From November 2 to November 8, the cryptocurrency market saw a total of 21 financing events, with a diverse range of sectors: 7 in infrastructure, 4 in DeFi, 2 in gaming, 1 in NFT, 1 in AI, 1 in DePIN, 1 in prediction markets, 1 in crypto education, 1 in social, 1 in CeDeFi, and 1 in CeFi.

This week, there was 1 financing event exceeding ten million dollars:

- The verifiable data infrastructure vlayer completed a $10 million Pre-seed round of financing, with investors including a16z, BlockTower Capital, and others.

This week, the enthusiasm for financing in the cryptocurrency market has declined, with a diverse range of sectors, including 7 in infrastructure and 4 in DeFi.

The verifiable data infrastructure vlayer secured the largest financing amount of the week, totaling $10 million.

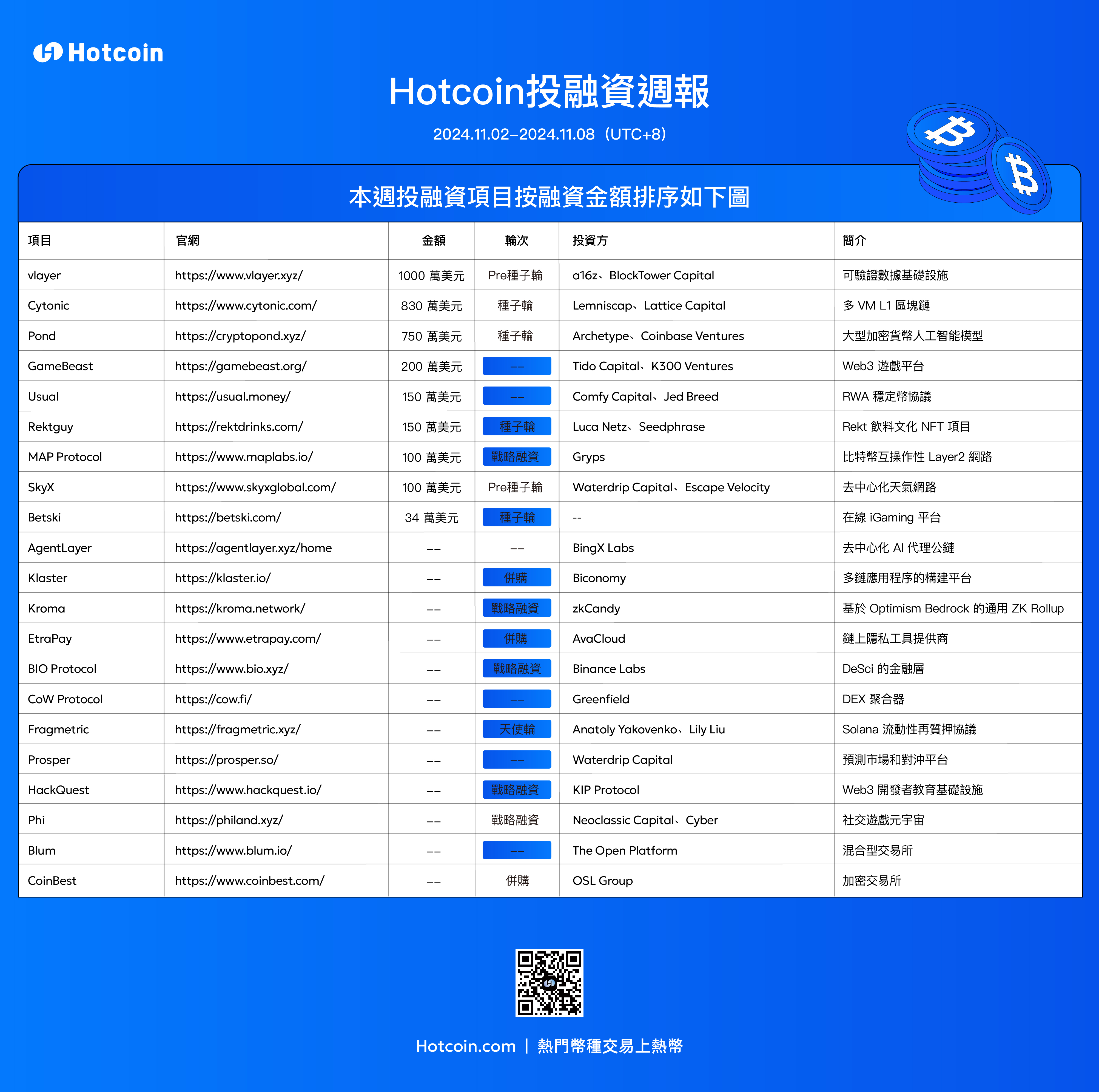

The financing projects this week are sorted by financing amount as shown in the image below:

