This report analyzes key dynamics such as the record high of Web3 game users, the explosion of on-chain Telegram games, and traditional gaming giant Ubisoft's entry into the market.

Written by: Stella L

In October 2024, the Web3 gaming market performed steadily, contrasting with the broader growth trend in the cryptocurrency market. Bitcoin rose by 15.9% during the month, nearing its historical price peak, while the market capitalization of gaming tokens remained at $21.15 billion, close to last month’s level. Daily active users reached 5.3 million, primarily driven by Telegram-based games, particularly with significant user growth achieved through blockchains like Matchain, Sui, and Core introducing Telegram games.

Several important developments occurred this month: traditional gaming giant Ubisoft launched its first blockchain game on Oasys, and crypto fund VanEck invested in Gunzilla Games. Meanwhile, funding continues to flow into the industry, with Azra Games securing $42.7 million in financing.

Macroeconomic Market Review

In October, the cryptocurrency market showed mixed performance, with Bitcoin exhibiting significant strength while other sectors saw more moderate gains. Bitcoin rose from $60,764 to $70,398, an increase of 15.9%. Notably, Bitcoin reached $72,751 on October 29, approaching the historical high of $73,104 set on March 14, 2024. In contrast, Ethereum's performance was relatively flat, rising from $2,453 to $2,519, only a 2.7% increase.

Data source: Bitcoin and Ethereum price trends

The cryptocurrency market in October was significantly influenced by the macro environment. The strengthening of the dollar and the weakening of the yuan heightened concerns over trade tensions and tariff risks. This currency volatility was accompanied by rising bond yields and increasing gold prices, indicating a complex shift in global risk perception and investment flows.

As the U.S. elections approach, political factors increasingly influence market sentiment. Investors are positioning themselves ahead of potential policy changes, accelerating Bitcoin's gains as the market weighs the possible impacts of different election outcomes on digital asset regulation and financial policy.

Institutional activity remained strong this month, with Bitcoin exchange-traded products (ETPs) recording substantial net inflows. This sustained institutional interest, combined with Bitcoin's performance diverging significantly from other cryptocurrency sectors, indicates that large investors are becoming increasingly selective in their allocations.

Regulatory developments continue to impact the market landscape. The FBI's investigation into NexFundAI tokens through "sting operations" marked a significant milestone, leading to market manipulation charges against three cryptocurrency companies and 15 individuals. Meanwhile, Crypto.com's legal battle with the SEC highlights the ongoing tension between industry participants and regulators.

Overview of the Blockchain Gaming Market

In October, the blockchain gaming industry showed mixed signals, with stable token market capitalization but notable changes in user metrics. The market capitalization of blockchain gaming tokens slightly increased from $21.07 billion to $21.15 billion.

Data source: Market capitalization of blockchain gaming tokens and Bitcoin

User engagement metrics exhibited more significant changes, with daily active users (DAU) reaching a new high of 5.3 million, an 11.3% increase from September. This growth was primarily influenced by a peak in user metrics for Matchain during October 10-13, when it launched four games within the Telegram ecosystem. The surge in Telegram game-related activities continues to reshape user acquisition patterns.

Data source: Daily active users of blockchain games

The number of transactions showed moderate growth, with an average daily transaction volume of 9.3 million, a slight increase of 2.1% from September. However, this growth rate remains lower than the increase in DAU, with the transaction volume per user remaining flat compared to September.

Data source: Daily transaction counts of blockchain games

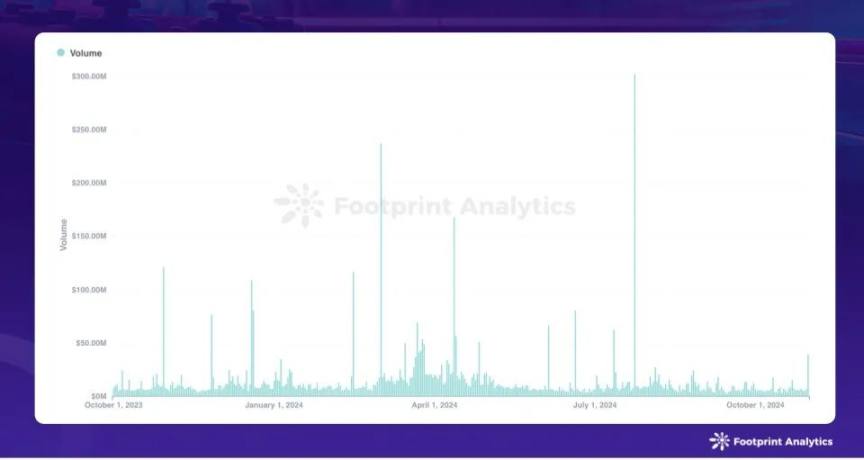

Transaction amounts experienced a slight contraction, with the average daily transaction value decreasing by 1.9% to $7.5 million.

