⚡️ StakeStone x Plume | What is the Vault product launched by the black horse project StakeStone on Binance and OKX —

Is it worth participating and how to participate?

As the strongest black horse for investment on Binance + OKX, StakeStone @Stake_Stone is the only staking protocol I have been following, and it is currently my main place for staking Ethereum.

In addition to generating yields more simply and conveniently, Stone can actually provide us with a wider range of use cases and earning opportunities.

I think for many friends who do not have much time to research but want to participate in staking to earn Ethereum rewards, StakeStone is a great place to go —

Moreover, since most of the tokens in this sector have recently been issued, StakeStone's community has also been receiving airdrop signals, so it should not be far from issuing tokens, which is why I am paying close attention to recent activities.

I have previously written several articles introducing StakeStone during my research on staking;

1️⃣ What exactly is StakeStone?

As a cross-chain liquidity asset protocol, StakeStone allows users to stake their crypto assets (such as Ethereum) into different protocols to earn staking rewards while maintaining the liquidity of their assets.

Compared to many LRTs that cause liquidity fragmentation, StakeStone uses the OPAP mechanism to optimize the asset allocation in its strategy pool, ensuring that STONE holders can automatically and easily obtain optimized staking rewards.

Through LayerZero technology, STONE, as an Omnichain Fungible Token (OFT), can flow seamlessly across multiple blockchain networks, enhancing asset liquidity and user earning potential. Stone aims to maximize the opportunity cost of ETH by only minting a high credit rating LRT that can serve as a cross-chain yield-generating Ethereum liquidity standard; this allows L2 and new public chains to continue building ecosystems on top of it at controllable costs.

In addition to Liquid ETH and STONE, StakeStone has also made significant strides in the BTCFI sector, launching Liquid BTC, SBT, and other BTCFI-related products; today, we mainly discuss their launched activities, which can also use SBTC for participation.

Through these mechanisms and functions, StakeStone strives to become an infrastructure for cross-chain liquidity, providing users with efficient and secure staking solutions while also offering developers a platform to develop and utilize liquidity projects. This positions StakeStone as an important player in the decentralized finance (DeFi) space.

That's why I previously referred to StakeStone as the future public chain's water supply company, because compared to other staking protocols, StakeStone's vision may be to become the standard service for cold-starting new public chains in the future, and through cold-starting, become a new asset standard that replaces ETH in every new public chain. At the same time, for more mature public chains and L2s, it will gradually replace existing ETH liquidity with higher capital efficiency provided by re-staking, becoming a new liquidity standard.

2️⃣ Introduction to the latest product StakeStone Vault

StakeStone focuses on creating earning opportunities for users through various cross-chain liquidity assets, so it has been emphasizing the launch of diversified earning products;

For example, this StakeStone Vault is a product launched by the StakeStone platform that will support products issued by project parties or asset management institutions in the future. You can think of it as giving the Stone you earn from staking Ethereum to the Vault; it acts as a manager for your funds.

The Vault has the following features —

1) Specialty yield (Yield Farming) vaults for specific purposes: specifically serving liquidity yield scenarios;

2) Cross-chain DeFi strategy vaults: will support cross-chain DeFi combination strategies, providing better yields;

3) CeDeFi combination strategy vaults: BTC and Stablecoin scenarios will be launched soon;

