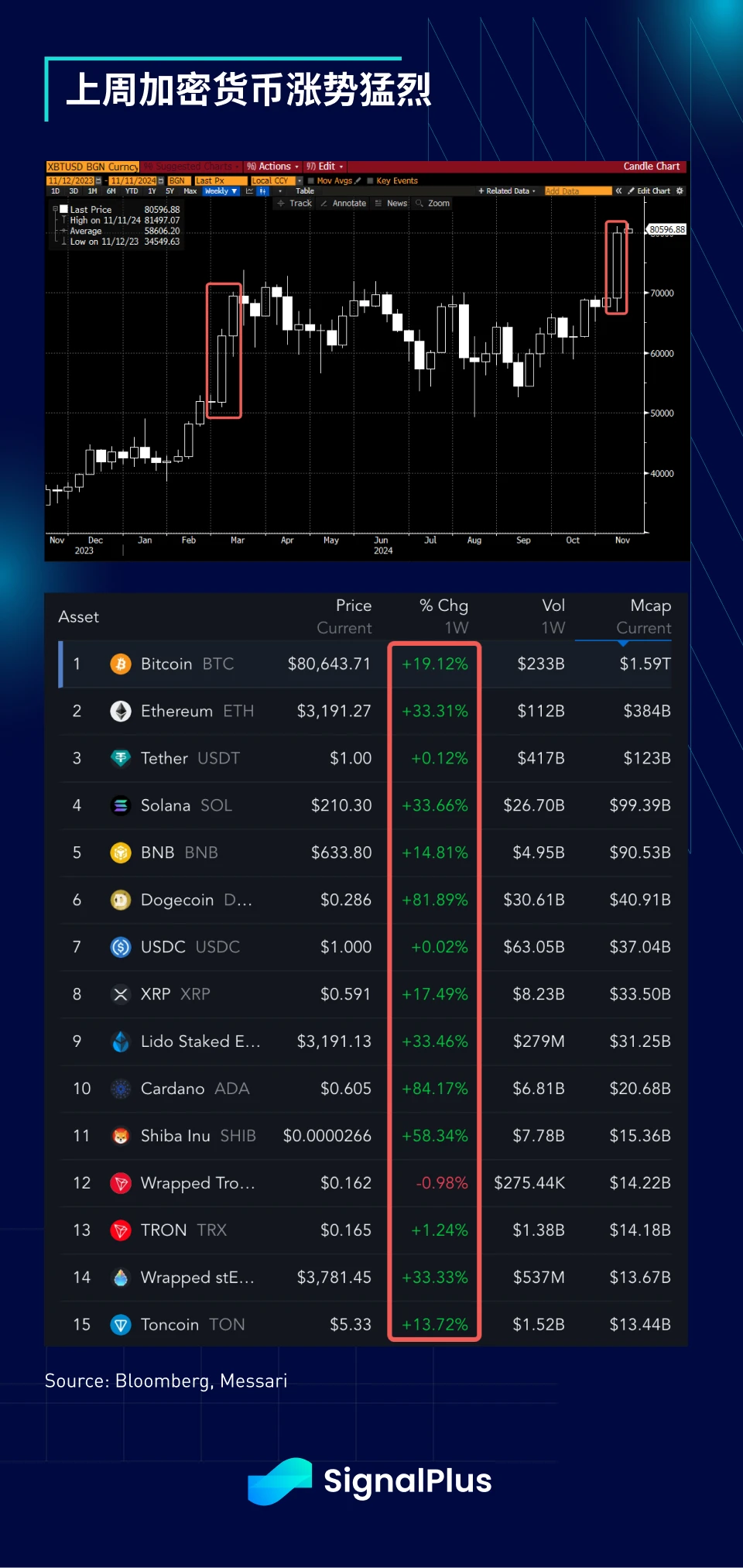

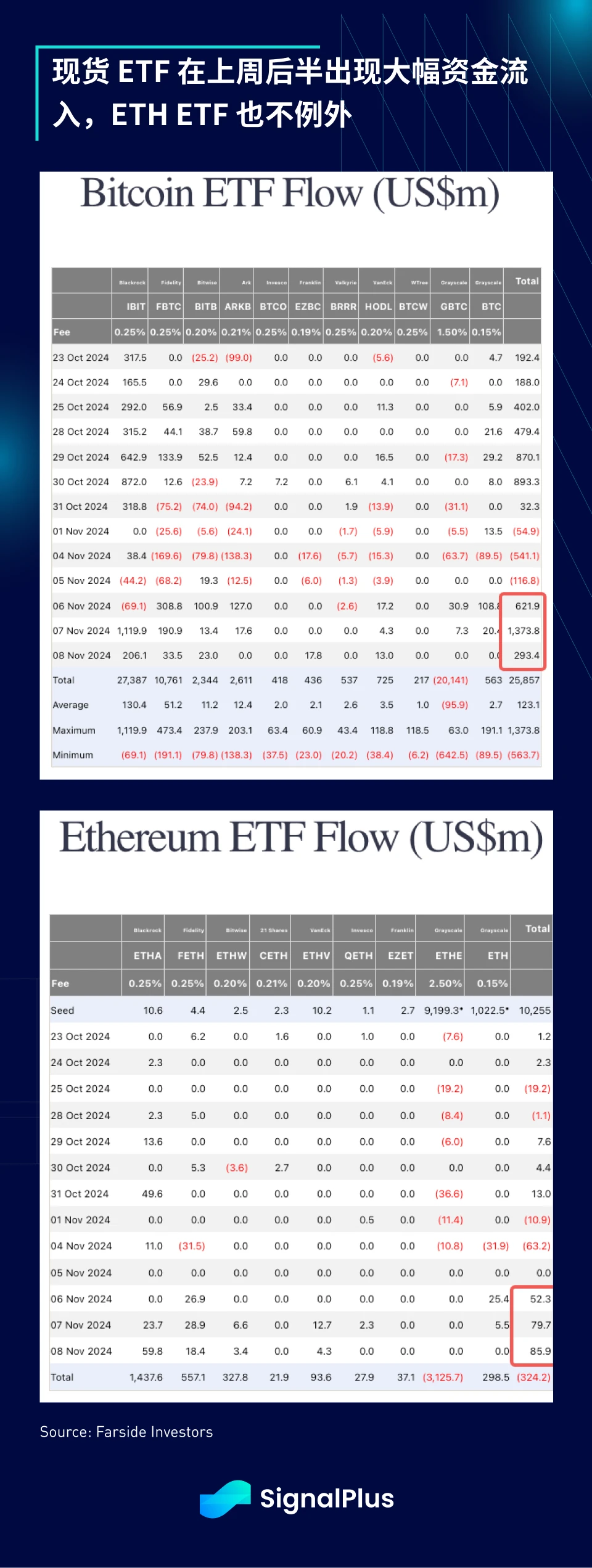

Although Trump will not officially take office for another two months after his election, the impact of his victory has already been widely reflected in geopolitics and capital markets. Cryptocurrency has once again become the focus, with BTC prices surpassing $80,000 while vote counting is still ongoing in some parts of the United States. Last Thursday, Blackrock's BTC ETF (IBIT) set a record for single-day inflows of $1 billion, and even the ETH ETF saw its third-highest single-day inflow in history.

