For those who are focused and invested, 2025 could be a pivotal year that changes lives.

Author: Yano, Co-Founder of BlockWork

Translation by: Deep Tide TechFlow

The bull market is divided into four phases.

Buckle up, we have just entered the most exciting phase.

Welcome to Phase Three~

Reminder: Phase One is Rebirth

This phase occurs from January 2023 to January 2024.

The main characteristic of the Rebirth phase is the fatigue of the bear market.

Indifference makes all stories lose their appeal.

Your friends and the media are still focused on the collapse of the bear market.

Layoffs are still ongoing.

However, prices are quietly recovering.

Bitcoin has tripled in value.

But you hardly notice because you are still at a loss on many investments.

Only seasoned cryptocurrency investors who have experienced more than two cycles realize that the bull market has begun.

Most people still do not believe this is the start of a bull market.

Phase Two is Excitement

This phase started in February 2024 and ended last week.

Some coins are nearing historical highs. Market stories are returning, but only a few each quarter.

Everyone in the cryptocurrency space knows we are now in a bull market.

But strangely, your friends still haven’t messaged you.

You are in a strange state of both excitement and anxiety.

Layoffs have basically ended, but hiring has not yet restarted.

The field seems closed off. No one is leaving, and no newcomers are joining.

Overall, life is good. Your cryptocurrency friends are all making profits.

This is the calm before the storm.

Phase Three is Euphoria

We are currently in this phase.

The Euphoria phase officially began with the presidential election on November 5.

It is a delightful moment.

Everyone is making money, but speculators have not yet flooded in.

Seize the opportunity to enjoy this moment, as it will be very brief.

The assets you hold are about to surpass historical highs (if they haven’t already).

In the past, there would only be a few new market stories each quarter, but now new stories are emerging every week.

By the end, there will be new stories almost every day.

No one is tired of these stories—every idea is seen as a “good” idea.

Everyone with followers is regarded as a genius and has their own insights on new market stories.

There will always be someone making money on this week’s hot coins, and I can guarantee they will brag about it.

This can be frustrating.

(But remember, everyone has their own interests, and no one will share their failures)

New market stories bring new coins.

Coins are rising every day. You won’t own most of them.

That week you might make 8%, but you will feel frustrated for missing out on the [hot new coins].

The combination of new coins and new stories brings about “Fear of Missing Out” (FOMO).

If you’re not careful, FOMO can get you into trouble.

Some advice:

Understand your investment strategy and its pros and cons.

Day trading? Know that it will affect your work and mental health.

Focusing on building? Be aware that you might miss out on some major trades.

Everything has its pros and cons—understand them.

Don’t try to do everything, or you won’t succeed.

Back to Phase Three.

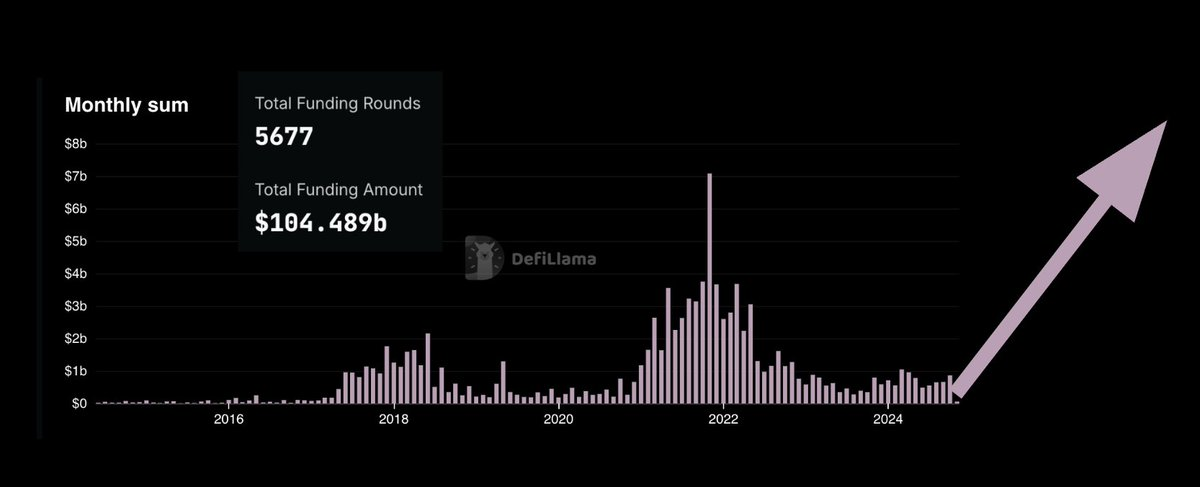

The private market is about to get exceptionally hot.

It all starts with asset allocators. They wake up on November 6 realizing they are severely underinvested in cryptocurrency.

They begin reaching out to venture capital firms and hedge funds for investment allocation.

These firms will announce the launch of large new funds faster than you might think.

Late-stage venture capital has been quiet for over two years. Now it will make a strong comeback.

Large funds and an open IPO market mean that Series B-D companies can raise funds again.

Large financings are becoming the norm once more.

Series A financing deals are closing quickly.

This attracts new world-class founders to join.

Hiring is becoming very competitive.

Protocols are offering attractive token rewards to top talent.

If you are a founder, you have 3-6 months (possibly less) to hire the best talent at a reasonable salary.

After that, you will need to scramble to catch up.

We are mainstream again.

Forbes, Bloomberg, CNBC… they are all excited about cryptocurrency.

Your friends are messaging you about Cardano. Your financial advisor suggests allocating 5% to Bitcoin.

Traditional finance is racing to “tokenize everything.”

Then, at some point in mid-2025, strange things start to happen.

Enter Phase Four: Disconnection

Fortune 500 companies announce massive purchases of Bitcoin.

Athletes and artists start to get involved—cryptocurrency permeates culture.

Venture capital firms no longer conduct due diligence.

Speculators raise millions and become the focal point.

Random coins skyrocket tenfold within a week.

In Phase Four, everyone starts to believe the market will rise forever.

Delusions affect decision-making.

This phase can also be described as madness.

Everything becomes unreasonable.

In the past, there would be new market stories every week.

Now everything has turned into a story.

Your wealth exceeds what you ever imagined.

Your high school friend issues a token, and his net worth reaches tens of millions.

A seasoned investor buys a sports team.

Bieber launches a decentralized social platform.

Lebron introduces a meme coin.

Major companies are pouring billions into marketing, so get ready.

The next 12 months will be a crazy time. For those who are focused and invested, 2025 could be a pivotal year that changes lives.

But if you’re not careful, the arrogance and laziness of Phase Four could cost you dearly.

Finally, don’t forget to enjoy life from time to time.

Now, let’s start building.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。