ETF issuers have accumulated 1 million bitcoins within 10 months, accounting for over 5% of the circulating supply of bitcoin.

Author: OurNetwork

Translation: ShenChao TechFlow

This week has been exceptionally noteworthy both on-chain and off-chain, primarily due to the U.S. presidential election. During this process, cryptocurrency-supported prediction markets played a significant role in helping track the final election results. In particular, Polymarket has seen trading volumes reach billions of dollars and has garnered considerable attention in political circles, as it predicted the election results before mainstream news media reported on them here.

Therefore, before we begin our regular bitcoin reporting, we have prepared a special report on prediction markets for you. As always, on-chain data and OurNetwork's top analyst team present us with a unique story.

Prediction Markets + Bitcoin Ecosystem

Polymarket | Ostium | Bitcoin ETF | Rootstock | BOB

Polymarket

Polymarket's trading volume in the prediction market exceeds $3.11 billion in 30 days

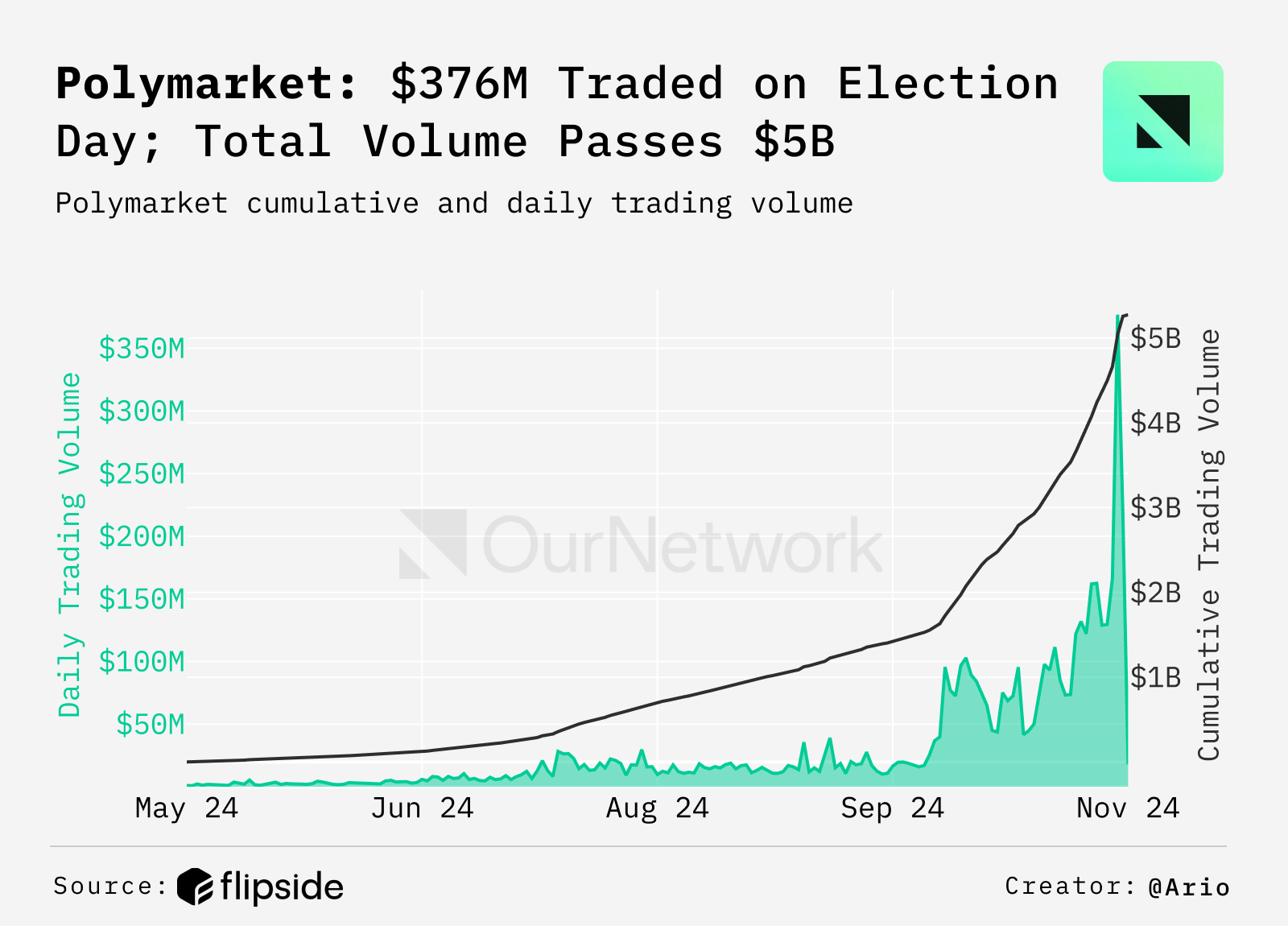

- The decentralized prediction market platform Polymarket has been active during the 2024 U.S. presidential election. Users have placed bets on various outcomes, with trading volume exceeding $3.11 billion in the past 30 days. Since late September, Polymarket's trading volume has surged, initially around $17 million per day, skyrocketing to over $376 million by November 5 (Election Day), a 22-fold increase.

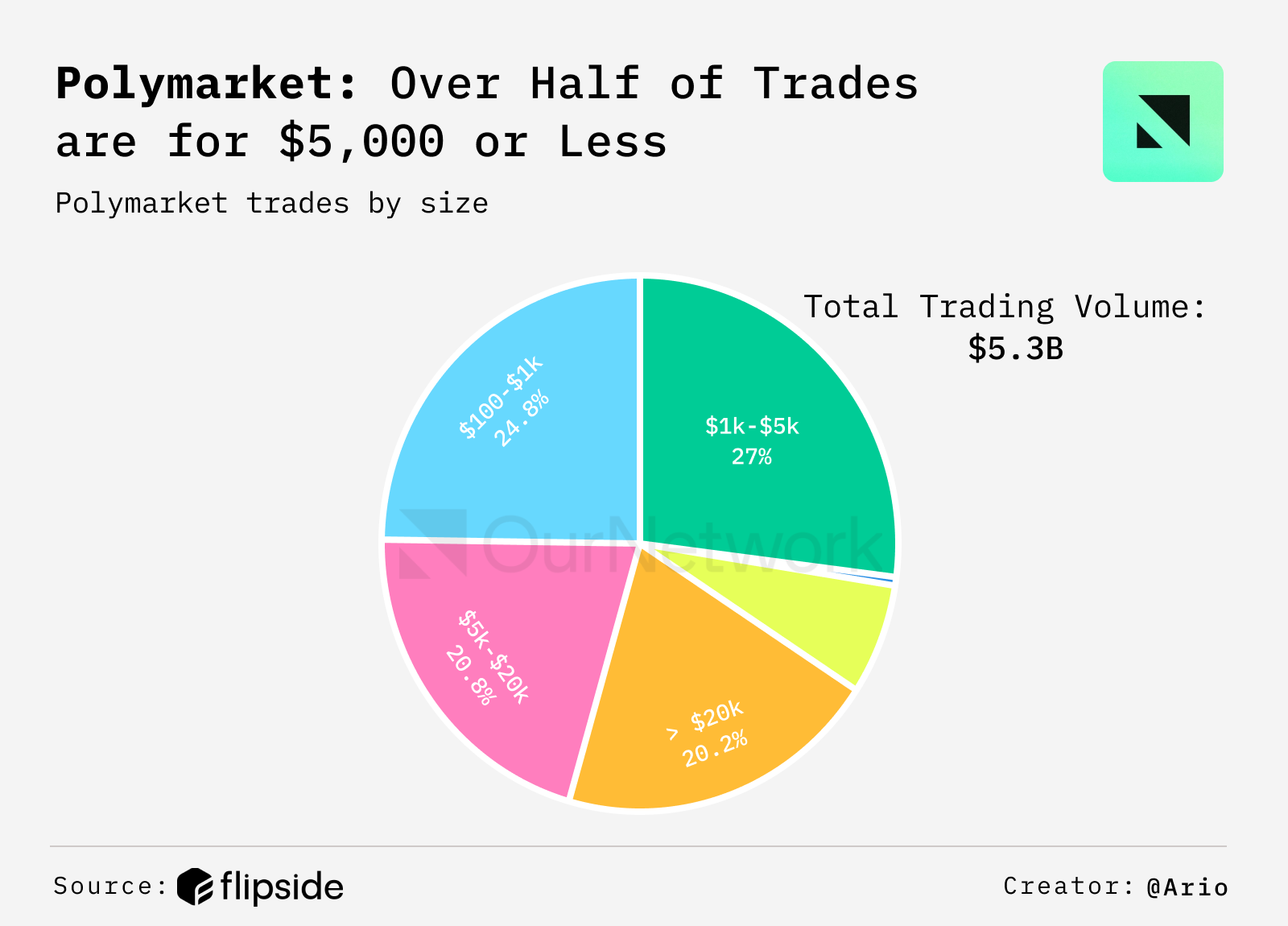

- Volume analysis shows that 27% of the transaction amounts are between $1,000 and $5,000, while another 25% of transactions are between $100 and $1,000, indicating high participation from retail users. Additionally, over 20% of the total trading volume comes from transactions exceeding $20,000, highlighting the significant influence of major market participants.