Data source: Daily transaction amounts of blockchain games

These metrics hold particular significance in the broader context of cryptocurrency adoption. a16z released the "2024 Crypto Status" report, estimating that the current active crypto users range between 30 million and 60 million, accounting for 5-10% of the total global crypto user count of 617 million reported by Crypto.com in June 2024. This significant gap highlights an important opportunity: converting existing cryptocurrency holders into active users. Although Web3 games have long been viewed as a crucial catalyst for the widespread adoption of blockchain, their performance in the current market cycle indicates that challenges remain in realizing this potential.

How are builders in the blockchain gaming space adjusting their strategies to bridge this engagement gap? We will explore this further below.

Overview of Blockchain Gaming Public Chains

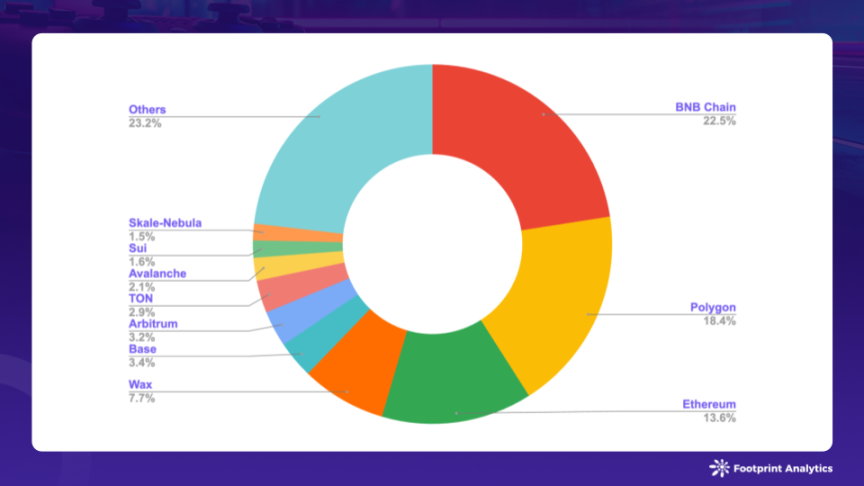

In October, the number of active blockchain games reached 1,606, a slight increase of 1.6% from September. BNB Chain, Polygon, and Ethereum led the market with shares of 22.5%, 18.4%, and 13.6%, respectively.

Data source: Proportion of active game projects on various public chains

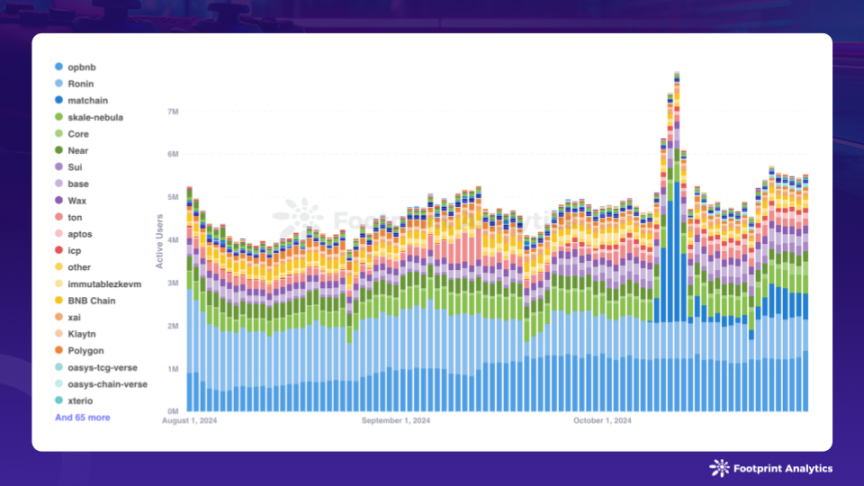

DAU metrics indicate a shift in the competitive landscape, with opBNB, Ronin, and the emerging Matchain becoming the top-performing chains. These chains had average DAUs of 1.2 million, 886,000, and 548,000, respectively, capturing 25.6%, 13.1%, and 11.2% of the DAU market share by the end of October.

