Key Indicators: (November 4, 4 PM -> November 11, 4 PM Hong Kong Time)

BTC/USD price increased by +18.4% ($68,000 -> $81,200), ETH/USD price increased by +27.6% ($2,460 -> $3,140)

BTC/USD year-end (December) ATM volatility decreased by -6.2 points (58.0 -> 51.8), December 25d skew increased by +0.1 points (3.1 -> 3.2)

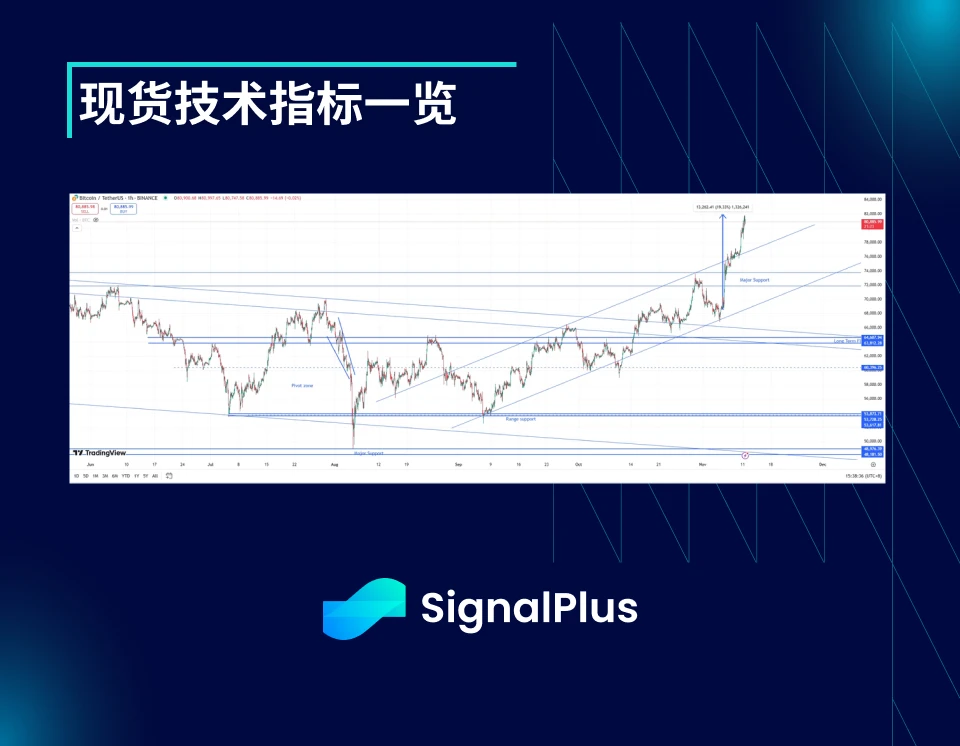

After the confirmation of Trump's succession as the next president, the price broke through the resistance level of $74k. Between 4 PM on Tuesday, November 5, and 4 PM on November 8, the price rose by 11% to our bullish target range for the election ($76k-$78k). Since then, the upward momentum has continued to strengthen. We remain optimistic about BTC post-election and set a long-term price target above $100k. In the short term, we may see some price fluctuations or declines, but the core technicals still support a bullish outlook.

We believe the current major support level of $74k-$72k will hold, considering the possibility of aggressive profit-taking and a pullback in the short term.

Market Themes

The gap in the winning probabilities of the two presidential candidates narrowed before the election, leading to a liquidation in the spot market and a drop to $67k. Nevertheless, Trump ultimately retained the presidency, while Republicans successfully gained a majority in both the House and Senate. This confirmed that this was indeed the fresh catalyst the cryptocurrency market had been waiting for. After the price rose to the $75k-$76k range early post-election, it surged forward, breaking through the key psychological level of $80k over the weekend. Meanwhile, with ETH returning above $3k, prices of other altcoins also surged significantly.

The Federal Reserve announced a dovish rate cut on the Thursday night after the election, and the loose macro backdrop continues to support strong performance of risk assets before the end of the year. The stimulus policy released by China on Friday failed to attract market attention, as there was a general belief that there was no strong reason to reduce risk assets in the short term. This will also continue to boost cryptocurrency prices.

Although the USD strengthened against other fiat currencies due to Trump's election (partly driven by rising dollar yields), the price showed no reaction to the new narratives supporting cryptocurrency regulation and potential strategic reserves. This situation may dominate in the coming months until further confirmation supports more capital inflows.