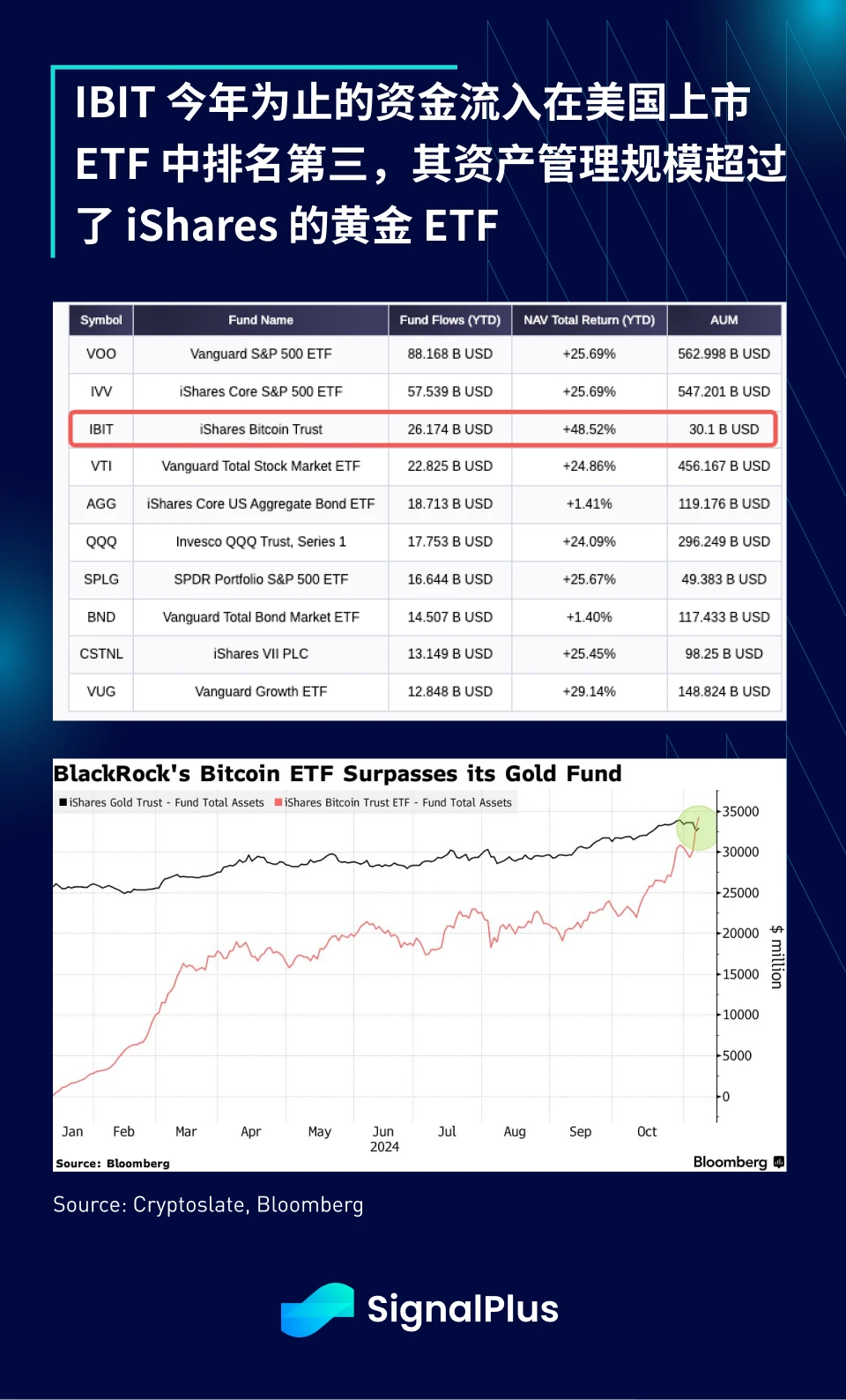

So far this year, IBIT's inflows rank third among all U.S.-listed ETFs, with assets under management exceeding iShares' own gold ETF, surpassing $33 billion. During this surge, centralized exchanges (CEX) have liquidated over $800 million in short futures positions in the past week, marking one of the largest short liquidations of the year. As leveraged funds return in large numbers, the funding rate for perpetual contracts has soared to around 30%.

Additionally, despite weak on-chain activity, inflows from traditional finance have become a stable support factor. The market capitalization of stablecoins has steadily rebounded this year, returning close to the historical highs of 2022. Further inflows into stablecoins should provide more margin funding, and as prices continue to rebound, leverage is expected to remain.

From a political perspective, considering that the incoming government is more inclined to support cryptocurrency legislation, the industry is increasingly optimistic about the emergence of a more favorable regulatory framework for cryptocurrencies in the future.

