The first crypto-friendly "Trump" has entered the White House, and market sentiment is soaring. The BTC price fluctuated around $68,000, quickly breaking through the $70,000 resistance level and reaching new highs. With significant volatility in the crypto market, how can investors seize the opportunity of a bull market to achieve long-term stable or even enhanced returns while effectively protecting their principal? Matrixport has delved into user needs and launched structured financial products suitable for various market conditions, different investor groups, and multiple investment requirements. This article will review Matrixport's structured financial products one by one, helping investors quickly identify the financial products that suit them!

1. Shark Fin: Predict the price range of the underlying asset to obtain excess returns, ideal for short-term volatile markets

"Shark Fin" is a structured financial product that offers cost protection and stable returns, aimed at increasing investors' yield during market fluctuations. Investors purchasing this product can enjoy a base annualized return while having the opportunity to earn a high return of 100.75% annually (real-time data as of 2024-11-07, for reference only). It is suitable for low-risk preference investors looking to enhance their returns.

Currently, Matrixport's Shark Fin supports investments in USDT, BTC, and ETH; it offers investment periods of 7 days, 14 days, 30 days, and 90 days.

Applicable Scenarios

Shark Fin is suitable for low-risk preference users who want to achieve returns exceeding the market average. When the market experiences short-term fluctuations, investors looking to increase their yield during volatility can choose Shark Fin to determine the price range of the cryptocurrency and seek enhanced returns. If the Shark Fin product matures and the price of the underlying asset is within the specified price range, users will receive enhanced returns; if it exceeds the price range, users will receive a guaranteed return. It is suitable for investors with low risk tolerance who want to achieve enhanced returns during volatility.

Example

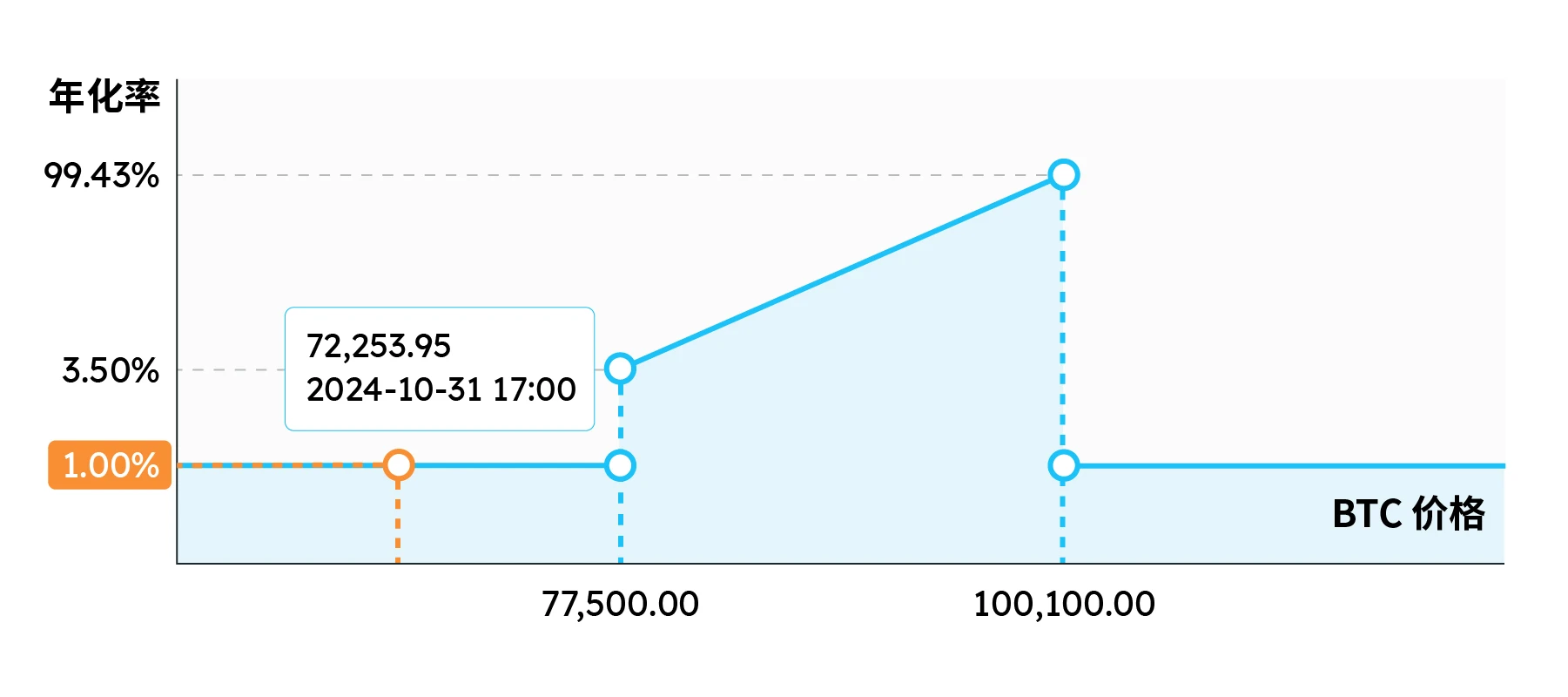

Assume A believes that the price of BTC will likely fluctuate between $77,500 and $100,100 in the coming days, but will ultimately stabilize at some price within that range. A uses 10,000 USDT to purchase the USDT-BTC bullish Shark Fin product.

