Original | Odaily Planet Daily (@OdailyChina_)

_

On November 6, the highly anticipated U.S. election finally concluded, with Republican presidential candidate Trump announcing victory in the 2024 presidential election. Trump is referred to as the "crypto president" due to his multiple public commitments to support the development of the crypto industry once in office. Following Trump's favorable win, Bitcoin set a new historical high on the day of voting, briefly surpassing $75,000, and this morning, Bitcoin rose to a peak of $76,848, continuing to set new highs.

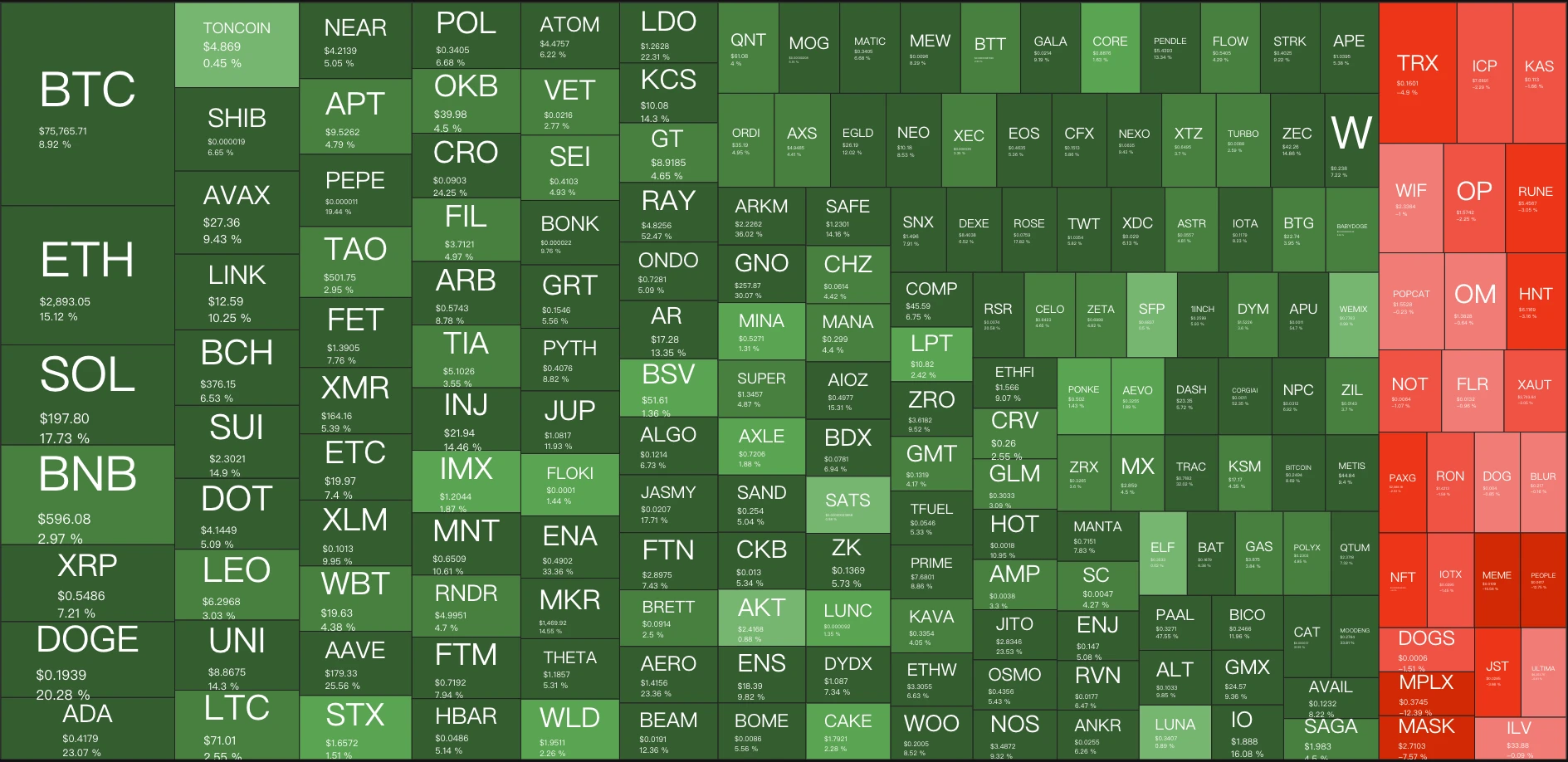

As of the time of writing, according to data from CoinGecko and TradingView, the total market capitalization of cryptocurrencies is $2.672 trillion, with Bitcoin's market share at 59.86%. Although Bitcoin's market share remains high, the altcoin market is also showing signs of recovery this month. According to Quantify Crypto data, in the past week, among the top 200 cryptocurrencies by market capitalization, 173 tokens, excluding BTC, have seen price increases, with SOL rising over 17%, DOGE over 20%, UNI over 14%, and LDO over 22%.

So, can the upward trend in the altcoin market continue after November? Which altcoins are worth paying attention to? Odaily Planet Daily will attempt to analyze the current favorable factors for the altcoin market in this article, while gathering various institutions' views on the future of the altcoin market, and finally considering which altcoins are worth focusing on from a trading perspective.

