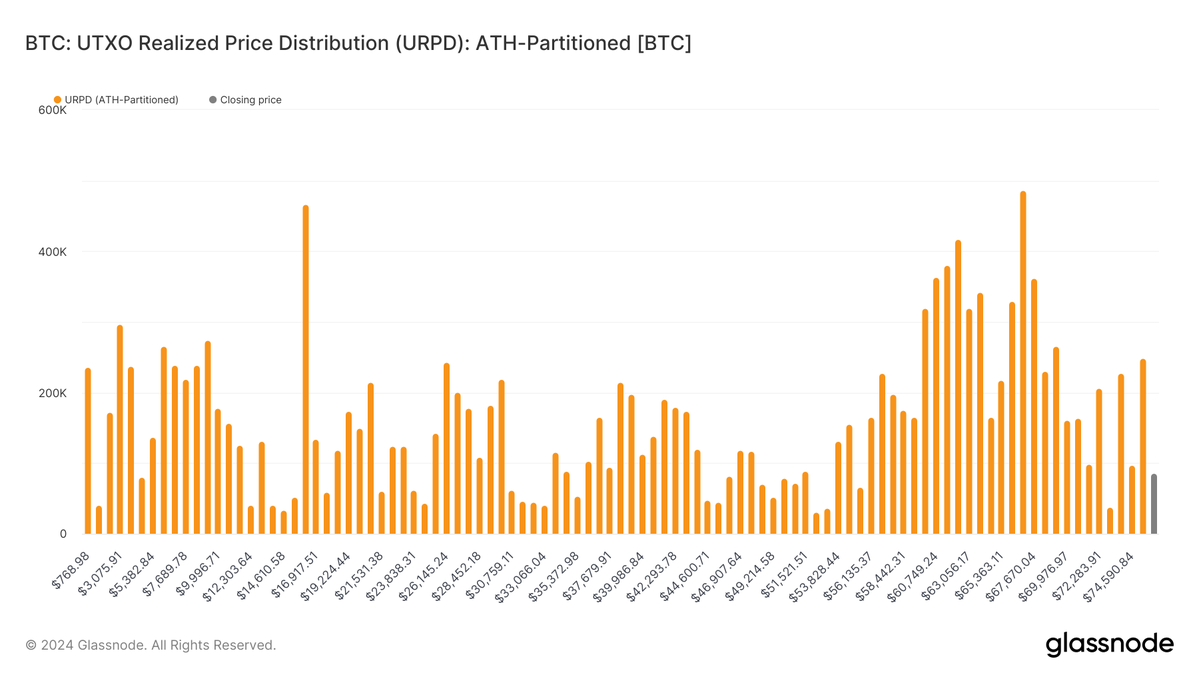

Yesterday, after Powell's speech, BTC once again surged to a new high, just one dollar short of breaking through $77,000. So, I apologize that there are still no detailed data on URPD today, but looking at the chip distribution is still fine. From the data, we can see that there has been a significant accumulation at the three levels of $73,000, $74,000, and $75,500. This stage is very important, indicating that a large number of investors are starting to hold #BTC due to FOMO.

Of course, this doesn't mean that these people won't sell once they buy; they are likely short-term investors. However, as long as the price hasn't dropped, it will be difficult to complete this part of the test. Additionally, we can see that there is still strong support between $56,500 and $69,000. Although there has been some consumption between $64,000 and $69,000, the strength of the support remains robust, and it will take more time to confirm whether it is stable.

Tomorrow is the weekend, and investor sentiment will gradually cool down over the weekend. Next Monday is Memorial Day in the United States, so it will be a three-day holiday. During the holiday, liquidity will be lower, making it easier for investor sentiment to reflect in the price. Although I don't currently believe there will be any negative news, we still need to be cautious about the possibility of a spike during low liquidity.

Of course, if investor sentiment remains FOMO during the three-day holiday, which is quite likely, then the rise of BTC may become even easier. Although it may seem like a cliché, as if both bulls and bears are saying the same thing, the actual advice is for everyone to at least stay away from high leverage during this period, as it is the safest approach. There is nothing to worry about with spot trading.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。