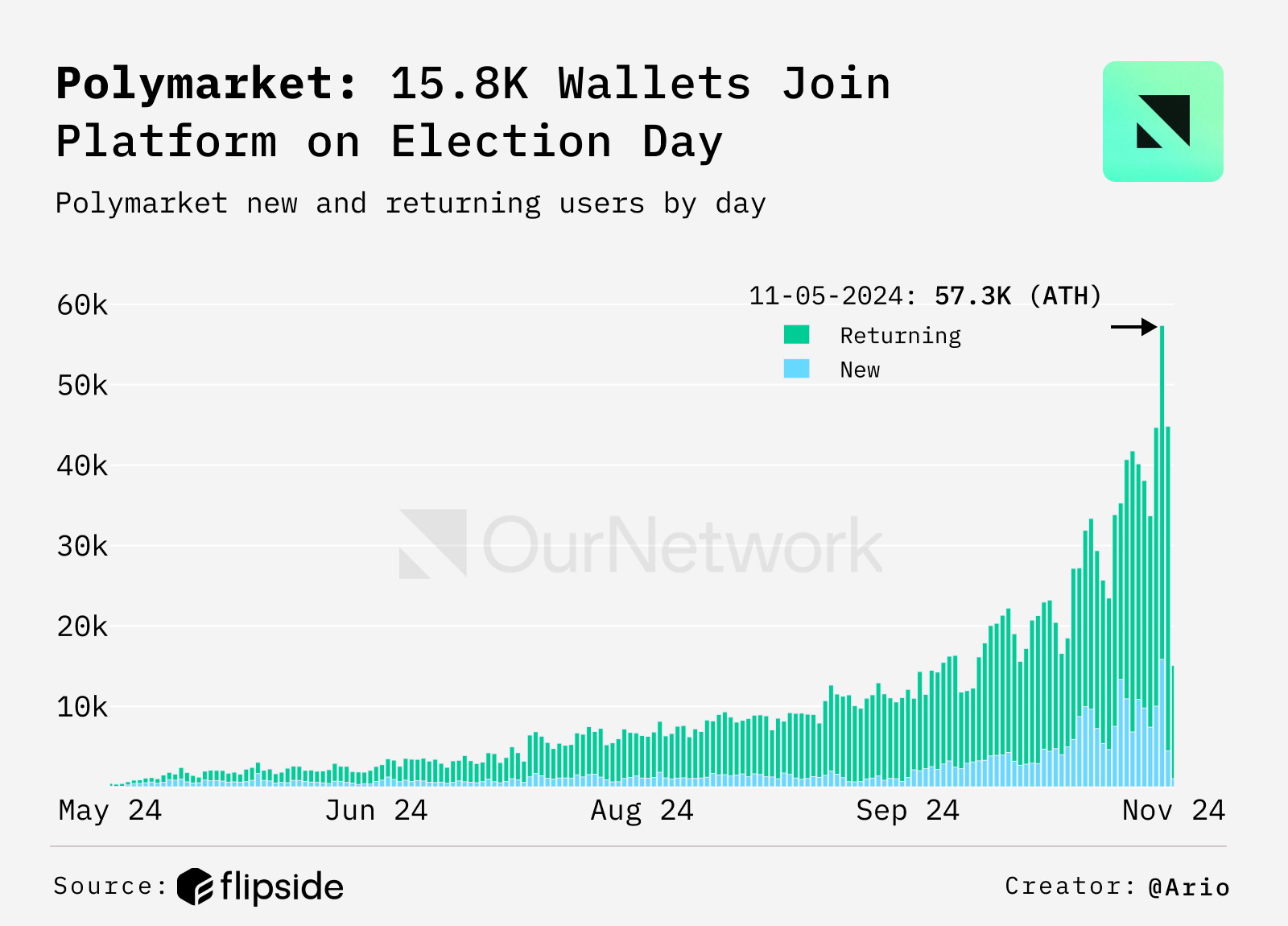

- The number of daily active users on Polymarket reached a new high of 57,300 on November 5, a significant increase from fewer than 400 in early May. This growth, combined with a high return rate of previous users, indicates strong user engagement. On November 5 alone, a record 15,800 new wallets joined the platform.

