"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment

Looking at the long-term, the entire industry is in a state of loss. From 2015 to 2022, the $49 billion invested in Token projects generated less than $40 billion in value, with a return rate of -19% (excluding fees and expenses).

Clearly, not all crypto venture capital has flowed into Token projects. Assuming venture capitalists collectively hold 15% of these Token FDVs. Based on the current market value, the venture capital industry theoretically holds Tokens worth $66 billion. If we exclude SOL, this value drops to $51 billion. Therefore, the overall investment in the industry before 2022 (excluding fees and expenses) grew by 34%, including SOL. If we exclude SOL, it is essentially flat. This data is based on the assumption that the locked Tokens' FDV can be sold at current prices.

When comparing venture capital with liquid assets, the performance of the vast majority of funds lags behind Bitcoin, especially since the low point. The current adoption curve of cryptocurrencies is similar to that of the Mag 7 in the early 2010s (or possibly even earlier), indicating that there is still a large market to be developed. Currently, the scale of funds in crypto venture capital is 20 times that of mature institutional liquid crypto funds (over $88 billion compared to about $4 billion). Therefore, if things develop as I expect, the asset management scale of liquid cryptocurrencies will surpass that of crypto venture capital.

What is the Main Theme of This Round of Crypto Bull Market?

PayFi connects the real world; AI Agent enhances the on-chain world; Meme = on-chain casino.

When selecting funds and GPs, Mason focuses on three core factors: performance (must have reliable data support), team (integrity, hands-on experience, holistic view, and continuous evolution), and strategy (needs to align with current market demands and industry development trends).

The industry is always changing, and participants at each stage are different, so investment strategies are not fixed. The better strategies in this cycle fall into three categories: coin-based enhancement strategies (TVL games, quantitative), buying BTC at a discount or mining, and strategies that outperform BTC in phases, such as CTA.

Conversation with Trader Sean: Money Will Avoid Foolishly Hardworking People

Sean has a complete Meme trading process: mainly relying on smart address systems and alpha communities. The basic process is: understand the project background, observe the chip structure, formulate a trading plan, set stop-loss levels and trading patterns, take profits in batches (upward spikes, event Price in, estimate valuation based on one's trading plan), set up a large screen Dashboard, and track popular coins in real-time.