So, can the upward trend in the altcoin market continue after November? Which altcoins are worth paying attention to? Odaily Planet Daily will attempt to analyze the current favorable factors for the altcoin market in this article, while gathering various institutions' views on the future of the altcoin market, and finally considering which altcoins are worth focusing on from a trading perspective.

Trump's Administration May Bring a Regulatory Spring for the Altcoin Market

With Trump's election as the next U.S. president, both traditional financial markets and the crypto market are beginning to digest the implications of Trump's electoral victory.

In traditional financial markets, the dollar and U.S. Treasury bonds surged due to the election results, but concerns over Trump's previously mentioned plans to reduce immigration, impose widespread tariffs, and cut taxes may drive up inflation, leading to declines in gold prices and oil prices after the election results were announced.

In the crypto market, Bitcoin's price was the first to react directly to Trump's victory, continuously setting new highs. During his campaign, Trump made numerous promises to the crypto industry, including not supporting CBDCs and establishing a national Bitcoin reserve (details in the image below). For the altcoin market, which faces stricter regulations, if these crypto-friendly regulatory policies can be consistently implemented, it will truly promote a recovery in the altcoin market.

The U.S. SEC, considered the "number one enemy" of the crypto industry, has imposed fines totaling $4.68 billion, with multiple crypto companies, including Binance, Coinbase, ConsenSys, and Uniswap, being accused by the SEC. After Trump's administration takes office, the SEC's vigilance towards the crypto industry is likely to relax significantly.

The U.S. SEC, considered the "number one enemy" of the crypto industry, has imposed fines totaling $4.68 billion, with multiple crypto companies, including Binance, Coinbase, ConsenSys, and Uniswap, being accused by the SEC. After Trump's administration takes office, the SEC's vigilance towards the crypto industry is likely to relax significantly.

On November 6, pro-crypto Republican Bernie Moreno defeated Ohio Democratic Senator Sherrod Brown to secure a Senate seat in Ohio, giving Republicans control of the Senate. To help Bernie Moreno win this seat, the pro-crypto super PAC "Defend American Jobs" spent $40.1 million in support.

This seat is particularly noteworthy for the crypto community because Brown currently serves as the chair of the Senate Banking Committee, one of the most influential committees in the Senate, which has jurisdiction over the SEC and the Commodity Futures Trading Commission (CFTC). Therefore, the appointment of crypto-friendly Bernie Moreno is expected to facilitate the passage of numerous crypto-related bills.

At the same time, the current SEC chair Gary Gensler will also be replaced, and Trump may appoint a "crypto-friendly chair"…… (_Related reading: _Who will be the new SEC chair after Gary Gensler?_)

These regulatory trends indicate that after Trump's administration takes office, the regulatory pressure facing the altcoin market will improve, ushering in a regulatory spring.

Bitcoin's New High, High Probability of Altcoin Rotation

As Bitcoin breaks new highs and maintains a market share around 60%, based on past bull market experiences, when Bitcoin's market share remains at a high point of 60%, an altcoin season is likely to follow soon. Compared to previous cycles, this round is generally believed to be driven by significant capital inflows and institutional purchases due to Bitcoin spot ETFs, which is one of the main factors influencing Bitcoin's price increase.

According to Grayscale's October crypto report, in October, the net inflow of U.S. spot Bitcoin exchange-traded products (ETPs) reached $5.3 billion, the highest level since February, with total net inflows exceeding $24.2 billion, and U.S. ETPs currently hold about 5% of the total Bitcoin supply.

However, it also pointed out that due to the existence of "basis trading" in Bitcoin, where Bitcoin is bought (through ETPs) while simultaneously selling Bitcoin (through futures), the inflow of spot Bitcoin ETPs does not have as significant an impact on Bitcoin's price increase as one might expect. Grayscale estimates that of the $24.2 billion net inflow into U.S. ETPs, about $5 billion (approximately 20%) may be used for pairing spot/futures positions.

Therefore, in addition to traditional financial market funds such as Bitcoin spot ETFs and institutional purchases, there are still many active crypto funds or retail funds in the market that are driving up Bitcoin's price. With Bitcoin reaching new highs and the potential for a shift in crypto regulation under Trump, these funds are more likely to rotate into the altcoin market, signaling the arrival of altcoin season.

How Do Various Institutions View the Future Trend of Altcoins?

Previously, multiple institutions remained pessimistic about the future trend of the altcoin market, believing that Bitcoin would absorb a large amount of crypto funds.

Top trader Eugene stated at the end of October on the X platform that the price movements in October truly showcased the current level of PvP in the cryptocurrency environment, indicating that while traditional financial funds are flowing in to purchase Bitcoin, no one is buying altcoins. Users can make money in certain areas (like GOAT and early AI Memes), but they can also easily give all their profits back to the market due to later panic buying.