Ostium

Kaledora Kiernan-Linn | Website | Dashboard

Ostium's trading volume exceeds $50 million

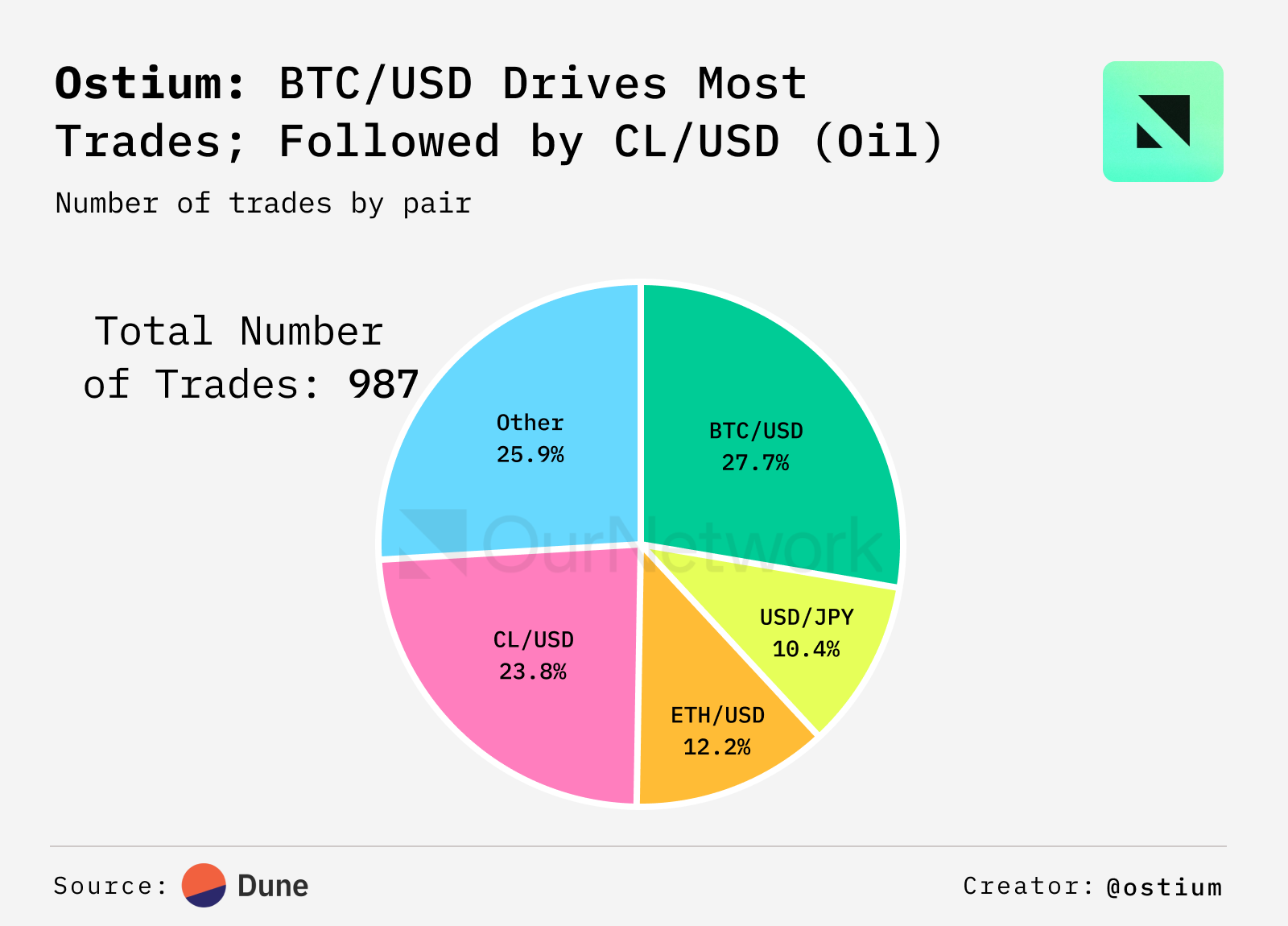

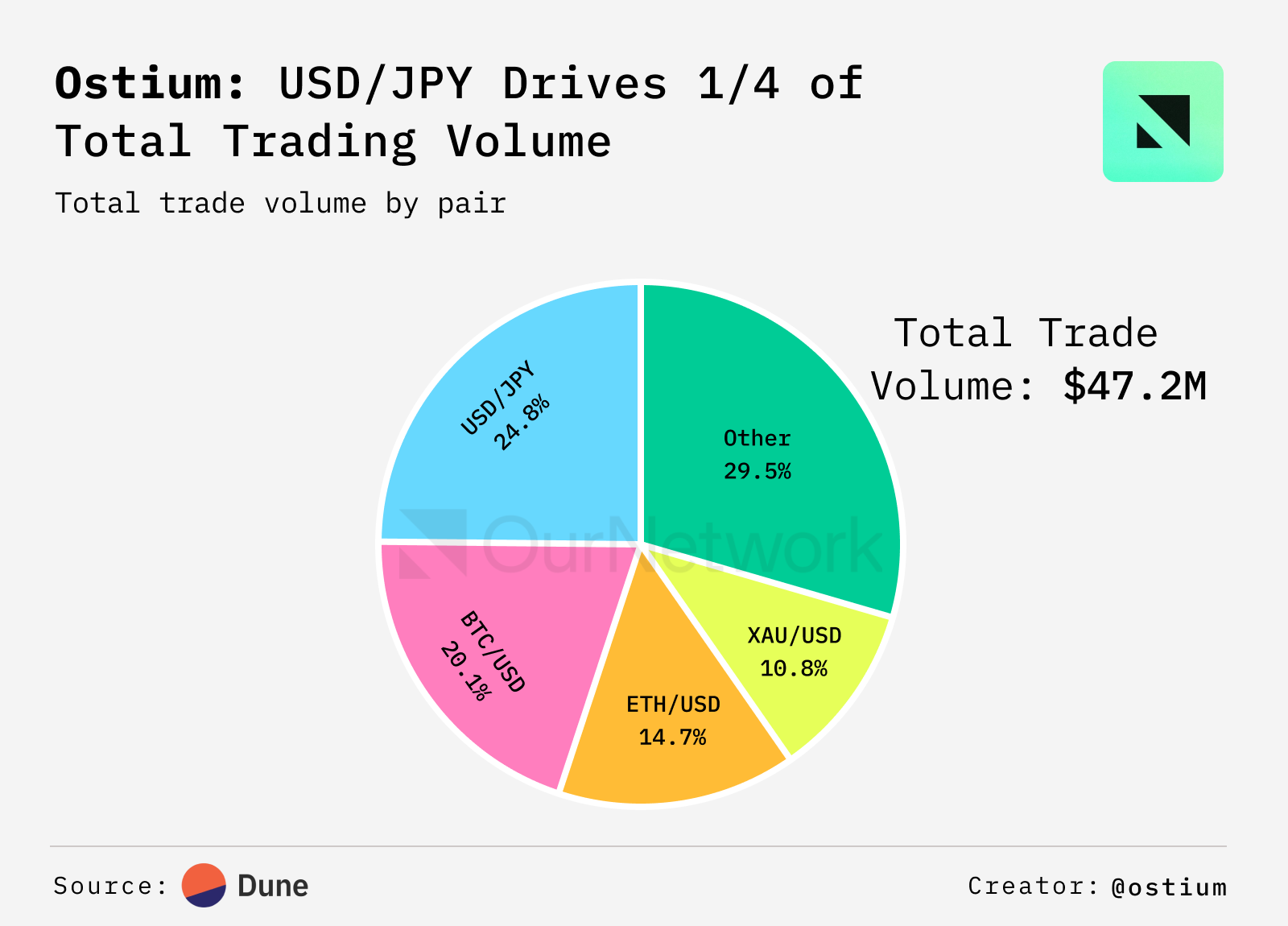

- Ostium is making macroeconomics tradable. Users only need a wallet and 10 USDC to trade long and short on various assets, from forex and commodities to cryptocurrencies and stock indices. Over 65% of Ostium's cumulative trading volume comes from actual assets, with USD/JPY accounting for a significant portion of trading volume due to recent yen volatility and Bank of Japan interest rate decisions. Although the trading volume for CL/USD (oil) is smaller, its independent trading frequency ranks second, accounting for over 20% of the platform's total trades.

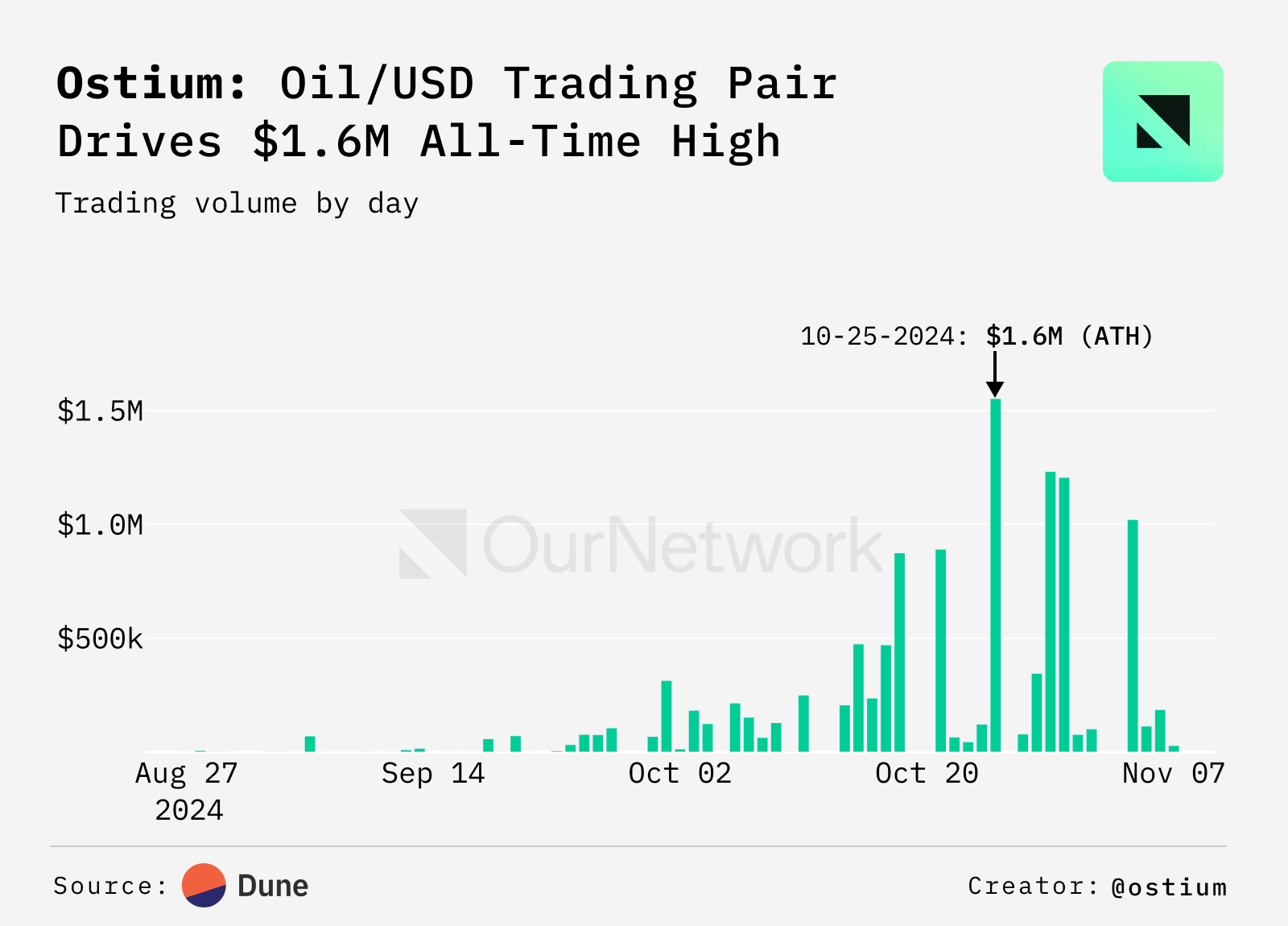

- Trading volume closely follows macro events related to various assets. In the commodities market (primarily oil), trading volume hit a record high on October 25, the day Israel launched retaliatory attacks on Iran, as the market feared potential damage to Iranian oil fields and its impact on prices.