Entrepreneurship

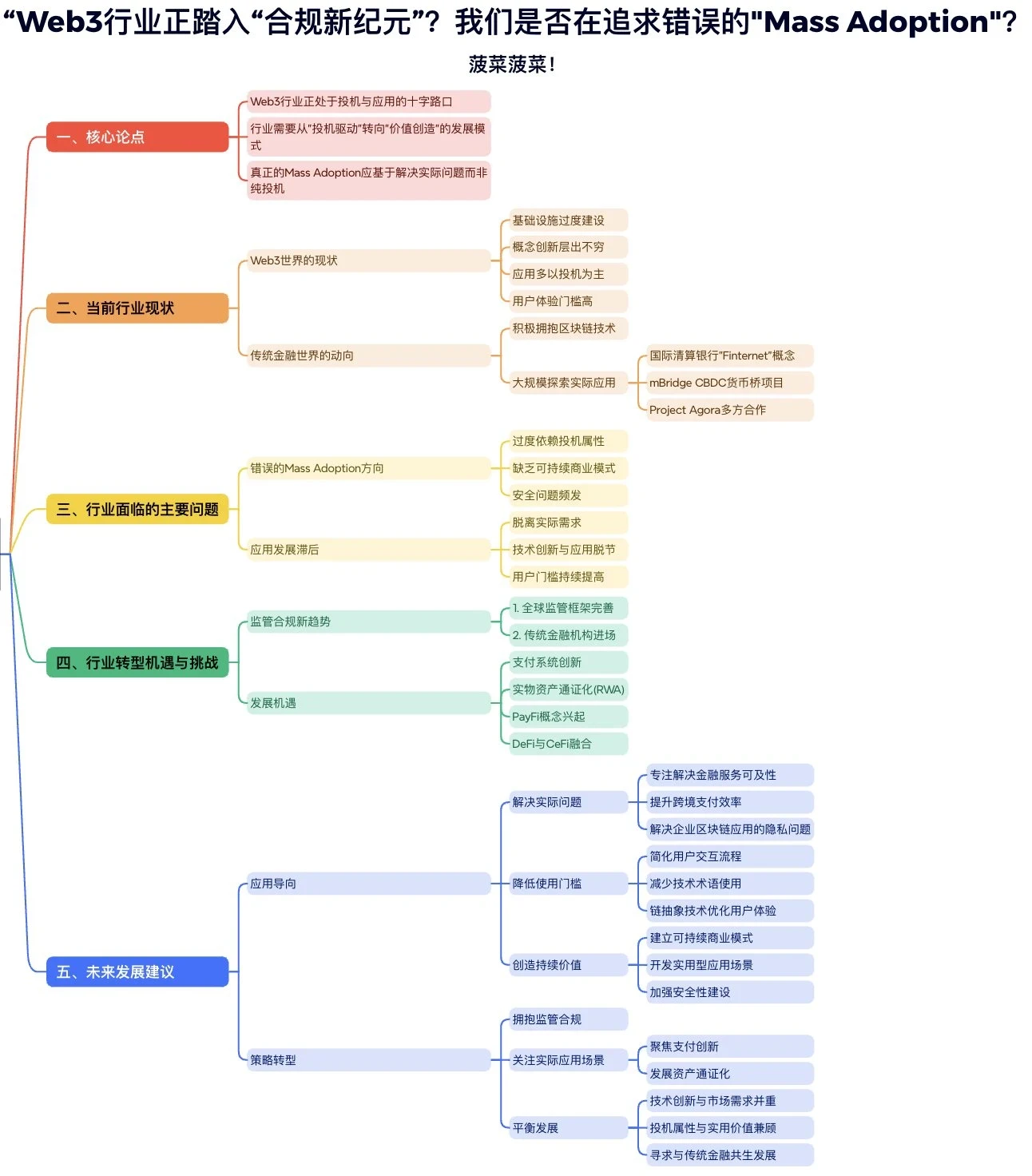

The Web3 Industry is Entering a "New Era of Compliance," Are We Pursuing the Wrong "Mass Adoption"?

The truly healthy and sustainable path to Mass Adoption in the industry must address real problems, lower usage barriers, and create lasting value.

Devcon is Coming, How Should Project Founders Build Social Influence?

Focus on one platform; specifically schedule creative time; utilize prompts and daily themes; seek team support; empower employees more.

Monad Founder to Peers: You Shouldn't Easily Give Away Advisor Shares

Entrepreneurs can actually receive a lot of advice for free; try to solve problems on your own; do not overestimate the endorsement value of advisors; be aware that advisors' contributions are very limited compared to full-time employees; manage expectations and don't be overly optimistic; those who are most likely to provide valuable advice often won't become your advisors; advisors find it hard to help solve core issues.

Data Interpretation: Is OP SuperChain a Profitable Business?

From a data perspective, the current development status of OP SuperChain is still relatively early; only the Base chain has been launched, while other chains are still in their infancy.

Airdrop Opportunities and Interaction Guide

"Web3 Version of MapleStory" MapleStory Universe Second Pioneer Test Guide

Meme

Meme Craze, VC's New Battleground, Opportunity or Trap?

The average daily turnover rate of Memes is about 11%, compared to 5% for DeFi, 7% for Layer 2, and 4% for Layer 1. This ratio not only highlights the high liquidity of Memes but also indicates a higher interest and trading frequency among users.

As of the end of the third quarter of 2024, the market capitalization share of Memes in the entire crypto market has increased from 0.87% two years ago to 2.58% today, with a continuing growth trend.

Memes are leveraged Layer 1, meaning that when the market improves, there can be a 5 to 10 times increase in Layer 1.