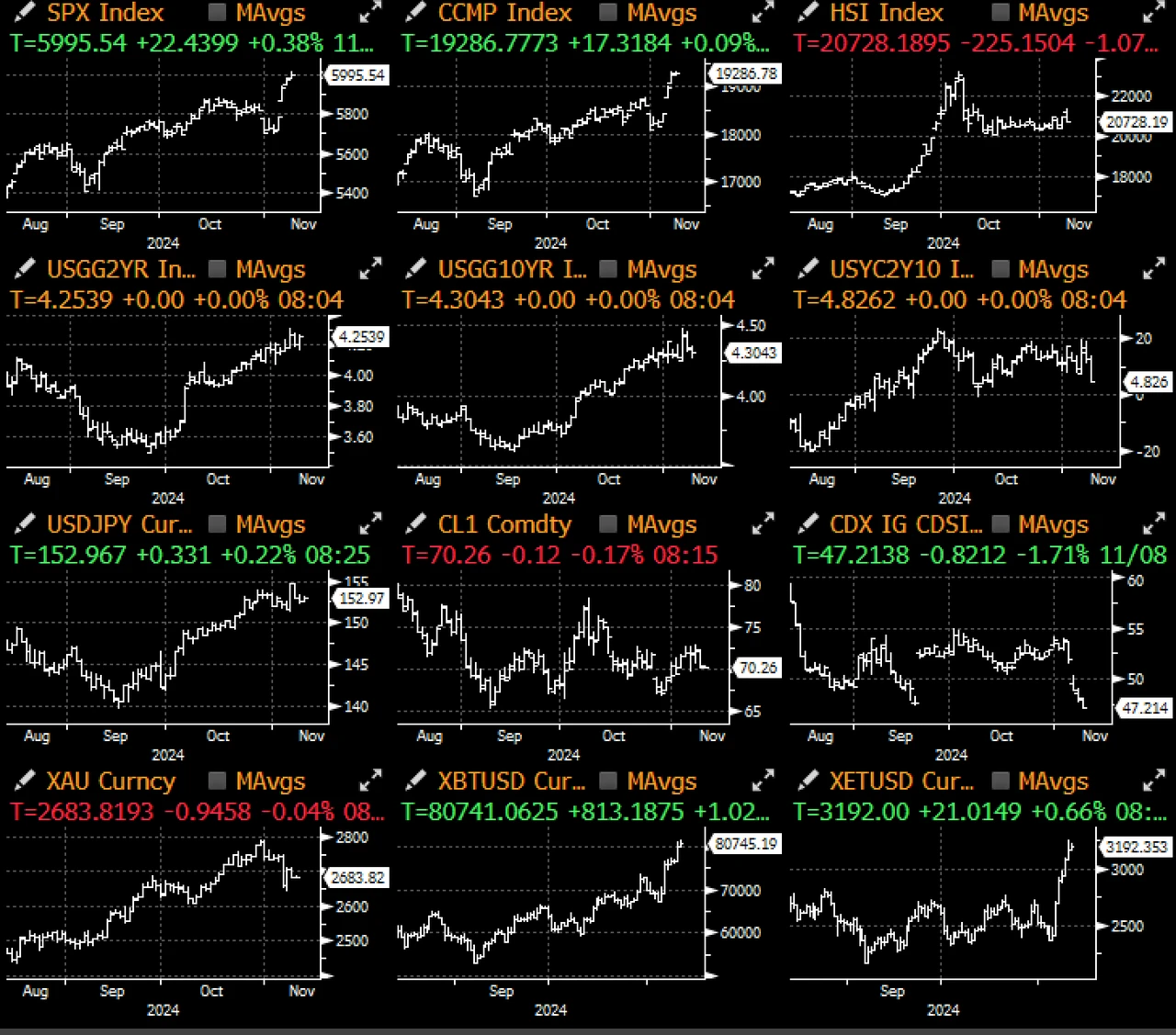

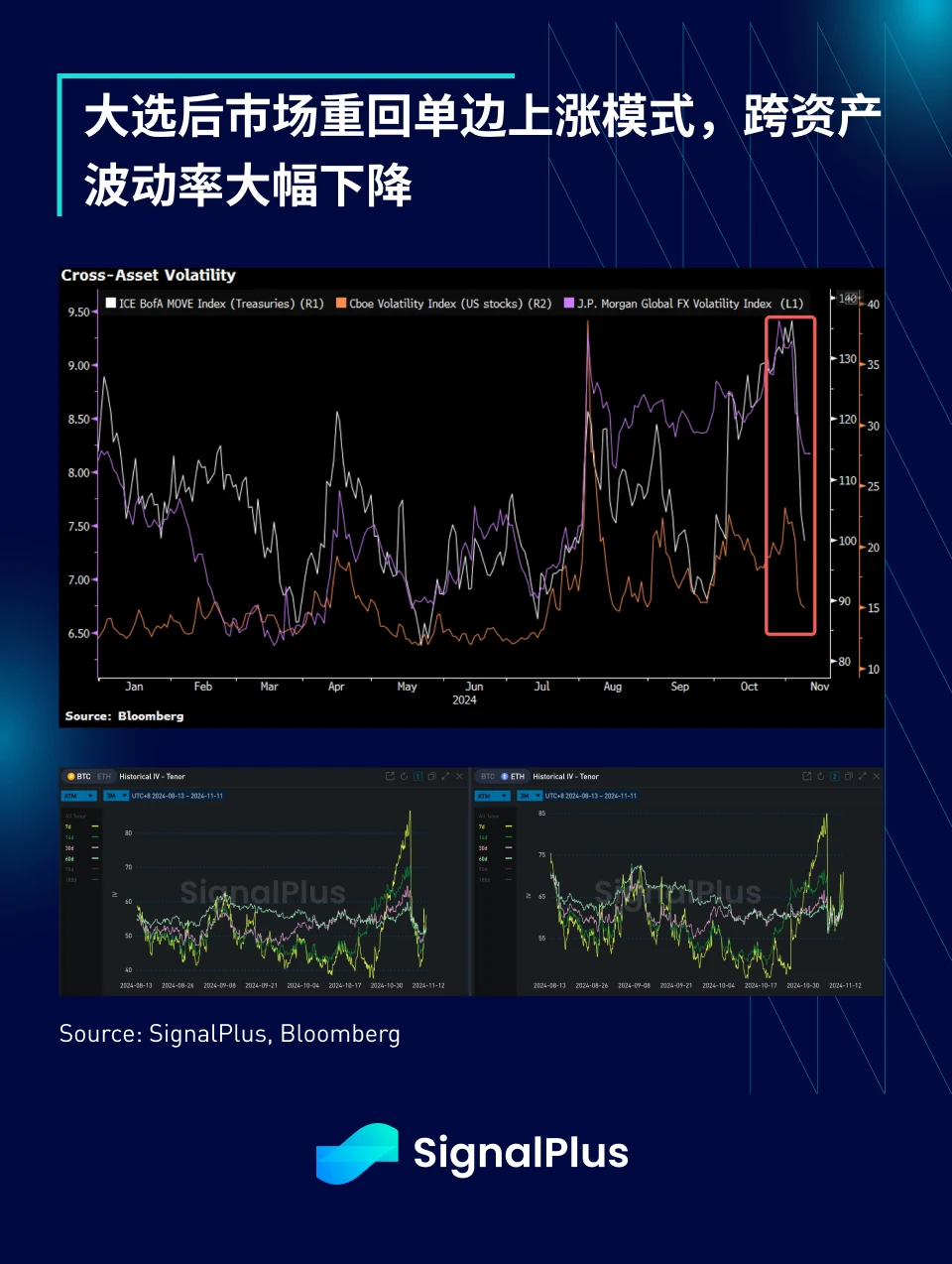

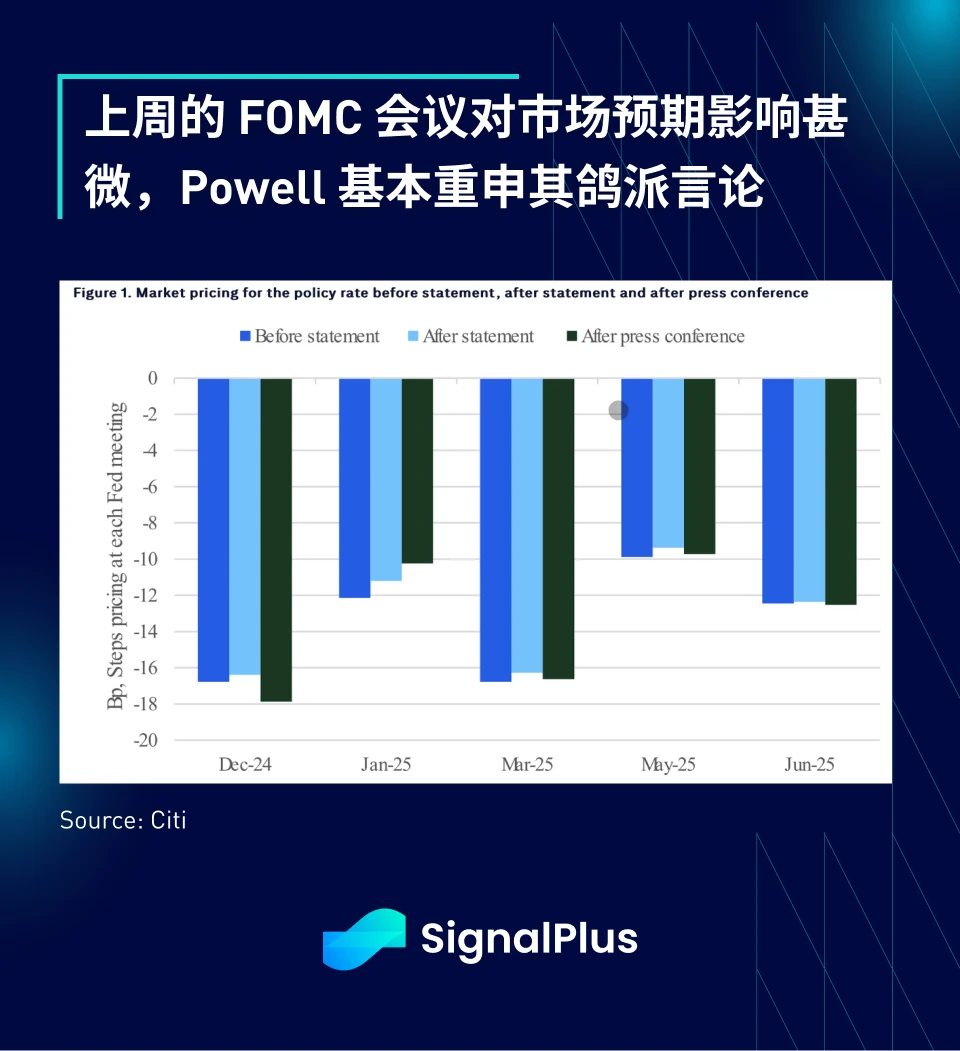

Returning to the macro market, the U.S. stock market has ignored the disappointment of China's stimulus policies and continues to reach new highs, while the fixed income market remains stable due to the dovish stance from last Thursday's FOMC meeting. Furthermore, as the market is expected to maintain a risk-on mode before the end of the year, the cross-asset volatility of macro assets has significantly decreased. On the other hand, with BTC breaking through $80,000, the volatility of BTC and ETH has slightly rebounded, and $100,000 call options have once again entered the market spotlight.

