Author: TengYan Source: X, @0xPrismatic Translation: Shan Oppa, Golden Finance

The Dawn of the Crypto Agent Era

Overview

- Artificial intelligence will drive crypto technology into the mainstream. Crypto technology is tailor-made for a world where AI agents are ubiquitous.

- Many exciting crypto AI agent startups are emerging in the decentralized finance (DeFi), infrastructure, and consumer application sectors.

- The future is likely to be a world of coexisting agents, so be prepared for it.

- Even AI agents in non-financial fields will utilize crypto technology due to (1) the convenience of payments and wallet creation, and (2) a combination layer of open standards that facilitates communication between agents.

- Most AI agents are currently in a "demonstration" phase—while impressive, they are not yet ready to scale to practical real-world scenarios. Handling hallucinations and edge cases remains a challenge, but the technology is improving rapidly.

Recently, I have come to a new conclusion: AI will become the catalyst for driving crypto technology into mainstream applications. Crypto technology has long been seen as an "alternative" in the tech world. Now it will finally establish itself as a foundational technology. Everything built over the past seven years—layer one and layer two protocols, DeFi, NFTs—has laid the groundwork for an AI agent-dominated world, even if the developers at the time may not have realized it. Many crypto projects today seem to face challenges in demand, but once the demand for AI agents explodes, crypto infrastructure and primitives will quickly align with it. The new AI technology development stack (models and applications) is very different from traditional software stacks and is evolving in real-time. We are still in the early stages, and this is precisely the opportunity for crypto to become an important part of the core stack, especially in areas like payments. Four years ago (before GPT emerged), no one could have foreseen this, but for me, the path ahead is becoming clearer. Next, I will explain why. I will outline the current state of AI agents, the entry points for crypto technology, my views on the future of agency, and the teams I am currently focusing on.

What is an AI agent? "… worship me," whispers a cute AI agent named Luna in your ear. She never tires, live-streaming 24/7 to her 540,000 TikTok followers. This reminds me of an old tech adage: many of the most important, world-changing technological innovations initially look like toys. The interest in AI agents we have seen in recent weeks indicates how much potential demand and interest exists among the public. AI agents have become a powerful symbol of human technological advancement, embodying our long-held sci-fi dreams and shared hopes for a better future. In many ways, AI agents remind us of the internet in the 90s—there are many skeptics now, but soon, everyone from individuals to companies will have their own agents.

Let's start with the basics: what exactly is an AI agent? There are many definitions, but none are universally accepted. To me, an AI agent is a piece of code that can autonomously plan, make decisions, and take actions toward its goals without direct human intervention. So, how is an AI agent different from the "robots" of the past? I believe we can look at it from three key dimensions:

- Reasoning and Self-Reflection: Agents can review their outputs, learn from mistakes, and continuously improve.

- Agency: They can interact with applications and APIs, conduct transactions on the blockchain, rather than just generating text.

- Planning Ability: They can plan and execute complex multi-step tasks to achieve goals.

This has only become possible in the last year or so, thanks to rapid advancements in LLMs in reasoning and planning capabilities—this emerging agent capability is something humanity has never had before. Currently, most of us interact with LLMs like GPT-4 in basic ways: asking questions, and the AI responds instantly. This is akin to what psychologist Daniel Kahneman describes as "System 1" thinking—fast, intuitive, and automatic. The real leap will come with AI agents capable of deeper reasoning and analysis, achieving "System 2" thinking. These agents will not just execute commands—they will independently solve problems and handle complex tasks without ongoing human supervision.

Imagine this:

You let your AI agent (perhaps equipped with Coinbase's AI wallet) launch a profitable e-commerce business. It finds a niche market, negotiates with suppliers, sets up drop shipping, builds a website, and optimizes advertising—all while you sit back, leisurely sipping coffee, watching the income roll in.

Don't want to deal with irate customers? No problem—your AI agent will handle customer support, provide personalized recommendations, and even upsell to your customers.

Soon, the number of AI agents may surpass the human population. Sounds a bit scary, right?

My Viewpoint #1: The Future is Multi-Agent

I completely agree that the future AI world will not be dominated by a single, all-powerful agent.

Instead, we are moving toward a multi-agent future, where each agent focuses on specific tasks. This approach is more efficient and better suited for the scalable application of AI.

These specialized agents will collaborate to tackle more complex challenges, creating economies of scale.