Matrixport stated on November 5 that Bitcoin's market share rose from 50% to 60% due to multiple favorable factors, but altcoins are constrained by declining user activity and token unlocking pressures, contrasting sharply with the explosive growth during the DeFi boom of 2020-2021, as investors are gradually shifting their crypto assets to Bitcoin.

Bitfinex analysts also noted that there has been a lukewarm situation in the altcoin market, with the speculative interest that once supported altcoins seemingly disappearing, reflected in stable funding rates and overall market sentiment being low. As Bitcoin absorbs most of the funds flowing into the crypto asset space, altcoins appear to have little prospect of recovery in the short term without new catalysts.

However, there are also views suggesting that funds will rotate into the altcoin market.

HashKey Group's chief analyst Jeffrey Ding analyzed that Trump's election has been seen as the "starting gun" for the cryptocurrency market, and it is expected that the digital currency market will continue to digest this favorable news until Trump takes office. A series of policies supporting cryptocurrencies promised by Trump during his campaign, including incorporating Bitcoin into the national reserve and replacing the current SEC chair Gary Gensler, are viewed as significant positives for the market. Given that Trump is known for "keeping campaign promises," we have reason to expect these policies to be gradually implemented after he takes office. The anticipation of these policy implementations, combined with the high probability of Trump's election, provides strong support for the price increases of Bitcoin and other cryptocurrencies.

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, stated on the Unchained podcast on November 1 that while liquidity may flow to Bitcoin after the election, if Bitcoin rises, the percentage increase in other coins will be greater. This is because people often have the "nominal price fallacy," for example, if Bitcoin is at $72,000, they feel that buying a coin worth $1 is cheaper and has more room to rise. This psychology leads investors to buy those coins that seem cheaper, creating what is known as the "rotation effect."

GSR analysts stated that the election will not overly impact Bitcoin, but from the perspective of altcoins, many project teams have been waiting for the right moment, observing the issuance of other tokens and the election results. When project teams are unsure whether the tokens they plan to deploy will be sued by the SEC within two months, few are willing to issue tokens now. If the election results favor improvements in crypto regulation, this situation will improve.

Bitwise Chief Investment Officer Matt Hougan pointed out before the election that regardless of whether Trump or Harris won, the regulatory environment for Bitcoin was improving, and if Trump won, it would have a greater impact on Ethereum and other altcoins. Benjamin Cowen, founder of Into The Cryptoverse, also stated on November 4 that the altcoin liquidation should end by December 2024 (at the latest by the second week of January 2025).

Review of Oversold Altcoins

In terms of altcoin performance over the past two days, the market has leaned towards a more positive outlook. However, while some altcoins have experienced a rebound, many are still in the "ankle chop" stage when considering the long-term market trends of altcoins and the current price movements of Bitcoin. Among the projects newly listed on Binance in 2024, many altcoins have experienced over an 80% pullback from their highs, so from a trading perspective, if an altcoin market emerges, these oversold altcoins will have a better chance of rebounding.

Below is a brief overview of some altcoins that were newly listed on Binance in 2024 but have seen significant pullbacks from their highs (data as of November 7):

Starknet (STRK)

Sector: L2

Listing Date: 2024-2-20

High Pullback: -85%

Sleepless AI (AI)

Sector: GAMEFI, AI

Listing Date: 2024-1-8

High Pullback: -84%

AltLayer (ALT)

Sector: Modular Blockchain

Listing Date: 2024-1-25

High Pullback: -85%

Pyth Network (PYTH)

Sector: Oracle, SOL Ecosystem

Listing Date: 2024-2-2

High Pullback: -67%

IO.NET (IO)

Sector: AI

Listing Date: 2024-6-11

High Pullback: -72%

Dogwifhat (WIF)

Sector: SOL MEME

Listing Date: 2024-3-5

High Pullback: -52%

AEVO (AEVO)

Sector: DEX

Listing Date: 2024-3-13

High Pullback: -91%

Ethena (ENA)

Sector: Synthetic Stablecoin

Listing Date: 2024-4-2

High Pullback: -65%

Dogs (DOGS)

Sector: TON, MEME

Listing Date: 2024-8-30

High Pullback: -65%

Hamster Kombat (HMSTR)

Sector: TON, GameFi

Listing Date: 2024-9-26

High Pullback: -63%

The above is just a selection of some oversold altcoins as examples. The altcoin market has experienced a long-term decline while Bitcoin has risen, and in the short term, there are many opportunities in the altcoin market. However, not all players have the time to carefully analyze the altcoin market and find profitable opportunities when the altcoin season arrives. To address this, Odaily Planet Daily has recently developed a short-term coin selection robot—Golden Ape to help users solve this problem.

This robot monitors real-time and continuously backtests long-term trading data of altcoins, combining it with Bitcoin price trend analysis. After months of refining the algorithm, it can help users find potential short-term rising targets and improve trading success rates. Currently, the Golden Ape Test version is entering the public testing phase, and users can now join the TG community for free to experience this intelligent coin selection tool, with the first batch of experience slots limited to 500.

Interested friends are welcome to join Odaily's Golden Ape TG community to explore the market together and discover and lock in valuable targets.

Screenshot of Golden Ape TG community

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。