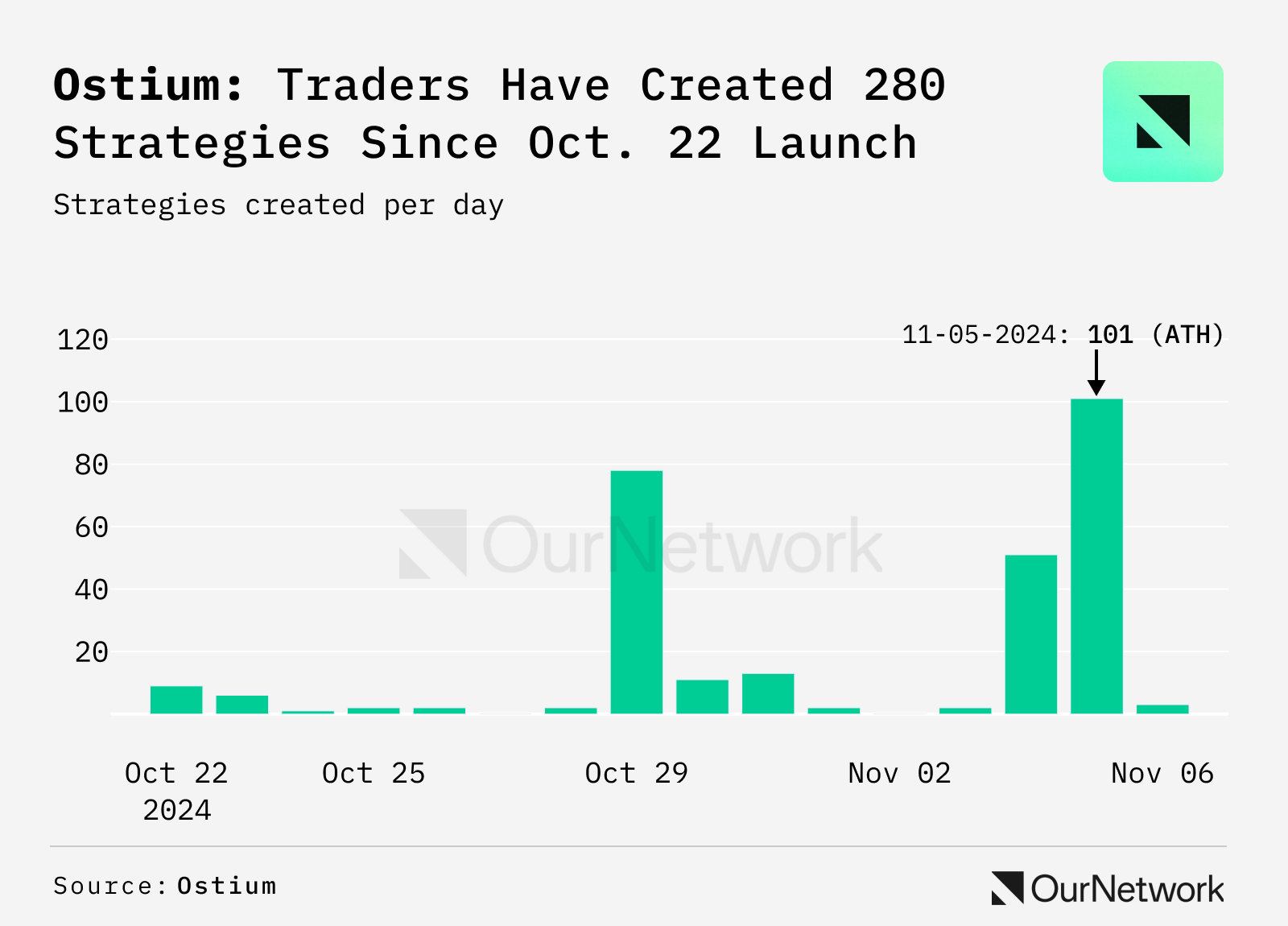

- Ostium recently launched the “Strategies” feature, a product based on its trading engine that allows traders to automate trading strategies based on prediction market data, such as “if TrumpWin probability exceeds 70%, go long on gold.” In the 10 days leading up to the election, traders created over 280 strategies on Ostium, with more than 100 created on election night alone.

Ostium (Internal)

Bitcoin ETFs

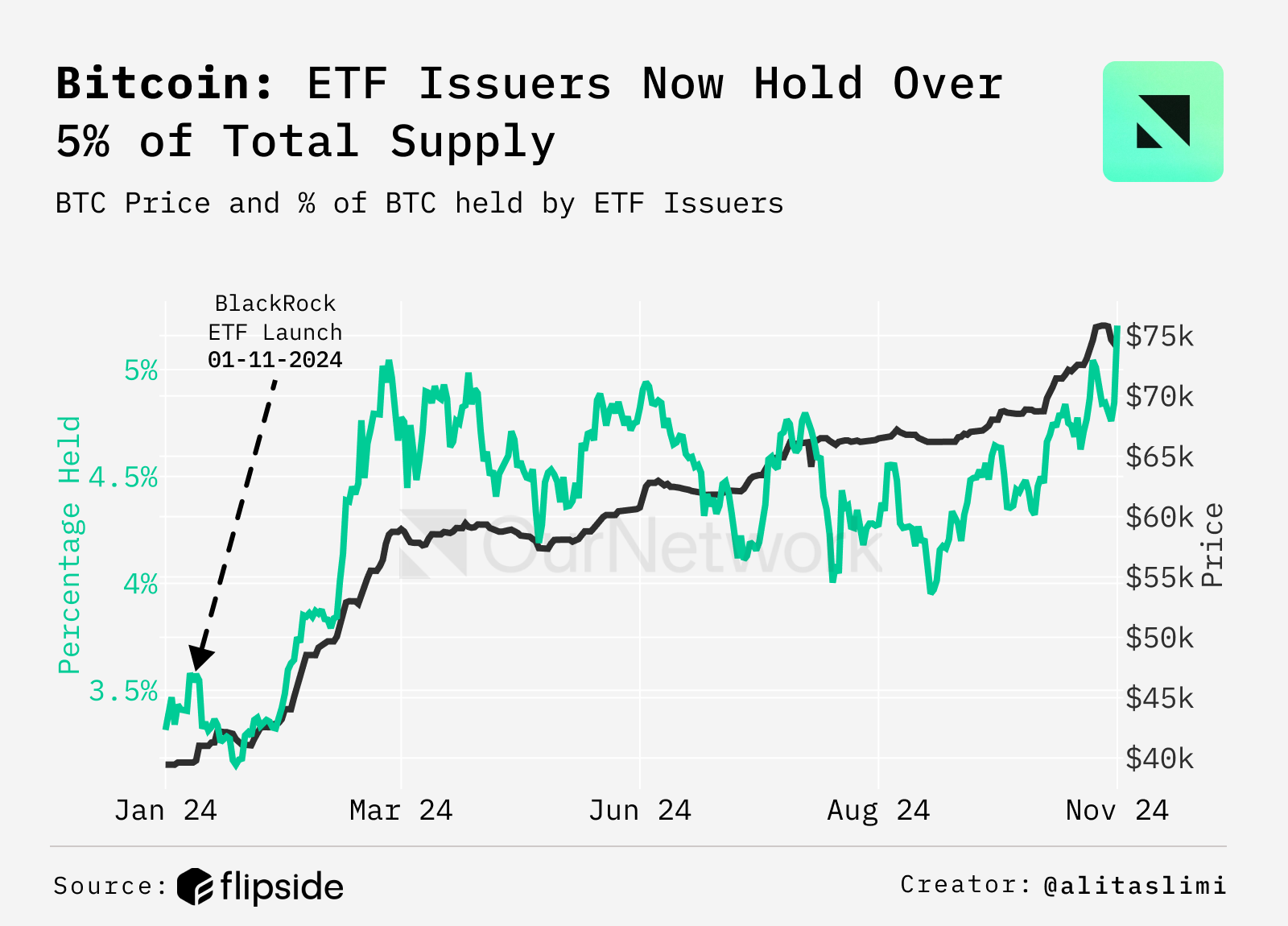

ETF issuers have accumulated 1 million bitcoins within 10 months, accounting for over 5% of the circulating supply of bitcoin.