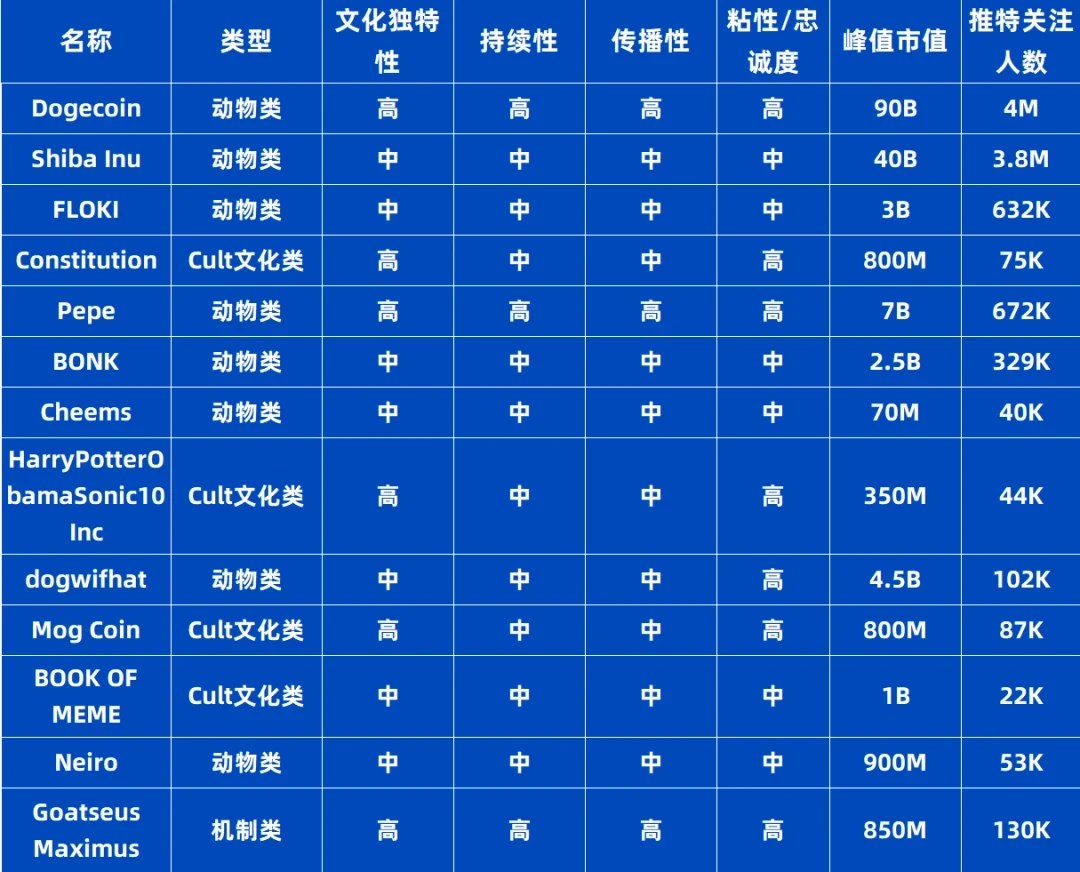

Animal Memes and Cult Culture Memes are types that are suitable for long-term attention. In contrast, other categories of Memes are often related to short-term trends, and their attention and popularity may rise rapidly and then fall back.