Data source: Daily active users of games on various public chains

opBNB showed strong growth, with average DAUs increasing by 10.5% from September, primarily driven by GombleGames and Alliance Games, which saw user growth of over 100% and 78%, respectively. Interestingly, this growth reflects BNB Chain's shift towards developing blockchain games on opBNB, while the BNB Chain itself experienced a 43.8% decline in average DAUs.

Matchain, a decentralized AI blockchain focused on data and identity sovereignty, launched its mainnet in August. The chain's daily users surged from 78 in September to 548,000 in October, primarily driven by Telegram-based games such as LOL, Jumper, and Digiverse. During the peak performance period from October 9 to 13, Matchain averaged 2 million DAUs, reaching a peak of 3.3 million DAUs on October 12. Although the user count significantly declined afterward, it stabilized at around 615,000 in the last week of October. The increase from 78 to 548,000 DAUs demonstrates the potential and challenges of user acquisition within the Telegram ecosystem. This is a common dilemma faced by the Web3 gaming industry, where projects struggle to maintain the momentum of initial user growth and achieve sustained organic growth.

Data source: Daily active users of Matchain games

Sui performed strongly, with average DAUs increasing by 105.1% to 186,000. Several Telegram-based projects drove this growth, including BIRDS (a Memecoin and game mini-program) and MemeFi. Notably, MemeFi shifted its token issuance from Ethereum L2 Linea to Sui a few weeks before its airdrop event. This strategy of combining Memecoins with gaming seems to be Sui's approach to maintaining user engagement.

Core's average DAUs increased by 75.7% to 109,000, driven by traditional Web3 games like World of Dypians and Pixudi, as well as new Telegram-based games. The "Talk-to-Earn" and "Tap-to-Earn" game TomTalk achieved significant success, accumulating over 1 million users on Core within a month. Core's strategy appears to focus on long-term ecosystem development through strong support, such as collaborations with TomTalk and Pixudi.

TON's average DAUs decreased by 27.7% to 195,000, reflecting a decline in activity for several games post-TGE. However, TON's success in user acquisition within the Telegram ecosystem has prompted the entire industry to follow suit. In addition to TON, several chains are now actively vying for the Telegram ecosystem's user base. Matchain, Sui, and Core have achieved significant success in this regard, while emerging chains like Sei, Ancient8, and Viction are also implementing similar strategies.

Meanwhile, other chains face their own challenges and opportunities. The Arbitrum community proposed a $220 million plan around the "Game Catalyst Program" (GCP), suggesting that the 220 million ARB tokens allocated by the foundation be returned to the treasury, highlighting the demand for financial and operational transparency regarding the GCP.

In contrast, Immutable zkEVM has taken a strategic step towards decentralization by removing its deployment whitelist and enabling permissionless deployment. Since the launch of its testnet in March 2024, Immutable zkEVM claims to have achieved significant growth, with over 2.5 million monthly active users on-chain in the first quarter.

Immutable

Overview of Blockchain Games

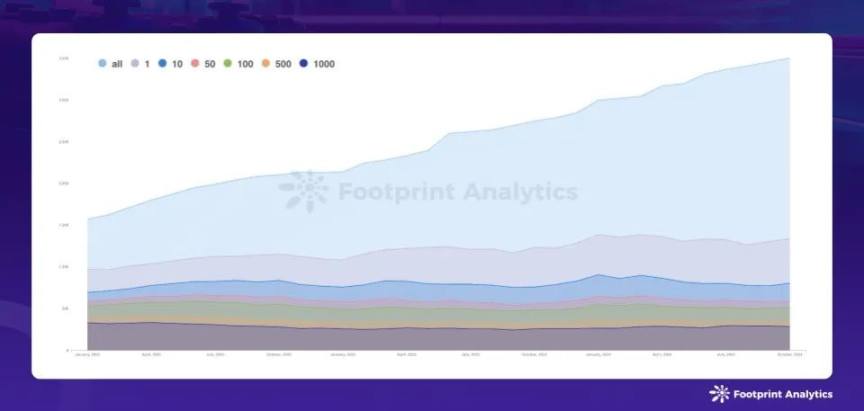

By the end of October, the blockchain gaming ecosystem had a total of 3,503 games, of which 1,336 remained active. There were 283 games that attracted over 1,000 monthly active users (MAU), accounting for 8.1% of the total number of games and 21.2% of active games.

