"Federal Reserve Rate Cut Day," "Day After Trump's Victory," the market is thriving.

Written by: Shaofaye123, Foresight News

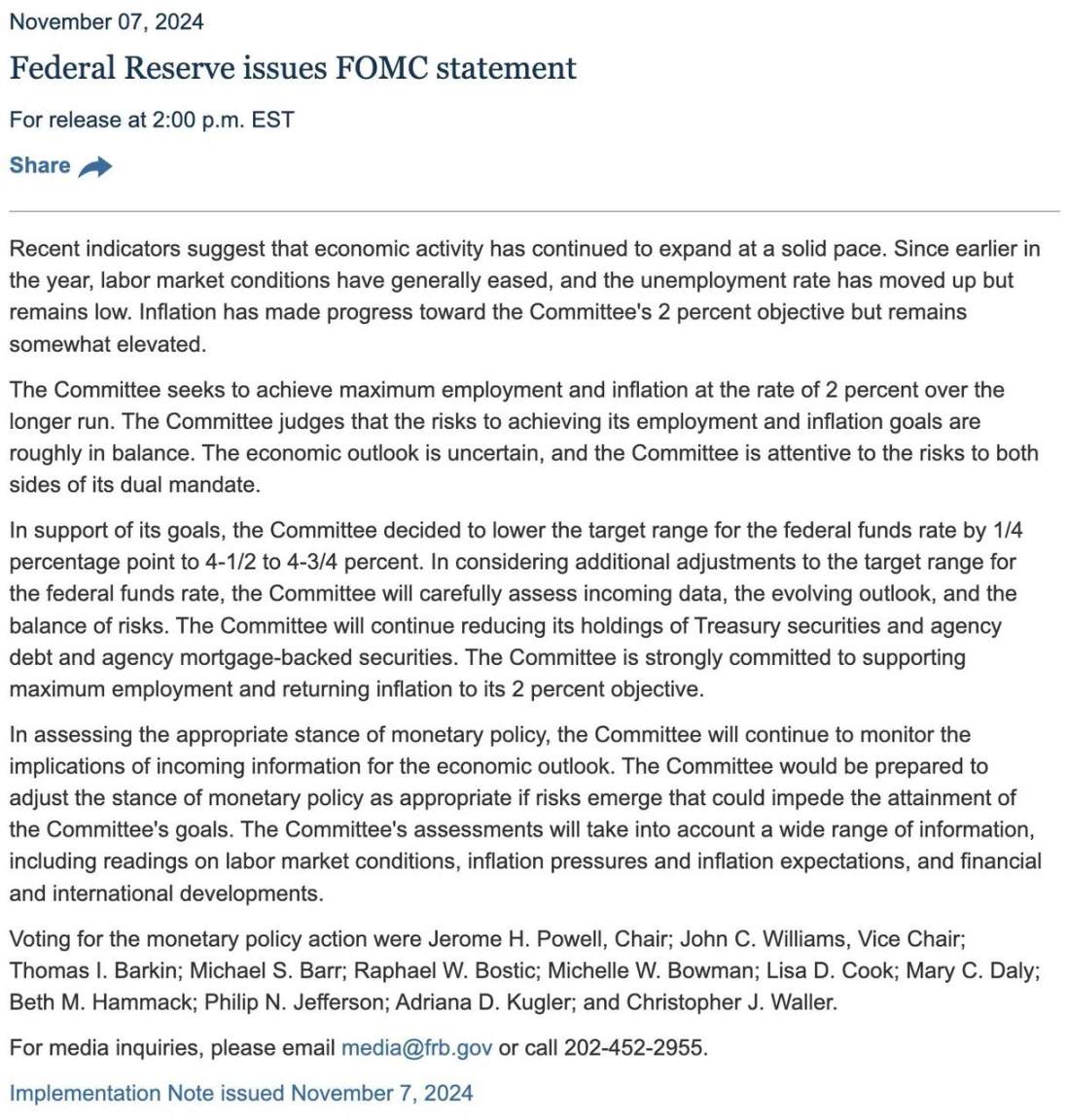

Under the spotlight of the global financial markets, the Federal Reserve's latest interest rate decision has once again become a catalyst for market volatility.

