Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.5 trillion, with BTC accounting for 59.94%, which is $1.5 trillion. The market capitalization of stablecoins is $178.1 billion.

This week, BTC's price has shown a volatile upward trend, with the current price of BTC at $76,460 and ETH at $3,028. Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: RAY with a 7-day increase of 53.31%, NEIRO with a 7-day increase of 55.63%, and the popular project DRIFT with a 7-day increase of 299.21%.

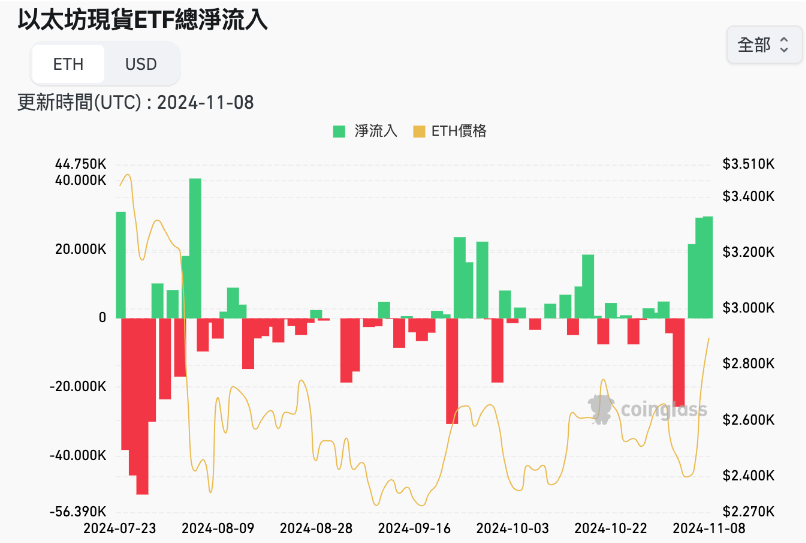

This week, the net inflow for the U.S. Bitcoin spot ETF was $1.615 billion, and the net inflow for the U.S. Ethereum spot ETF was $154.7 million.

On November 6, according to the Associated Press, Trump was elected as the 47th President of the United States; on November 8, the Federal Reserve lowered the benchmark interest rate by 25 basis points to 4.50%-4.75%, marking the second consecutive rate cut; on November 7, the Bank of England cut interest rates by 25 basis points, lowering the benchmark rate from 5% to 4.75%.

After the pro-cryptocurrency Trump won the election, the Google search volume for Bitcoin surged, indicating increased interest from retail investors in digital assets and optimism about the market's future development.

The "Fear & Greed Index" on November 8 was 75 (up from last week), indicating a sentiment of greed over the past 7 days.

Understanding Now

Review of Major Events of the Week

On November 4, Bitcoin's market share rose to 60.52%, setting a new high in this bull market;

Jupiter's founder stated that he has never sold JUP and will release significant news;

Two Ethereum researchers resigned from their advisory positions at EigenLayer, citing complaints regarding neutrality issues;

On November 4, the NYSE applied to the SEC to convert the Grayscale Digital Large Cap Fund into an ETP;

On November 5, a Mt. Gox address transferred out 32,371 Bitcoins, worth approximately $2.19 billion;

The prediction market Kalshi topped the Apple App Store's free app chart, while Polymarket ranked second;

Bloomberg ETF analysts noted that BTC's rise was influenced by the election, with this indicator being clearer compared to stocks;

Lumoz opened esMOZ airdrop inquiries and announced airdrop details;

ZachXBT responded to "its deployment of ERC-20z tokens": Zora did not inform that the open version NFT minting would end with the launch of ERC 20 tokens and never intended to speculate on the investigation subject;

A former White House official stated that Democrats would no longer fight against cryptocurrency to the end;

Arkham's derivatives trading platform has opened registration, with trading set to start in one week;

pump.fun reported October revenue of $30.5 million, setting a historical high;

SushiSwap launched a linear vesting platform for Memecoin issuance;

The Sui ecosystem's Meme token launch platform Turbos.Fun officially went live, with over 560 projects launched within 6 hours;

Analysis: Bitcoin premium on Coinbase turned positive, indicating rising demand for Bitcoin among U.S. investors;

On November 7, the Federal Reserve cut interest rates by 25 basis points as expected, abandoning the "more confident" statement;

Republican SEC Commissioner Uyeda stated that the SEC's duty in 2025 is to end the Biden administration's "cryptocurrency war."