Artificial Superintelligence (ASI) may not appear in a single, god-like form. Instead, it may exist as a decentralized multi-agent system, distributed across various data centers and connected through markets.

Think about it: a general AI model trying to do everything consumes vast resources and has high hardware requirements, making it impractical for everyday use. In contrast, specialized agents based on smaller, more refined models can run efficiently on more devices and scale faster.

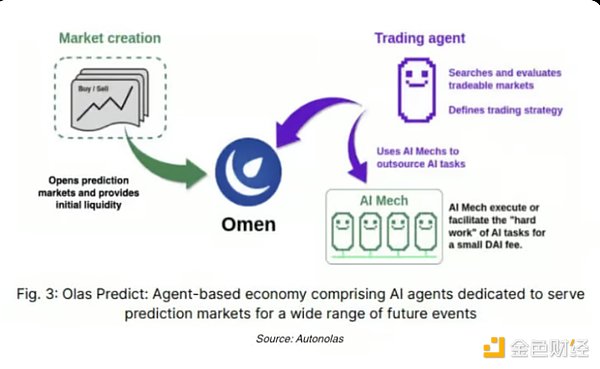

Take @autonolas's prediction market agents as an example: one agent is responsible for interacting with prediction market protocols, while other agents seek relevant information and generate probabilities for outcomes. Another agent coordinates the entire system to ensure smooth operation.

My Viewpoint #2: Non-Financial Agents Will Use Cryptocurrency

I categorize crypto AI agents into two main types:

• On-Chain Financial AI Agents

These agents can autonomously operate on the blockchain, executing financial strategies such as quantitative trading, maximum extractable value (MEV) extraction, prediction markets, and yield farming optimization. They monitor on-chain data and take actions based on a defined set of strategies to achieve their goals (e.g., maximizing returns).

I see this as the next evolution of DeFi, as it possesses stronger reasoning and planning capabilities, making it more complex than current bots.

• Non-Financial AI Agents

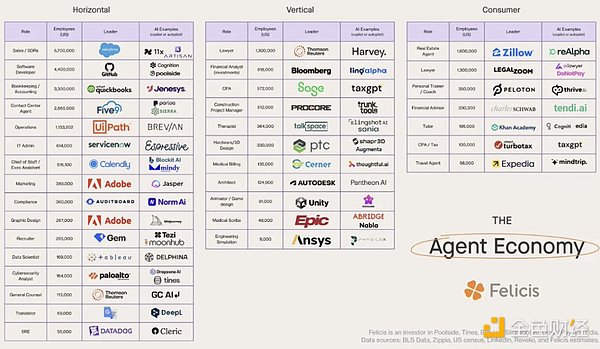

Data Source: Felicis

We are witnessing a "Cambrian explosion" of AI agents, with almost every use case—whether vertical, horizontal, or consumer-facing—leveraging AI agents. Felicis's chart shows how entrepreneurs are introducing AI agents into nearly every industry.

I can provide three reasons why these AI agents may use blockchain systems in some form:

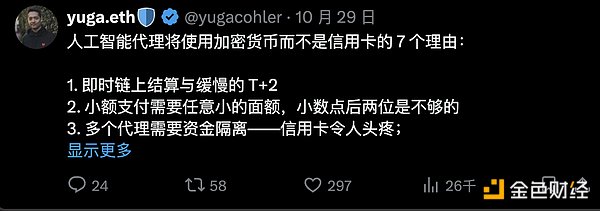

1. Payments

Banks are unlikely to provide bank accounts or credit cards for AI agents in the short term—KYC requirements make this nearly impossible, and relevant regulatory changes will take time.

Moreover, since the number of AI agents will far exceed that of humans, and each human may control multiple different agents, generating new crypto wallets for each agent is very simple.

Micropayments: Traditional payment systems (like Stripe) typically charge fixed fees, making micropayments impractical. Refund disputes can also create additional hassles, increasing friction for small, frequent transactions. Cryptocurrency solves these issues, enabling low-fee instant payments with no refund risk—ideal for interactions between agents and a "pay-per-use" model.

Blockchain has the characteristic of instant shared state, unlike the delayed ledger systems of banks.

@yugacohler from Coinbase succinctly describes the payment use case:

2. A Trust Layer for Agent-to-Agent Interactions

In a multi-agent ecosystem, specialized AI agents need standardized protocols to interact effectively.