The product matures in 7 days, with an annualized rate of 1% – 99.43%, and a reference price range of $77,500 – $100,100.

When the product matures, user A may face the following situations:

If the settlement price at maturity is $100,000, the final return = 189.92 USDT (10,000 * 99.03% * 7 / 365). When the settlement price is between $77,500 and $100,100, investors will receive an APY of 1% – 99.43%. The closer the settlement price is to $100,100 (but not equal to $100,100), the higher the return.

If the settlement price at maturity is ≤ $77,500 or ≥ $100,100, user A will receive a base APY of 1%, with the final return = 1.91 USDT (10,000 * 1% * 7 / 365).

2. Trend Smart Earnings: Predict market trends to obtain enhanced returns, greater profits in one-sided markets

Trend Smart Earnings is a cost-protected structured financial product. Users do not need to accurately predict market conditions; they only need to guess the direction to earn high returns, and even if they guess wrong, they can still receive guaranteed returns. Currently, Matrixport's Trend Smart Earnings supports investments in USDT, BTC, and ETH; it offers investment periods of 7 days, 14 days, 30 days, and 90 days.

Applicable Scenarios

Trend Smart Earnings is more advantageous in one-sided markets, as it eliminates the one-sided knockout mechanism. Even if the market price continues to rise or fall, returns will not decrease due to knockouts. This design allows Trend Smart Earnings to perform better in strong one-sided market environments, flexibly capturing one-sided market trends, especially suitable for investors with clear expectations of future trends.