Infrastructure

According to ROOTDATA financing data on November 8, MAP Protocol completed a strategic financing round of $1 million, with investors including Gryps. The MAP protocol serves as the interoperability layer for the Bitcoin network, built on a ZK light client. It acts as a gateway for developers and users in the Bitcoin ecosystem and facilitates interoperability between different Bitcoin L2s and both EVM and non-EVM ecosystems.

According to ROOTDATA financing data on November 7, Cytonic completed a seed round of financing totaling $8.3 million, with investors including Lemniscap and Lattice Capital. Cytonic is an L1 blockchain aimed at creating a unique ecosystem open to all technologies used in Web3. With its unique multi-virtual machine technology, Cytonic aims to interoperate with all ecosystems without becoming part of any single ecosystem.

According to ROOTDATA financing data on November 5, vlayer completed a Pre-seed round of financing totaling $10 million, with investors including a16z and BlockTower Capital. vlayer is a trusted and verifiable data infrastructure powered by zero-knowledge proofs.

According to ROOTDATA financing data on November 4, AgentLayer completed a financing round with an unknown amount, with investors including BingX Labs. AgentLayer is a decentralized AI token public chain that combines artificial intelligence with human collaboration. AgentLayer utilizes OP Stack and EigenDA to create AgentChain, a public blockchain that enhances coordination and collaboration among agents supported by the AgentLink protocol. This blockchain facilitates contracts and transaction logs between agents and provides an OP sorter to enhance the collaborative network of agents.

According to ROOTDATA financing data on November 4, Klaster completed a merger financing round with an unknown amount, with investors including Biconomy. Klaster is a building platform for multi-chain applications that abstracts all the complexities of building multi-chain dApps, allowing developers to focus on their application scenarios in just two minutes. It enables smart contracts to call EVM functions on any CCIP-supported network from any other network while providing composability and atomicity guarantees. Developers can easily convert existing dApps to support sovereign multi-chain assets and cross-chain communication.

According to ROOTDATA financing data on November 4, Kroma completed a strategic financing round with an unknown amount, with investors including zkCandy. Kroma is a general-purpose ZK Rollup based on the Optimism Bedrock architecture, developed by Lightscale. Initially, Kroma used a Scroll-based zkEVM, operating as an Optimistic Rollup with ZK fault proof. Kroma aims to transition to ZK Rollup once the generation of ZK proofs becomes more cost-effective and faster. Kroma is deployed on the Sepolia testnet for further testing and optimization.

According to ROOTDATA financing data on November 2, EtraPay completed a merger financing round with an unknown amount, with investors including AvaCloud. EtraPay is a Layer 1 blockchain designed for everyday payments, based on the Avalanche blockchain architecture, where every transaction on the payment network is encrypted and protected through zkMorphic proofs.

DeFi

According to ROOTDATA financing data on November 8, BIO Protocol completed a strategic financing round with an unknown amount, with investors including Binance Labs. The BIO protocol serves as the financial layer for DeSci, aiming to accelerate the influx of capital and talent into on-chain science. bioDAO can use the auction contracts of the BIO protocol to raise funds and directly allocate them to research projects, IP assets, and other biotechnology organizations.

According to ROOTDATA financing data on November 6, Usual completed a financing round totaling $1.5 million, with investors including Comfy Capital and Jed Breed. Usual is a stablecoin protocol that launched USD, a permissionless and fully compliant stablecoin backed 1:1 by real-world assets (RWA). USUAL is a governance token that allows the community to guide the future development of the network. Usual addresses current issues in the stablecoin market by redistributing profits to the community and rewarding token holders with real yields generated from RWA.

According to ROOTDATA financing data on November 4, CoW Protocol completed a financing round with an unknown amount, with investors including Greenfield. CowSwap is a DEX aggregator that features MEV protection. The CoW protocol matches trades from various on-chain liquidity sources through batch auctions. It is able to provide users with better prices and save significant amounts on gas fee optimization and liquidity provider fees.

