Original Title: The Rise of Polymarket: Here to stay or an election phenomenon?

Author: Animoca Digital Research

Translation: Scof, ChainCatcher

Editor: Nianqing, ChainCatcher

Key Questions

- Why does the world need Polymarket?

- Will Polymarket's popularity continue after the U.S. elections?

- Is Polymarket the next killer app for cryptocurrency?

- Will Polymarket issue a token?

- Polymarket is an on-chain prediction market that addresses the critical issue of information scarcity by providing quantifiable odds for future events, offering a numerical representation of probabilities that was previously lacking in news media and social discussions.

Summary

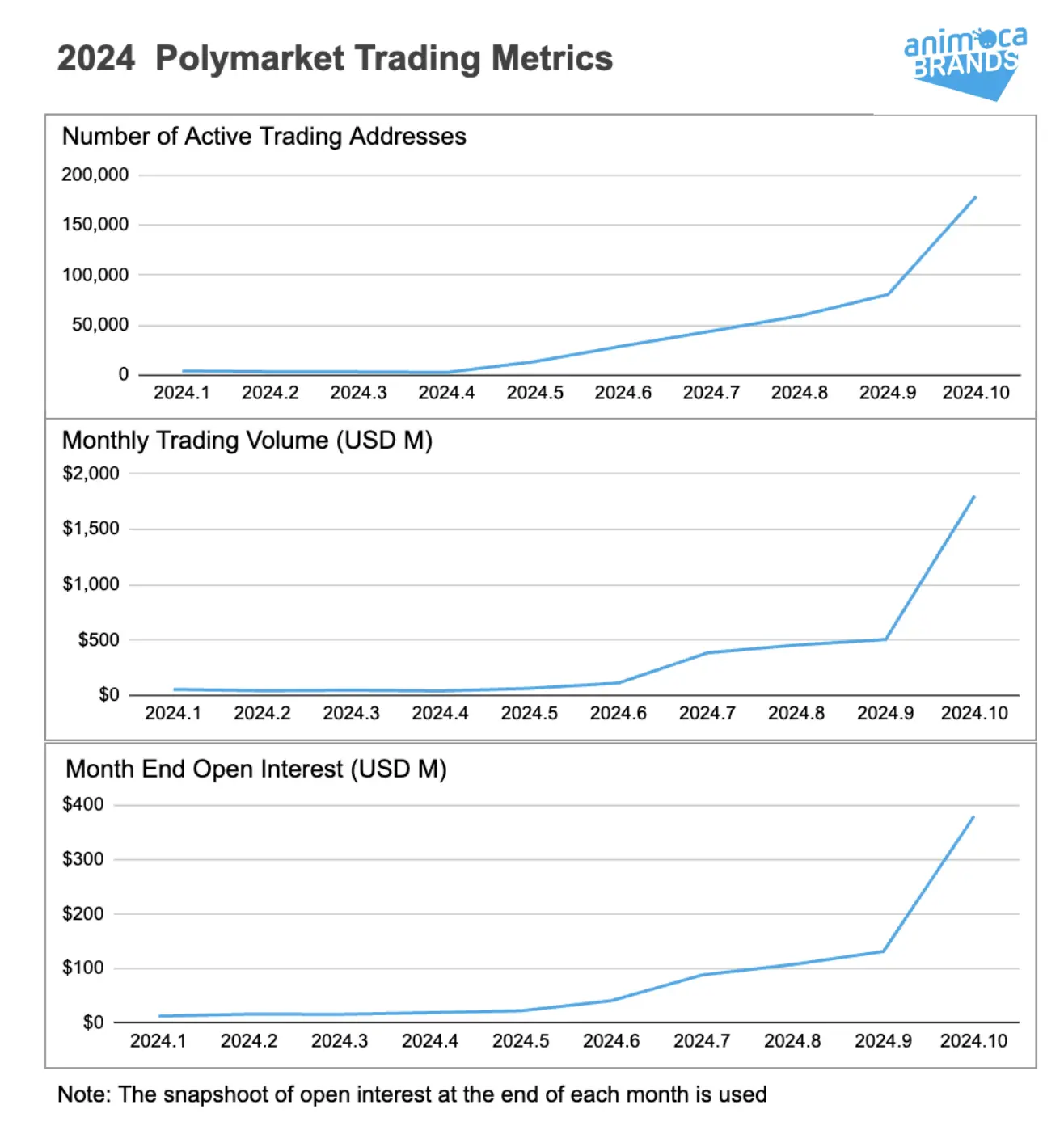

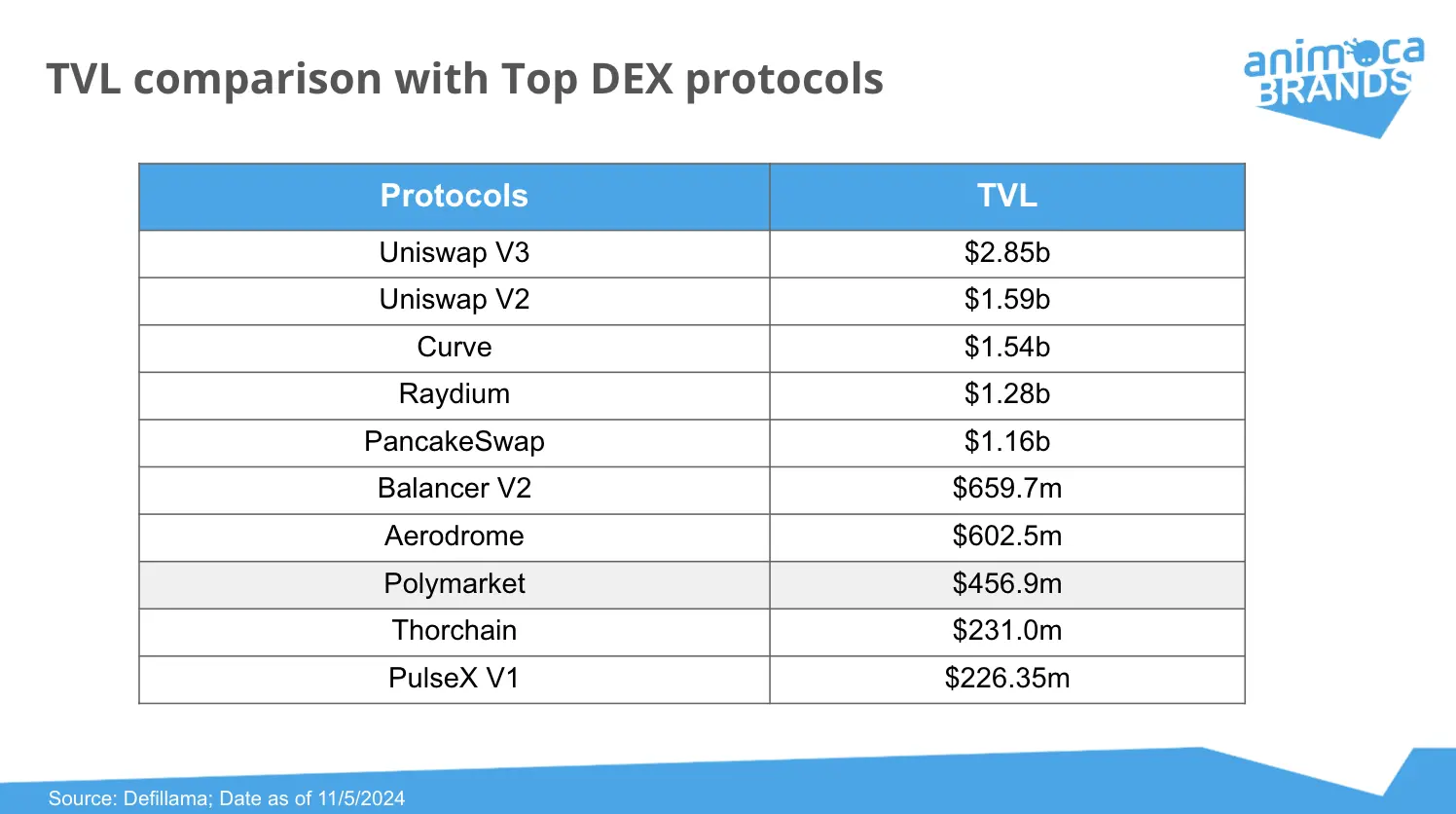

- The platform has experienced significant growth over the past six months. From April to October, monthly trading volume skyrocketed from $40 million to $2.5 billion, while the amount of open contracts grew from $20 million to $400 million. The amount of locked capital is now comparable to leading decentralized exchanges like SushiSwap AMM V3, and even matches the total value locked (TVL) of networks like TON.

- In October, Polymarket's website traffic reached 35 million visits, double that of popular betting sites like FanDuel. Its predictions for the U.S. elections have been frequently cited by mainstream media such as The Wall Street Journal and Bloomberg. This growth indicates that Polymarket has evolved from a well-known project in the crypto space to a platform capable of reaching mainstream audiences, marking a long-awaited milestone in public adoption of Web3.

- Our analysis suggests that new users of Polymarket are likely to continue using the platform after the U.S. election cycle. About 4/3 of users trade on non-election-related topics, indicating a sustained interest in diverse subjects.

- Polymarket has not yet determined plans for issuing a token. The company is exploring the possibility of introducing a token to validate real-world event outcomes but has not made an official decision.