Macroeconomics

On November 5, the Reserve Bank of Australia maintained the interest rate at 4.35% for the eighth consecutive meeting, in line with market expectations;

On November 6, according to the Associated Press, Trump was elected as the 47th President of the United States;

On November 7, the Bank of England cut interest rates by 25 basis points, lowering the benchmark rate from 5% to 4.75%, in line with market expectations;

On November 7, the U.S. Securities and Exchange Commission (SEC) filed a motion in the Northern District of California to seek dismissal of Kraken's key defense in an ongoing legal dispute;

On November 8, the Federal Reserve lowered the benchmark interest rate by 25 basis points to 4.50%-4.75%, marking the second consecutive rate cut, in line with market expectations;

On November 8, according to Cointelegraph, market observers noted that after Trump's election victory, Google search volume for Bitcoin surged, indicating increased interest from retail investors in digital assets;

On November 9, according to official news, the U.S. SEC postponed its decision on whether to approve Ethereum spot ETF options for further analysis and public comment collection, particularly regarding whether the proposed rule changes meet the requirements of the Securities Exchange Act. The SEC emphasized concerns about the potential impact of the proposal on preventing market manipulation, protecting investors, and ensuring a fair trading system.

ETF

According to statistics, from November 4 to November 8, the net inflow for the U.S. Bitcoin spot ETF was $1.615 billion; as of November 8, GBTC (Grayscale) had a total outflow of $20.141 billion, currently holding $16.838 billion, while IBIT (BlackRock) currently holds $33.232 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $79.165 billion.

The net inflow for the U.S. Ethereum spot ETF was $154.7 million.

Envisioning the Future

Upcoming Events

Devcon 2024 will be held from November 12 to November 15, 2024, in Bangkok, Thailand. Devcon is an Ethereum conference for developers, thinkers, and makers, aimed at bringing decentralized protocols, tools, and culture to people. Previous summits have been held in Berlin, London, Shanghai, Cancun, Prague, Osaka, and Bogotá;

The Australian Crypto Convention will take place in Sydney from November 23 to 24, and is one of the largest cryptocurrency events in the Southern Hemisphere, held annually in Australia to facilitate connections between investors and decision-makers in the cryptocurrency and blockchain industry;

The Block will host the Web3 summit "Emergence" on December 5 and 6 at the Prague Congress Center in the Czech Republic, aimed at fostering connections between technology and capital, bridging Wall Street and the crypto space. The summit will gather representatives from various industries and chains to discuss ETF and asset management, as well as uncertainties in crypto regulation.

Project Progress

BounceBit will launch CeDeFi V2 on November 11, and all user positions after November 11 will be automatically migrated to V2;

Coinbase's derivatives trading platform Coinbase Derivatives will launch silver (SLR) and Stellar (XLM) futures on November 11;

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on Bitwise's Ethereum spot ETF options trading application, with the latest deadline set for November 11;

The Ethereum L2 network Taiko will open reward claims for the first quarter until November 12 at 8:00;

The stablecoin protocol Usual is expected to have its TGE in mid-November, with 90% of USUAL allocated to the community and only 10% to the team, advisors, and investors. Airdrops will reward participants based on the number of Pills held before the release. Pills holders will receive a total of 7.5% of the total supply. From the TGE, USUAL holders can stake their tokens as USUALx. Stakers will also receive 10% of the USUAL issued by the protocol in the future.

Important Events

Former Celsius CEO Alex Mashinsky will return to court for trial on November 13. According to court records, Alex Mashinsky has not appeared in person since February. In addition to the hearing on November 13, U.S. District Judge John Koeltl has ordered both parties to hold a pre-trial conference on January 16, with the jury trial set to begin on January 28;

The attacker of Mango Markets is seeking to dismiss fraud and manipulation-related charges and request a retrial, with the next ruling scheduled for November 13.

Token Unlocking

Aptos (APT) will unlock 11.31 million tokens on November 11, worth approximately $92.4 million, accounting for 2.18% of the circulating supply;

Sei (SEI) will unlock 124 million tokens on November 15, worth approximately $53.19 million, accounting for 1.24% of the circulating supply;

Cyber (CYBER) will unlock 2.98 million tokens on November 15, worth approximately $9.97 million, accounting for 2.98% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors of different levels. Our professional content includes the "Play to Earn Web3" series of tutorials, in-depth analysis of cryptocurrency industry trends, detailed analysis of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。