The market sentiment index is an important barometer that reflects investors' expectations and confidence regarding the future trends of the market. Today (November 8), the cryptocurrency market's greed and fear index stands at 75, indicating an optimistic attitude among investors. The head of Galaxy Research stated that the market is not overheated, and the Bitcoin options market has priced Bitcoin at $80,000 for the expiration at the end of November.

Greed and Fear Index Maintains Above 70, Market Sentiment Optimistic

The greed and fear index is a measure of market sentiment, designed to help investors assess whether the current market sentiment leans more towards fear or greed. It is typically represented on a scale from 0 to 100, where 0 to 24 represents extreme fear, 25 to 49 represents fear, 50 to 74 represents greed, and 75 to 100 represents extreme greed.

According to AICoin statistics, the greed and fear index has remained above 70 for the past week, indicating that the market sentiment is optimistic, with overall market sentiment reaching greed or extreme greed.

Image Source: AICoin

Does a high greed and fear index indicate that the market is currently overheated? Galaxy Research Director Alex Thorn stated in a market report published by Cointelegraph yesterday (November 7): "From a fundamental perspective, the market does not seem overheated."

At the same time, Barthere noted in the market report on November 7: "Bitcoin has broken historical highs with massive trading volume, clearly indicating that Bitcoin will continue to maintain positive momentum post-election." He pointed out that after Donald Trump won the U.S. presidential election on November 5, traders began to "re-risk," which has been reflected in the recent upward trend of the cryptocurrency market.

Despite the positive market sentiment and high levels of greed, several analysts have pointed out that there is no sign of overheating. However, investors should remain thoughtful and calm, avoiding impulsive investment decisions driven by FOMO (fear of missing out).

Market Expects Bitcoin to Break $80,000 This Year

According to Bitwise's early October forecast report, three major conditions must be met for Bitcoin to reach the $80,000 price target this year: a significant victory for the Democratic Party in the elections, two interest rate cuts + stimulus measures, and no major negative surprises. Currently, these three conditions are largely achievable.

The Chief Investment Officer of Bitwise also stated, "Regardless of how news develops, Bitcoin can rise to $80,000 (or even more) next year. But if we want to achieve this goal by the end of the year, the aforementioned scenario (the three factors) would be helpful."

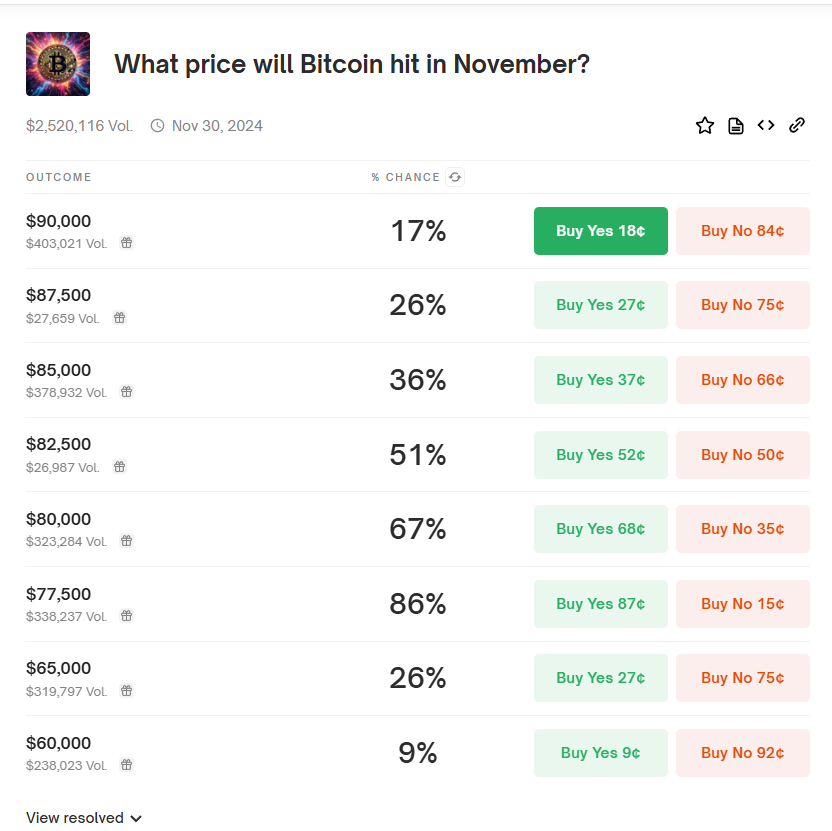

According to Polymarket data, market bets on "What will the price of Bitcoin be in November (end of November)?" indicate strong bullish expectations for BTC, with a high proportion predicting it could reach $77,500, $80,000, $82,500, or $85,000. AICoin's market data shows that BTC is currently valued at $76,205. For detailed analysis, you can download the AICoin app https://www.aicoin.com/download.

Image Source: Polymarket

Global investment bank JPMorgan released a report this Thursday (November 7) that also holds an optimistic view on Bitcoin, stating, "We are optimistic about Bitcoin in 2025."

Conclusion

Investors maintain a positive outlook on the future price trends of Bitcoin, especially driven by recent political and economic events, with Bitcoin prices expected to break the $80,000 mark. Although the index indicates that the market is in an extreme greed phase, many analysts believe that the market fundamentals remain healthy and are not overheated. In such an optimistic environment, investors still need to stay calm and rational, carefully manage risks, and avoid impulsive investments driven by fear of missing out (FOMO).

Market expectations and optimistic analyses both indicate Bitcoin's potential for short-term price increases, while the long-term outlook is also positive, making future trends worth watching and anticipating.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。