Introduction

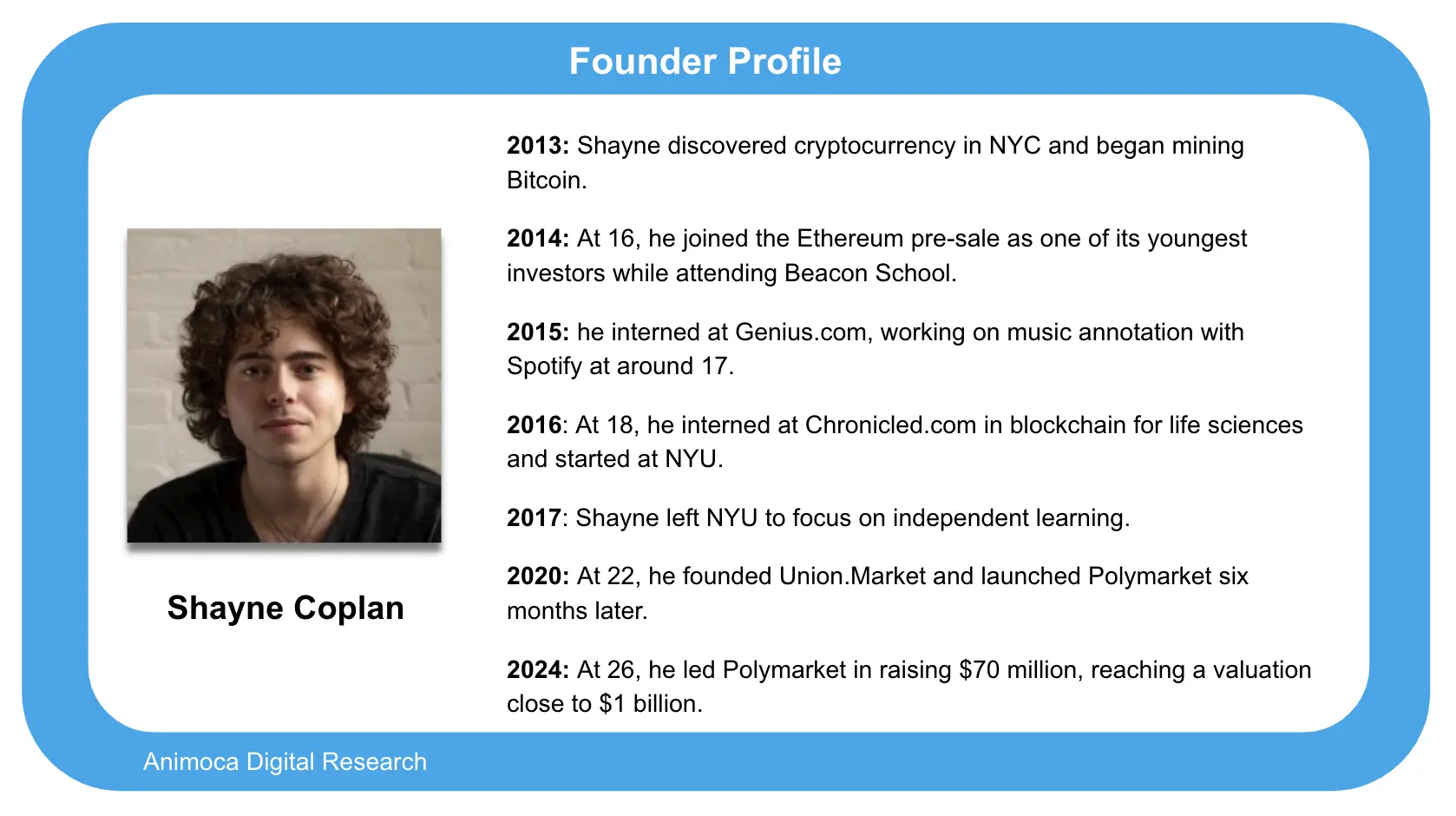

Polymarket is a blockchain-based prediction market platform founded in 2020 by 22-year-old Shayne Coplan. Its timely launch quickly attracted significant attention during the 2020 U.S. election cycle. Despite subsequent volatility in the crypto market, Polymarket has resiliently survived and returned with greater popularity in the 2024 U.S. election cycle.

Prediction markets are innovative trading platforms where participants can create and trade contracts regarding whether future events will occur. By trading on "yes" or "no" options, the market can aggregate collective opinions, where the price of "yes" contracts represents the consensus probability of the event occurring at a given moment. This real-time pricing provides valuable insights into public expectations and predictions.

Real-time tracking of event probabilities is often overlooked by news media and social platforms. While the U.S. elections attract significant attention, there is no centralized platform that can integrate information on daily developments into quantifiable expected assessments in real-time. The "Electoral College" system in U.S. elections complicates predictions, leading analysis sites like FiveThirtyEight to primarily focus on polling results without providing clear odds for potential winners.

Polymarket fills this gap with its presidential election prediction market. New information, such as candidate activities and polling data, is immediately reflected in the future prices of events. This quantifiable and instant updating feature has helped Polymarket quickly gain popularity and become a common reference in social media discussions during elections.

In the near future, Polymarket's probability trends may become common charts in mainstream news broadcasts. If this happens, it is not hard to imagine news networks like CNN and ABC incorporating real-time probability charts into their reporting of major events, providing audiences with data-driven insights and background information similar to financial news reporting.

How Did Polymarket Become Popular?

Birth

Polymarket was founded by Shayne Coplan in 2020, coinciding with the U.S. presidential election. The prediction event regarding "Will Trump win the 2020 U.S. presidential election?" attracted a large number of participants, with trading volume reaching $10.8 million within months, pushing Polymarket's monthly trading volume to over $25.9 million at one point.

The platform also caught the attention of many notable figures, including Vitalik Buterin, who expressed recognition of Polymarket's potential through a blog post in 2021. Although the platform was relatively niche at the time, trading volume for some of its popular events had already exceeded $1 million, indicating significant growth potential.

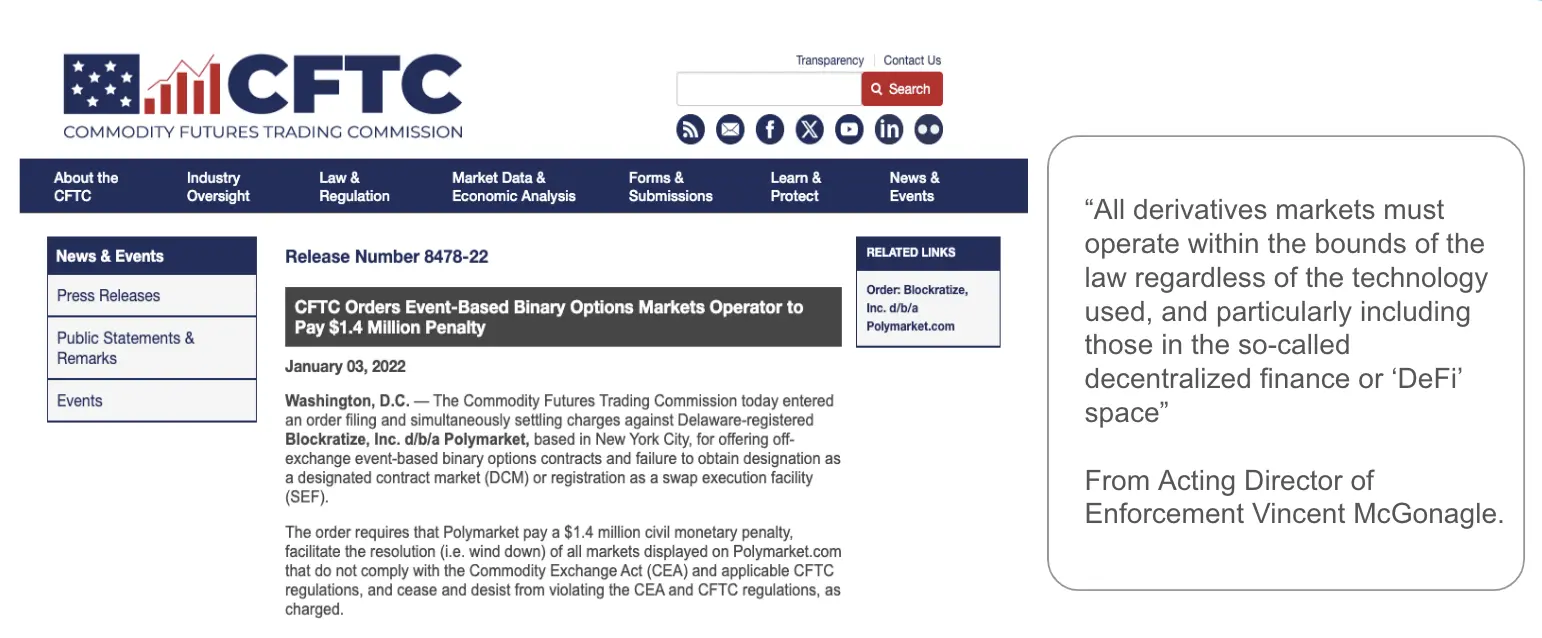

Regulatory Setbacks

As a platform straddling the line between gambling and futures trading, Polymarket faced unique regulatory challenges. These challenges peaked in October 2021 when the U.S. Commodity Futures Trading Commission (CFTC) launched an investigation into the platform due to its rapid growth and involvement in providing unlicensed futures trading services. In January 2022, Polymarket reached a settlement with the CFTC, agreeing to pay a $1.4 million fine for offering binary options trading without the necessary futures trading license approval.

As part of its compliance efforts, Polymarket subsequently adjusted its operational structure to an offshore platform, prohibiting U.S. residents from participating in its markets. The company also hired former CFTC commissioner J. Christopher Giancarlo as an advisor to help navigate complex regulatory issues and ensure future compliance.

This settlement resolved some uncertainties regarding Polymarket's operations, allowing market activity to gradually return to levels seen in early 2021. However, a significant question remains: when will Polymarket be able to break through its current limitations and enter the mainstream market?

