⚡️Yesterday, the net inflow of Bitcoin spot ETFs in the United States was $293.6 million——

IBIT (BlackRock): +$206.25 million

FBTC (Fidelity): +$33.52 million

BITB (Bitwise): +$23 million

EZBC (Franklin): +$17.8 million

BlackRock's IBIT has surpassed its gold ETF (IAU) in asset size in just 10 months.

Why should we pay such close attention to this data?

Because Bitcoin spot ETFs are an important channel for funds from the web2 world to flow into the web3 world, and the price of Bitcoin is largely proportional to the enthusiasm for capital inflows.

As long as this indicator does not experience a significant trend reversal, #Bitcoin's performance should not be too poor!

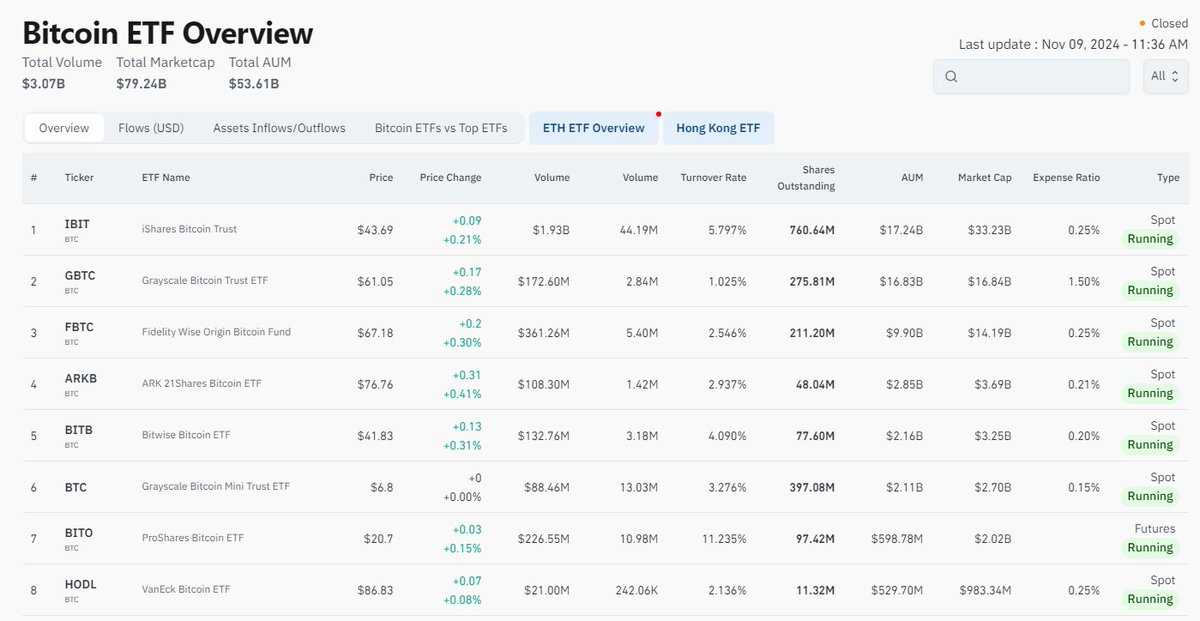

Here are a few tools and websites to view comprehensive ETF data:

https://sosovalue.com/tc/assets/etf/us-btc-spot

https://www.coinglass.com/bitcoin-etf

https://farside.co.uk/btc/

https://www.theblock.co/data/crypto-markets/bitcoin-etf/spot-bitcoin-etf-flows

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。