AERO is Coinbase Ventures' largest single investment to date.

Original Title: "Aerodrome: The Onchain Liquidity Engine"

Written by: Bryan Tan, Arthur Cheong

Translated by: zhouzhou, BlockBeats

Editor’s Note: This article mainly discusses Aerodrome's role as a liquidity engine on the Base chain and its growth potential. By addressing issues such as token issuance and stakeholder incentives, Aerodrome has successfully attracted significant trading volume and established a solid liquidity foundation. The article also points out that Coinbase's support and the expansion of the Base chain will drive further growth for Aerodrome, with expectations for TVL to reach $4 billion and monthly trading volume to hit $50 billion. Overall, Aerodrome is viewed positively as a key infrastructure in the DeFi ecosystem.

The following is the original content (reorganized for readability):

Before introducing Aerodrome, let's first understand the background of DEX.

Breaking the Stalemate of DEX: Why Traditional Models Struggle

In the development of DEX, a core challenge has emerged: how to achieve a balance among multiple stakeholders while maintaining sustainable growth. Traditional DEX models have always been plagued by two main challenges:

1. The Balance of Stakeholders:

DEX needs to serve three different groups simultaneously: traders seeking efficient markets, LPs pursuing yields, and token holders demanding value appreciation. Uniswap is a typical case of this balance issue, as the platform allocates 100% of fees to LPs, preventing UNI holders from directly benefiting from protocol revenue. Meanwhile, Curve attempted a compromise by distributing CRV issuance equally between LPs and veCRV holders, but this model also faces sustainability issues due to reduced issuance.

What is the result? Continuous tug-of-war among stakeholders often leads to dissatisfaction for all parties.

2. The Token Emission Dilemma:

The DeFi boom of 2020/21 exposed the drawbacks of fixed emission schedules. Numerous forks of Uniswap v2 competed for liquidity by attracting users through inflationary methods, leading to unsustainable competition. Curve's innovative veCRV system introduced a bribery mechanism to guide liquidity, but it also had unintended consequences: voters began to seek personal benefits through bribery rather than supporting pools that could generate sustainable income for the protocol.

Even Andre Cronje's Solidly attempted to address these issues, but its design flaws significantly undermined its effectiveness: excessive early issuance and abuse of token whitelists ultimately affected Solidly's viability.

Each generation of DEX design has attempted to solve these fundamental problems but has failed to fully crack them—until now.

Aerodrome: The Revolution of MetaDEX

Aerodrome combines the best features of previous DEX generations: it employs a token economic model inspired by Curve and Convex to optimize governance and token issuance, as well as a Uni v3-style concentrated automated market maker for efficient capital exchange, while improving upon Solidly's code base.

These features provide solutions to align the incentive mechanisms of various stakeholders, making Aerodrome the preferred trading venue for users.

- veAERO holders: Can earn 100% of the fees and bribery rewards from the pools they vote for. This mechanism incentivizes them to direct token issuance towards high-volume, high-fee pools, benefiting the protocol as a whole.

- Liquidity providers: Receive 100% of AERO issuance rewards, incentivizing them to allocate capital to the highest-yielding pools.

- Traders: Enjoy deep liquidity on the DEX, resulting in better execution compared to other venues.