Source: CFTC Official

Towards Mainstream

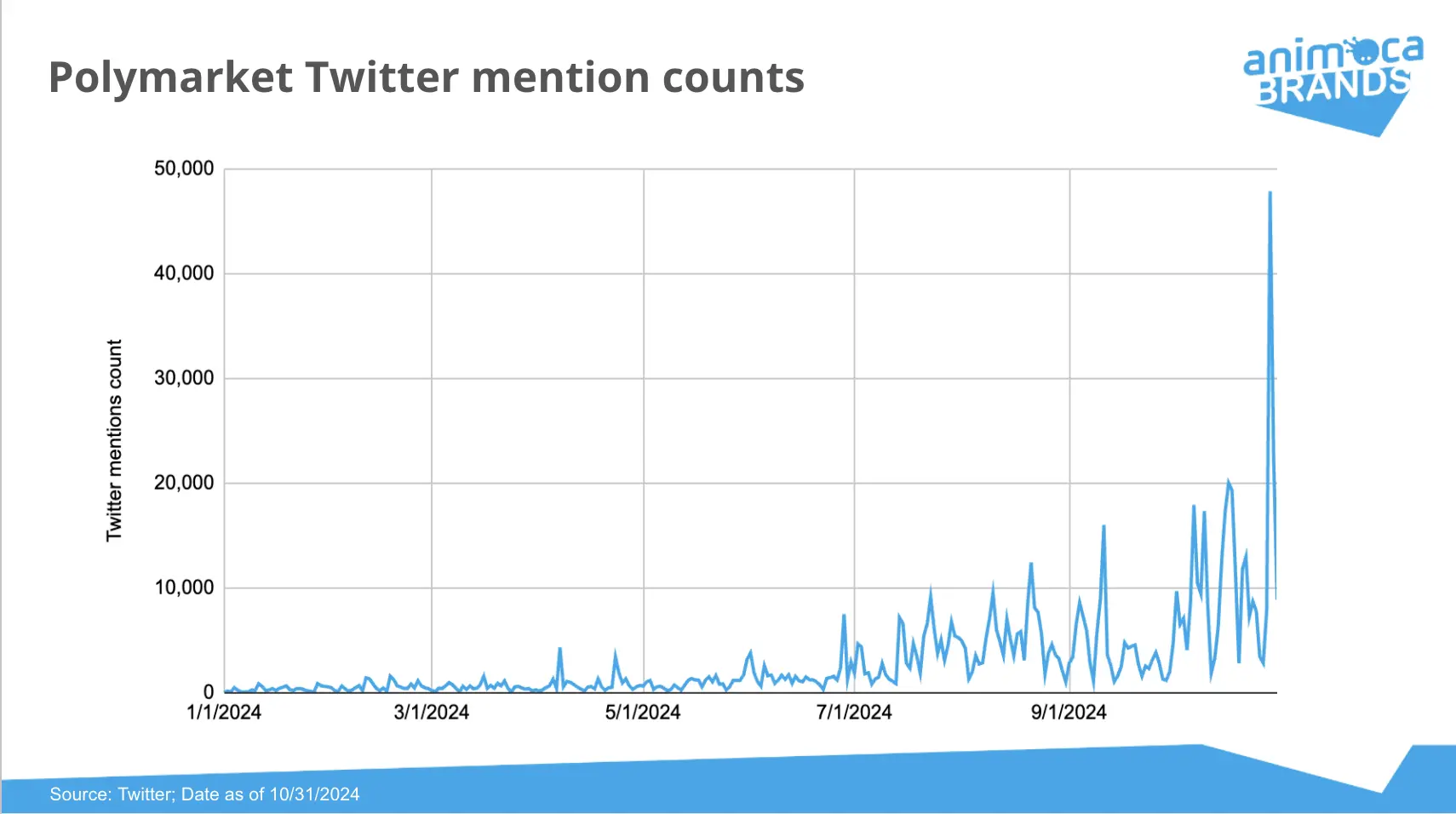

A year after the CFTC settlement, Polymarket launched the "2024 U.S. Presidential Election Winner" market in January 2024, quickly sparking a surge in trading activity. As the year progressed, significant political events—including an assassination attempt on Trump and Biden's unexpected announcement of withdrawal—further fueled interest in election predictions. By the final month of the election, as early voting results were released, Polymarket's popularity reached an all-time high.

Throughout the 2024 election cycle, Polymarket's monthly trading volume soared from millions of dollars to $50 million in January, nearly $400 million in July, and easily surpassed $1 billion by October. The total amount of open contracts—representing locked USDC and potential payouts if all contracts settle—grew from $7 million on January 1, 2024, to approximately $400 million by November 1, 2024. This locked capital exceeded the total TVL of TON, ranking Polymarket 18th in the blockchain infrastructure ecosystem by locked amount.

Polymarket's attention is not limited to the trading community; its Google search popularity and website traffic have surged, reflecting widespread public interest. Major media outlets such as The Wall Street Journal, Bloomberg, and CNN, as well as public figures like Trump, frequently cite Polymarket's election predictions. In a significant milestone towards mainstreaming, Bloomberg integrated Polymarket's election odds into its terminal system in August. Polymarket has not only become an important project in the crypto industry but has also successfully attracted broad public attention, which is a long-desired goal for the Web3 industry.

The Web3 industry has yet to achieve mainstream adoption, primarily due to the lack of a "killer app" that can create a similar impact as the iPhone in the field. The collaboration between Telegram and TON has generated significant excitement in the Web3 community due to its immense potential for driving widespread adoption. Similarly, Polymarket is exploring new directions that are expected to push the industry frontier, providing promising pathways for broader audience engagement and advancing Web3 towards wider applications.

Platform Activity

Website Traffic

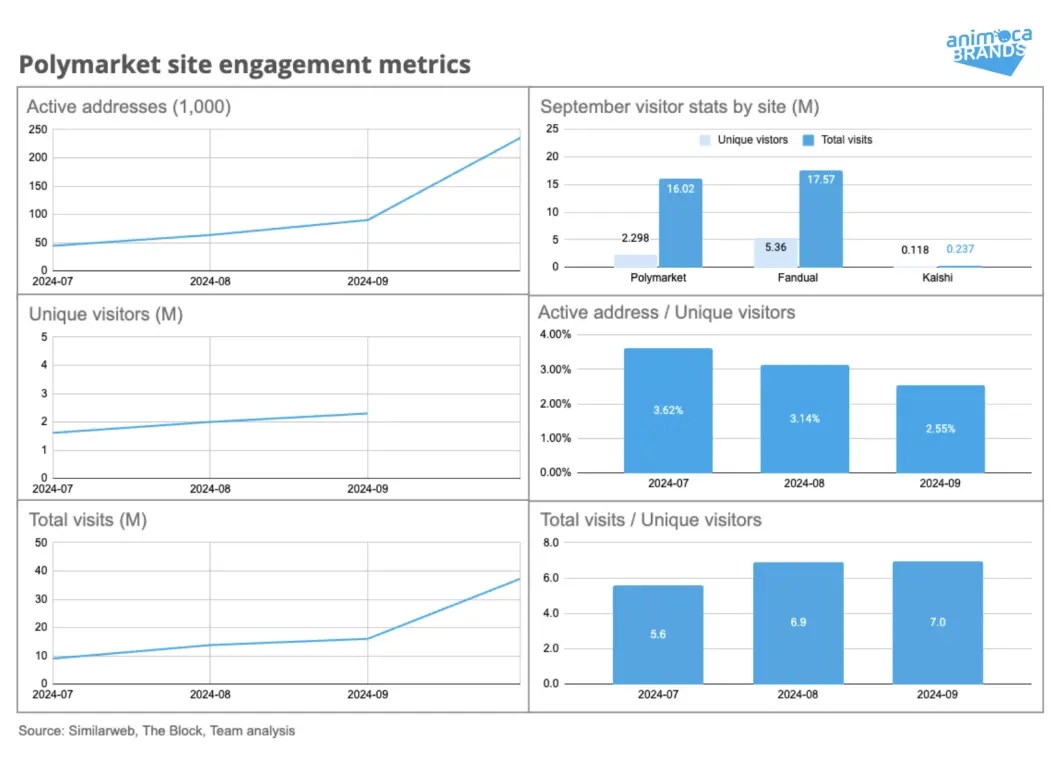

As Polymarket's trading volume and participant numbers hit new highs, its website traffic also surged. In September 2023, Polymarket had 2.3 million unique visitors, with total visits reaching 16 million. By October, monthly visits doubled to 35 million, placing it among popular betting platforms like FanDuel. FanDuel had 5 million unique visitors and 17 million total visits in September, while the regulated prediction trading site Kalshi had 118,000 unique visitors and 237,000 total visits in the same month, with Polymarket's performance far exceeding these platforms.

From the perspective of user engagement, the ratio of active traders to visitors on Polymarket was about 3% in July, but it has declined over the past three months. This indicates that the majority of Polymarket's audience primarily seeks information rather than engaging in trading. As Polymarket's visibility continues to rise, this trend becomes increasingly evident, reflecting its appeal as an information resource.

Additionally, the ratio of visits to unique visitors shows that website visitors average seven visits per month, indicating high engagement and stickiness among Polymarket users. This combination of high traffic and high engagement highlights Polymarket's potential not only as a trading platform but also as a significant source of trusted predictive information for major events.

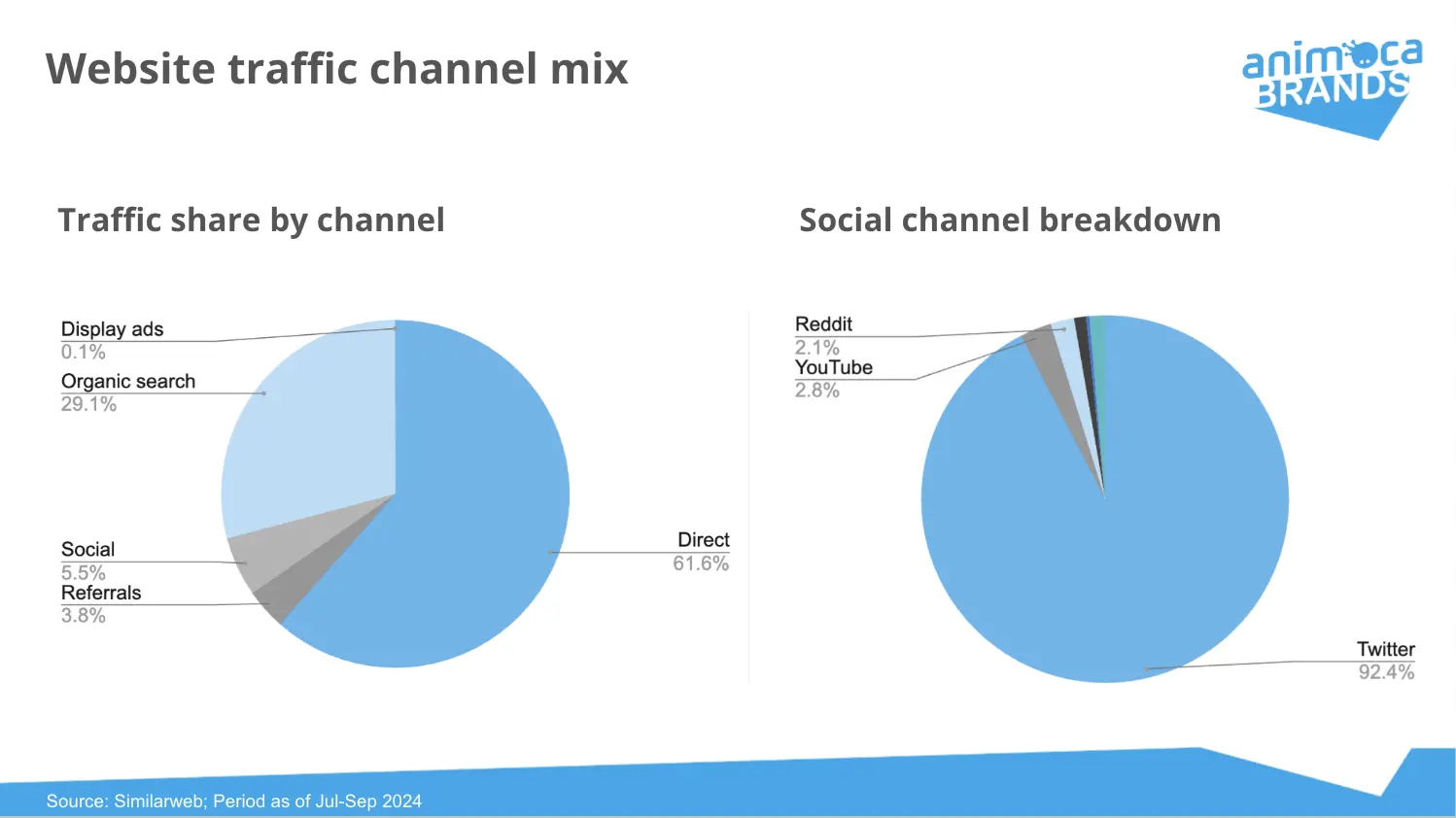

The primary source of traffic for Polymarket comes from direct URL access, indicating that most users are already familiar with the platform before visiting. Another 30% of visitors enter through organic search, suggesting that many users specifically search for Polymarket's name to access the site. Social media contributes about 5% of the traffic, with Twitter being the main source, aligning with Twitter's active role in cryptocurrency and election discussions.

