Trading Philosophy: Look at the trend in the long term, find entry points in the short term;

Technical Analysis: In terms of Bitcoin, the weekly chart shows a large bullish candlestick, with the Bollinger Bands opening upwards. The market is experiencing a strong upward trend, akin to bamboo shoots after a rain. The MACD moving average continues to rise, and bullish volume is increasing. The KDJ line is also moving upwards. On the daily chart, there have been six consecutive bullish candlesticks, with the Bollinger Bands continuing to open upwards. The MACD moving average continues to rise, and bullish volume is still increasing, with the KDJ line also moving upwards. On the 4-hour chart, the Bollinger Bands continue to open upwards, and the market has strongly broken through the upper Bollinger Band, frequently hitting new highs. It is currently in a high-level consolidation phase, with the MACD moving average continuing to rise, but bullish volume is starting to decrease, and the KDJ line is moving steadily.

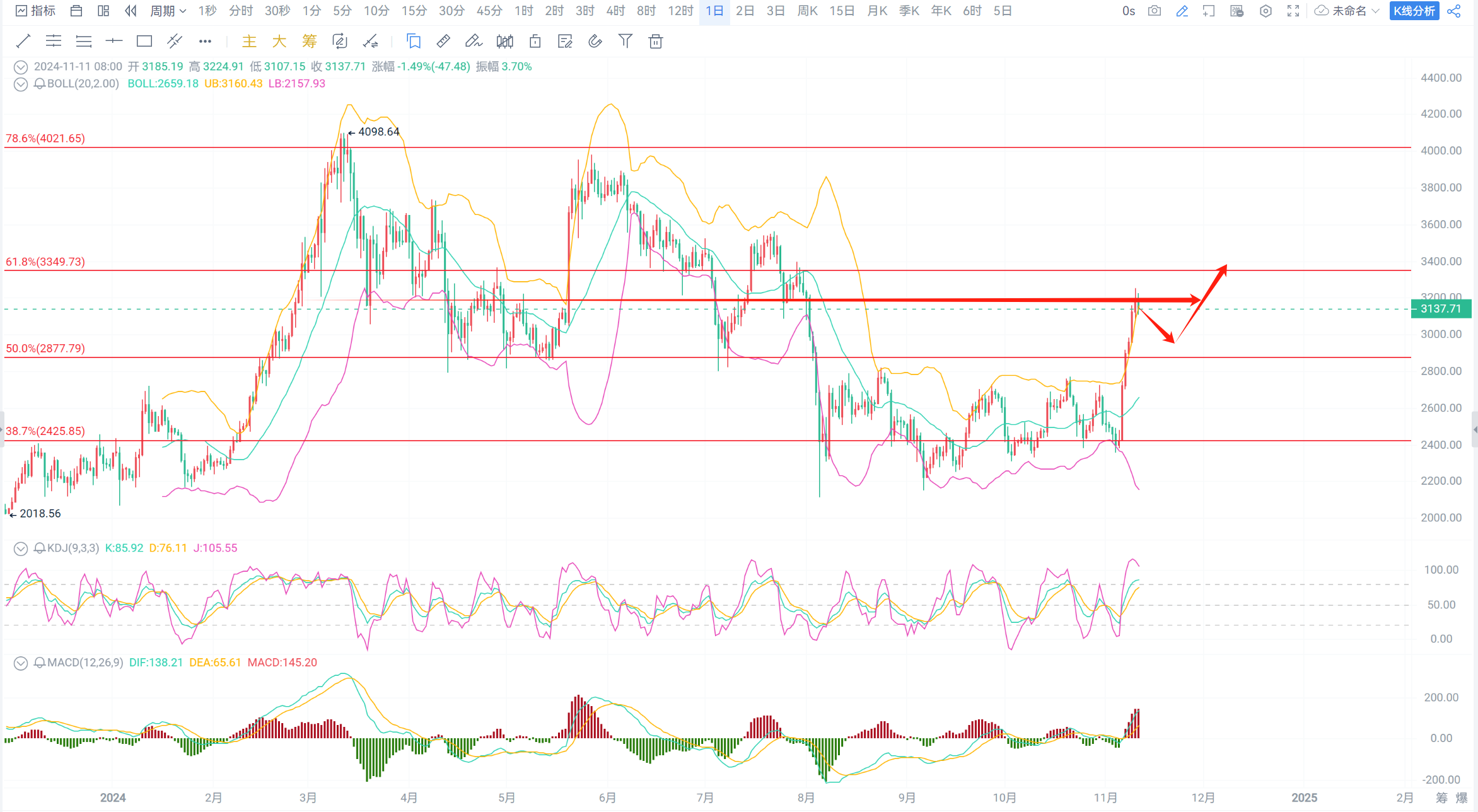

In terms of Ethereum, the weekly chart shows a large bullish candlestick, breaking through the middle Bollinger Band and currently consolidating. Both the MACD moving average and KDJ line are moving upwards, with bullish volume starting to increase. On the daily chart, there are also six consecutive bullish candlesticks, indicating a standard upward trend after breaking out of a box structure. The Bollinger Bands are starting to open upwards, the MACD moving average continues to rise, and bullish volume is still increasing, while the KDJ line is starting to flatten out. On the 4-hour chart, the Bollinger Bands continue to open upwards, but the MACD moving average is starting to decline, with bearish volume beginning to increase, and the KDJ line is moving downwards.

In summary, the market trend is currently driven by significant positive news, with Bitcoin showing no signs of topping out and Ethereum closely following suit. There is still a lot of room for growth above, but with the positive news already priced in, the increase has been excessive. For trading, it is recommended to take aggressive short positions in the short term, while conservative traders should wait for a pullback to go long!

Trading Advice: Aggressive short positions!

Short Bitcoin in the 81300-81700 range, targeting 80000-79000, with a stop loss at 82500;

Short Ethereum in the 3160-3190 range, targeting 3100-3050, with a stop loss at 3250;

The strategy is time-sensitive; please refer to private real-time guidance for specifics!

Follow the WeChat public account Yunyan!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。