Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the King’s articles and videos, and I hope the brothers who have been following the King will return.

Click the link to watch the video:https://www.bilibili.com/video/BV1BRm1YSEGx/

Cryptocurrency Market Analysis and Trading Suggestions for November 10

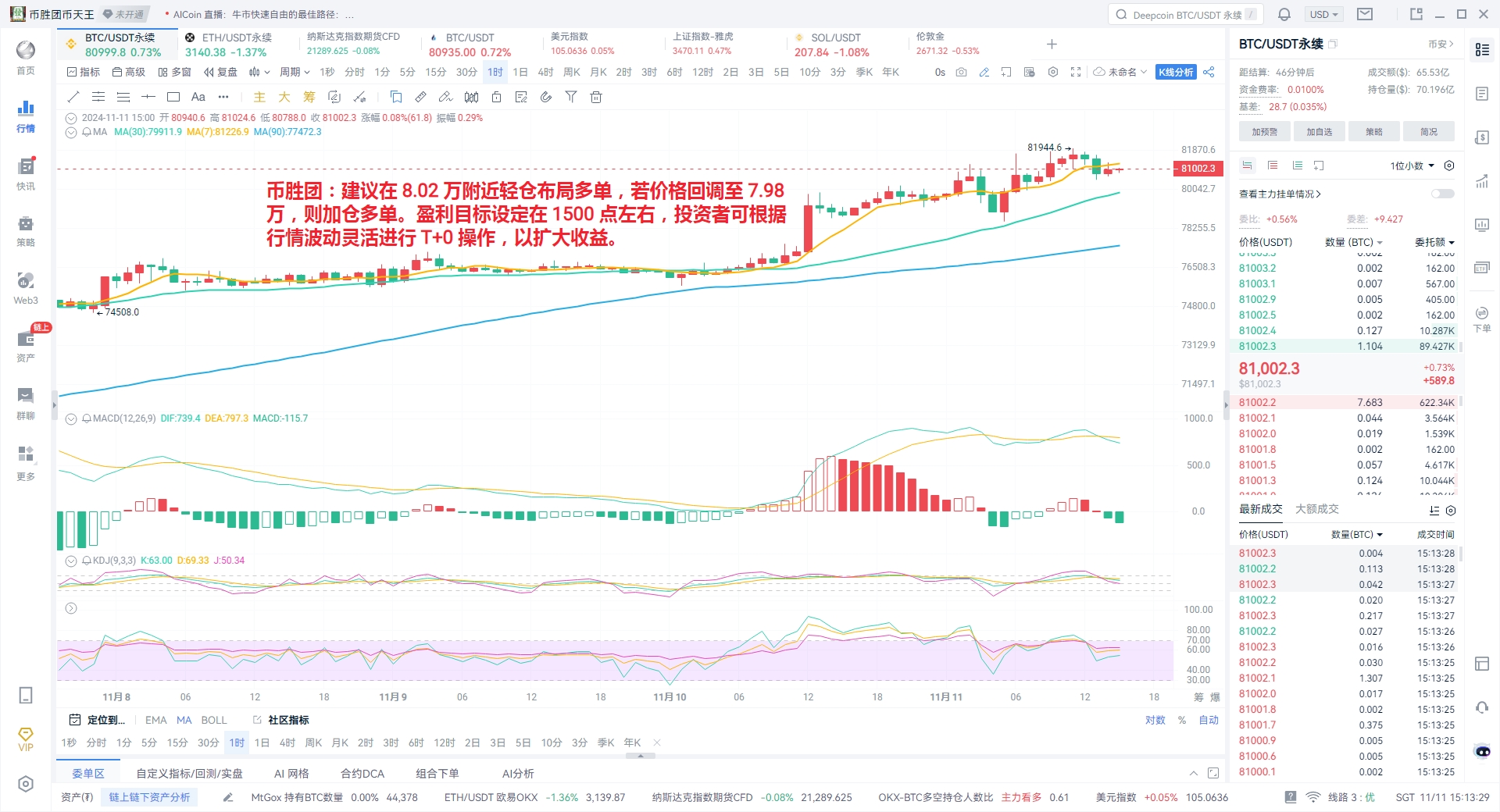

In the midday analysis on November 10, we provided ideas for going long and for buying on pullbacks. Bitcoin has continued to rise from yesterday's price of 79,000 and is now approaching the high of 82,000. In contrast, Ethereum has not yet started a rebound, but it is currently maintaining a strong position in the short term. Below is a more detailed analysis and trading guidance.