Example

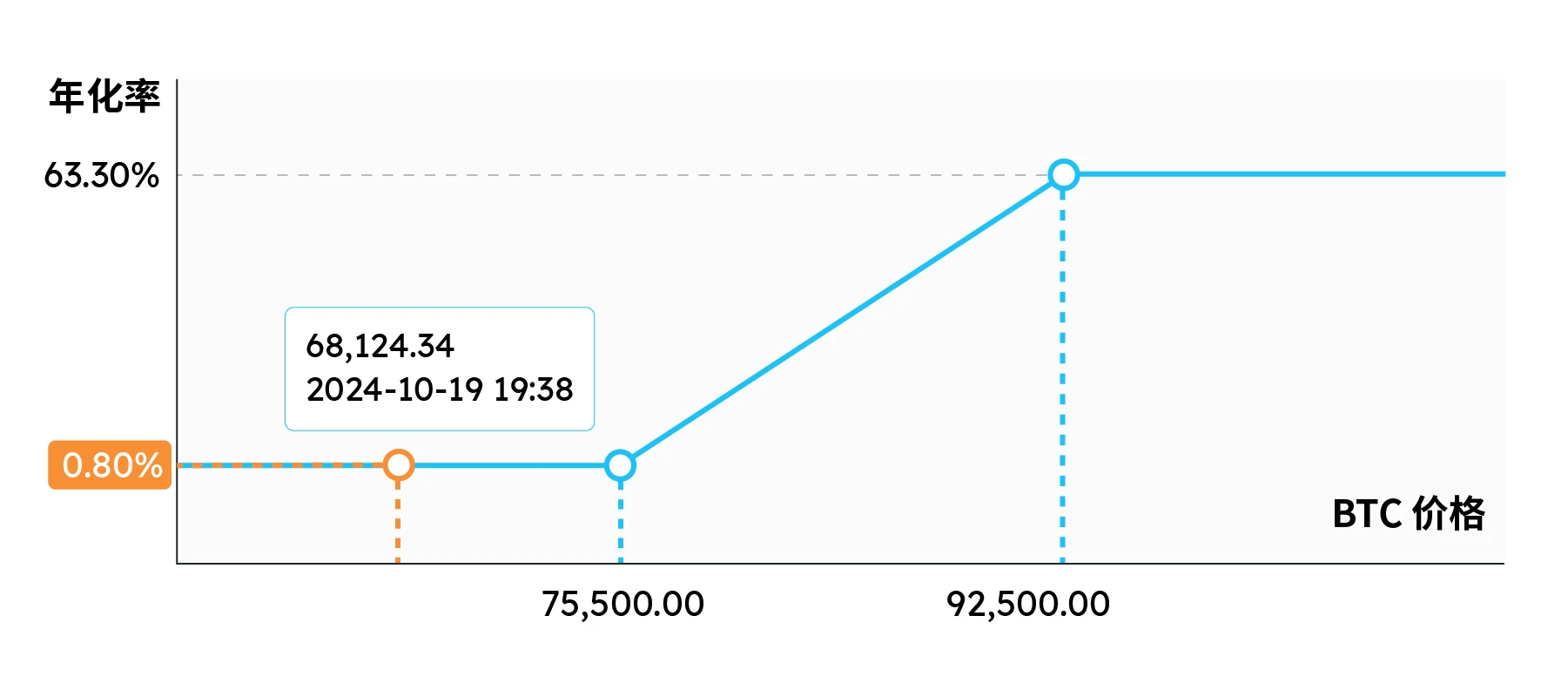

Assume A believes that the price of BTC will continue to rise in the coming days and that the upward range will be between $75,500 and $92,500. A uses 10,000 USDT to subscribe to the BTC bullish Trend Smart Earnings product, which matures in 7 days with an annualized rate of 0.8% – 63.3%, and a price range of $75,500 – $92,500.

When the product matures, user A may face the following situations:

If the settlement price at maturity is $100,000, exceeding $92,500, regardless of the actual price, the subscriber will enjoy the highest APY of 63.3%, with the final return = 121.37 USDT (10,000 * 63.3% * 7 / 365);

If the settlement price at maturity is $80,000, within $75,500 – $92,500, A will enjoy enhanced APY based on the difference between the BTC settlement price and $75,500, with the final return = 33.25 USDT (10,000 * 17.34% * 7 / 365);

If the settlement price at maturity is $70,000, falling below $75,500, A will enjoy a guaranteed 7-day 0.8% APY return, with the final return = 1.53 USDT (10,000 * 0.8% * 7 / 365);

3. Snowball: Long-term volatile markets, sustainable enhancement of returns

As a classic structured product, "Snowball" can capture more returns in volatile markets. Snowball has "knock-in prices" and "knock-out prices." As the name suggests, when the Snowball product purchased by investors fluctuates between these two prices, the returns will increase like a snowball rolling in the snow.

Matrixport's "Snowball" products currently offer USDT bullish snowballs, BTC bullish snowballs, BTC bearish snowballs, ETH bullish snowballs, and ETH bearish snowballs; investment supports periods of 7 days, 14 days, 30 days, 90 days, and 180 days.

Applicable Scenarios

Snowball is suitable for investors with a certain risk tolerance and clear expectations of market trends. When the market continues to fluctuate, Snowball can capture more returns. It is worth noting that when the underlying asset breaks through the protection price, a currency conversion will occur, allowing investors to flexibly settle based on actual conditions to avoid asset loss.

