How does MicroStrategy plan to become a trillion-dollar company?

Written by: Jack Inabinet, Bankless

Translated by: Bai Shui, Golden Finance

Michael Saylor's MicroStrategy (MSTR) has been accumulating BTC since 2020, and it has been unstoppable, transforming the software company into one of the best-performing equity investment companies over the past two bull market cycles.

Despite incurring massive losses each quarter in 2024, MSTR's performance has still easily outpaced BTC, with prices doubling parabolically since September, rising 200% year-to-date!

At MicroStrategy's recent earnings call on October 30, company executives unveiled their "21/21 Plan," a strategic initiative aimed at raising $42 billion in capital at a 50/50 ratio (equivalent to 80% of MSTR's market cap at the time of analysis). The planned combination of stock sales and bond issuances will become the largest secondary stock offering in U.S. stock market history.

Today, we will decode Michael Saylor's infinite money-making machine and explore how MicroStrategy intends to become a trillion-dollar company.

What is Saylor creating?

MicroStrategy announced in August 2020 that it would spend $250 million to purchase 21,454 BTC, becoming the first publicly traded company to implement a BTC treasury strategy, with this initial investment yielding nearly 500% returns over a four-year lifespan.

As of September 2024, MicroStrategy holds 252,220 bitcoins.

While MicroStrategy has maintained its status as a BTC giant among direct corporate holders, the launch of the spot BTC ETF in January 2024 reshaped the landscape of major holders, with BlackRock surpassing MicroStrategy to become the fourth-largest BTC holder, following Binance, Sabase, and Coinbase.

Although the market initially valued MicroStrategy at five times the value of its BTC assets, as holders gradually realized they would be perpetually diluted to fund additional BTC purchases, this premium began to disappear by the end of 2021, and MSTR found its trading price below its net asset value (NAV).

Unlike when MicroStrategy first began accumulating BTC in 2020, investors no longer need to exit traditional markets to gain exposure to crypto assets. However, even in the ETF era, MSTR shares have continued to trade at a persistent premium since February 2024.

Compared to a spot ETF that simply tracks BTC performance (minus management fees), MicroStrategy offers its shareholders a BTC accumulation strategy tool that can increase the number of tokens per share.

When MSTR shares trade above the value of its held BTC, MicroStrategy can conveniently raise funds through two avenues: at-the-money stock issuance and convertible bond sales. The authorization for at-the-money stock issuance allows MicroStrategy to issue and sell new MSTR shares to the market to raise cash, while convertible bond sales enable MicroStrategy to borrow money under extremely favorable conditions in exchange for redeemable debt obligations in cash or a certain number of MSTR shares in the future.

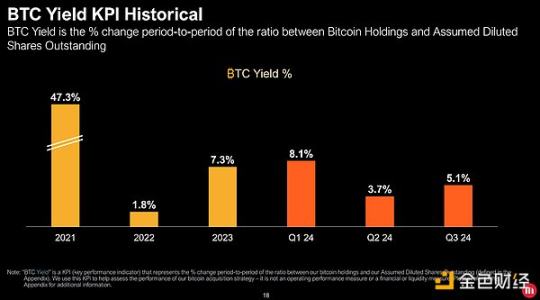

In its Q2 2024 earnings report, MicroStrategy introduced "BTC Yield" as a key performance metric for investors, emphasizing the quarter-over-quarter growth in BTC held per share.

Despite the ongoing bear market, MicroStrategy unorthodoxly secured a $205 million BTC-collateralized term loan from Silvergate in March 2022, but crypto industry experts often liken the company to a money printer, as its executives seem to raise unlimited cash to buy BTC during market booms through stock dilution.

In a recent interview with analysts from sell-side research firm Bernstein, Michael Saylor revealed his company's ultimate goal: to transform into a mature Bitcoin financial services provider.

When shareholders buy MSTR, they are not just purchasing BTC; they are also buying the management's ability to effectively utilize capital markets and the balance sheet to generate more returns.

Investment Considerations

MSTR's performance in 2024 has undoubtedly outperformed BTC, but historically, it has also exhibited higher volatility, experiencing more severe downward fluctuations alongside significant upward rebounds. Speculators seeking leveraged BTC exposure are better off directly utilizing the underlying asset.

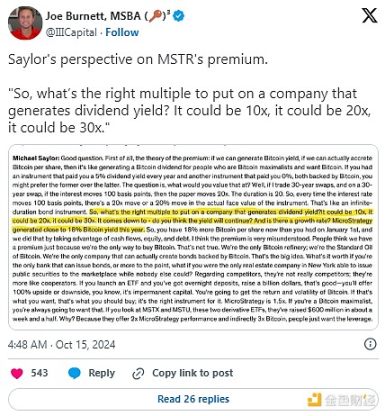

While astutely leveraging public capital markets allows MSTR shareholders to accumulate more BTC, MicroStrategy's ability depends on investors' continued willingness to purchase shares at a premium.

As shown in 2022, MSTR shares may trade below net asset value for extended periods. If convertible bonds mature while net asset value remains discounted, MicroStrategy will be forced to sell unexpectedly large amounts of stock to dilute investors' equity or sell held BTC to redeem outstanding bonds.

The FASB rule changes set to take effect this December will allow digital assets to be reported at their fair market value. Although MicroStrategy has announced net profit losses for three consecutive quarters in 2024, adopting these new accounting standards will positively impact the company's finances, making MSTR a potential candidate for the S&P 500 index. Adding it to that index or others like the Nasdaq 100 would unleash passive, price-agnostic liquidity that could be sold to accumulate more BTC!

Compared to investing in non-productive spot BTC, MicroStrategy shares have the potential to accumulate additional tokens, and unlike companies in the fiercely competitive cryptocurrency mining sector, MicroStrategy has a significant differentiation advantage due to its massive BTC moat. As long as there is a speculative desire for Bitcoin, investors can rest assured knowing that someone may be willing to purchase shares at a premium or lend cash under favorable conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。