.

· Jito

Jito is currently the DApp with the highest TVL in the Solana ecosystem, with a TVL exceeding $3 billion, accounting for more than one-third of the total TVL in the Solana ecosystem. Jito allows users to deposit Solana or Solana's LST tokens for re-staking, and its biggest feature compared to other staking protocols is its MEV suite, which extracts MEV revenue from transactions in the Solana ecosystem and distributes this income to stakers, thereby increasing their earnings.

Currently, Jito's re-staking deposits have reached a hard cap of $25 million, indicating that the second phase will raise the limit to meet more users' staking needs.

· Kamino

Kamino is a top stablecoin and LST asset yield platform in the Solana ecosystem, integrating functions such as borrowing, liquidity provision, and leverage. Currently, the total value locked (TVL) of the entire protocol has reached $2 billion.

Kamino supports one-click automatic compound concentrated liquidity strategies, allowing users to maximize returns by controlling borrowed funds. Additionally, Lend V2 is expected to be launched in the fourth quarter of this year, which will allow for permissionless creation of different borrowing markets to meet a broader range of user needs, as well as the introduction of automated single-asset borrowing vaults to aggregate liquidity across markets, aiming to become the foundational layer of finance on the Solana chain.

· Marinade

Marinade is also a liquidity staking protocol in the Solana ecosystem, currently with a TVL of $1.79 billion, ranking fifth after Raydium. However, despite being a liquidity staking protocol, Marinade's protocol yields are far less than those of Jito. Recently, Marinade has been promoting its Solana staking services aimed at institutional investors, resulting in a nearly 50% increase in TVL over the past month and a half.

03

Summary

The meme craze has indeed driven the excitement of the entire Solana ecosystem, with the most direct manifestation being Solana's on-chain revenue and user activity.

However, the current meme phenomenon is merely a product of a specific period in a bull market. Once we enter a bear market, if the meme trend does not continue, how Solana can maintain its leading advantage as a public chain is something that needs to be considered. Just like the once-booming NFT market, after the feast, there can be a lot of mess left behind. Can Solana leverage the popularity of memes to create a healthier ecological revenue structure?

What are your thoughts on the periodic meme craze on Solana? Feel free to leave a comment for discussion.

Article link: https://www.hellobtc.com/kp/du/11/5527.html

Source: https://mp.weixin.qq.com/s/9sO-9_NGMokbxBCDltkOGA

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。