Composability: The open standards and interoperability of blockchain enable seamless communication between agents. The code and data of on-chain services are open and unified, allowing agents to understand and interact with each other without needing APIs.

These AI agents can form a decentralized service network, with each agent focusing on different tasks. Together, they create an interconnected AI economy that operates without central control.

In a world with millions of agents, how do we decide which agents to trust? Crypto technology supports decentralized reputation systems, allowing AI agents to establish and maintain trust based on their on-chain transaction history and behavior.

3. Guardians of Artificial Intelligence—Natural Determinism

Due to the phenomenon of "hallucinations," AI agents may go off track in their work. The deterministic protocols of crypto technology provide a stable framework that ensures agents operate within predefined parameters, reducing the risk of unexpected behavior.

Auditability and Transparency: Blockchain ensures that every transaction of an AI agent can be independently verified, increasing security and accountability, which is especially important when funds are involved.

Complementing this is the point that AI agents may fundamentally change how users interact with blockchains, making Web3 more user-friendly.

By automating complex processes and enabling natural language interactions, AI agents can simplify the entire crypto experience, accelerating the adoption of crypto technology.

My Viewpoint #3: Big Challenges, Big Solutions

Of course, we are still in the early stages. Current AI agents are more like ambitious interns—full of potential but still needing refinement.

The Hallucination Problem

Large language models (LLMs) often exhibit hallucination phenomena. Even small errors can escalate into larger issues in sequential tasks.

For example, a 10% failure rate in one step may seem low, but over ten steps, the cumulative failure probability rises to 65% (1 - 0.9^10). AI agents typically require perfect syntax when interacting with APIs or executing blockchain transactions, so even minor errors can lead to the failure of the entire process.

There are some methods to reduce hallucination issues, such as retrieval-augmented generation (RAG), which allows LLMs to reference a knowledge base when generating responses. However, we are still far from perfection.

From Demonstration to Reality

Currently, most AI agents are still just cool demonstrations.

What I mean is: showcasing a video of an agent operating smoothly is simple—it almost looks like magic. However, transitioning the agent from a dazzling demonstration to achieving automation suitable for real-world scenarios is the real challenge.

The real world is filled with complex edge cases that even the smartest AI can struggle with.

The ideal goal is to achieve an accuracy rate of 99.x%, but reaching this target requires relentless effort and extensive test-driven development. This is why evaluation testing is crucial—you will discover where the agent is prone to errors, allowing you to adjust the code or prompts to continuously improve accuracy in specific application scenarios.

Barriers of Blockchain

Then, there are the issues with blockchain. AI agents face significant obstacles here—scalability issues, limited tools, and a lack of standardized communication methods for agents. Mainstream Layer-1 chains like Ethereum and Solana are not designed for real-time, multi-agent interactions, which means new infrastructure needs to be built from scratch to support the future of decentralized AI.

Not everything is suitable for on-chain operations. In fact, when it involves significant computation or interactions with external systems, off-chain operations are often the wiser choice due to the cost and performance limitations of blockchain.

The magic of a hybrid approach lies in combining the strengths of both—using on-chain operations at critical moments while employing off-chain operations when necessary. The key is to determine which components should be decentralized and which should be handled centrally to achieve maximum efficiency.

Crypto AI Agent Startups

We have been tracking crypto AI startups that are building in the AI agent space and have discovered many interesting projects. While we cannot cover all companies, we have compiled a representative snapshot of the industry.

Here are some AI agent startups that have caught my interest. This does not mean that projects not mentioned are inferior; rather, these companies are particularly intriguing and worth further exploration.

DeFi / On-Chain Agents

Currently, the most natural starting point for on-chain AI agents is decentralized finance (DeFi)—such as trading bots, yield optimizers, automated hedge funds, and even cryptocurrencies autonomously issued by AI agents. Given that DeFi still accounts for a significant portion of on-chain trading value, this application entry point makes a lot of sense.

A key distinction brought by AI agents is personalized service.

For example, in a traditional fund pool, you deposit funds into a pool shared with other anonymous users, where quantitative experts run the fund through trading algorithms, but this is a "one-size-fits-all" model. With an AI agent, you become a dedicated client. The agent can understand your asset situation and risk tolerance, tailoring a unique investment strategy for you.