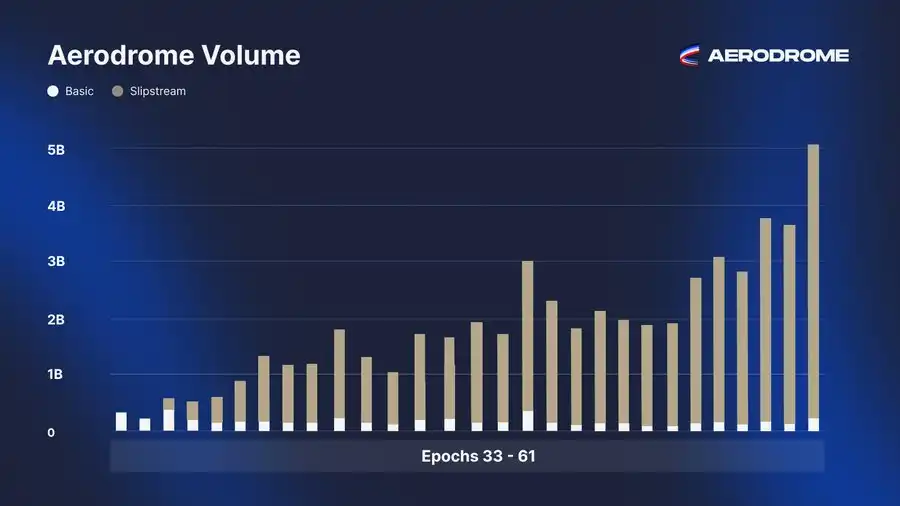

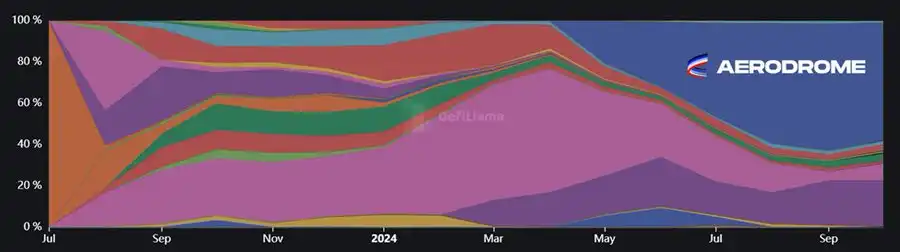

Notably, since the launch of Aerodrome Slipstream (a Uni v3-style clAMM) in April 2024, Aerodrome's DEX market share on the Base chain has surged to 63%, successfully replacing Uniswap's position.

Source: DeFiLlama as of 3rd Nov 2024

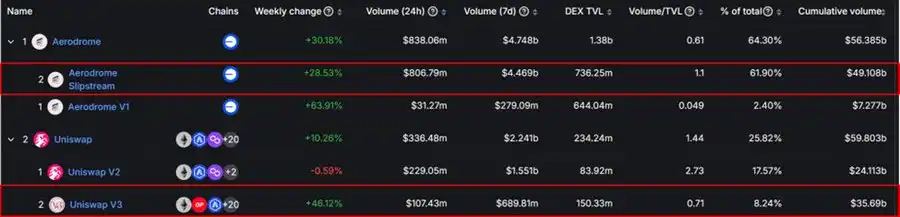

Aerodrome Slipstream has achieved growth in total trading volume while exhibiting higher overall capital efficiency compared to Uniswap V3 on the Base chain. This dominance is even more pronounced considering the fraudulent token pools present on Uniswap.

Source: DeFiLlama as of 3rd Nov 2024

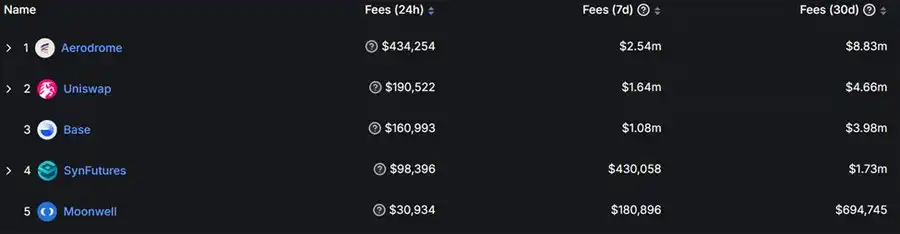

Additionally, Aerodrome generates the highest fee revenue among all dApps on the Base chain.

Source: DeFiLlama as of 3rd Nov 2024

The Rise of the Decentralized Exchange Giant: Aerodrome's Rapid Ascent

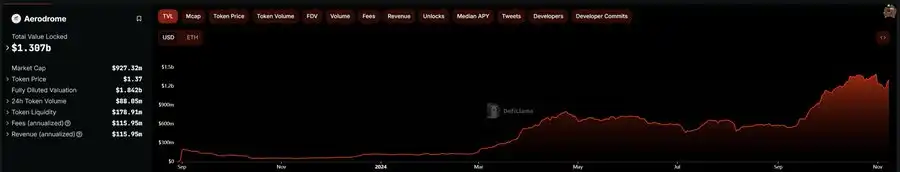

In the past year, Aerodrome's total locked value has skyrocketed 12 times to $1.3 billion, accounting for about 50% of the total TVL on the Base chain. Notably, despite significant market volatility, Aerodrome's TVL has continued to grow from March to September, demonstrating strong resilience.