It is noteworthy that paid traffic sources, such as paid search and display ads, account for a very low percentage, highlighting that the platform attracts users through brand awareness and organic interest rather than relying on paid advertising. This combination of traffic sources demonstrates Polymarket's growing influence among users, who increasingly view it as a reliable source of predictive information.

Geographically, over half of the traffic comes from the United States, followed closely by four allied countries closely related to the U.S., which are also significantly affected by U.S. election outcomes.

These observations suggest that most Polymarket users have established the platform as a fixed reference source, using it regularly to track significant events as they unfold. This trend aligns with CEO Shayne Coplan's view that Polymarket's value lies in providing "the most accurate information signals on the internet."

Market

Each event predicted on Polymarket typically contains one or more markets, each taking the form of binary outcome pairs. For example, in the "U.S. Election" event, independent markets include "Trump Wins Y/N" and "Harris Wins Y/N," along with some lower-priority markets like "Biden Wins Y/N."

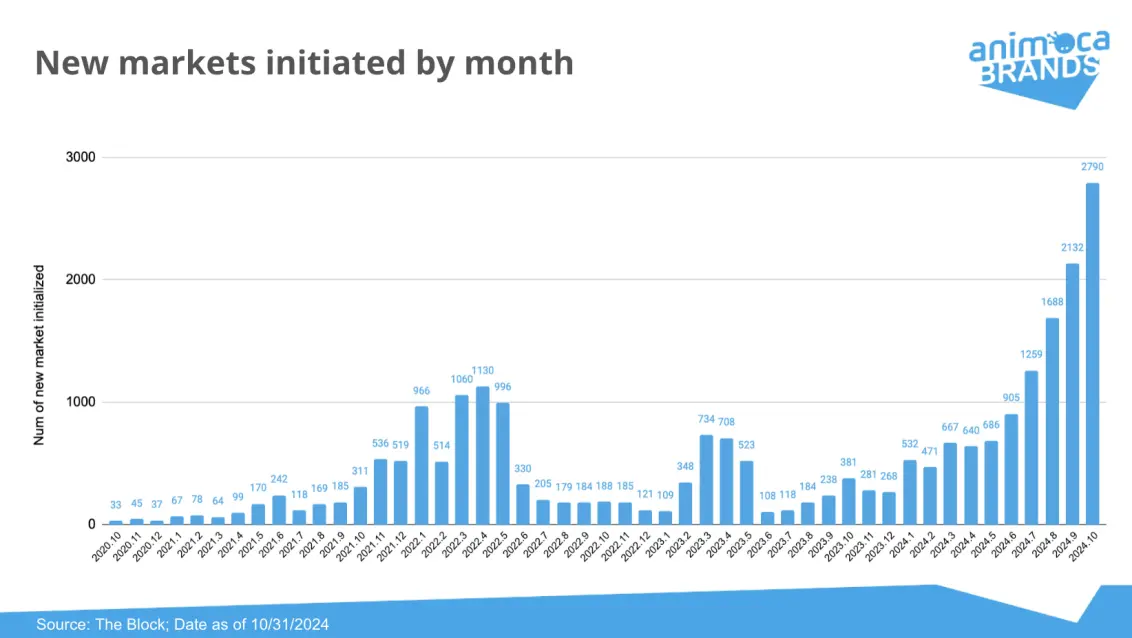

The Polymarket team is responsible for creating new markets while considering community input in the process. At the end of 2021 and the beginning of 2022, the team attempted to launch up to 2,000 markets per month, possibly to increase user engagement. However, this rapid pace eventually stabilized to several hundred markets per month. Starting in January 2024, market creation surged again, showing exponential growth, indicating that the recently added markets have received widespread recognition and positive feedback from users.

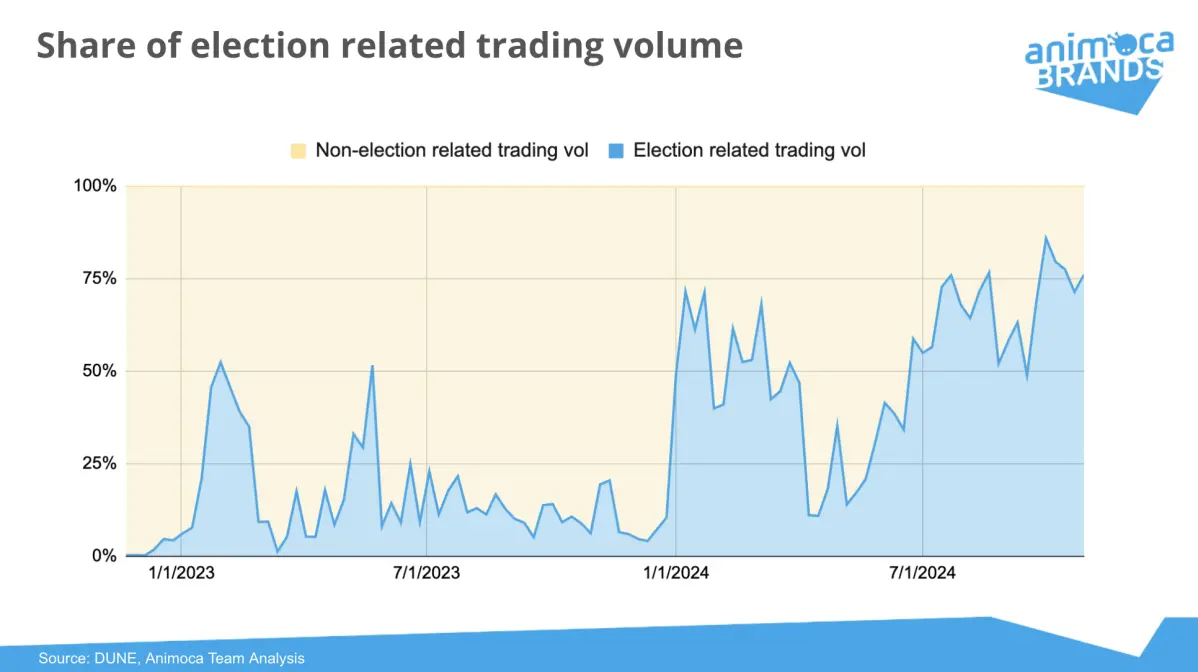

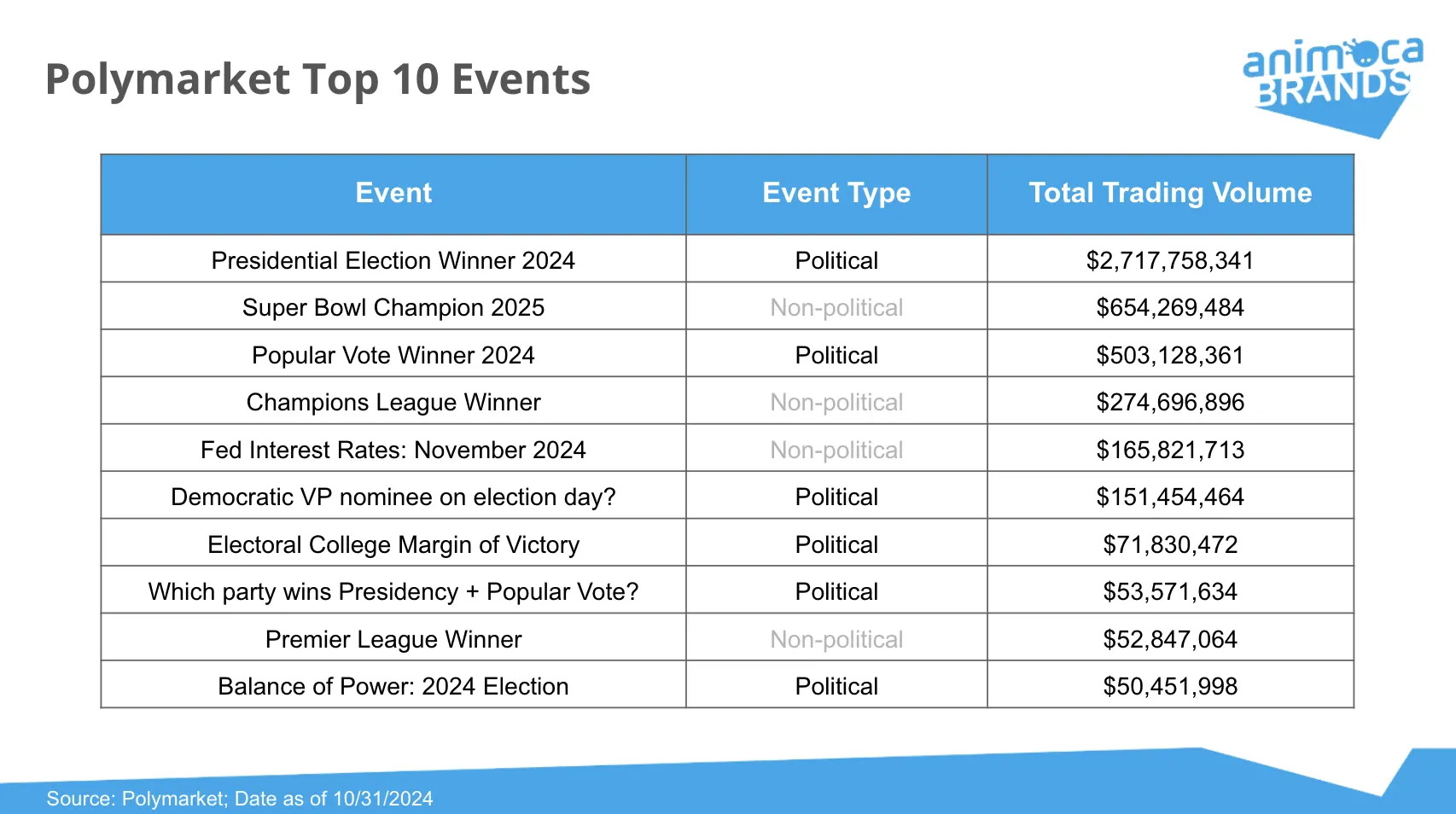

Since January 2024, markets related to the U.S. elections have become the main driver of Polymarket's trading volume, accounting for about 50% of total trading volume in the first half of 2024, and reaching over 75% as election interest surged. Interestingly, despite the spike in election-related trading volume, non-election markets still attract significant trading activity, accounting for nearly 25% of total trading volume. Among these, sports-related markets, such as predictions for the Super Bowl and the UEFA Champions League, stand out, demonstrating the diversity of user interests beyond the election cycle. This balance indicates that Polymarket's appeal is expanding, gradually positioning itself as a multifunctional prediction platform.