Some Meme Data Indicators

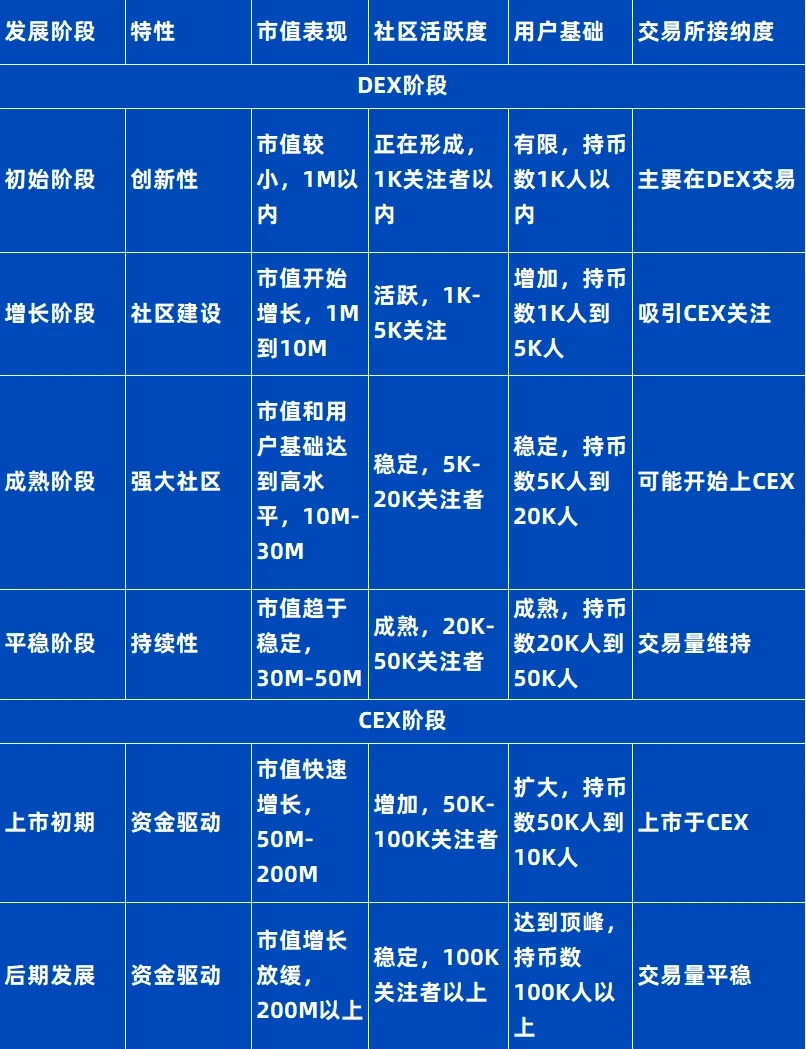

Meme Lifecycle Reference Table

Big Picture: Global monetary supply expansion and investment behavior.

Small Environment: Retail investors seeking new avenues for wealth growth.

Trend: Financialization of internet culture.

Risk Considerations: Life and death, manipulation remains; market saturation, innovation stagnation.

Insights: Extracting the essence (key features like fair issuance and low circulation token economics).

Outlook: Tokenized software business VS tokenized concepts.

Wintermute, GSR Markets, Auros Global, B2C 2 Group, and Cumberland DRW collectively hold over $120 million worth of MEME coins, with Wintermute being the institution with the largest holdings and covering the most popular projects, and several of its MEME coins have successfully launched on Binance.

Diamond Hands, High Profit-Loss Ratio? What are the Winning Factors in Solana Meme Trading?

The most obvious distinguishing feature between top addresses and others is that their holding duration far exceeds that of regular addresses, showing a clear positive correlation, approximately holding for 6-8 days, which is similar to the fermentation duration of top tokens on Solana. Another factor that shows a clear positive correlation is the stop-loss rate; as profits increase, stop-losses are also relaxed, but the differences across intervals are not significant.

Surprisingly, the profit rate is not directly related to the profitability of the address, indicating that the overall profitability of the address is related to "win rate," meaning that identifying and holding long are the roots of the profitability differences among addresses.

"Diamond hands" are the core and key to achieving top-level profits. However, for readers with limited capital, mimicking such strategies may be challenging.

Meme Cultivation Manual: Rebirth, I Want to Be a Diamond Hand (Part Four) | Produced by Nanzhi

The deep evaluation system has received a new upgrade.

The Meme Battlefield Under the U.S. Election: No Surge Yet, Most Have Encountered a Crash

Good news leads to bad news. Large funds are choosing to be more cautious during times of market uncertainty. The biggest beneficiaries of the U.S. election may be mainstream crypto assets like Bitcoin. The excessive generation of new MEMEs has diluted market attention. Homogeneous competition is severe, lacking true narrative capability.

Bitcoin Ecosystem

Bitcoin Market Report: Major Trends, Insights, and Bullish Price Predictions

On-chain analysis of Bitcoin: The balance of Bitcoin on exchanges is at a historical low, indicating that holder confidence is continuously increasing, with more and more choosing self-custody.

Surge in Bitcoin ETFs: In October, ETF inflows exceeded $5.4 billion, with BlackRock's IBIT leading the market. This reflects the increasing acceptance of Bitcoin in mainstream financial markets.

Mining dynamics: Russia and China are expanding their mining influence, while the U.S. still maintains the largest share of hash power.

Ethereum

The Importance of EigenLayer for the Future Development of Ethereum from a Long-Cycle Perspective

EigenLayer has built a "programmable security market," allowing Ethereum's core security resources to be allocated on demand, thereby enhancing Ethereum's market position as a secure settlement layer under the new trends of "modular" and "chain abstraction." To some extent, EigenLayer strengthens Ethereum's external investment and influence system.

The logic of Ethereum's "deflation" is no longer viable; it can only continue to follow the logic of stacking "leverage."

EigenLayer is crucial for maintaining the "technology supremacy" consensus principle of Ethereum's Rollup-Centric strategy.

DeFi

Opportunities and Challenges Under Uniswap's Innovation: What Lies Ahead for DEX?

The three main directions recently promoted by Uniswap are Uniswap X, Uniswap V4, and Unichain.

With the development of DEX RFQ networks like Uniswap X and Arrakis, and modular DEX architectures like Uniswap V4 and Valantis, the landscape of DEX will enter a new phase. First, many issues within the AMM business segment will be resolved, while the business scope will expand significantly. Secondly, there are still many RFQ-related issues that need to be addressed under the current intent landscape. Finally, AMMs will focus on long-tail markets, optimizing the gradually dominant PMM structure.