From a data perspective, Bitcoin's market cap is steadily growing by about 10 billion daily, with a price increase of about 1,000 points each day. The inflow and growth ratio is reasonable, as the influx of funds has driven this growth. Ethereum's data ratio is imbalanced, with net outflows over 15 and 30 days yet still showing growth, thanks to retail investors holding their positions without selling, leading to a short-term rise. There is a net inflow trend over 7 days and 24 hours, with a net inflow of 155 million in 24 hours and 167 million over 7 days. However, this inflow is severely disproportionate to the growth; just 167 million has caused Ethereum to rise from 2,356 to 3,184, indicating a significant bubble. Investors need to assess the extent of this bubble; once the market reverses, Ethereum could experience a sharp decline, potentially exceeding Bitcoin's drop, and the rapid decline may make it difficult for investors to exit, posing a much higher risk than Bitcoin. Investors should have a risk assessment scale in mind.

1. Bitcoin Trend Analysis

From the daily chart, Bitcoin's daily candle closed up nearly 5% yesterday, briefly breaking through the 80,000 mark, showing a strong one-sided upward trend. Looking at the 4-hour chart, after consecutive bullish candles, the maximum retracement only reached near the 4-hour MA10 moving average, steadily climbing along the 5-day moving average. As of now, there are no obvious signs of a peak. Generally, a true downward trend only occurs after a pullback followed by a failed second peak. Therefore, as long as Bitcoin does not fall below the 4-hour MA10 moving average and does not show a significant pullback with a failed second peak, the long strategy remains viable.

2. Ethereum Trend Analysis

The daily chart for Ethereum shows that yesterday it formed a red candlestick with upper and lower shadows, quickly rebounding after retracing to the daily MA256 moving average (3066), indicating that this support level is relatively solid. However, there is some divergence between bulls and bears in the short term. While Bitcoin continues to break new highs, Ethereum has not been able to follow suit, with its price oscillating around the MA5/10 moving averages on the 4-hour chart. If Bitcoin continues to break upward, Ethereum is expected to see a rebound.

3. Midday Trading Thoughts (Written at 13:30)

(1) Bitcoin (BTC)

It is recommended to lightly position long orders near 80,200. If the price retraces to 79,800, then increase the long position. Set a profit target of around 1,500 points, and investors can flexibly conduct T+0 operations based on market fluctuations to expand profits.

(2) Ethereum (ETH)

You can lightly go long near 3,120, and if it retraces to 3,080, then increase the long position. The initial target is set at 3,250; once the price breaks this level, you can appropriately reduce your position and hold, looking further towards 3,380 to capture the profits from the rebound.

4. Comprehensive Market Consideration

Currently, Bitcoin's short-term trend is extremely strong, while Ethereum is in a phase of divergence between bulls and bears. Investors should closely monitor Bitcoin's subsequent movements, hoping that its rebound can push the price to break above the 3,500 high. Additionally, given the correlation between the cryptocurrency market and the U.S. stock market, it is also necessary to pay attention to the market trends in U.S. stocks to timely adjust investment strategies in response to potential market fluctuations and risks.

This article is independently written by the Coin Victory Group. Friends in need of current price strategies and solutions can find the Coin Victory Group online. Recently, the market has been primarily characterized by fluctuations, accompanied by intermittent spikes, so when making trades, please remember to control your take-profit and stop-loss levels. In the future, when facing significant market data, the Coin Victory Group will also organize live broadcasts across the internet. Friends who wish to watch can find the Coin Victory Group online and contact me for the link.

Mainly focused on spot, contracts, BTC/ETH/ETC/LTC/EOS/BSV/ATOM/XRP/BCH/LINK/TRX/DOT, skilled in strategies around high and low support and resistance for short-term fluctuations, medium to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, and monthly head predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。