Users

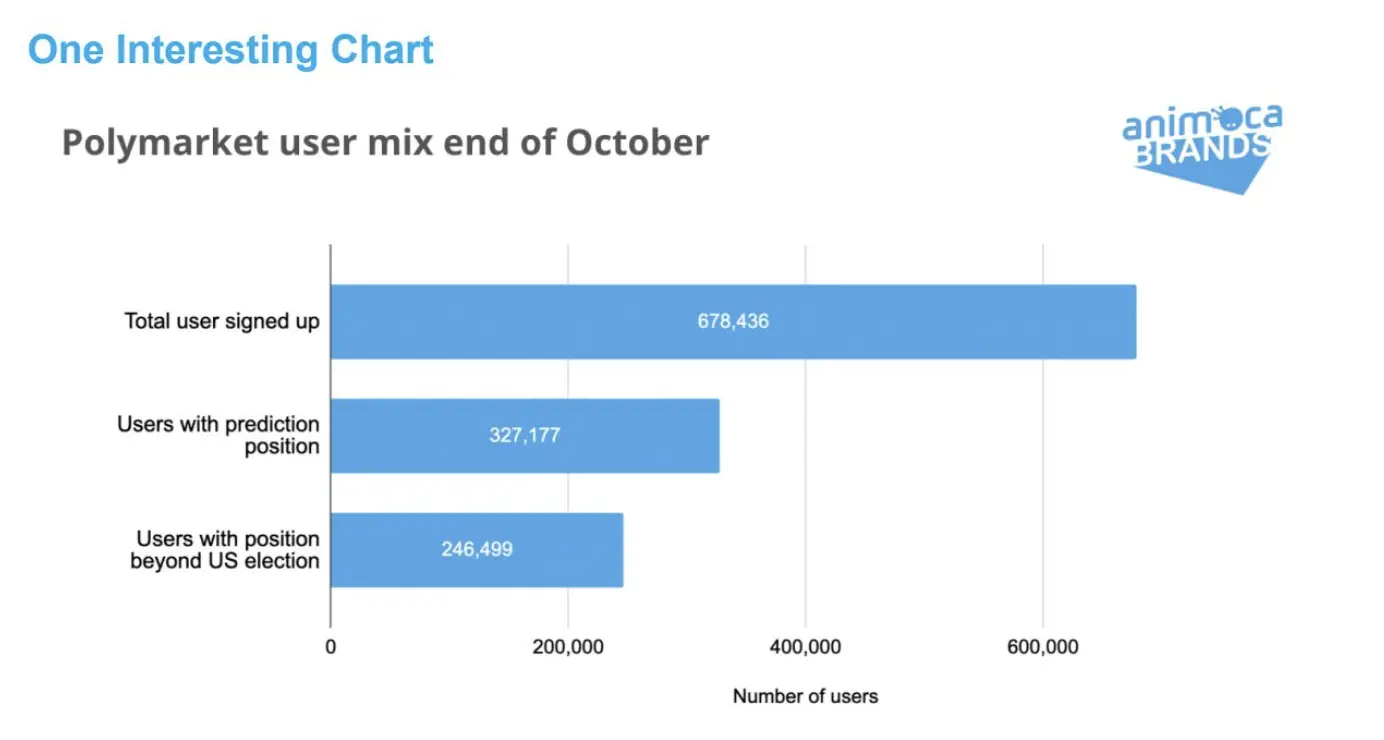

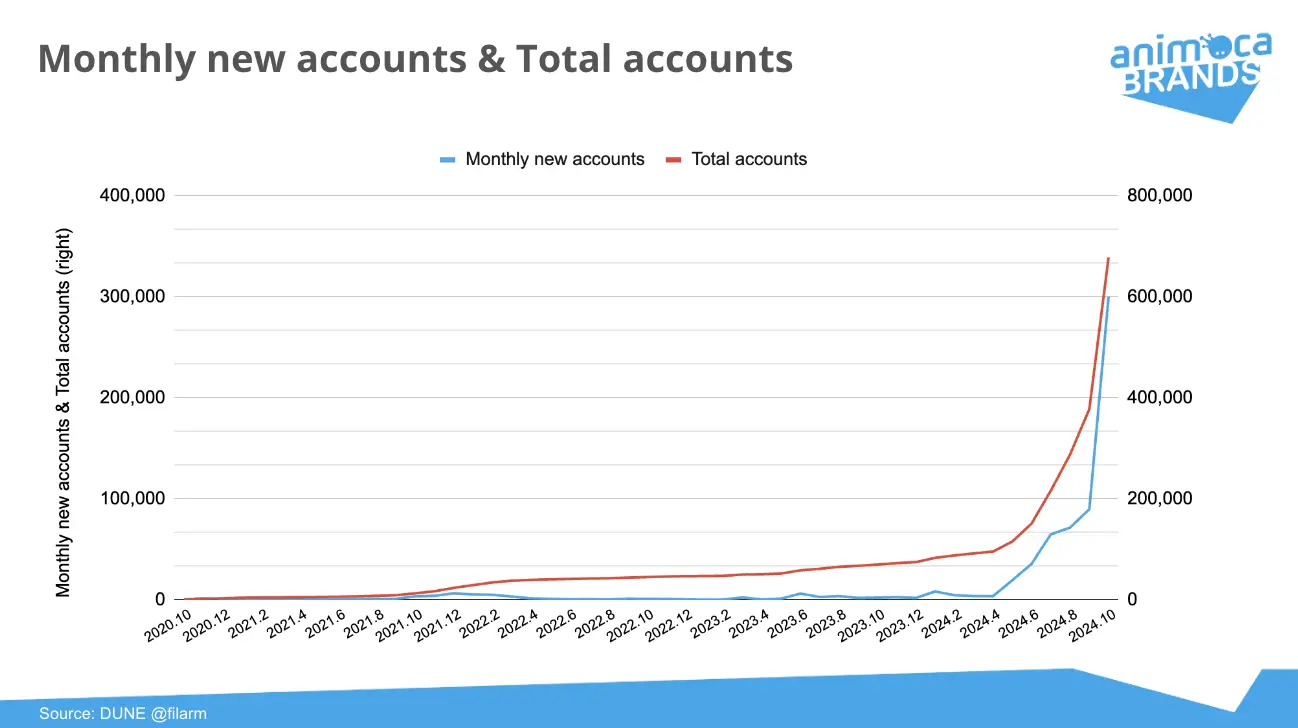

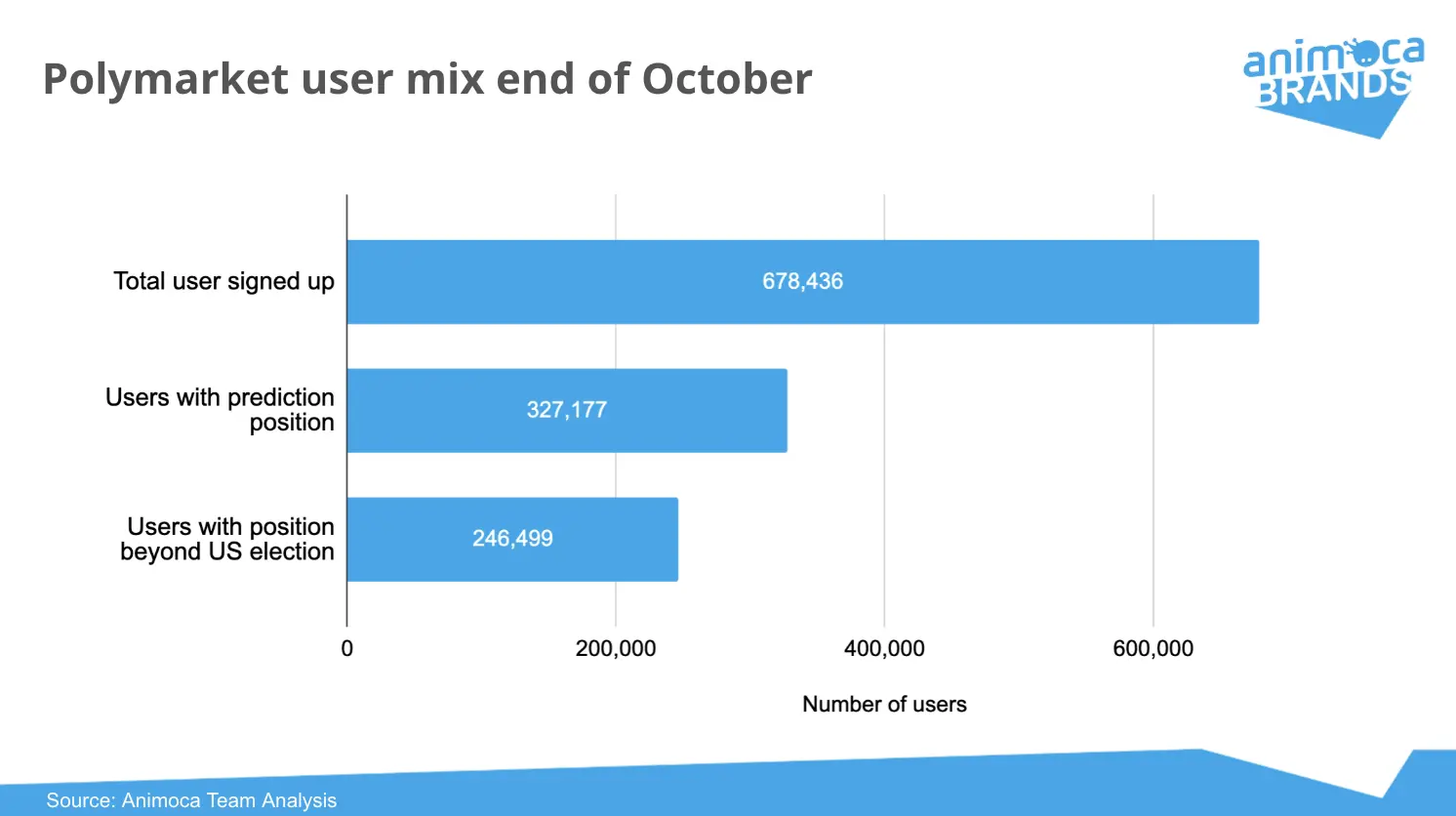

Since mid-2024, Polymarket has seen a surge in new user registrations, with over 300,000 new registered users in October alone. This rapid growth means that 86% of users joined the platform in the past six months. In October, the platform recorded 235,000 active trading addresses, accounting for 35% of all registered users.

As of November 3, there are a total of 327,000 users, with half of the registered users maintaining active positions. Among these active users, about 80,000 focus on markets related to the U.S. elections, while the remaining 247,000 engage in other market categories. This indicates that the significant participation in non-election markets reflects users' sustained interest in the platform, suggesting that this interest could support the platform's continued growth and relevance even after the election cycle ends.

A Global Perspective on the U.S.

These observations reveal an interesting phenomenon: although most visitors to Polymarket come from the U.S., only non-U.S. users can participate in trading due to regulatory restrictions. This creates a unique situation where users from other parts of the world are effectively predicting the next U.S. president, while Americans primarily act as observers.