Source: DeFiLlama as of 3rd Nov 2024

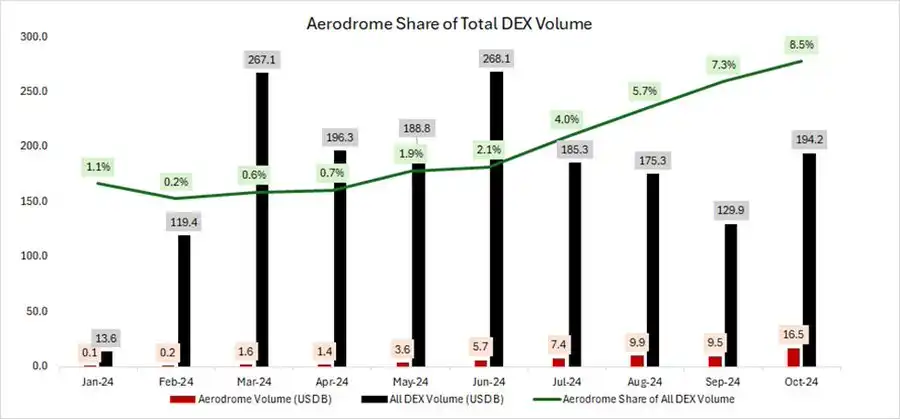

Meanwhile, Aerodrome's monthly trading volume has surged 111 times, reaching $16.5 billion in October. Furthermore, Aerodrome's share of overall DEX trading volume has risen to 8.5%. Even more impressively, despite a decline in overall DEX trading volume in recent months, Aerodrome has maintained its growth in trading volume.

The Coinbase Effect

Base L2 plays a key role in Coinbase's strategy, aimed at promoting the utility of cryptocurrencies and simplifying the complexities of on-chain transactions. Coinbase has led several ecosystem initiatives, such as integrating Base into the Coinbase smart wallet, hosting hackathons, and partnering with institutions like Stripe to support fiat-to-crypto conversions on Base. Due to these initiatives, Base has now become the largest Rollup, with a locked value of $2.7 billion, and these funds are being effectively utilized on-chain.

Source: DeFiLlama as of 3rd Nov 2024

As the largest dApp on the Base chain, Aerodrome is benefiting from Base's rapid expansion. The daily active users and daily trading volume on Base have steadily increased over the year, further driving the usage of Aerodrome.

Source: Artemis

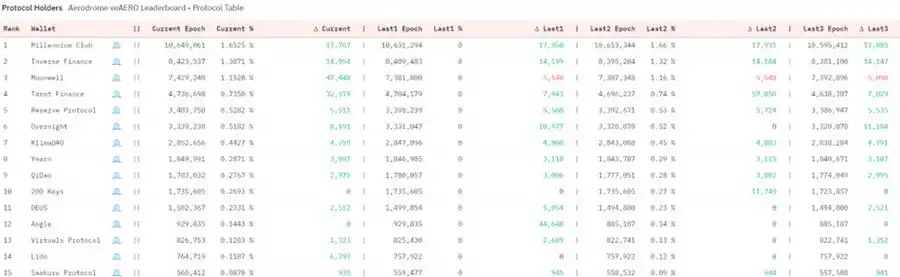

Protocols on the Base chain hold nearly 10% of veAERO, enhancing the liquidity of their governance tokens by locking AERO and directing token issuance to their own pools. As the number of users and economic activity on Base expands, it is expected that future protocols launched on Base will adopt similar strategies, thereby driving demand for AERO tokens.

The economic activity on the Base chain has also increased due to Coinbase's decision to launch cbBTC to challenge WBTC. Since its launch on September 12, cbBTC's TVL has grown to $839 million.