Revisiting Ethena: After an 80% Drop, Is ENA Still Undervalued in the Hitting Zone?

Ethena's business positioning is as a synthetic dollar project with "native yield," meaning its track is in the same lane as MakerDAO (now SKY), Frax, crvUSD (Curve's stablecoin), and GHO (Aave's stablecoin) — stablecoins. The business model of stablecoin projects is generally similar: raise funds, issue debt (stablecoins), and expand the project's balance sheet; utilize the raised funds for financial operations to generate financial returns. When the returns from the project's operational funds exceed the comprehensive costs of raising funds and running the project, the project is profitable.

In the past two months, ENA has rebounded nearly 100% from its low, even with the rewards for Season 2 opening in early October. These two months have also been dense with news and positive developments for Ethena. There are promising stories for Ethena in the coming months to a year: with the rising expectations of Trump's return and the Republican victory (results expected in a few days), the warming crypto market will benefit the perpetual arbitrage yields and scales of BTC and ETH, increasing Ethena's protocol revenue; more projects are expected to emerge within the Ethena ecosystem after Ethereal, increasing ENA's airdrop income; the launch of Ethena's self-operated public chain could also bring attention and staking scenarios for ENA, although I expect this will be launched after more projects accumulate on the second chain.

However, the most important thing for Ethena is that USDE can be accepted as collateral and trading assets by more leading CEXs.

As a product with a clear Lindy effect (the longer it exists, the stronger its vitality), Ethena and its USDE still need more time to validate the stability of its product architecture and its survival capability after subsidies decline.

Weekly Hot Topics Recap

In the past week, Trump won the election as the new President of the United States (related special topic); Bitcoin hit a new historical high, reaching $76,400; crypto-related stocks surged; the Federal Reserve cut interest rates by 25 basis points, with no votes against; Elon Musk's net worth increased by $20.9 billion in a single day, maintaining his position as the world's richest person;

Additionally, in terms of policy and macro markets, U.S. media reported that the 2024 election has already cost $14.7 billion, possibly the most expensive in history; Elon Musk: a complete reform of the U.S. government is coming soon; U.S. Senator Warren defeated crypto industry supporter John Deaton, winning a Senate seat in Massachusetts; Trump's team is considering nominating Robinhood's Chief Legal Officer Dan Gallagher as SEC Chair; the Monetary Authority of Singapore announced the advancement of a financial services tokenization plan; Russia introduced a regulatory framework for crypto mining, defining it as a legal activity and stipulating operational requirements for miners;

In terms of opinions and statements, Cathie Wood discussed the U.S. election and Trump's economic policies: the market likes tax cuts; analysts predict that inflation in the U.S. may rise rapidly after Trump takes office, the Federal Reserve will change its interest rate cut plan; Arthur Hayes: During the U.S. election, Solana will be the "high beta Bitcoin"; CryptoQuant CEO: Currently, stablecoins are mainly used for non-trading purposes, and their supply growth is insufficient to boost BTC; Matrixport research: The new SEC chair and U.S. strategic reserves may drive BTC to break $100,000; Murad: The road to the Meme coin super cycle is now paved; Andre Cronje: Coinbase has repeatedly requested listing fees and is willing to disclose all evidence for public verification; Jupiter's founder: has never sold a single JUP and will announce significant news soon; Sotheby's Vice President: I deployed the BAN token, did not earn $1 million, and burned 3.7% of the tokens;

In terms of institutions, large companies, and leading projects, the Ethereum Foundation released its 2024 report: a financial reserve of $970 million; two Ethereum researchers resigned from their advisory roles at EigenLayer due to conflicts of interest to focus on Ethereum; on November 8, SOL's market capitalization surpassed BNB again, becoming the fourth largest cryptocurrency by market cap; Telegram will launch 10 new mini-program features, including sending gifts and monetizing advertisements; MakerDAO decided to retain the rebranded Sky brand and plans to launch a new stablecoin and expand projects; OpenSea CEO discusses the new version: we built a new platform from scratch; Lumoz airdropped 15 million esMOZ to ZKFair users.

In terms of security, Truth Terminal founder: registered domain name issues have arisen, please do not visit; ZachXBT: the crypto gambling platform Metawin is suspected of being attacked, with losses exceeding $4 million… Well, it has been another week of witnessing history.

Attached is the portal for the "Weekly Editor's Picks" series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。