Thus, Polymarket has become a platform where international participants provide a global perspective on U.S. political events, with the core goal of meeting the needs of an audience primarily based in the U.S.

How Polymarket Works

Prediction Market Mechanism

Prediction markets can be traced back to political betting in the 16th century, initially focusing on events like papal succession. These markets allow participants to bet on future outcomes and have gradually evolved into platforms that aggregate public opinions on uncertain events. In July 2018, prediction markets entered the crypto space with Augur, the first decentralized prediction platform built on Ethereum. Two years later, Polymarket launched, allowing users to deposit USDC and bet on the future outcomes of various events.

The operation of prediction markets is similar to futures markets: they create contracts that pay a fixed amount if a specific event occurs, and participants trade these contracts by submitting buy and sell offers. The price of the contracts at any given moment represents the market's consensus estimate of the probability of the event occurring.

Traditionally, prediction markets have been highly regarded for their efficient integration of diverse information, enhancing the accuracy of predictions, as discussed by James Surowiecki in "The Wisdom of Crowds." Prediction markets can capture people's views from various sources, continuously refining collective insights through participants' probability estimates.

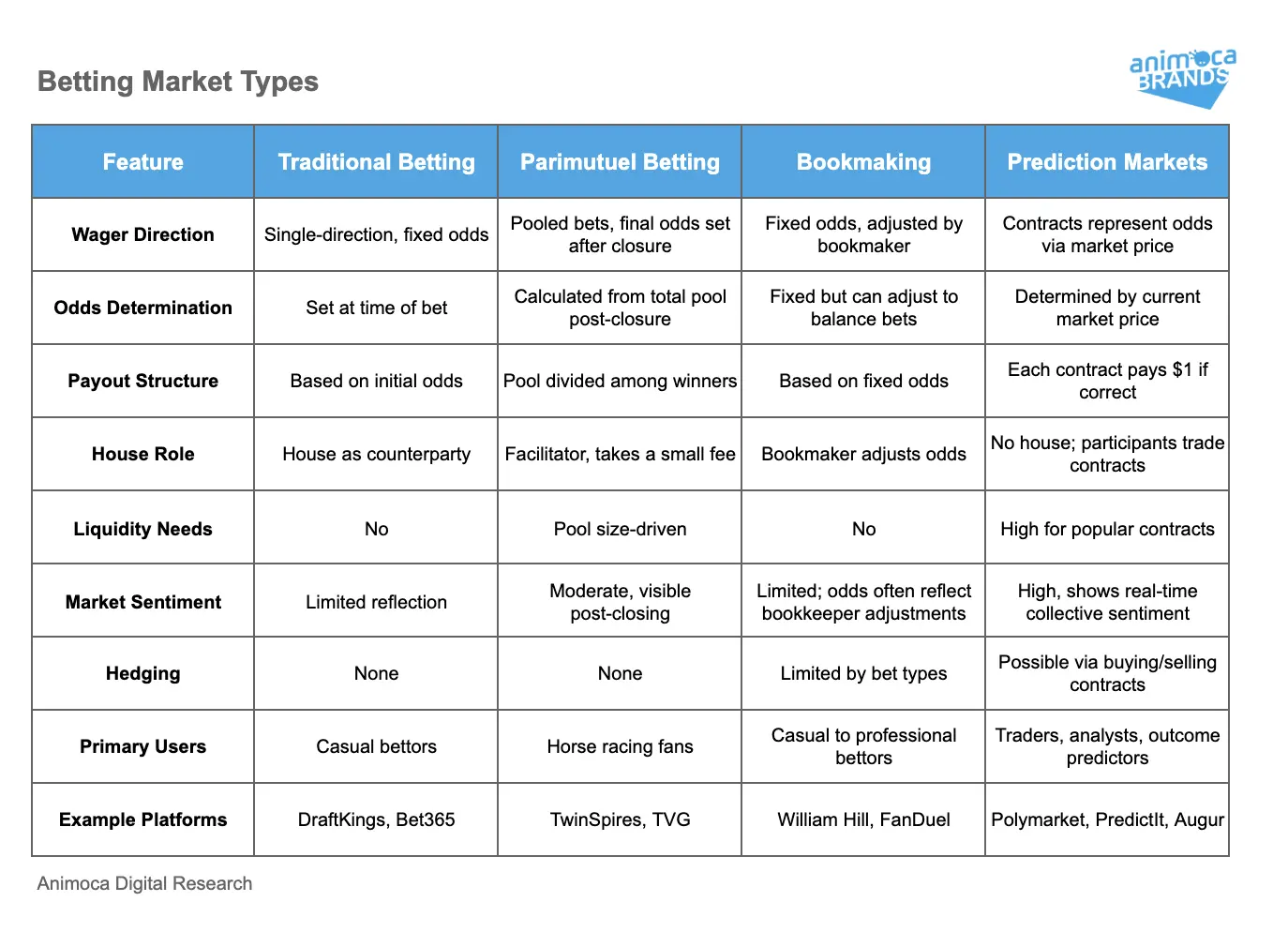

Differences from Traditional Betting

Although prediction markets have existed for a long time, traditional betting markets still attract more participants. To understand the reasons, we first need to take a closer look at betting markets.

There are several key differences between prediction markets and traditional betting markets. First, prediction markets are two-sided trading markets that allow participants to exit their positions at any time before the event outcome is determined. Second, prediction markets continuously update consensus odds, reflecting public sentiment in real-time, while traditional bookmakers primarily adjust odds to balance betting pools, ensuring that bookmakers minimize potential losses. This practice often leads bookmakers to overcorrect odds, distorting the true probabilities of events.

However, prediction markets also face unique challenges, particularly regarding liquidity. To facilitate smooth trading, platforms must ensure that contracts have sufficient liquidity, which requires stable sources of liquidity. This can be achieved through automated market makers (AMMs), similar to decentralized exchanges (DEXs), or through order books supported by market makers, akin to centralized exchanges (CEXs). Regardless of the method, incentives must be provided for liquidity providers, which increases costs for traders or the exchanges themselves.

Liquidity issues are particularly pronounced in low-attention events. Traditional betting meets varying demands by setting initial odds and pooling bets, while prediction markets rely on sufficient user interest to keep trading active. In the absence of adequate activity, prediction markets struggle to achieve meaningful odds, limiting their accuracy and appeal for low-traffic events.