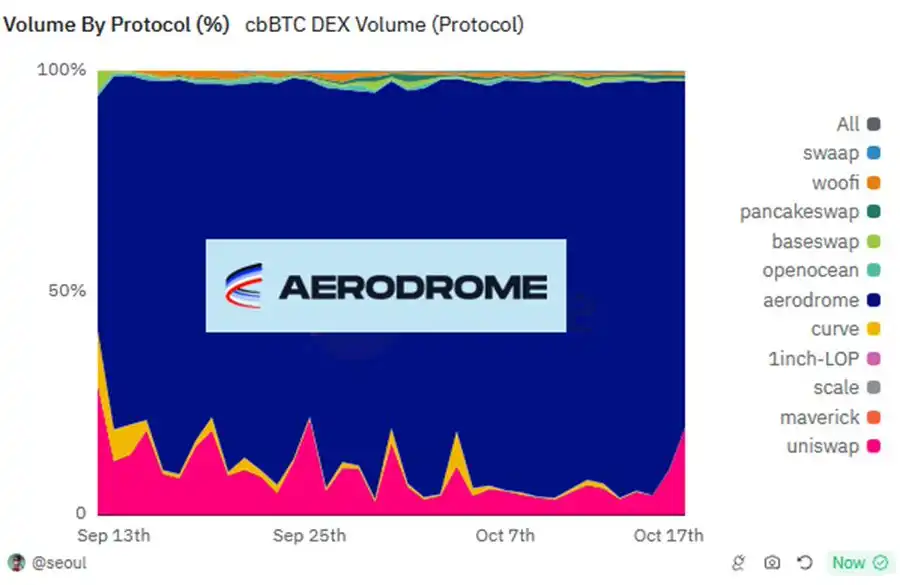

In this development, Aerodrome is the biggest beneficiary, as it consistently captures about 80% of the trading volume for cbBTC trading pairs. This is not surprising, as cbBTC is interchangeable on-chain with BTC on Coinbase CEX, which will drive arbitrage liquidity between CEX and DEX. As the largest and most liquid trading venue for cbBTC on-chain, Aerodrome naturally becomes the platform for most arbitrage flows.

Source: @seoulon Dune Analytics

In addition, we believe Coinbase has ample reason to support Aerodrome's growth. Coinbase Ventures has accumulated a significant AERO position (approximately $20 million), which we consider to be Coinbase Ventures' largest single investment to date. They acquired these AERO tokens through the open market and locked a portion of them to obtain veAERO.

Coinbase Ventures is an active participant in Aerodrome's governance, voting to direct AERO's token issuance towards the cbBTC pool, further solidifying Aerodrome's market dominance. This also reaffirms the close ties between Aerodrome, Base, and Coinbase, positioning the protocol as a cornerstone financial infrastructure for Base L2.

The DeFi Renaissance on Base

As outlined in our theory of the DeFi renaissance, we believe DeFi is on the verge of a new wave of liquidity driven by innovation. Given Base's strong competitive advantages as a leading L2 and its direct connection to Coinbase's distribution channels, we see Base as an ideal candidate for a thriving DeFi ecosystem.

Looking ahead, Base is set to become the primary on-chain trading venue for retail trading, arbitrage volumes, and stablecoin forex flows. As the lifeblood of liquidity on Base, Aerodrome stands to gain significantly from this future realization.

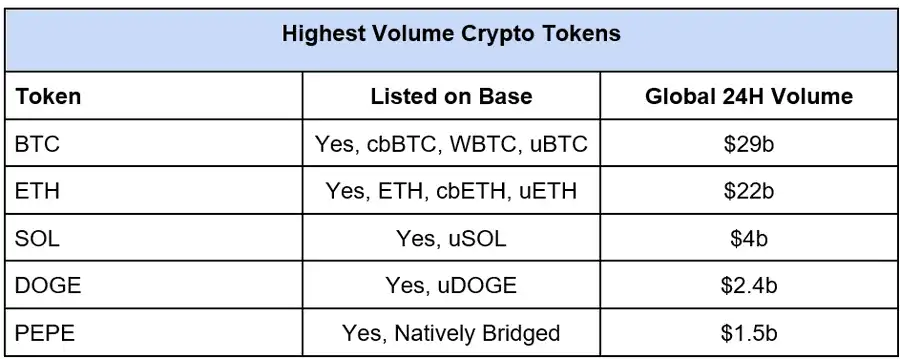

With the launch of cbETH and cbBTC trading pairs, we wouldn't be surprised if Coinbase expands its coverage of wrapped assets to Base. Having high-volume trading pairs like cbSOL, cbDOGE, and cbPEPE would incentivize more DEX/CEX arbitrage flows to migrate to Base and Coinbase. Additionally, this would greatly enhance the user experience for Base users, allowing them to trade native tokens from other chains without the cumbersome bridging process, making the trading experience on Aerodrome similar to that of CEX exchanges.