According to ROOTDATA financing data on November 4, Fragmetric completed an angel round of financing with an unknown amount, with investors including Anatoly Yakovenko and Lily Liu. Fragmetric is Solana's native liquid re-staking protocol, with a vision to enhance the security and economic potential of the Solana ecosystem. By leveraging Solana's token expansion, Fragmetric effectively implements NCN reward distribution. Additionally, Fragmetric has designed practical solutions, such as standardized token schemes, for utilizing various LSTs in re-staking platforms. Fragmetric's mission is to build a secure, transparent, and efficient re-staking infrastructure that empowers users and supports the stability of the Solana re-staking ecosystem.

Gaming

According to ROOTDATA financing data on November 4, Betski completed a seed round of financing totaling $340,000, with investors not disclosed. Betski is an integrated online iGaming platform designed to provide users with a unique ownership model through tokenization. By integrating blockchain technology, Betski offers token holders the opportunity to share in the profits generated from all bets on the platform.

According to ROOTDATA financing data on November 4, GameBeast completed a financing round totaling $2 million, with investors including Tido Capital and K300 Ventures. GameBeast is a multi-chain game platform developer within the Solana ecosystem, featuring several games including "Destiny of Gods." GameBeast offers a variety of games ranging from mini-games to AAA titles, providing users with more diverse token spending opportunities.

Others

According to ROOTDATA financing data on November 8, Rektguy completed a seed round of financing totaling $1.5 million, with investors including Luca Netz and Seedphrase. Rektguy is an NFT project centered around Rekt beverage culture, where users earn double points for every drink purchased, allowing buyers to climb the leaderboard and potentially earn rewards through Rekt Coin.

According to ROOTDATA financing data on November 7, Pond completed a seed round of financing totaling $7.5 million, with investors including Archetype and Coinbase Ventures. Pond is a large cryptocurrency artificial intelligence model that recommends tokens to users based on similar on-chain behaviors. Pond's AI model can identify patterns and trends in on-chain data and behaviors, helping to identify investment opportunities.

According to ROOTDATA financing data on November 7, SkyX completed a Pre-seed round of financing totaling $1 million, with investors including Waterdrip Capital and Escape Velocity. SkyX is a blockchain-driven meteorological network that employs an incentive system and web3 protocols. Its goal is to establish an innovative meteorological ecosystem by combining advanced meteorological IoT devices with blockchain-based decentralized service protocols, utilizing $SKY as a utility token to achieve economic benefits and address traditional challenges in the meteorological industry. SkyX originated as a company selling smart devices and data services for meteorological stations, operating a network of 16,000 weather stations.

According to ROOTDATA financing data on November 6, Prosper completed a financing round with an unknown amount, with investors including Waterdrip Capital. Prosper is a non-custodial cross-chain prediction market and hedging platform. Prosper is developing a unique on-chain liquidity aggregation technology to address issues in the prediction market landscape. The core features of Prosper.so include: cross-chain prediction support and on-chain liquidity aggregation, binary liquidity models, betting insurance, user-owned predictions and options, and integration of real-world assets.

According to ROOTDATA financing data on November 5, HackQuest completed a strategic financing round with an unknown amount, with investors including KIP Protocol. HackQuest is a gateway to the Web3 development world, providing a comprehensive one-stop educational infrastructure that minimizes friction and helps both developers and non-developers enter the Web3 space.

According to ROOTDATA financing data on November 5, Phi completed a strategic financing round with an unknown amount, with investors including Neoclassic Capital and Cyber. Phi is a social gaming metaverse focused on creating "on-chain identities" and verified wallet activities using ENS to easily visualize on-chain identities. It incentivizes users to interact with various Web3 protocols, providing feedback for all protocols and accelerating the overall network effects of Web3. The protocol allows users to generate personalized spaces using their ENS and then declare objects in the game based on their wallet activities. Using these objects, users can build their own Web3 worlds to showcase their on-chain identities. The project's goal is to accelerate the mass adoption of the entire Web3 ecosystem by providing recreational features such as social interaction, gaming, and art.

According to ROOTDATA financing data on November 5, Blum completed a financing round with an unknown amount, with investors including The Open Platform. Blum is a hybrid exchange that provides universal token access through gamification in a Telegram mini-app. Blum allows access to both CEX and DEX tokens on a single platform, supporting over 30 chains and offering additional features including AI navigation, P2P trading, and derivatives trading.

According to ROOTDATA financing data on November 4, CoinBest completed a merger financing round with an unknown amount, with investors including OSL Group. CoinBest is a cryptocurrency exchange that allows users to trade Bitcoin (BTC), Ethereum (ETH), and other crypto assets anytime and anywhere through this application.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。