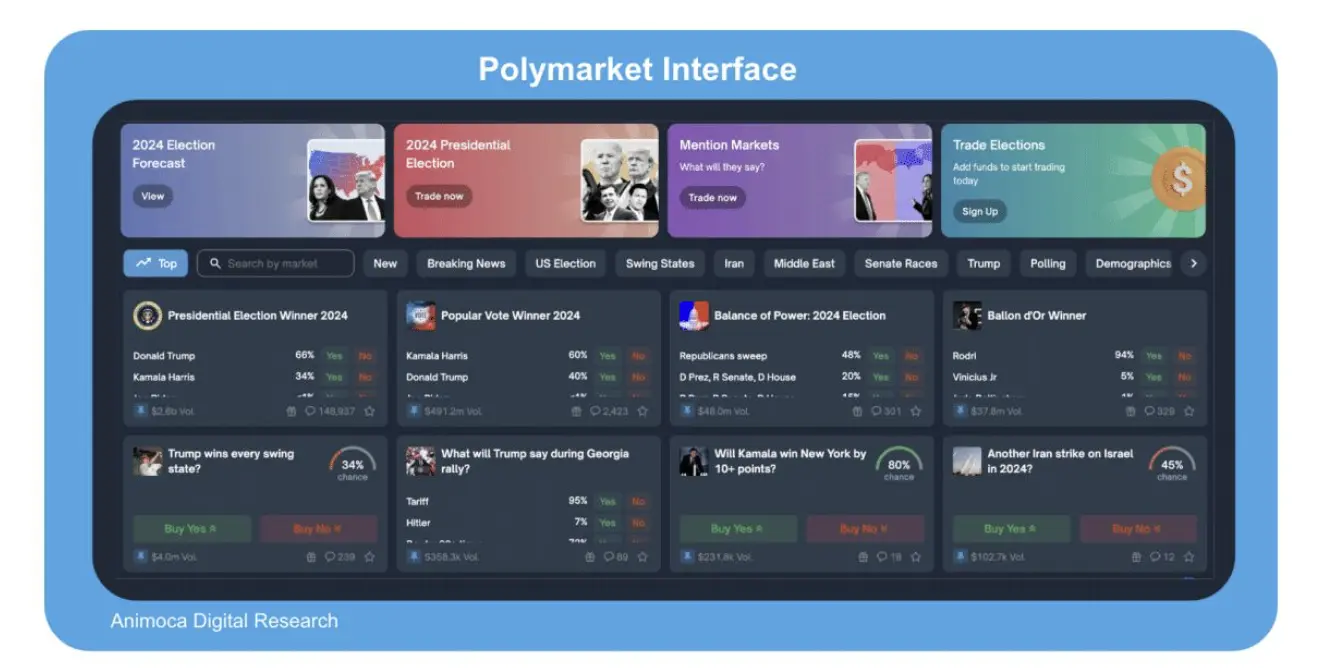

Polymarket's User Interface

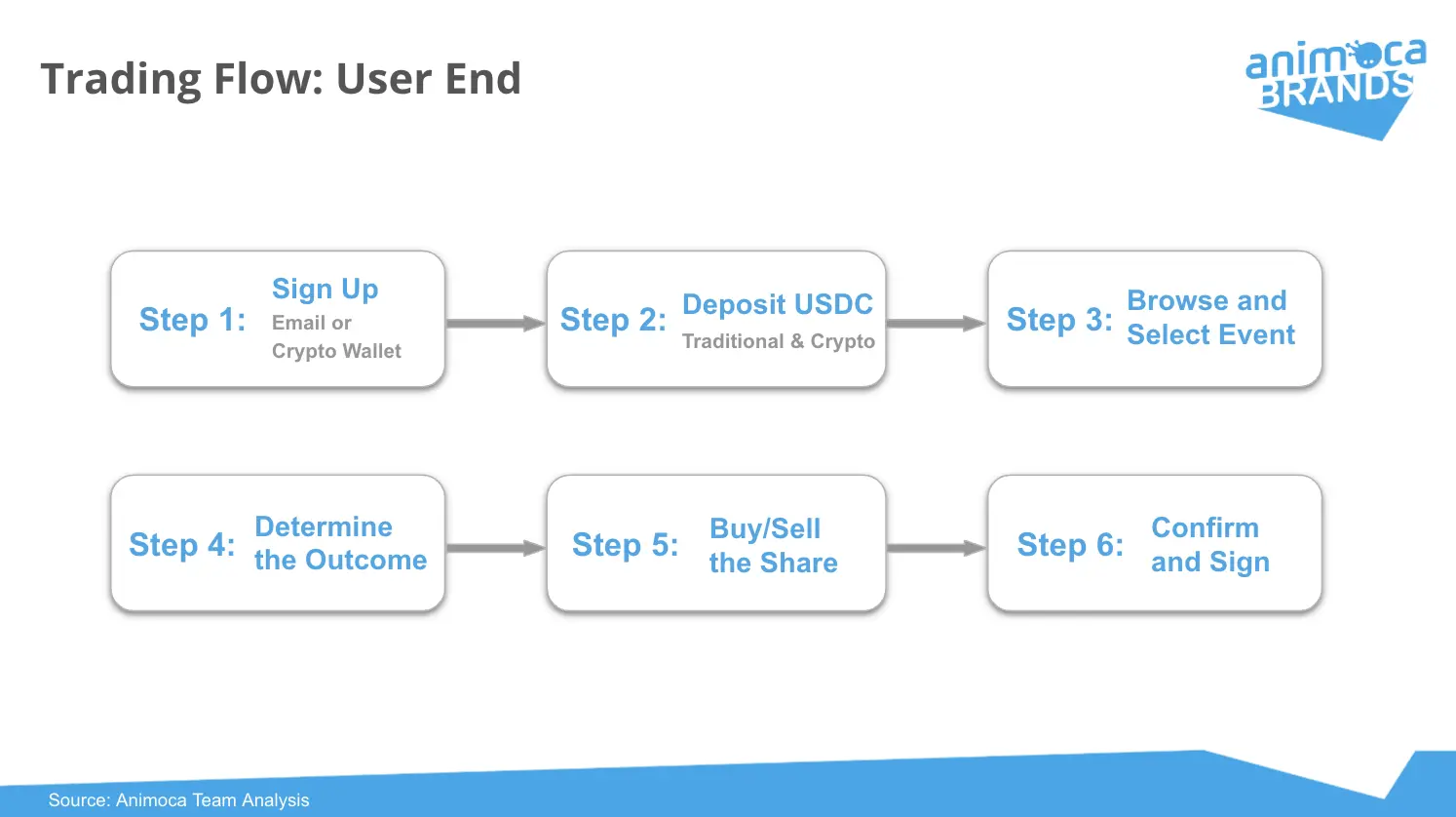

Polymarket stands out with its clean and smooth user experience. The platform uses USDC (a dollar-pegged stablecoin), which is a federally regulated stablecoin backed by the dollar, for trading and payments. Since transactions are entirely on-chain, using on-chain currency is essential.

The user journey begins with registration via email or a crypto wallet, followed by transferring USDC from an existing wallet to the platform or purchasing USDC directly with fiat through Moonpay. After browsing available markets and selecting an event, users can leverage real-time data to guide their predictions. The next step is to buy or sell based on these insights, with the interface displaying potential returns. Once the trade is confirmed, the user's account address completes the transaction. In case of disputes, users can also raise challenges to resolve events.

Trading

In Polymarket's peer-to-peer prediction market, trades occur directly between users, with prices naturally formed by user-driven orders. When a new market is launched, there are no shares or preset prices; traders post limit orders based on the price they are willing to pay, effectively acting as market makers. For binary events, users can bet on "YES" or "NO" outcomes. When the total amount of "YES" and "NO" orders reaches $1.00, these orders will pair, establishing the initial market price. For example, a $0.60 "YES" order will pair with a $0.40 "NO" order to set the price. As trading progresses, buy and sell orders can match directly at the existing price, increasing liquidity.

Polymarket uses ERC-1155 tokens, known as "outcome tokens," to represent these binary predictions. In addition to binary choices, the platform also supports more complex market scenarios:

- Category markets: Users choose from multiple mutually exclusive outcomes (e.g., A, B, C).

- Scalar markets: Break down broad questions into a series of yes/no contracts.

- Combination markets: Allow layered predictions through combinations of multiple questions.

This diversification expands the platform's flexibility, allowing for the future creation of more types of events.

When an event concludes on Polymarket, profits are distributed based on the winning outcome. The value of the winning shares is $1.00, while the value of the losing shares is $0.00. The market will settle when the outcome is clear and meets the established rules. If a user disagrees with the settlement result, they can challenge it by posting a $750 USDC bond, which will only be refunded if the challenge is successful, providing an incentive for valid disputes and avoiding frivolous claims.

Technical Architecture

Polymarket's technical design includes several components that ensure the prediction market operates in a decentralized manner.

The Gnosis Conditional Token Framework (CTF) provides the infrastructure for creating conditional tokens, allowing tokens to be created for various event outcomes. The CTF exchange is the on-chain component of Polymarket's order book, supporting atomic swaps between CTF ERC-1155 assets and ERC-20 collateral, settling matched orders in a non-custodial manner. Meanwhile, offline operators are responsible for order matching and trade submission, managing outstanding orders and allowing for immediate offline order placement and cancellation.

To match betting information, the UMA CTF adapter connects optimistic oracles with CTF conditions, initializing markets and settling conditions by querying the UMA oracle and obtaining settlement data. The UMA optimistic oracle resolves prediction market issues and allows for dispute resolution during the challenge period, ensuring accurate on-chain reporting of off-chain events. Another component, the NegRisk adapter, enables Gnosis CTF to manage binary markets, converting "NO" tokens into collateralized "YES" tokens and integrating binary outcomes into a unified market structure. Finally, the NegRisk Exchange is a simplified trading contract for Polymarket, allowing trading within the NegRisk market through a central limit order book (CLOB).

Company Overview

Team

Polymarket's team is led by three key figures:

- Shayne Coplan, Founder and CEO: Shayne is a New Yorker who entered the Web3 space at 15, starting with Bitcoin mining. He dropped out of New York University in 2017 and subsequently launched Polymarket in 2020.

- David Rosenberg, Vice President of Business Development and Strategy: David has extensive experience in business development and strategy, having worked at Foursquare, GIPHY, and Snap. He joined Polymarket in June 2020 after serving as Director of Strategy at Snap for four years. David graduated from the University of Cambridge in 2011.

- Liam Kovatch, Head of Engineering: Liam dropped out of Columbia University in 2018 to begin his DeFi career. He founded Paradigm Labs and served as Chief Engineer at 0x. He joined Polymarket in 2021 and quickly rose to lead the engineering team.

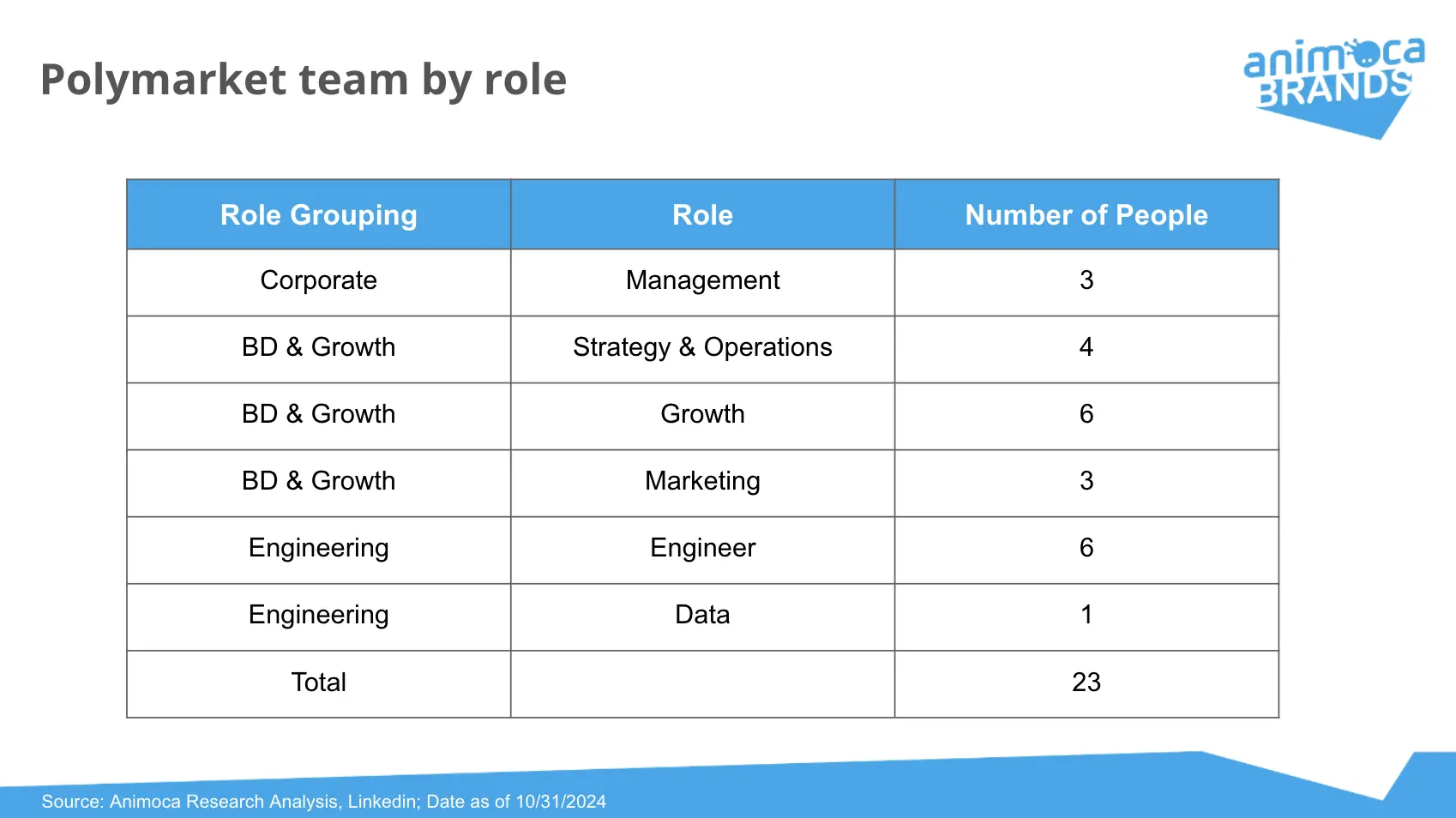

The rest of the company is organized around business development and engineering, with 12 members focused on growth, marketing, and strategy, and 8 members focused on engineering and data, bringing the total employee count to 23. The company also employs part-time or outsourced professionals to support other functions such as finance. Most team members are based in New York.

