In fact, the issue of inflation has been overlooked by many, mainly because the Federal Reserve has not stopped raising interest rates for this reason.

It may become apparent again in the future; in fact, this has already been implied in the 10-year Treasury yield. The current situation is that the stock market is in a frenzy, while the bond market is gloomy. However, this situation will not last long; it is estimated that it will only be about six months to a year at most, and the stock market will have to follow the bond market.

The question arises: what are better assets in an inflationary environment?

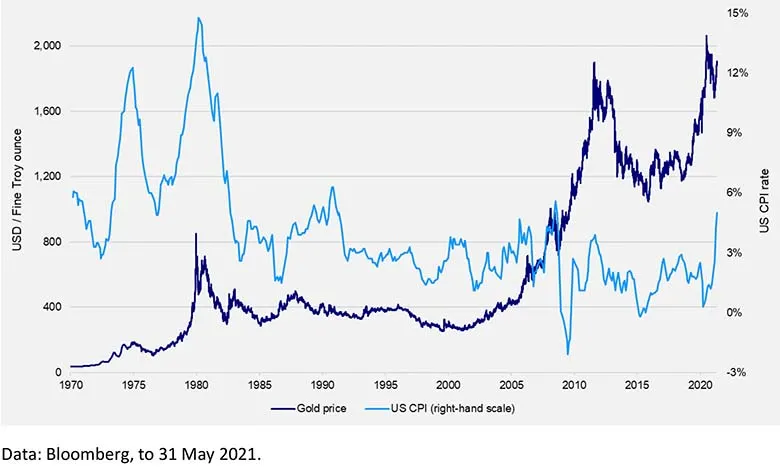

Excluding stocks, gold has historically performed well in inflationary environments. Since 1971, gold has had an annual return of 15% in environments where inflation exceeds 3%, while the annual return in non-inflationary environments is only 6%. BTC may move in sync with gold, or it may not, as it has not yet been tested.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。