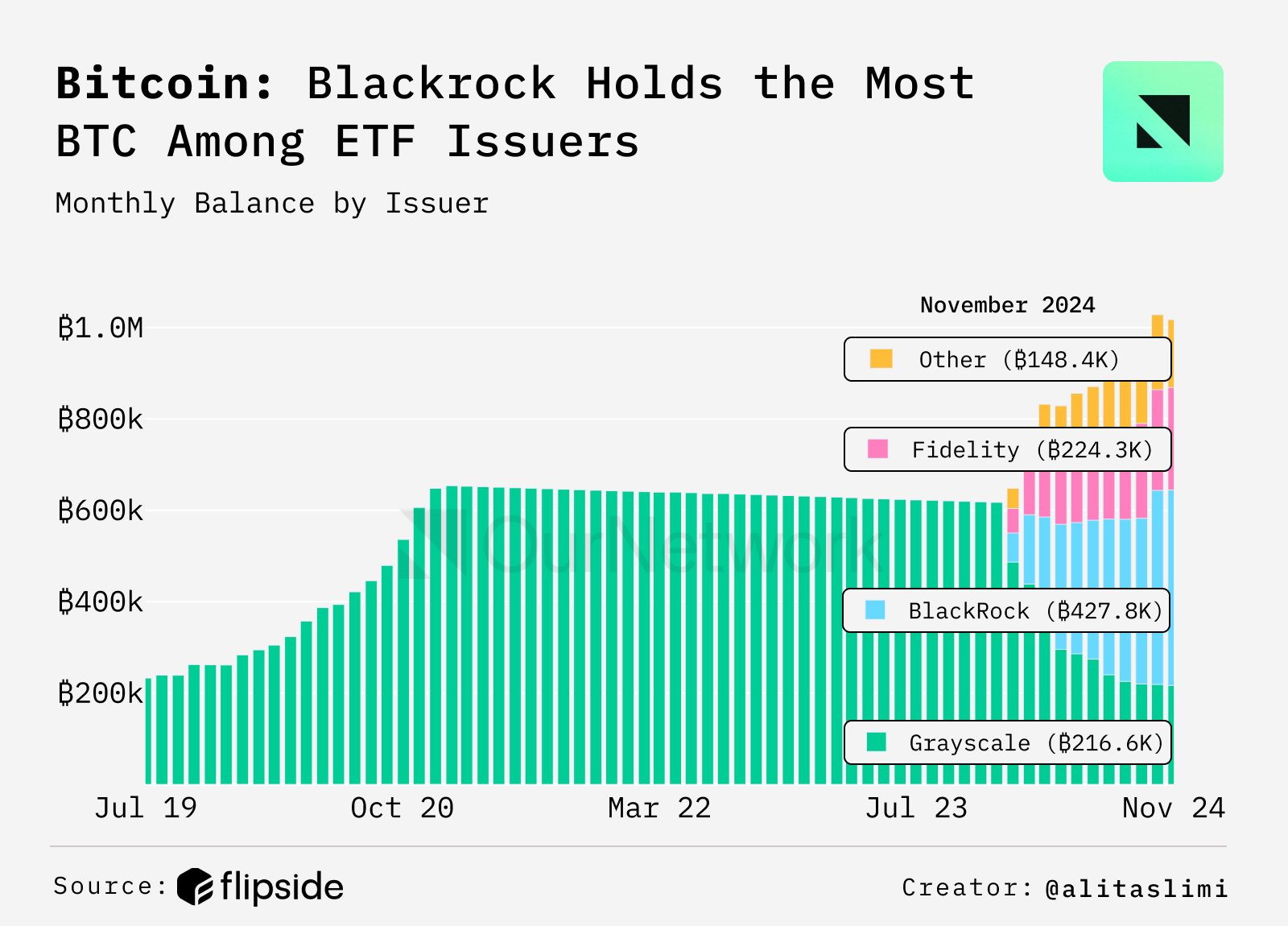

- Grayscale was once the largest holder of bitcoin ETFs, but due to ongoing monthly sell-offs, BlackRock has taken its place. In just 10 months, the bitcoin holdings of ETF issuers have increased from 600,000 to over 1 million, accounting for 5% of the circulating supply of bitcoin. This sustained buying pressure has driven up the price of bitcoin to historic highs, demonstrating strong institutional interest in bitcoin.

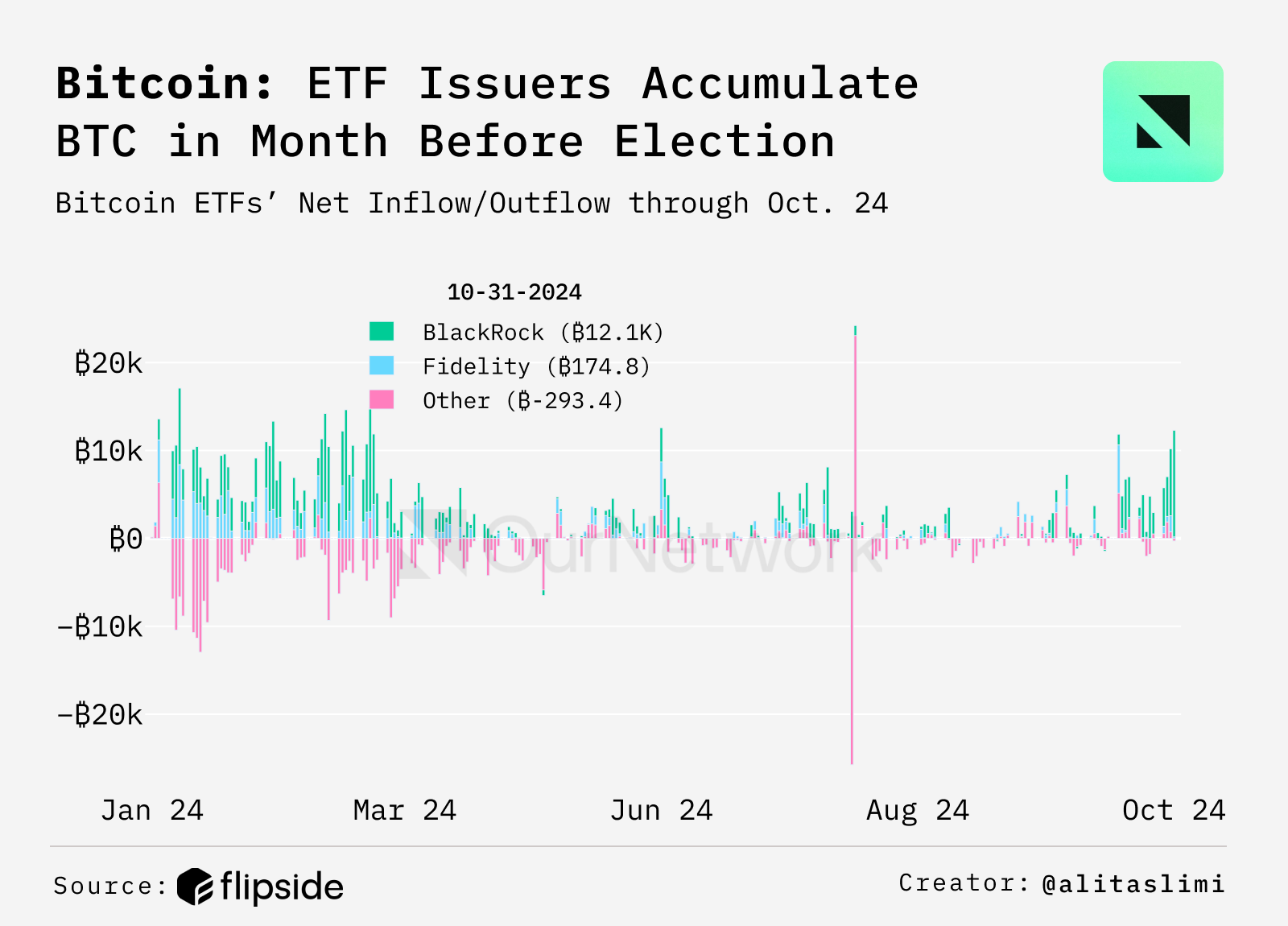

- Daily net inflows of bitcoin show that issuers have been actively buying bitcoin in the 30 days leading up to the U.S. election. Despite increased sell pressure from Ark/21Shares and Bitwise recently, and a general rise in token prices post-election, BlackRock and Fidelity have emerged as the biggest beneficiaries.