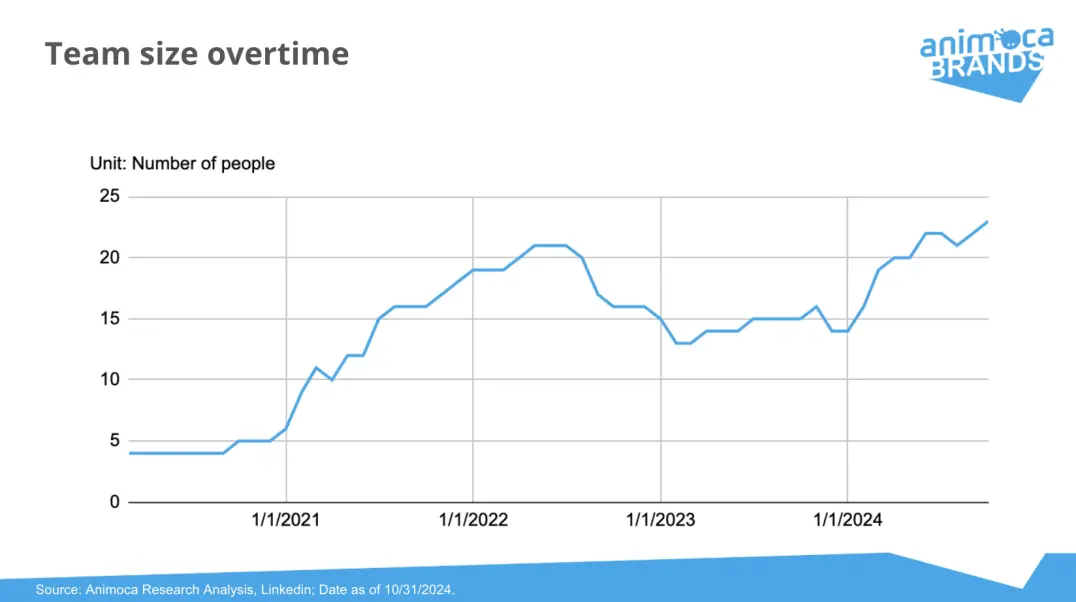

The size of Polymarket's team has changed over time. The company started with only four employees, and after achieving initial success in 2020, the team rapidly expanded to about 20 employees by mid-2022. However, in the second half of 2022, the team size was reduced due to the impact of the CFTC investigation, maintaining a lean structure until early 2024.

In early 2024, the company began to expand its team again, indicating that leadership expects the operational environment of the platform to become more favorable in response to a subsequent surge in trading volume.

Operational Profit and Loss

Currently, Polymarket does not charge any fees for platform usage, including buying and selling positions, reward distributions, or fund deposits and withdrawals. Previously, the platform charged liquidity provider (LP) fees for trades to compensate liquidity providers under the automated market-making mechanism, but this fee was eliminated after transitioning to an order book structure at the end of 2022. While there are fees incurred when using third-party services to convert fiat to USDC, these fees are paid to the service providers, not to Polymarket.

In addition to not charging fees, Polymarket also supports platform operations by subsidizing operational costs, including market-making rewards for the order book, gas fees for on-chain transactions, and website maintenance. Reports indicate that Polymarket has distributed over $3 million in USDC incentives to date, with popular markets offering liquidity providers up to 600 USDC in rewards daily.

Polymarket's early cash flow may have been supported by ecosystem incentives. The platform received approximately 160,000 UMA tokens from UMA, valued between $40,000 and $48,000, as an incentive for adopting the UMA tech stack. However, there is no public information regarding whether Polymarket received incentives or profit-sharing from its exclusive fiat-to-USDC partner Moonpay or its blockchain partner Polygon. These incentives are crucial for maintaining daily operations, especially considering the company raised only $4 million before mid-2024.

Although no formal profit plan has been announced, the CEO has hinted at the possibility of introducing platform usage fees in the future. On the other hand, given their recent success in fundraising, the team may not be in a hurry to seek profit sources but rather continue to subsidize platform operations to solidify their leading position in the prediction market space. Considering that over 95% of the platform's traffic is for content consumption rather than trading, the platform could quickly generate cash by increasing display advertising instead of charging transaction fees.

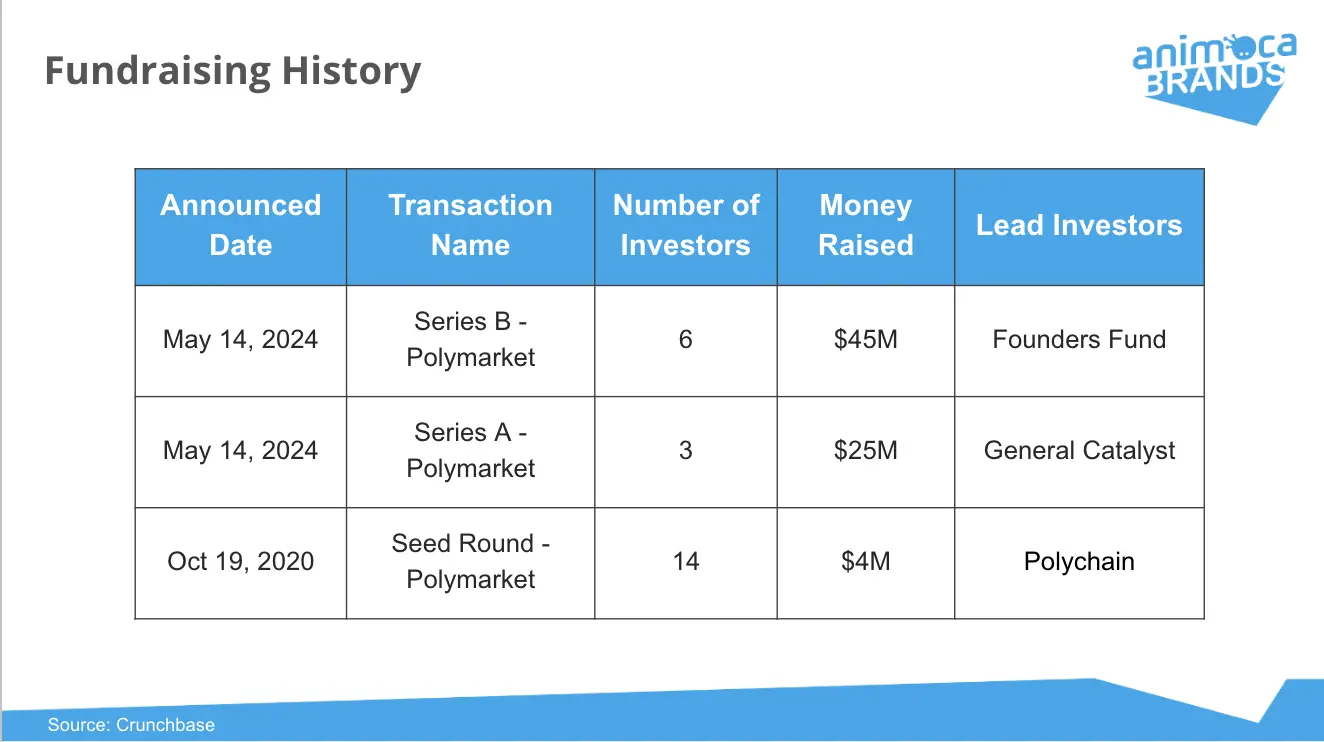

Funding Situation

Polymarket's first round of funding occurred in 2020, successfully raising $4 million. In May 2024, the company closed two rounds of funding, attracting $70 million from nine investors. This funding is expected to significantly enhance Polymarket's scalability, including strengthening talent acquisition and market coverage.

It is currently unconfirmed whether there are plans for a token generation event (TGE), but recent reports indicate that Polymarket is exploring a possible $50 million funding round. The company has also hinted at the potential launch of a token aimed at allowing users to verify the outcomes of real-world events.

Given Polymarket's rapid fundraising pace and the traditional IPO challenges it may face due to its overseas structure, the likelihood of a token generation event appears quite high. As for the company's valuation, the valuation details were not disclosed in the funding rounds. However, based on the $45 million raised in the B round, it can be reasonably speculated that Polymarket's valuation may have reached the billion-dollar level.

SWOT Analysis

Although Polymarket has been operating for four years, it has only recently gained significant market attention and remains in a highly volatile phase. Instead of speculating about the future, it is clearer to examine its potential development path through a SWOT analysis:

Strengths

Polymarket's greatest strength lies in its unprecedented public attention. This high level of exposure attracts a large number of participants, creating a virtuous cycle—more participation means more accurate and trustworthy predictions. This self-reinforcing cycle, if managed well, can solidify Polymarket's market leadership.

Additionally, Polymarket's on-chain architecture distinguishes it from traditional prediction markets, ensuring the highest level of transparency and thereby building trust. However, compared to other on-chain competitors, this advantage is not significant, as Polymarket lacks proprietary intellectual property or a dedicated blockchain, making it easier for other projects to replicate its model.

Weaknesses

The liquidity issues surrounding niche events are a major bottleneck for Polymarket as it expands into diverse topics. This problem is an inherent challenge of prediction market design, and the order book model exacerbates this issue. Unlike traditional sports bookmakers that can easily cover a wide range of events, Polymarket must provide sufficient incentives to narrow spreads and improve liquidity for less popular topics.

Another limitation is that, due to Polymarket's team being U.S.-centric, the platform inherently excludes U.S. users from participating in trading. This mismatch may hinder its global development and could continue to face regulatory issues in the U.S. The "Super Bowl Champion" market remains the most popular sports event on the platform, indicating that its strategy still heavily favors the U.S. audience.

Opportunities

With its growing reputation for reliable crowdsourced event predictions, Polymarket is poised to become a core component of media and social content consumption. This integration could bring more traffic and open up new revenue streams.

Polymarket's data also has tremendous potential to become an alternative asset for quantitative trading. With its high reliability in predictions, the platform can attract more attention from institutional investors and algorithmic traders, thereby stimulating demand for broader event predictions.

From a geographical perspective, Polymarket's success can quickly expand to regions with growing Web3 adoption, such as Asia and the Middle East. There will also be strong demand for regional event predictions in local languages.

Threats

Like other similar platforms, Polymarket faces legal uncertainties. Regulatory challenges have already impacted platforms like Betfair and Predict It, raising questions about whether peer-to-peer predictions will be classified as gambling, securities, or other financial products. Increased regulatory scrutiny poses a significant risk.

Another operational threat is the possibility of market manipulation. As Polymarket is a decentralized platform, individuals or groups with substantial capital may influence odds, leading to misleading trends and undermining market trust in its predictions.

Conclusion

Since early 2024, Polymarket has experienced explosive growth, successfully positioning itself as a crowdsourced prediction platform for major events, particularly filling a gap in media coverage and social discussions surrounding the U.S. elections. In the past six months, the platform has attracted over 500 million users, with total assets deposited reaching $400 million.

Our analysis indicates that Polymarket's strong momentum is likely to continue even after the elections conclude. In media terms, citing Polymarket predictions has become a routine practice for traditional media and social platforms, while the majority of platform users have already held positions on topics beyond the elections, demonstrating ongoing engagement in diverse events.

In the long run, Polymarket's growth will depend on clever market positioning, content strategy, and responses to the regulatory environment. As the platform's popularity grows, public attention and competition from traditional and Web3 platforms will also increase. To fully leverage its exposure and influence, the Polymarket team must make strategic choices to solidify its position while maintaining the public interest it has already cultivated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。