Example

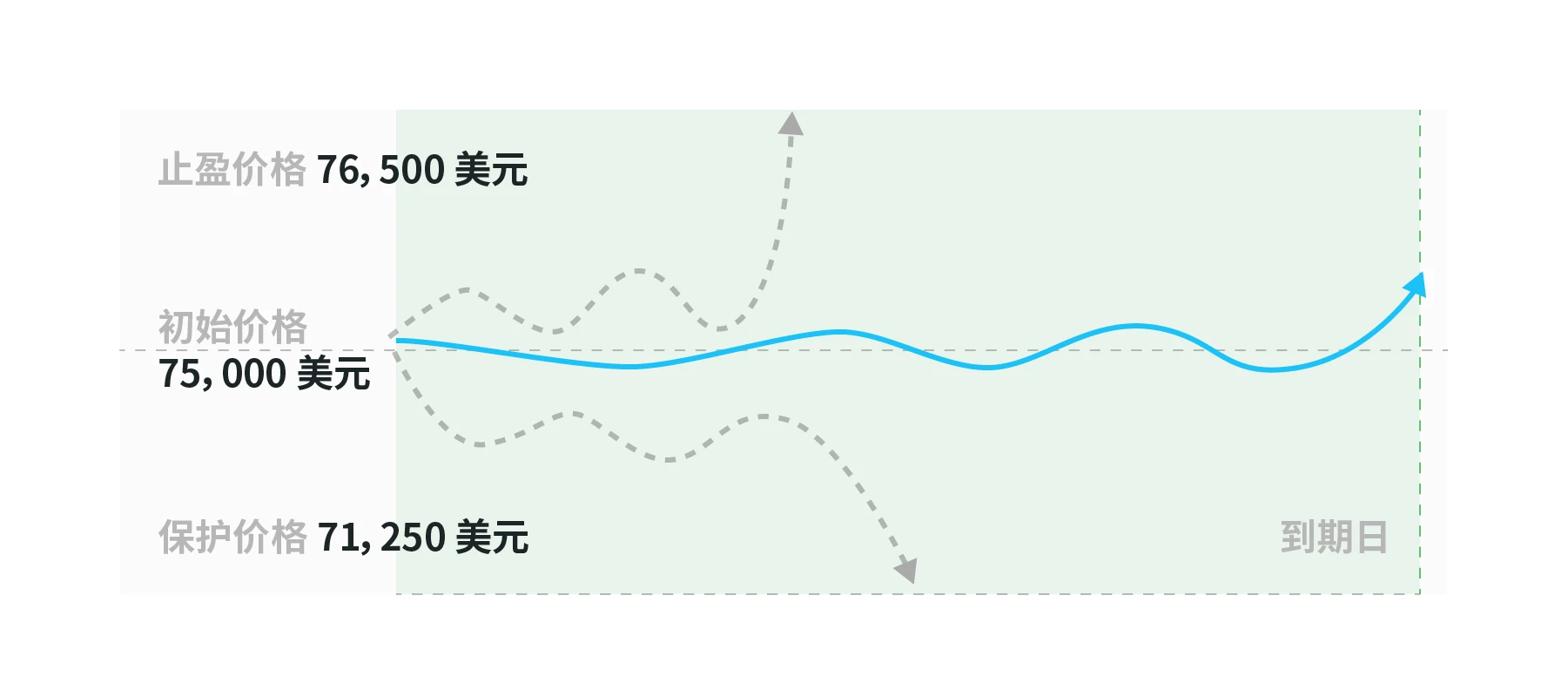

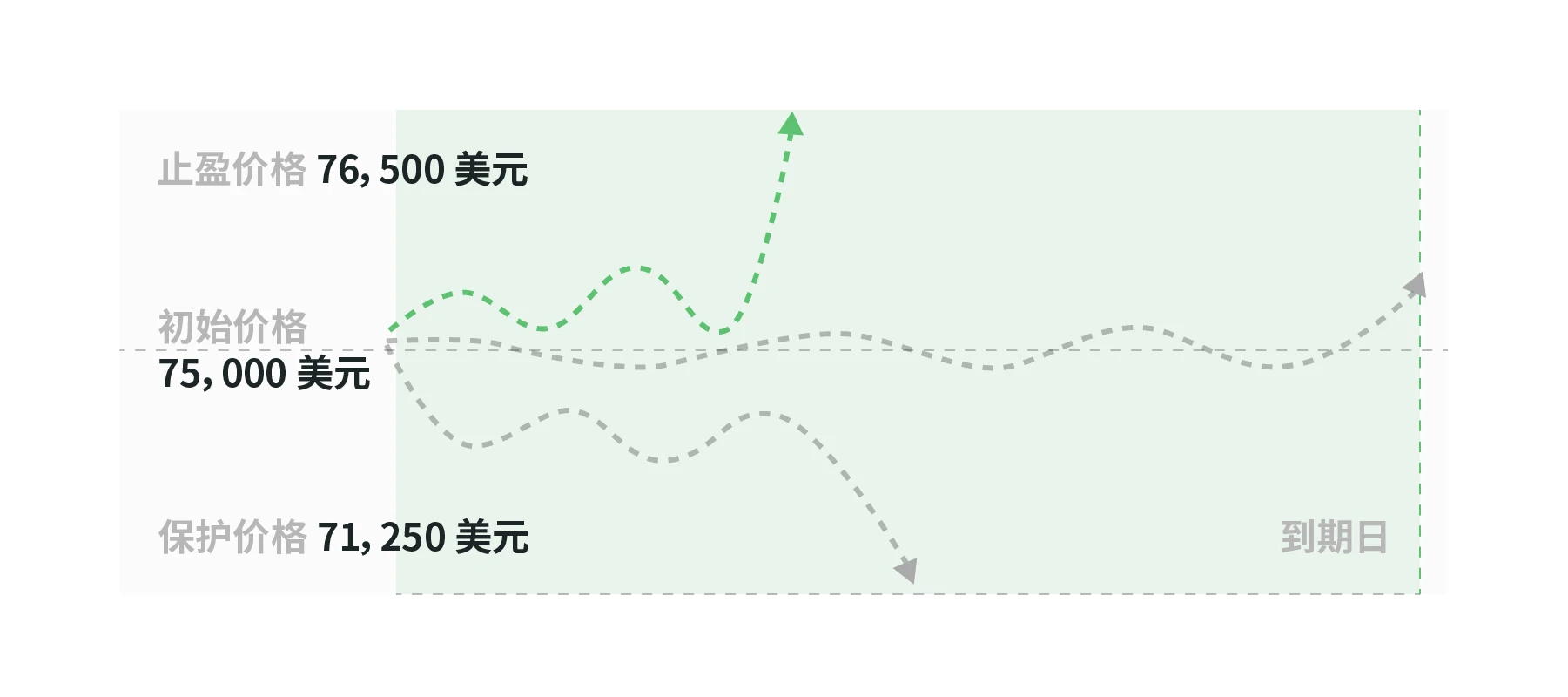

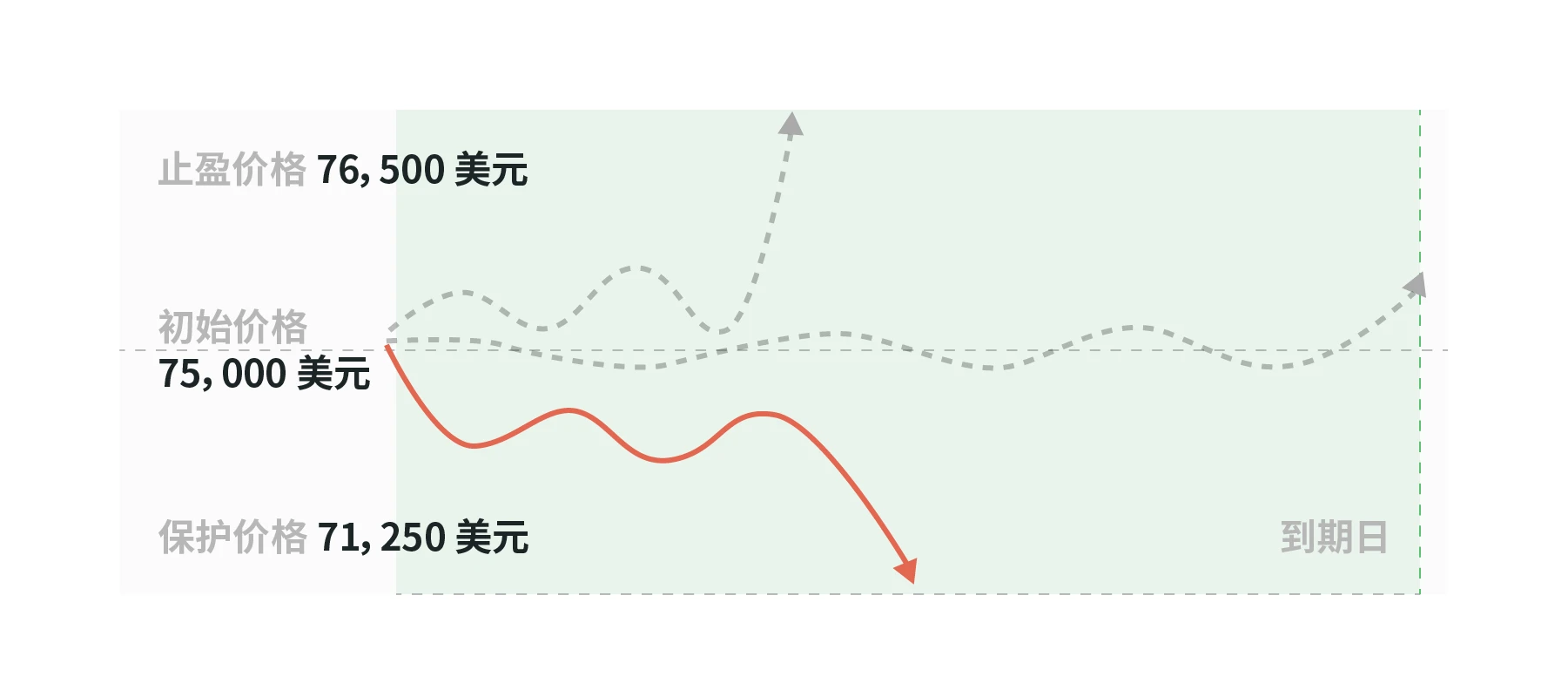

Assume A believes that the price of BTC will fluctuate in the near future, with a certain probability of rising during the fluctuations. A uses 10,000 USDT to subscribe to the BTC bullish Snowball product, which matures in 7 days, with an annualized rate of 92.59%, the current BTC price at $75,000, a take-profit price of $76,500, and a protection price of $71,250.

When the product matures, user A may face the following situations:

- If the settlement price at maturity is $70,000, with the settlement prices of $71,250 and $76,500 not triggering any knock-in or knock-out events, the product matures smoothly and settles in USDT, A can obtain a return = 177.56 USDT (10,000 * 92.59% * 7 / 365);

- If during the product's operation, on the 3rd day, the observed price of BTC is $77,000, and the observed price ≥ $76,500, a knock-out event is triggered, taking profit early. The product will settle in the currency unit early, and A can obtain a return = 76.1 USDT (10,000 * 92.59% * 3 / 365);

- If during the product's operation, on the 3rd day, the observed price of BTC is $70,000, and the observed price ≤ $71,250, a knock-in event is triggered. The investor's settlement asset will undergo currency conversion and will be settled as BTC at the price of $70,000, with A receiving a return = 0.104 BTC [ (10,000 * (1 + 92.59% * 3 / 365)) / 70,000 ]