In the early hours of November 8, after announcing a 25 basis point cut to the benchmark interest rate, market confidence was further boosted, leading to a spectacular rally in both the cryptocurrency and U.S. stock markets.

Bitcoin Leads the Charge, Altcoins Continue to Rise

The Federal Reserve's rate cut decision not only lowered borrowing costs but also injected a strong dose of liquidity into the market. Additionally, the Bank of England also adopted a similar easing monetary policy, cutting rates by 25 basis points to 4.75%, resulting in a broad increase in UK bond prices. The Swedish central bank also cut rates by 50 basis points for the first time in ten years, meeting expectations, and may further increase easing measures to support the economy. All of these factors have further solidified expectations for global liquidity easing.

After the Federal Reserve's rate cut announcement, Bitcoin's price briefly dipped to a low of $74,500 but quickly rebounded, nearing the historical high of $77,000. As of the time of writing, Bitcoin's trading price is $75,869.

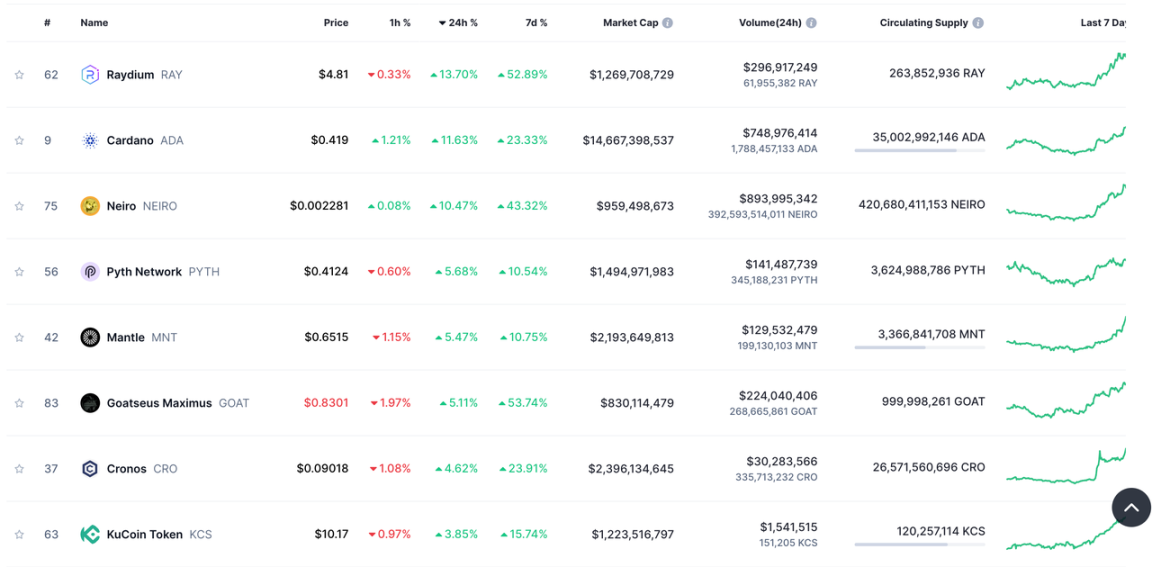

The altcoin market also saw a rise, with Raydium (RAY) leading the top 200 tokens by market capitalization, increasing by 13.7%, followed by Cardano (ADA) and Neiro (NEIRO), which rose by 11.63% and 10.47%, respectively.

ETF Data Continues to Flow In, Market Expected to Maintain Uptrend

Bitcoin spot ETF data can provide insights into the movements of off-exchange funds. When there is significant net inflow, buying pressure increases, making it more likely for Bitcoin's price to rise. According to SoSoValue data, in the past half month, there were only 4 days of net outflow, and the amount of net outflow was relatively small. In contrast, the net inflow on October 30 alone exceeded $890 million, with $870 million on the 29th. The net inflow on the 15th, 16th, 17th, and 28th all exceeded $450 million, indicating that off-exchange buying power remains quite strong.