- Since the beginning of the year, despite price fluctuations, the proportion of bitcoin held by issuers has steadily increased. ETFs have driven up the price of bitcoin, while issuers continue to accumulate bitcoin, indicating that these institutions may be implementing long-term investment strategies.

Rootstock

Guilherme Wenceloski & Martin Benedikt Busch | Website | Dashboard

Rootstock's TVL grows 107% year-over-year, backed by 60% of bitcoin's hash power

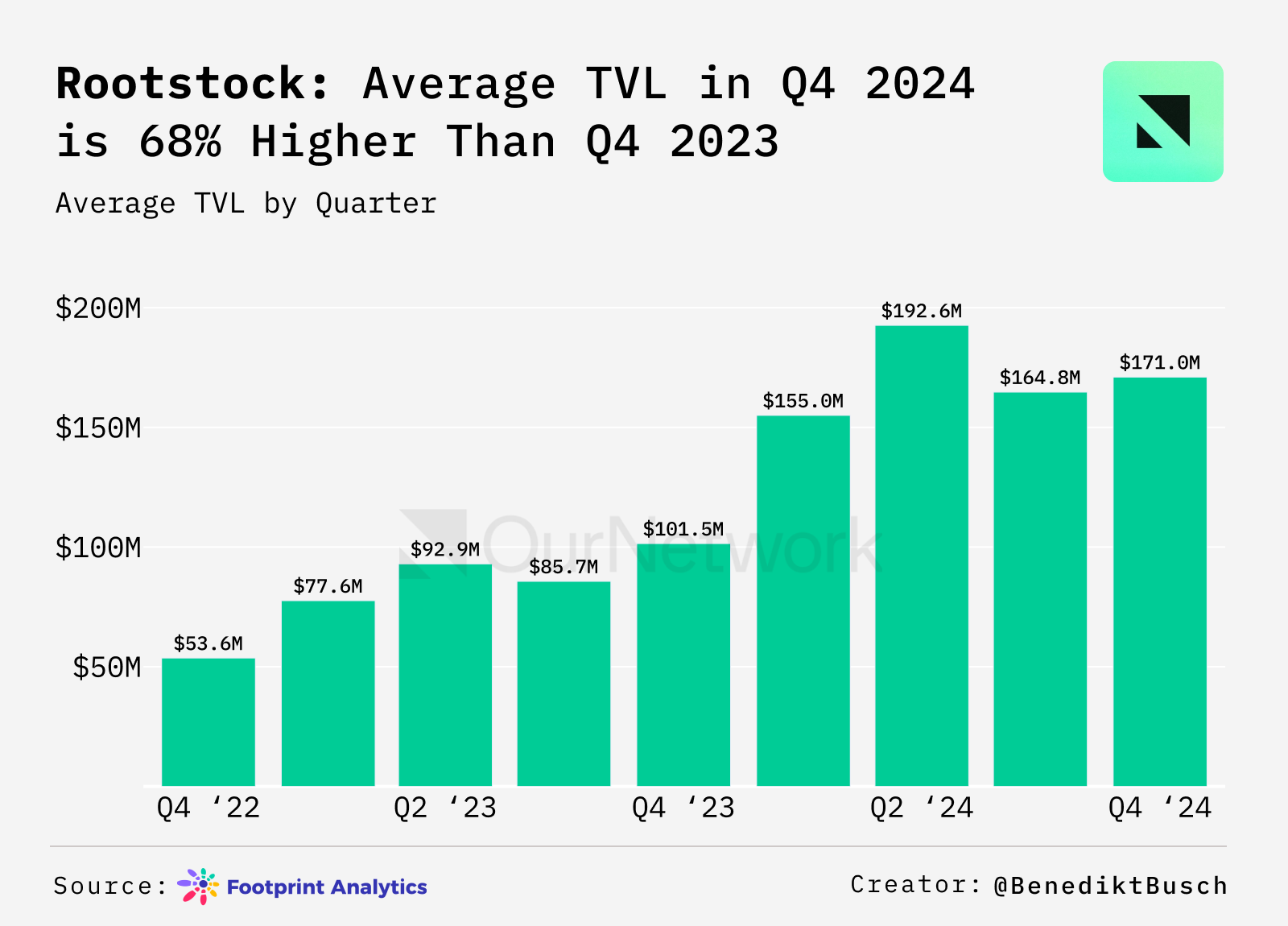

- Rootstock is a leading DeFi Layer 2 solution on Bitcoin. Its innovative roadmap (including BitVMX and Union Bridge) and focus on interoperability have driven secure and scalable DeFi innovations. In Q4 2024, the average total value locked (TVL) reached $171 million, a 68% increase from Q4 2023. This growth is primarily attributed to partnerships with protocols like Sushi and Uniswap, as well as rising demand for bitcoin DeFi.

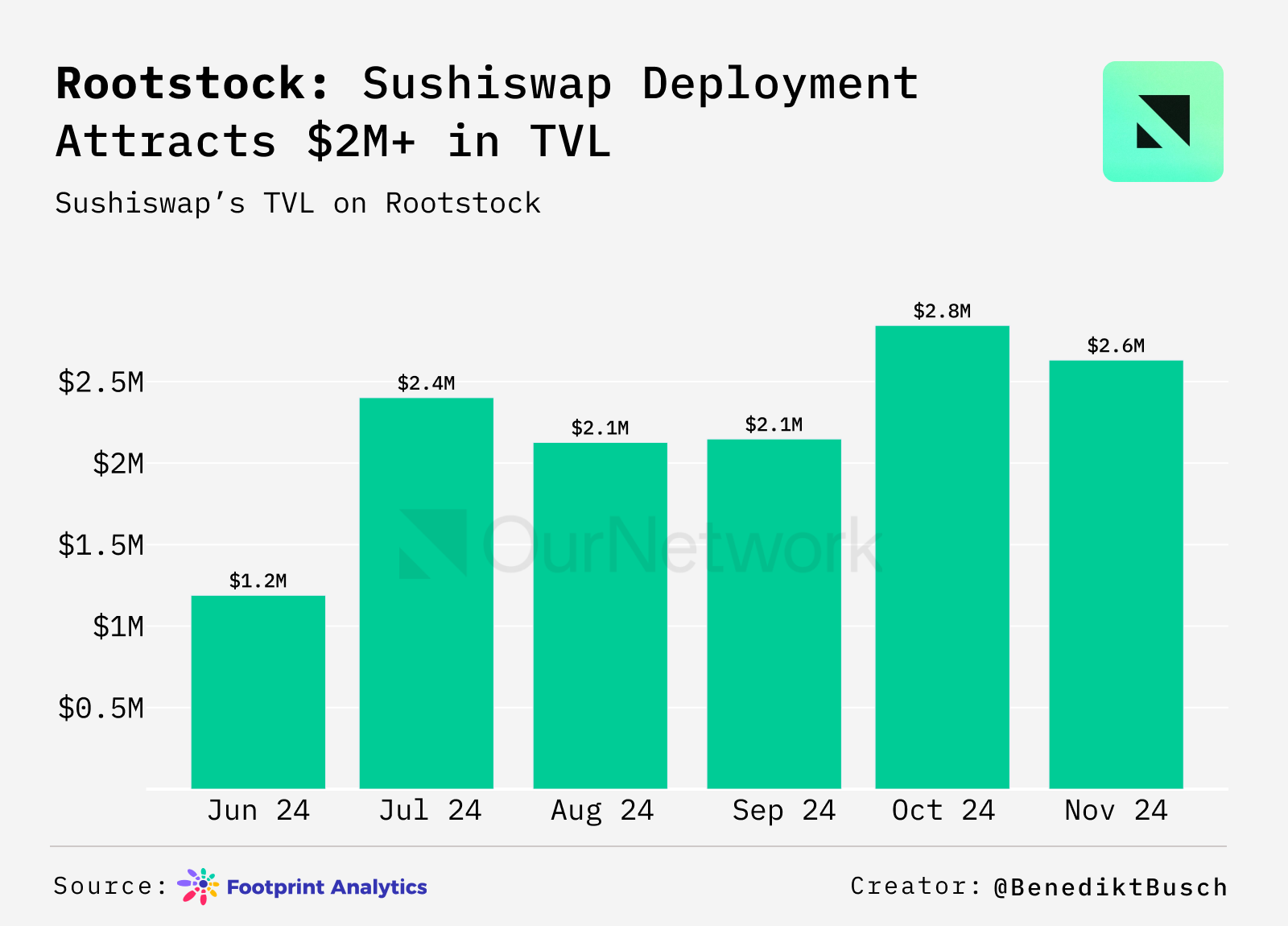

- Rootstock introduced Sushiswap as a new partner and decentralized exchange in June, enriching its product offerings and driving significant monthly growth in TVL. This partnership has enhanced Rootstock's DeFi capabilities, connecting bitcoin to a broader DeFi ecosystem.

