The fluctuations in the price of Bitcoin (BTC) have consistently attracted the attention of global investors. Recently, on November 10, the price of Bitcoin once again broke through eighty thousand, setting a new historical high. This price level marks Bitcoin's entry into a new phase of price discovery, sparking heated discussions in the market. This article will explore the reasons behind the rise in Bitcoin's price, analyze the driving factors, and look ahead to future trends.

Favorable Macroeconomic Environment

The rise in Bitcoin's price is closely related to the global macroeconomic environment. Trump's victory in the U.S. election is considered an important factor driving the increase in Bitcoin's price. The market generally expects that Trump's election will lead to a more lenient cryptocurrency policy, further boosting the demand for Bitcoin.

At the same time, the Federal Reserve's interest rate cut policy has also positively impacted Bitcoin's price. The Federal Reserve announced a 25 basis point rate cut in a recent meeting, which the market interpreted as good news, as a low-interest-rate environment typically encourages investors to seek higher-yield investment opportunities, with Bitcoin being one of them.

Strong Inflows of ETF Funds: A Reflection of Market Confidence

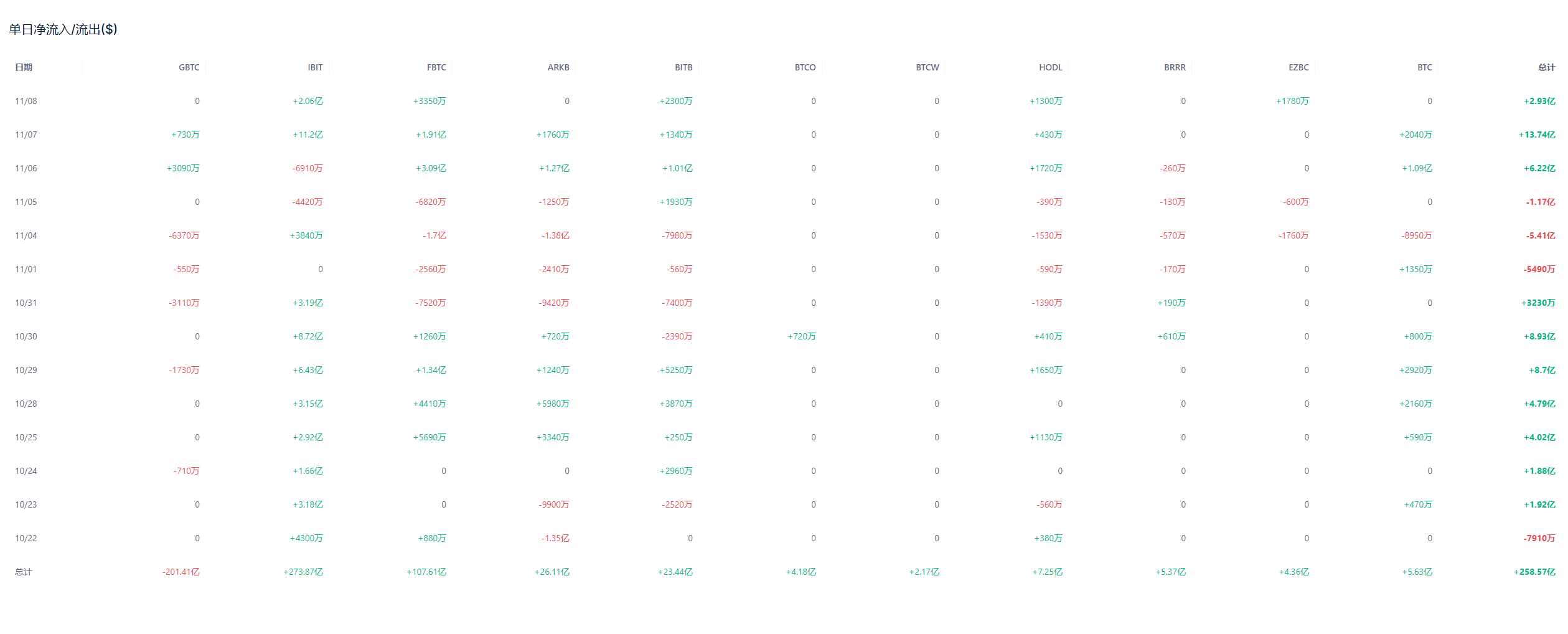

The inflow of funds into Bitcoin ETFs (Exchange-Traded Funds) is also a significant factor driving the price increase. Recently, the holdings of ETFs reached a new high, indicating a notable increase in investor interest in Bitcoin. Especially after Trump's victory, the market's acceptance and confidence in crypto assets have improved, further driving the inflow of ETF funds.

According to AICoin market data, on November 7, the net inflow of BTC spot ETFs reached a historical high, with a single-day inflow of 1.374 billion. For more details, you can download the AICoin app here.

Image Source: AICoin

Historical data also shows that Bitcoin often performs strongly in the fourth quarter of specific years. According to AICoin data, Bitcoin's investment returns in the fourth quarter following halving events in 2012, 2016, and 2020 were 97.7%, 58.17%, and 168.02%, respectively. This historical trend provides data support for the current price increase.

Image Source: AICoin

Optimistic Expectations from Market Analysts

Several market analysts hold an optimistic view of Bitcoin's future trends. PlanB, the creator of the Bitcoin Stock-to-Flow (S2F) model, predicts that Bitcoin could reach $1 million by the end of 2025. He also points out that Bitcoin's scarcity will be a core factor driving its price increase.

Another analyst, Alex Krüger, believes that if Trump wins, Bitcoin's target price by the end of the year could reach $90,000. Meanwhile, The Giver takes a more conservative stance, suggesting that the election-driven rise in Bitcoin may be a temporary phenomenon, with potential adjustments in the future.

Despite the strong upward momentum in Bitcoin's price, investors should remain cautious. Former Binance CEO Zhao Changpeng (CZ) reminds investors to manage risks, avoid putting all their funds into one basket, and suggests gradually increasing investments.

Additionally, the market's high volatility means that investors should closely monitor market dynamics and adjust their investment strategies in a timely manner to cope with potential market fluctuations and price adjustments.

Conclusion

The rise in Bitcoin's price is the result of multiple factors working together, including changes in the macroeconomic environment, inflows of ETF funds, and support from historical data. Although the market outlook is positive, investors should still act cautiously and manage risks appropriately. As the market continues to develop, Bitcoin's price may continue to fluctuate, and investors should stay alert to make informed investment decisions at the right time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。