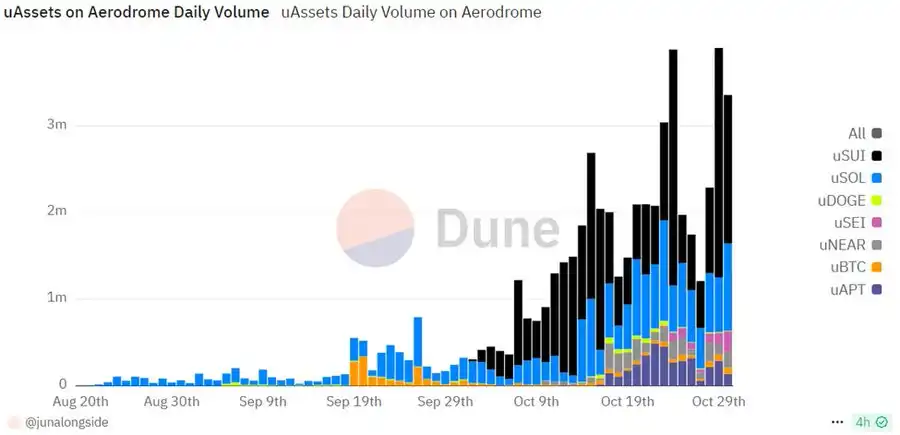

We have already seen early signs of this scenario, thanks to wrapped assets supported by the Universal Asset protocol. Aerodrome traders can now trade popular assets like SOL and DOGE without leaving the Base chain.

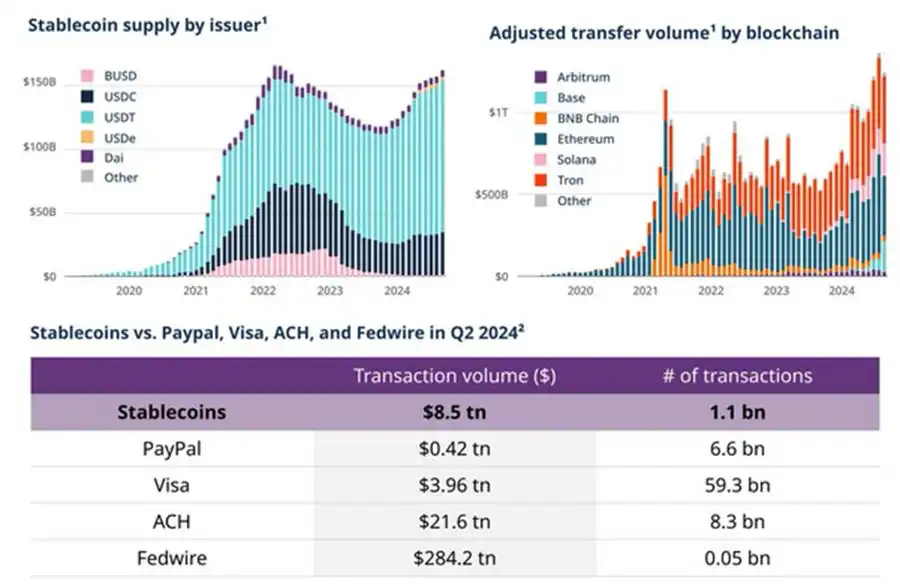

Stablecoin trading volume is also a promising growth area that could significantly drive economic activity on Base. Following Coinbase's acquisition of a stake in Circle in 2023, they now have both the vested interest and capability to promote the broader use of Circle's stablecoin on Base.

In addition to USDC and EURC, we believe other major high-volume global currencies, such as the Japanese yen and British pound, may also launch on Base in the future. Aerodrome has already begun to tap into this vast market, supporting liquidity pools for USDC and EURC, which currently have a daily trading volume of $70 billion.