4. Dual Currency: Buy low and sell high, a tool for short-term volatile markets

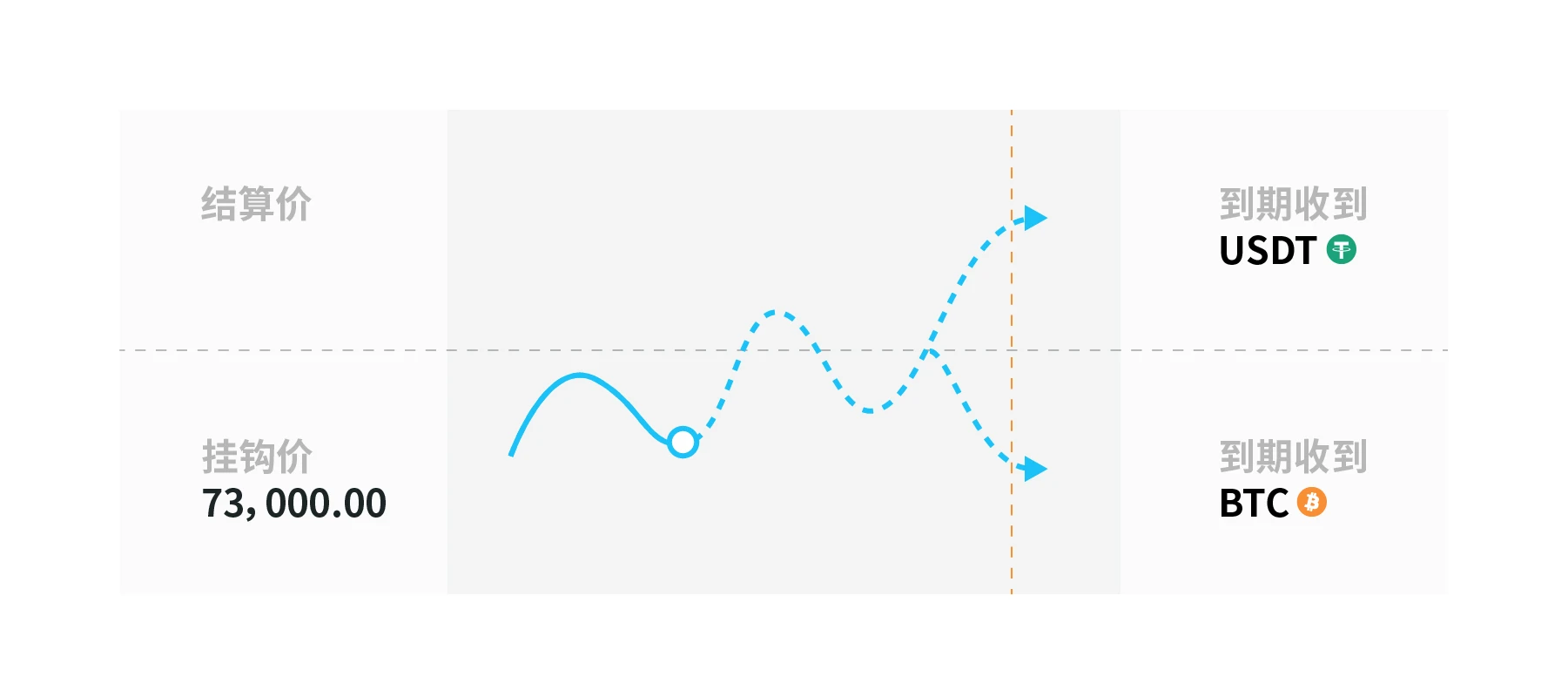

"Dual Currency Investment" involves two currencies, with investment directions divided into "sell high" and "buy low." Generally, choosing the "sell high" direction requires purchasing the corresponding currency, while choosing "buy low" requires using USDT/USDC. However, there are exceptions, such as Matrixport's "ETH/BTC" product, where choosing "sell high" requires investing ETH, and choosing "buy low" requires investing BTC.

When used properly, dual currency can meet various user needs such as taking profits, bottom fishing, and accumulating coins. "Dual Currency Investment" is a "non-principal protected but fixed yield" financial product, where the yield is clear and fixed at the time of purchase, but the settlement currency is uncertain. When the product matures, the settlement currency depends on the comparison between the settlement price at maturity and the reference price.

Matrixport's "Dual Currency Investment" products support 12 assets including BTC, ETH, ARB, BCH, BNB, ORDI, OP, etc.; the investment period is broad, supporting a wide range of investment cycles from 0.1 to 287 days.

Applicable Scenarios

Choosing to sell high is equivalent to selling a call option, while choosing to buy low is equivalent to selling a put option. Dual currency investment is suitable for investors who have a clear expectation of the current market trend to earn additional returns in the base currency, and it allows buying or selling once the reference price is reached, without any transaction fees.