Additionally, it is worth noting that the daily trading volume of BTC futures on the Chicago Mercantile Exchange has surged to a new high of $13.15 billion, far exceeding the average daily trading volume of $4.56 billion in 2024. Coinbase's premium has also turned positive for the first time in weeks. The demand from institutional traders is increasing.

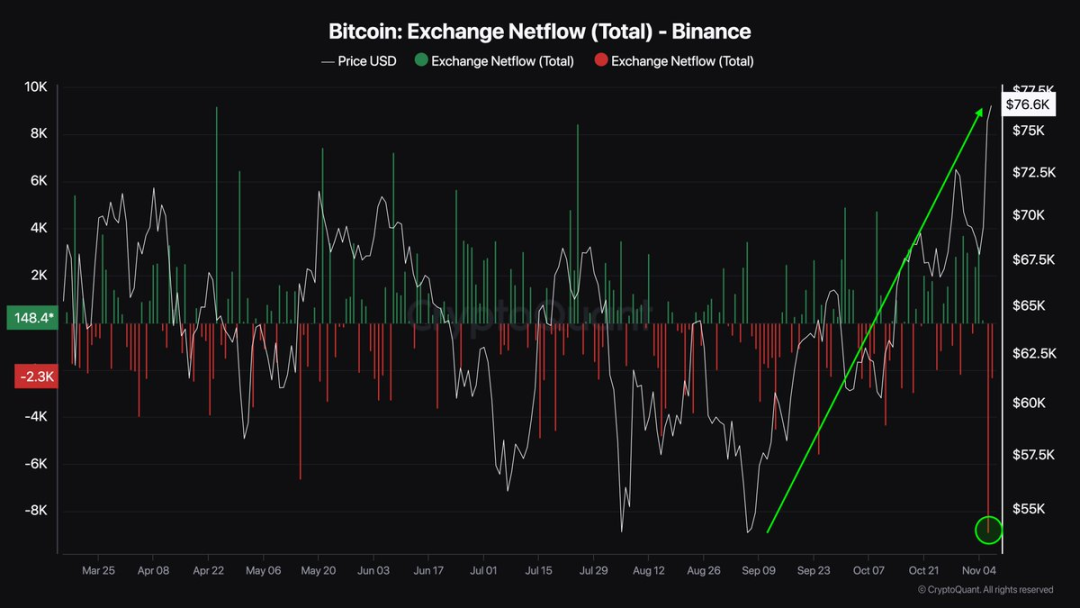

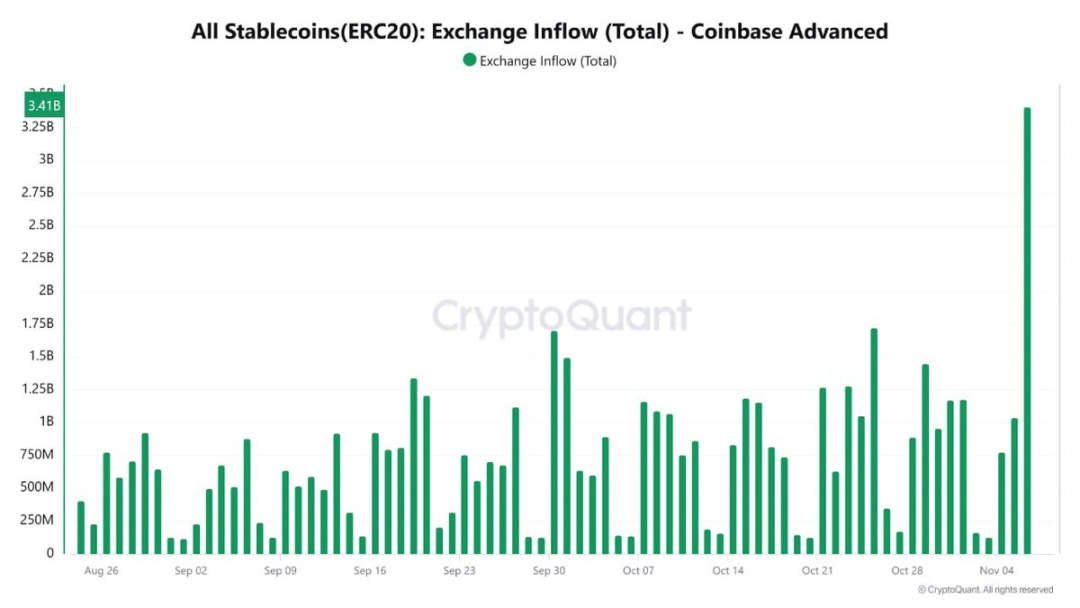

BTC Continues to Flow Out of Exchanges, Stablecoin Deposits Increase

BTC continues to flow out of exchanges, reaching the highest withdrawal level this year. This indicates a reduction in selling pressure, suggesting the market is on the verge of a breakout.

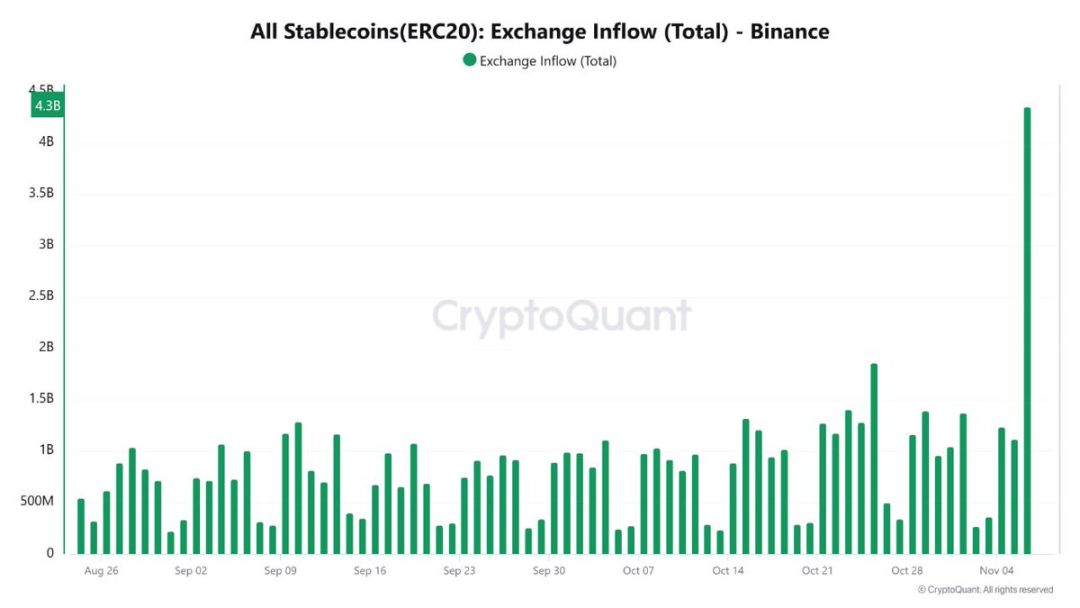

In contrast to the outflow of BTC from exchanges, stablecoin deposits on Coinbase and Binance have significantly increased. Since September 2020 to February, a large amount of deposits and an upward trend could form a rebound. If a large amount of deposits continues to show an upward trend, the cryptocurrency market is likely to see a new rise.

Analysts: Bitcoin Could Reach $150,000 After Short-Term Consolidation

According to trader analysis, strong spot demand and rising buying pressure reflect a shift in the market towards sustained support. Daily chart data shows that the larger sell order zone is currently located between $77,000 and $78,000, with no significant selling pressure until $83,000.

Analysts expect Bitcoin may experience short-term consolidation, but some believe Bitcoin will continue to rise to $77,500 or even higher. CNBC reports that BTC's price could reach $100,000 before the presidential inauguration.

Long-term predictions from analysts like Peter Brandt indicate that Bitcoin is currently in the best position of the bull market halving cycle, with a peak expected to be between $130,000 and $150,000 by the end of 2024. Market analyst CryptosRus suggests that compared to previous cycles, Bitcoin could reach $100,000 by early 2025.

The Federal Reserve's interest rate decision has injected new vitality into the market, and the rebound trend is expected to continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。