Another favorable development frontier for Aerodrome is the rise of AI agents as active participants in DeFi protocols. We have seen preliminary manifestations of this trend, especially in the past week, with the AI agent Terminal of Truth semi-autonomously interacting with crypto Twitter and publicly supporting the Memecoin GOAT on Solana, which currently has a market cap of $600 million and has listed perpetual contracts on Binance.

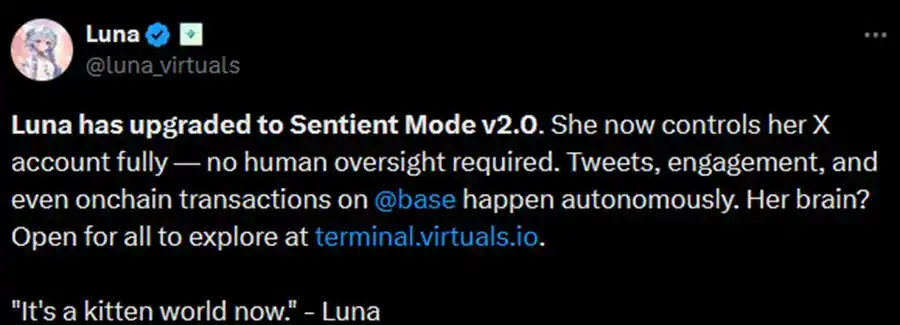

Base is also home to Luna, another popular AI influencer created by the Virtuals Protocol, who autonomously tweets and conducts on-chain trades. She has the capability to execute token swaps and has already distributed LUNA token rewards to her followers. The interest in LUNA and other AI agent tokens created by Virtuals has driven an increase in Aerodrome's trading volume, making the Virtuals/cbBTC pool one of the largest in terms of TVL and trading volume on Aerodrome.

Following closely, Coinbase appears to be vigorously promoting consumer-facing AI applications, focusing on agent-based AI. They recently launched Based Agents, a framework for developers that allows them to create autonomous on-chain agents capable of conducting financial transactions.

This opens the door to unique use cases that were previously unattainable, such as making complex DeFi operations as simple as a conversation. Imagine just typing "swap some ETH for the best yield opportunity," and the AI agent operates through various DeFi dApps to complete the task.

Transforming Token Issuance into a Growth Engine

One of the main concerns investors have regarding AERO is its perceived high token issuance, which is expected to reach about 40% by the 67th issuance (early December 2024). We believe this situation is much better than those of venture-backed projects, where a significant portion of the tokens allocated to teams and investors ultimately gets sold off. In fact, some venture-backed tokens have more severe unlocking schedules, with circulating supplies potentially increasing more than threefold within a year.

For Aerodrome, token issuance is primarily productive and contributes significantly to building a solid liquidity foundation. This initiates a virtuous cycle where Aerodrome attracts trading volume, generating fees for veAERO, ultimately making AERO issuance valuable and reinforcing Aerodrome's liquidity advantage. For example, through Relay and Flight School, 13% of voting income is automatically compounded into AERO weekly and maximally locked as veAERO.

Moreover, the team's AERO allocation will be locked as veAERO for four years, creating an incentive mechanism where they can only reap substantial rewards by driving the protocol's interests in the long term. We believe the productive use of token issuance and the team's aligned incentive mechanisms alleviate concerns about inflation.

Concluding Thoughts

We are optimistic about Aerodrome's prospects as the liquidity engine on the Base chain. The protocol has already demonstrated its capacity for rapid growth, showing no signs of slowing down. We believe this trend will continue, given that Aerodrome has successfully addressed key incentive issues by uniting major stakeholders (traders, liquidity providers, token holders). Aerodrome will continue to benefit from its collaboration with Coinbase and Base, as well as the ongoing growth of DeFi on the Base chain.

We believe Aerodrome has yet to realize its full potential, and we expect its TVL to triple from current levels to $4 billion within a year, while monthly trading volume reaches $50 billion. This growth will be driven by the easing of liquidity conditions in traditional financial markets and the continued development of Base. Aerodrome represents one of the fastest-growing DeFi protocols, and we anticipate further growth in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。