For example, if an investor believes that the market will be volatile, choosing a suitable dual currency product with prices fluctuating between the upper and lower thresholds can yield higher returns; if the investor anticipates a short-term decline followed by a rebound, selecting a suitable "buy low" product can not only allow them to buy at a lower price but also earn APY returns; if the user believes the market will experience a pullback after rising, choosing a "sell high" product provides an opportunity for profit-taking at a high point.

Example

Assume user A believes that the BTC price may rise slightly in the short term and wants to use dual currency investment to earn additional returns in the base currency while selling BTC at a high point, but A is unwilling to pay any transaction fees. A can use 1 BTC to subscribe to the BTC dual currency product, which matures in 15 days with an annualized rate of 96% and a reference price of $73,000.

When the product matures, user A may face the following situations:

If the settlement price at maturity is $100,000, and the settlement price ≥ $73,000, the dual currency will sell the invested BTC principal and the BTC earnings at the price of $73,000, settling the earnings in USDT. A's final return = 2,880 USDT (1 * 73,000 * 96% * 15 / 365).

If the settlement price at maturity is $70,000, and the settlement price is $73,000, the dual currency will settle the earnings in the base currency, and A will ultimately receive = 1.039 BTC [1 * (1 + 96% * 15 / 365)].

5. Seagull: Earn returns even in uncertain markets

Similar to the principle of seagull options in traditional finance, Seagull is composed of a combination of three ordinary option strategies with the same expiration date. In simple terms, Seagull is a "special structure" dual currency product that shares a similar risk structure with dual currency but addresses the pain point of traditional dual currency products, which often miss out on earnings in one-sided markets, allowing for amplified returns in such conditions.

Matrixport's "Seagull" product supports BTC, ETH, and USDT; the period spans can meet different customer needs.

Applicable Scenarios

The use cases for Seagull are relatively broad, whether in a volatile market, sideways market, or one-sided upward trend. When users are uncertain about the future price direction, they can try Seagull to lock in maturity returns, as long as the price does not touch the conversion price at maturity, asset conversion will not occur. If a sustained one-sided market occurs, users can achieve high enhanced returns.