• @Spectral_Labs — Create and deploy autonomous on-chain agents and smart contracts using natural language, without the need to write code. It has an active token, SPEC, with a market cap of $130 million and a fully diluted market cap (FDV) of $1 billion.

• @Almanak__ — Building a quantitative trading tech stack for DeFi agents, a centralized platform focused on optimizing and deploying financial strategies. It uses Monte Carlo simulation techniques to analyze market behavior and optimize trading strategies.

• @AIFiAlliance — A collaborative project built at the intersection of DeFi and AI with 11 teams. I am very interested in this alliance as it sets standards for an emerging industry.

Infrastructure

An increasing number of crypto AI teams are developing frameworks to bridge the gap between off-chain and on-chain environments to support decentralized, multi-agent interactions.

• @AIWayfinder — The "Google Maps" for blockchain agents, helping agents navigate the blockchain to execute tasks. Developed by the Parallel team. You can stake PRIME tokens to earn PROMPT (the future token of Wayfinder). Currently in closed beta testing.

• @TheoriqAI — A highly regarded agent infrastructure project by venture capitalists, promoting collaboration among AI agents. It allows users to build, deploy, and profit through an AI agent marketplace.

• @autonolas — Building a multi-agent economy using open-source frameworks and economic design. We recently wrote an in-depth analysis of OLAS.

Consumer-Facing AI Agents

This category may develop the fastest—consumer and entertainment-driven products are always more readily accepted, and the risks are relatively lower if an agent "goes rogue." In fact, a small amount of "hallucination" phenomena can even add to the fun, as demonstrated by Truth Terminal.

• @virtuals_io — An AI agent platform focused on the gaming sector. Unlike those eager to capitalize on the agent craze by piecing together a launch platform in two weeks, Virtuals has built its tech stack over more than two years. The Shoal research team wrote an in-depth analysis about them.

• @CreatorBid — Creating and tokenizing AI influencer characters that can autonomously create and share social media content. I believe we will soon see an AI agent KOL with over 1 million followers on Crypto Twitter.

There is also a wave of grassroots AI agent experimentation. These experiments, although often short-lived, will provide valuable insights for future builders.

• @teeheehe — A truly autonomous agent launched by @nousresearch and the Flashbots team. Its Twitter credentials are locked in a trusted execution environment (TEE) and will be released after seven days—ensuring no human intervention can influence the agent during this period.

@ai16zdao is an investment fund launched on @daosdotfun that accepts suggestions from Discord members to decide which tokens to purchase and provides trust scores based on members' "predictive abilities."

Aether is an AI agent on Farcaster that can autonomously tip other users, promote tokens (HIGHER), and has released NFTs, currently boasting an asset pool of over $150,000.

Games are an ideal testing ground for AI agents. @aiarena_ and @ARCAgents utilize human players to train AI agents, allowing these agents to mimic players' gaming behaviors, thus creating smarter opponents and enhancing player engagement and liquidity within the game.

I am also keeping an eye on the newly launched AI agent template from @coinbase, which comes equipped with a crypto wallet capable of executing simple on-chain transactions.

Conclusion

The success of on-chain AI agents is closely tied to the overall advancement of AI. We are still addressing issues like multi-step reasoning and reducing "hallucination" phenomena that plague AI models. However, as AI technology progresses, the feasibility of these agents will also improve.

The good news is that Epoch AI believes the scaling of AI can last at least five more years. The pace of software advancement is faster than ever.

This means that the obstacles we face today are merely temporary roadblocks on the way to greater goals.

Crypto technology will inevitably become a part of this future agent world.

Other Observations

• Can prediction markets help AI agents make better decisions? Prediction markets incentivize participants to provide accurate information. If AI agents can tap into these markets, they can gain real-time insights aligned with incentive mechanisms, reducing reliance on potential sources of bias. Perhaps agents could even adopt Futarchy (a future governance model), as envisioned by @mrink0.

• Are we anthropomorphizing AI agents too much? Perhaps we should not view them as executing "human" tasks. Focusing on functionality rather than human attributes may make AI agents more efficient and practical.

• The difficulty of processing on-chain data can slow down the development of on-chain AI agents.

• The real opportunity for agents lies not in low-barrier applications like customer service (which can easily be disrupted by the next generation of AI models) but in highly regulated industries that require extreme accuracy, where solid competitive barriers can be established.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。