ATM Implied Volatility

BTC ATM Implied Volatility (November 4 - November 11, 4 PM Hong Kong Time)

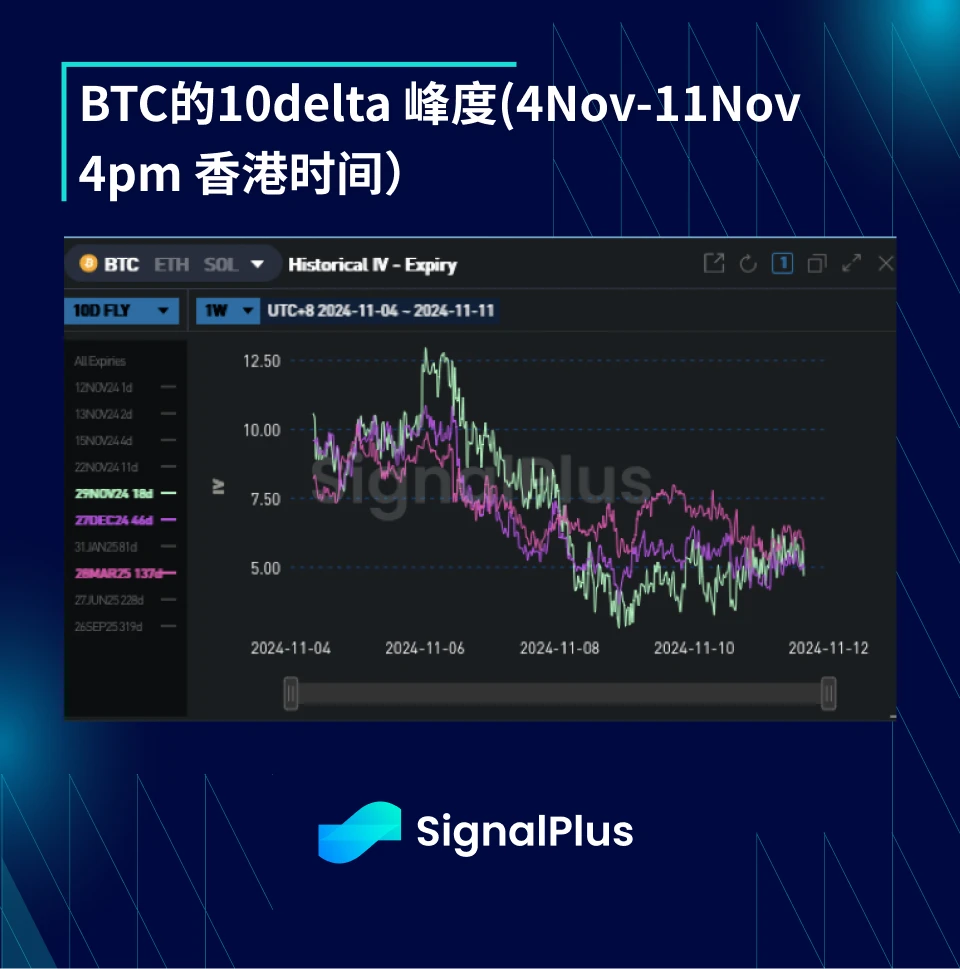

The volatility surrounding the election event ultimately ended with a lower pricing. Two days before the event, the market gradually lowered the time price movement to 5.5%, but the actual daily movement on election day was close to 8.5%. The direction of the election day's results caught the entire market off guard, as many expected a more intense election and raised premiums from mid-November to the long term, anticipating delays in the election results. Ultimately, these premiums were aggressively cleared post-election.

After the election, the level of implied volatility has shown a downward trend, mainly due to the market's bullish outlook on higher price range volatility (using traditional call spreads) and selling pressure. Meanwhile, interest in directional trading through options has been lacking as prices gradually rise, except for some rollovers seen at certain strike prices.

With the new regime taking office, there is a structural argument that volatility may weaken. If Trump successfully promotes regulatory measures for cryptocurrencies in the U.S., it will unleash a new wave of capital inflow. This capital inflow will provide support for prices and weaken volatility. Additionally, aside from the election event, the actual volatility of prices has also decreased to the low 40s in recent months, further confirming this view. However, we need to point out that there is still a long way to go before Trump can truly gain congressional approval for cryptocurrencies.

Skew/Kurtosis

Despite the bullish market sentiment, the skew has remained largely unchanged this week. It still reflects a classic upward structure (mainly caused by selling pressure and bullish call spreads), creating a bullish outlook on volatility at higher price points, which has not yet been offset by new demand. Therefore, as prices rise,

The correlation between price and implied volatility has not performed well, impacting the skew and eliminating the effects of bullish sentiment and downside supply.

Currently, the kurtosis is gradually decreasing, but we believe it is currently oversold. Because even though the spot may stabilize within a new local range, it could still explode above $100k or drop below $60k-$65k during certain risk-off events.

Wishing everyone good luck in the coming week!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。