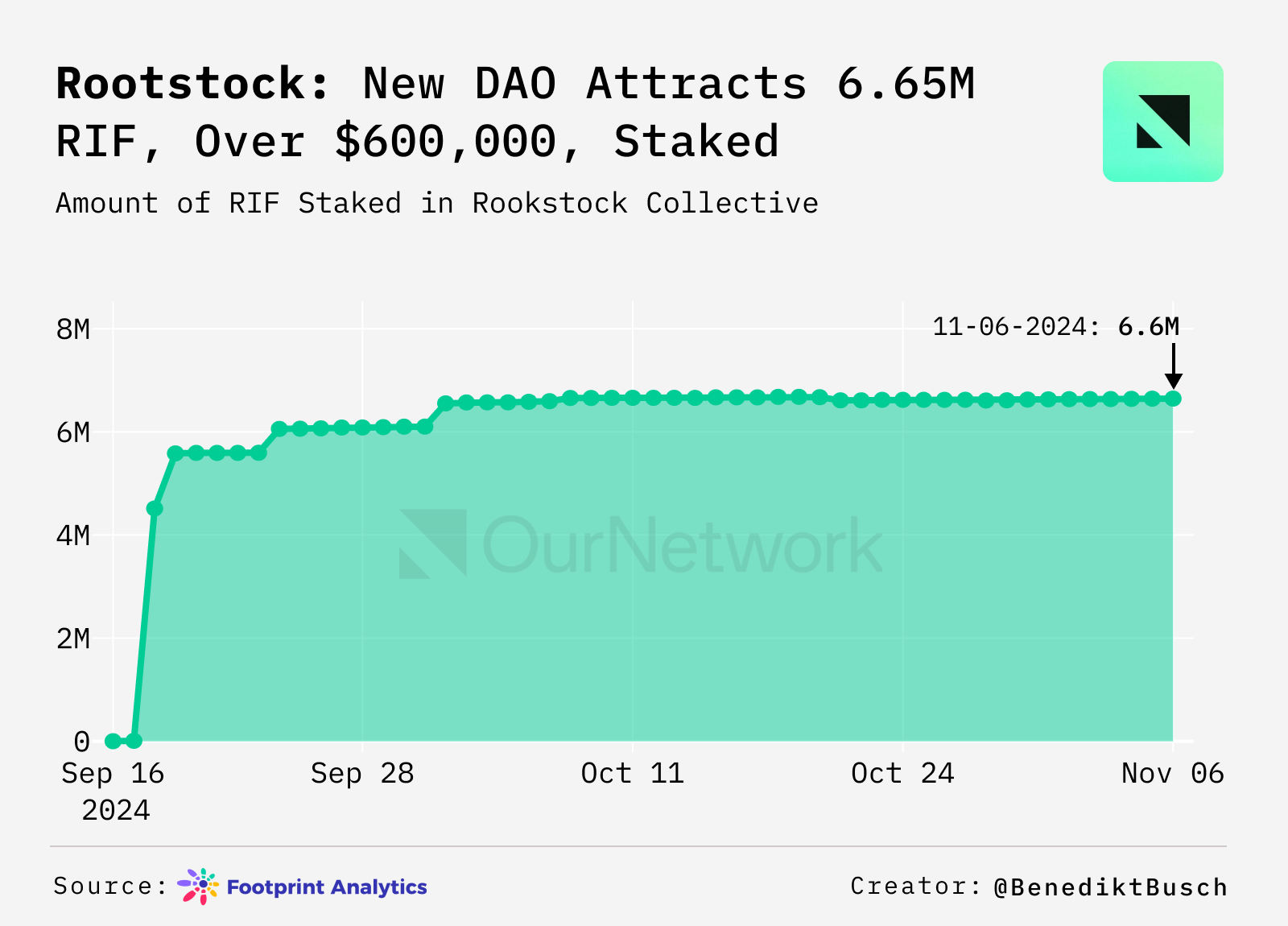

- RootstockCollective, launched in September 2024, is a new DAO aimed at supporting developers and incentivizing projects on bitcoin. Through RootstockCollective, developers can receive funding and governance rights. As of November 6, 2024, a total of 6,645,263 RIF has been staked.

BOB

BOB's summer activity platform breaks through, daily trading volume surges 27%

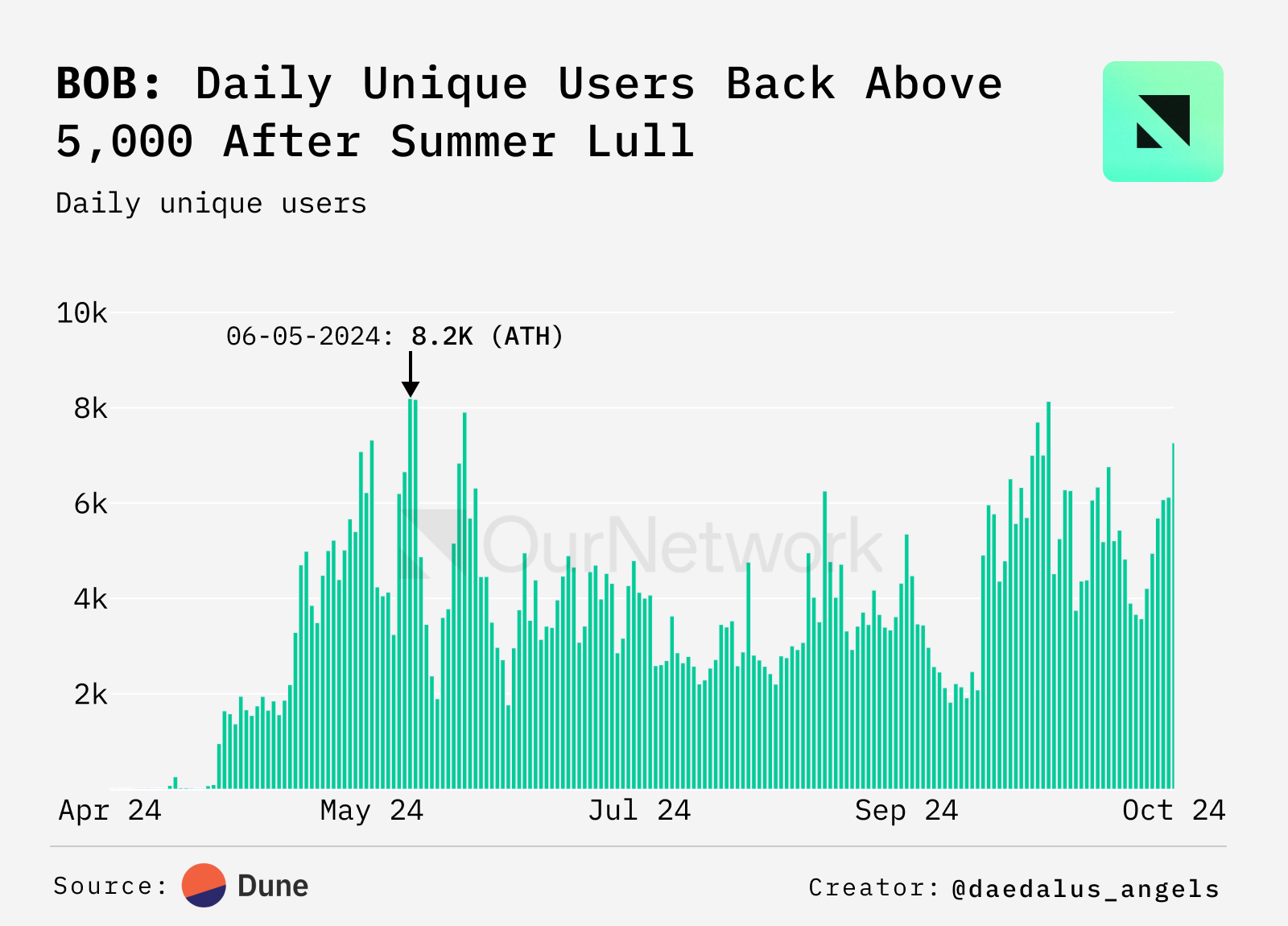

- Since its launch on May 1, the number of daily active users on BOB has steadily increased, peaking at 8,192 on June 4. However, throughout the summer, BOB's daily active user count mostly remained between 3,000 and 3,500. This stagnation in summer activity may suggest that the concept of "DeFi on Bitcoin" is losing attention. However, this trend did not last long—BOB's daily active user count has climbed again, averaging 5,589 over the past month, bringing the total user count on the platform to 172,379.