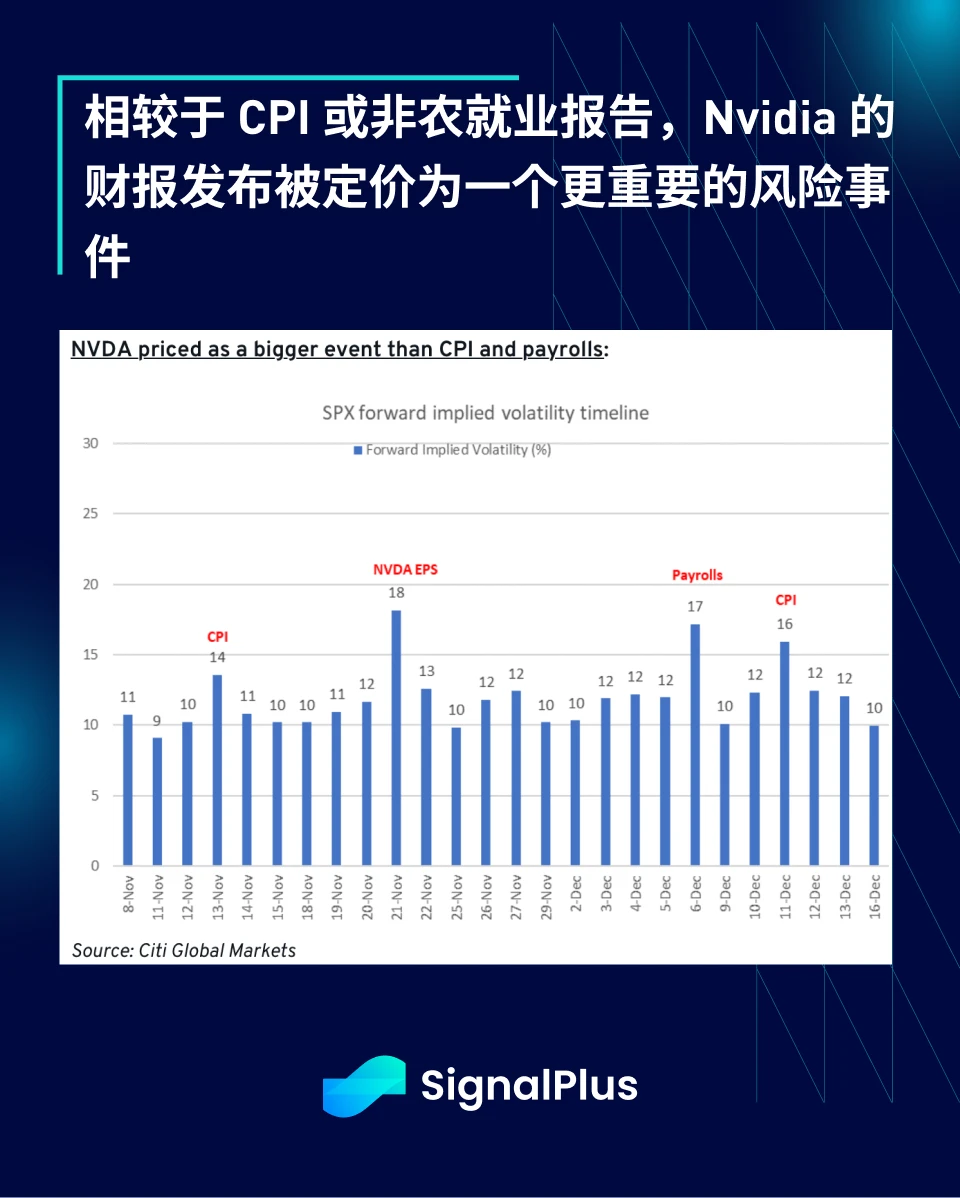

This week will see the release of CPI data, and aside from that, there are not many other significant macroeconomic data points this month. Interestingly, market pricing reflects that Nvidia's earnings report is considered a more important risk event compared to the CPI or non-farm payroll reports, indicating that the market has more confidence in the Federal Reserve's stance and that there are no obvious negative catalysts in the market environment.

So, enjoy the party while it lasts, but still maintain cautious risk management. Good luck to everyone!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。