Data source: Monthly active blockchain games

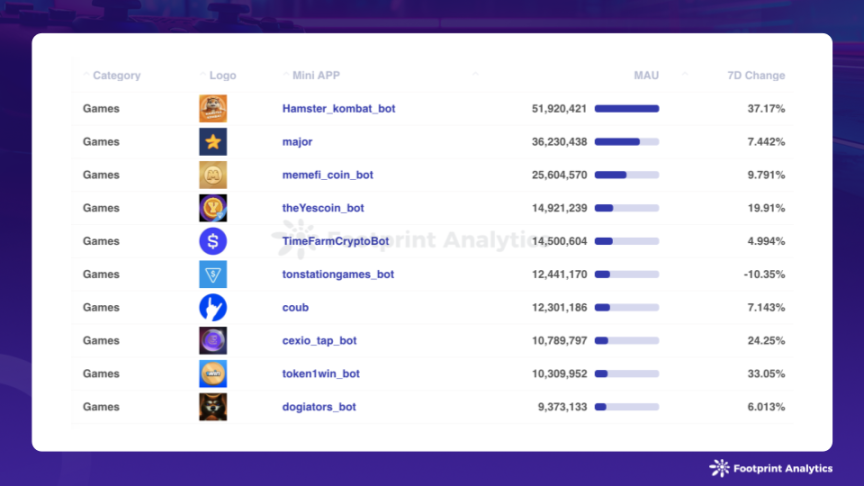

The phenomenon of Telegram games continues to shape the industry landscape, but it also faces challenges in sustainability. Hamster Kombat topped the October Telegram game Mini App list with 51.9 million MAU. However, the claimed user numbers (nearly 300 million in August and September) contrasted sharply with the latest retention figures, and the token price dropped 70% from its historical peak post-TGE, indicating that the project still faces opportunities and challenges in converting initial user interest into sustained engagement.

Data source: Popular Telegram Mini Apps list

On another front, Ubisoft entered the blockchain gaming space with Champions Tactics: Grimoria Chronicles, a tactical RPG launched on October 23 on Oasys's Layer 2 Home Verse, focusing on PvP combat and team-building mechanics.

A notable investment event this month was VanEck's crypto fund announcing its investment in Gunzilla Games. VanEck had previously invested in Parallel. Gunzilla launched the highly anticipated game Off the Grid on PlayStation 5 and Epic Games this month. Off the Grid is built on its blockchain Gunzilla (recently upgraded from Avalanche subnet to L1) but explicitly positions the game in its official Q&A as "not an NFT game," rather a battle royale game that includes "optional NFT elements." This reflects a trend of integrating blockchain features as auxiliary mechanisms rather than core components of the game.

Off The Grid

This evolving approach to blockchain integration, especially driven by established gaming companies, indicates market maturity, with technology used to enhance rather than define the gaming experience. This subtle shift may bridge the gap between traditional and Web3 games.

Investment and Financing in Blockchain Games

In October, the Web3 gaming industry exhibited strong growth in investment activities, raising a total of $94.6 million across 13 financing events, a significant increase of 44.2% compared to September. Four of these activities did not disclose their funding amounts.

Investment and financing events in the blockchain gaming sector in October 2024 (Source: crypto-fundraising.info)

A highlight of this month was Azra Games raising $42.7 million in Series A funding, led by Pantera Capital and supported by industry giants such as a16z crypto, A16Z GAMES, and NFX, indicating confidence in advanced mobile gaming experiences. Azra's vision for a "fourth-generation mobile RPG" marks a significant evolution in mobile gaming, offering a console-level gaming experience with features like an open world, complex camera systems, real-time combat, and extensive PvE activities. An increasing number of investors are betting on the integration of console-level gaming experiences with mobile platforms, suggesting a potential shift in how Web3 games are consumed.

The infrastructure sector also showed activity, with Alliance Games securing $5 million in Series A funding led by Animoca Brands and Asymm Ventures. Alliance Games focuses on AI-driven decentralized infrastructure, addressing key needs within the ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。