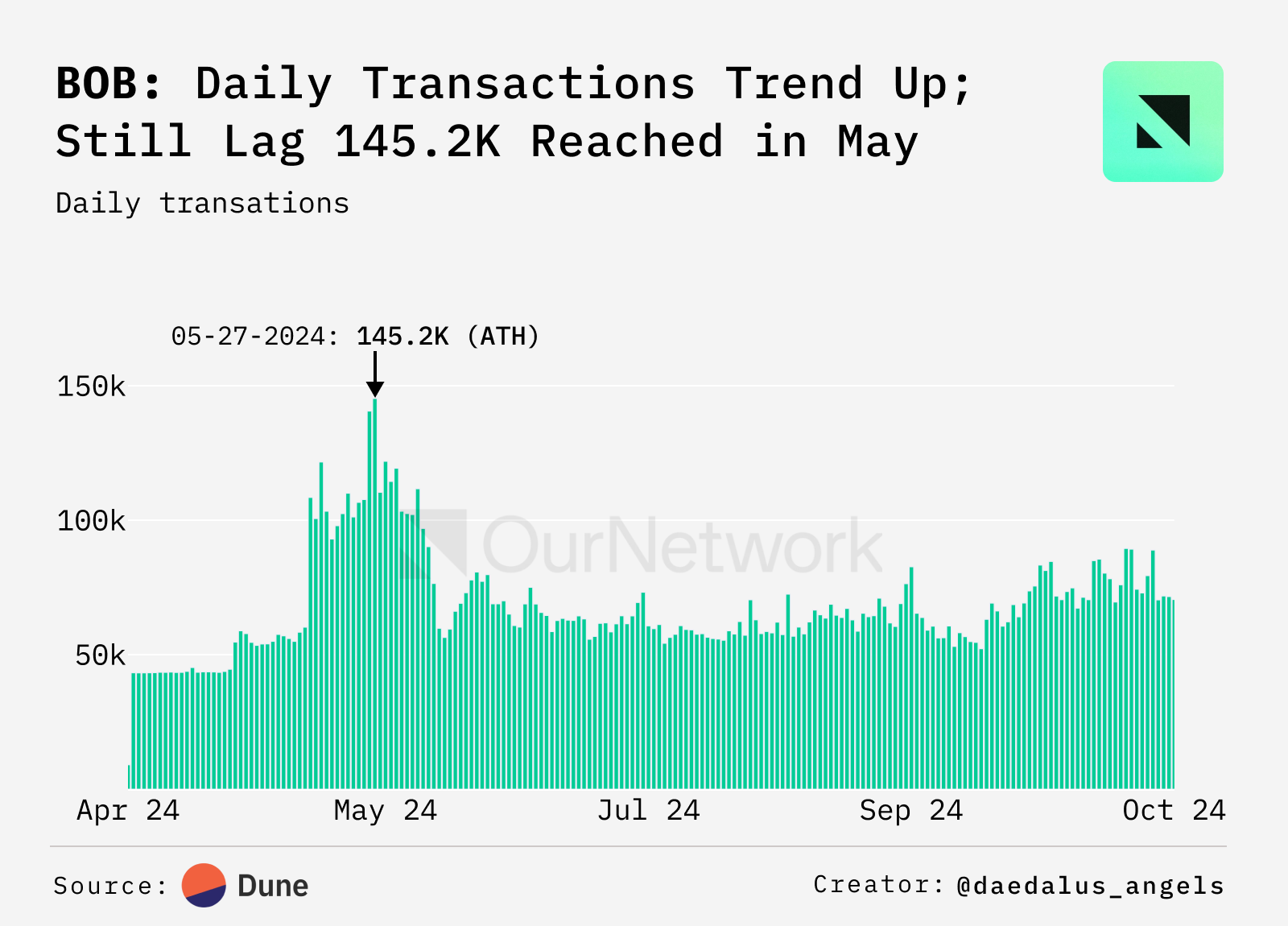

- Similarly, BOB's daily trading volume hit a historical high of 145,224 transactions on May 27, stabilizing between 55,000 and 65,000 transactions over the next three months. Recently, BOB's daily trading activity has broken this sideways trend, with a four-week average trading volume reaching 74,033 transactions, an increase of approximately 27%.

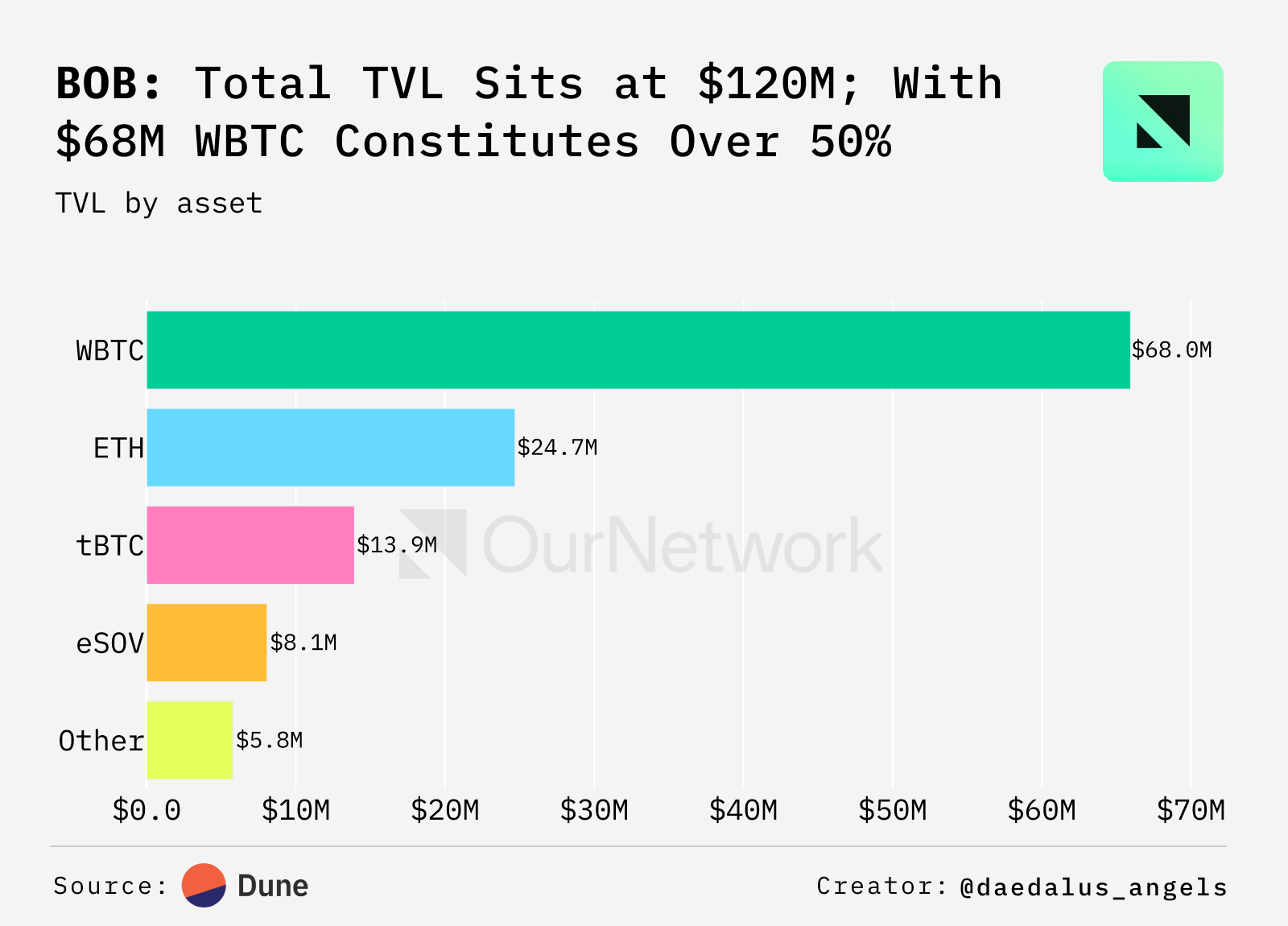

- BOB's total value locked (TVL) is currently slightly above $120 million, which includes $68 million in WBTC, $24 million in ETH, $14 million in tBTC, and $8 million in eSOV.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。