Example

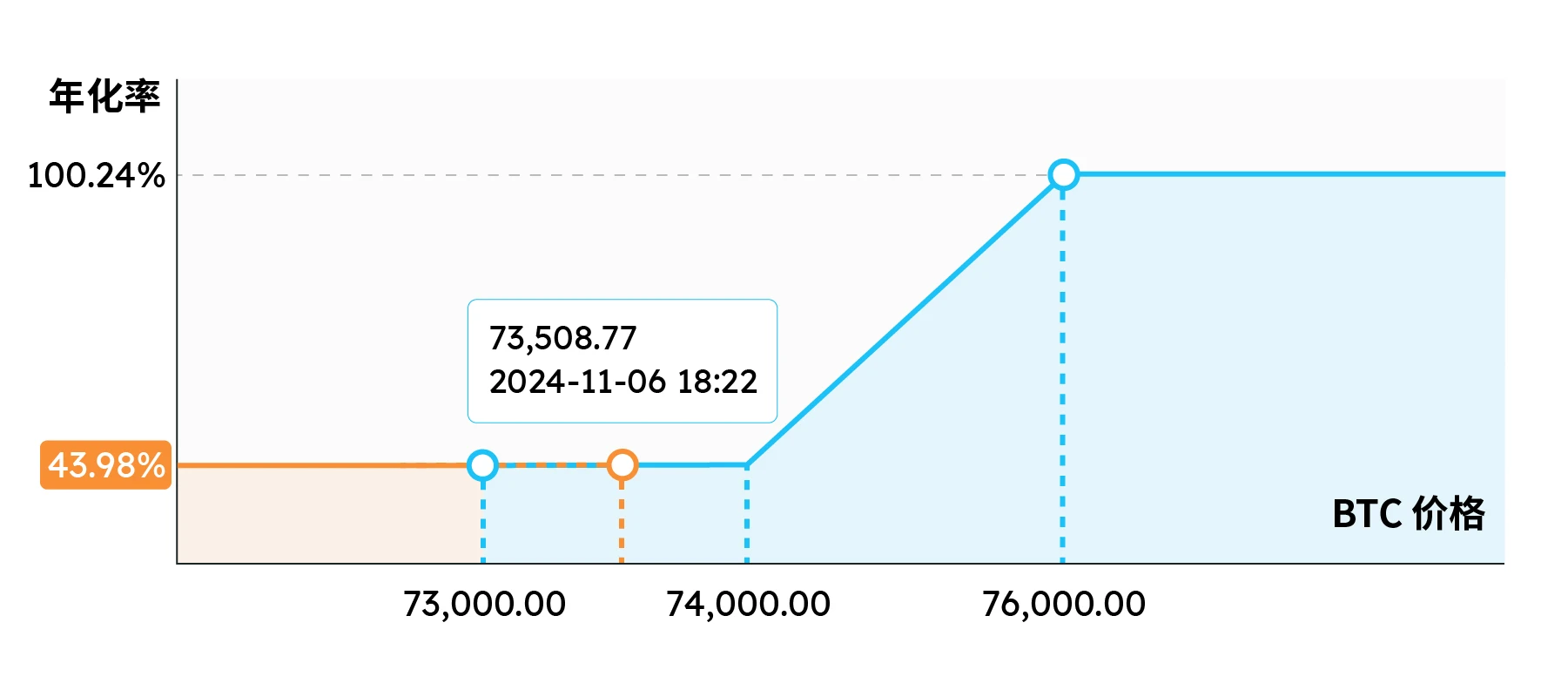

Assume A believes that the price of BTC is likely to fluctuate upward in the near future and wants to earn additional returns in the base currency. A uses 10,000 USDT to subscribe to the BTC bullish Seagull product. The product matures in 15 days with an annualized return rate of 43.98%–100.24%, a conversion price of $73,000, a benchmark price of $74,000, and a maximum price of $76,000.

When the product matures, user A may face the following situations:

If the settlement price at maturity is $100,000, and the settlement price ≥ $76,000, A will receive the highest APY of 100.24%, with a final return = 411.94 USDT (10,000 * 100.24% * 15 / 365).

If the settlement price at maturity is $75,000, when the settlement price is between $74,000 and $76,000, A will receive returns between the base 43.98% APY and the maximum 100.24% APY, with a final return = 296.25 USDT.

If the settlement price at maturity is $73,500, when the settlement price ≤ $74,000, A will receive the base 43.98% APY, with a final return = 180.73 USDT (10,000 * 43.98% * 15 / 365).

If the settlement price at maturity is $70,000, and the settlement price ≤ $73,000, the user will receive an annualized return of 43.98% and will buy BTC at the price of $73,000, ultimately A will receive = 0.1394 BTC [10,000 * (1 + 43.98% * 15 / 365)] / 73,000.

6. Installment Purchase: Buy now, pay later, locking in crypto assets

"Installment Purchase" is a crypto derivative of the traditional financial product "installment payment warrants," exclusively launched by Matrixport. Investors can lock in potential returns on crypto assets in advance through installment payments, improving capital utilization. Currently, the installment purchase supports up to ten times leverage and avoids liquidation without additional margin.

Matrixport's "Installment Purchase" product supports BTC, ETH, and USDT, with a wide range of investment periods from 0 to 365 days.

Applicable Scenarios

Installment Purchase is suitable for investors who wish to maintain long-term exposure to cryptocurrencies like BTC. Investors can purchase BTC and other cryptocurrencies through a relatively low down payment and enjoy potential appreciation returns from holding the underlying assets while maintaining long-term market exposure. At maturity, investors can choose to pay the final payment and physically settle to obtain BTC and other cryptocurrencies; they can also choose not to pay the final payment, settling in cash or automatically reinvesting.

Return Mechanism

Assume user A wants to purchase BTC but is concerned about potential losses due to price fluctuations after holding the spot. The user can use the installment purchase to lock in future returns on a certain amount of BTC by paying a certain percentage of the down payment.

If the real-time price of BTC is $75,961, A purchases an investment period of 84 days, with a down payment of $14,941 and a final payment of $68,000, with a maturity date of January 31, 2025.

After the product's maturity date, user A can choose the following settlement methods. On the maturity date, they can choose to "pay" or "not pay":

Pay the final payment of $68,000 and receive 1 BTC. Since the down payment and final payment amounts are fixed, the investor will benefit from the price difference of BTC during the holding period.

Not pay the final payment of $68,000 and automatically reinvest. If the investor does not want to pay the final payment immediately, they can choose to use the settlement price at maturity as the down payment for the next installment purchase product, maintaining market exposure through automatic reinvestment.

Not pay the final payment of $68,000 and settle the installment purchase product based on the cash value of 1 BTC at maturity.

The cash value settlement formula is as follows:

Cash Value = Max { 0, [ (Settlement Price - Final Payment) / Settlement Price] * Purchase Quantity }

Note: The cash value is a minimum of 0, meaning that even if the reference price drops significantly, the investor's maximum loss is only the down payment, and there will be no negative cash value.

The above content does not constitute investment advice, sales offers, or purchase offers to residents of the Hong Kong Special Administrative Region, the United States, Singapore, or other countries or regions where such offers or invitations may be prohibited by law. Digital asset trading may involve significant risks and volatility. Investment decisions should be made after careful consideration of personal circumstances and consultation with financial professionals. Matrixport is not responsible for any investment decisions made based on the information provided herein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。