As Bitcoin (BTC) surpassed the $80,000 mark yesterday (November 10), investors are increasingly focused on its future trends and potential influencing factors. In this context, the views of KOLs and large institutions on BTC's future trajectory are particularly important. Their analyses encompass not only macroeconomic trends but also changes in market technicals and the policy environment.

KOL Perspectives

- PlanB's Long-Term Prediction

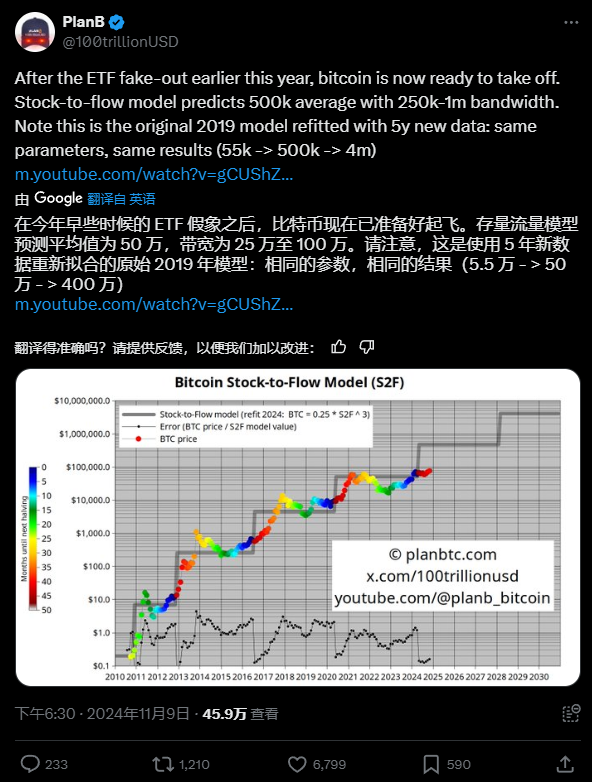

PlanB, the creator of the Bitcoin Stock-to-Flow (S2F) model, predicts that Bitcoin's price will reach new highs in the coming years. He points out that Bitcoin's scarcity will continue to drive its price up, especially after the halving event. According to his model, Bitcoin's price could exceed $500,000 by 2025.

Image Source: x

- Alex Krüger's Short-Term Optimism

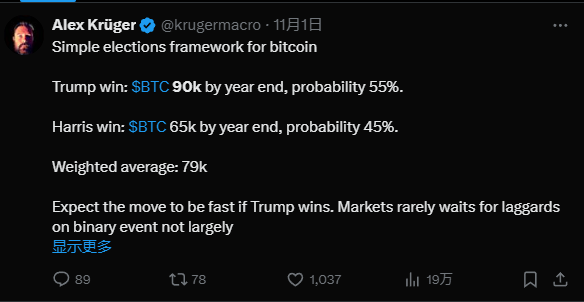

Trader Alex Krüger believes that Trump's victory will quickly push Bitcoin's price higher, potentially reaching $90,000 by the end of the year. He notes that market expectations regarding Trump's policies will rapidly reflect in Bitcoin's price, especially after the election results are confirmed.

Image Source: x

- Arslan Butt Predicts a Possible Entry into Six Figures This Year

Crypto market player Arslan Butt believes that with the increasing institutional adoption and the anticipated impact of the 2024 Bitcoin halving, these two factors may combine to briefly push Bitcoin's valuation into the six-figure range before slightly retreating.

- Toe Bautista Points Out Positive Election News

GSR research analyst Toe Bautista states that Trump's win in the U.S. presidential election has had a significant positive impact on Bitcoin's price. He notes that under favorable macro conditions, Bitcoin's price may continue to rise, and market expectations are already paving the way for future gains.

After Trump's victory, the U.S. policy environment may become more favorable for the development of the cryptocurrency market. The Republican majority in the Senate provides political support for the introduction of cryptocurrency regulations, which could bring a clearer regulatory framework to the crypto industry. The Trump team is considering nominating Robinhood's Chief Legal and Compliance Officer Dan Gallagher as the chairman of the U.S. Securities and Exchange Commission (SEC), a potential personnel change that the market interprets as a positive signal for the crypto market.

- Greg Cipolaro Believes Bitcoin is Becoming a Political Necessity

Greg Cipolaro, Global Research Director at NYDIG, states that Bitcoin is becoming a political necessity. With Trump's election, Bitcoin and its underlying blockchain technology may be more integrated into the mainstream financial system, further driving its price up. Cipolaro emphasizes that not holding Bitcoin will become a financial burden in the future. He also predicts that the new regulatory environment may be more favorable for the development of cryptocurrencies.

- CoinShares Optimistic About BTC Spot ETF

CoinShares points out that Trump's policies may accelerate the passage of Bitcoin legislation, further promoting the development of the ETF market. The spot Bitcoin ETF has attracted significant capital inflows in the market, becoming one of the key drivers of recent price increases. Following Trump's election, the market's friendly expectations towards cryptocurrencies have strengthened, bringing more attention and capital inflows to Bitcoin ETFs.

Image Source: x

Cautious Perspectives

Despite Bitcoin's soaring price, market analysts express concerns about its future volatility. The Giver, an anonymous senior investor, warns that the current price increase may be a short-term phenomenon and does not necessarily reflect a long-term trend. He points out that market liquidity and event-driven effects may lead to price adjustments after the election.

On the other hand, Markus Thielen, an analyst at Matrixport, suggests adopting hedging strategies to cope with the uncertainties brought by the election. He believes that after Trump's election, Bitcoin and other crypto assets may continue to rise, but market uncertainties still exist. Markus Thielen recommends a hedging strategy of "going long on Bitcoin and shorting Solana" to address market uncertainties.

Conclusion

As a barometer of the cryptocurrency market, Bitcoin's price movements not only reflect market sentiment but also reveal the combined effects of macroeconomic factors, policy changes, and more. The analyses from KOLs provide investors with multi-faceted market insights, helping them make more informed decisions in a complex market environment. While investors chase high returns, they also need to be wary of market volatility and potential risks, ensuring appropriate risk management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。