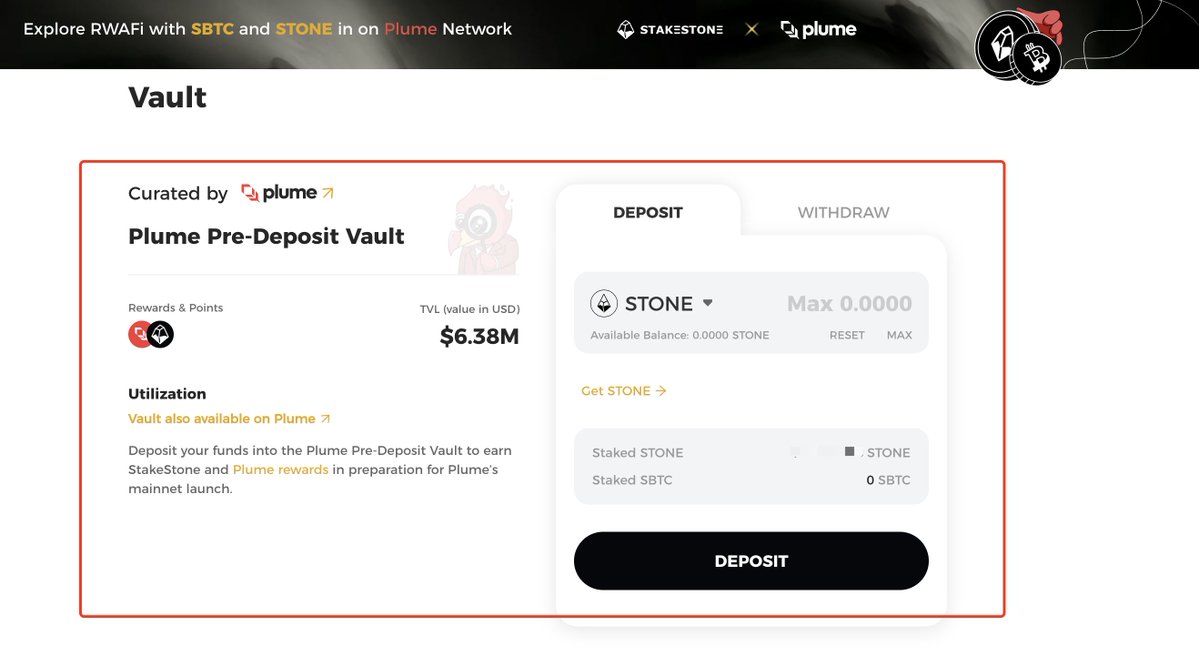

Currently, strategic partners that have been established include Plume, Berachain, CIAN, Coinsummer, Amber Group, and others; the first phase will collaborate with the popular RWAfi chain Plume to launch the StakeStone x Plume Pre-deposit Vault;

3️⃣ Introduction to Plume Network

1) What is Plume Network?

Plume Network @plumenetwork is a modular Layer 2 blockchain designed for Real-World Assets (RWA). It aims to simplify the deployment of assets on-chain and create a composable ecosystem through integration with decentralized finance (DeFi) applications.

Plume Network tokenizes top-quality assets and directly integrates capital and compliance providers into the Plume chain, specifically designed for emerging RWAfi projects and on-chain net new capital;

Plume Network's seed round raised $10 million: led by Haun Ventures, founded by the first female partner at a16z, with other notable investors including Galaxy Digital, SV Ventures, etc.;

Core team: from Layer Zero, Polyhedra, Galaxy Digital, JP Morgan, etc.

2) What problems can Plume solve (distinguishing DeFi, RWAfi, and other RWAs):

Plume creates a DeFi ecosystem for users, allowing real-world assets to be tokenized on its blockchain, enabling these assets to be represented, traded, and managed on-chain, such as real estate, commodities, bonds, etc.;

It allows users to seamlessly access and invest in various types of RWAfi. Plume has built a composable DeFi ecosystem to release liquidity and facilitate the trading of RWAfi assets.

Such as RWAfi lending, RWAfi liquidity staking, RWfiA leveraged trading; RWAfi generates actual returns from RWAs through stable and long-term investment strategies, rather than just point rewards.

3) Plume and RWAfi bring new market imagination space to crypto

The market lacks new gameplay and yield scenarios worth pursuing, and point-based gameplay and various anti-farming strategies have left the market feeling fatigued. Plume, as the first modular solution dedicated to all RWAfi, brings new gameplay and increments to DeFi:

Real returns: Plume generates actual returns from RWAfi through stable and long-term investment strategies, rather than just point rewards;

Linking funds and assets from various industries in the real world, bringing new on-chain liquidity increments to crypto, opening up trillion-dollar market imagination space: Various assets on Plume include: tokenized stocks, content IP, real estate, hotel rooms, collectibles (sneakers, watches, trading cards, etc.), renewable infrastructure (solar farms, carbon credits, RECs, etc.), wine and whiskey, Web3 shopping/marketplaces, stablecoins, and private credit; DeFi scenarios include: AMMs, RWAfi Perp DEX, RWAfi lending/borrowing, RWA liquidity staking, RWAfi leveraged trading, etc.

4️⃣ StakeStone x Plume Pre-Deposit Vault activity tutorial;

Plume's testnet data has performed well, and this collaboration with StakeStone's Vault is also the first time to open a pre-deposit cap, with a limit of $5 million, but I just saw that the $5 million limit was filled in five minutes, and they reopened a $30 million cap, which you can choose to participate with Stone or SBTC;

The $5 million is expected to fill up quickly, below is the tutorial and some explanations —

5️⃣ How to participate in staking

The staking method is very simple:

1) Click the link to enter the StakeStone x Plume Pre-Deposit Vault interface;

Click the Connect Wallet button in the upper right corner, select your commonly used wallet and choose the Ethereum network;

2) If you already have Stone on the Ethereum network or have SBTC on the Ethereum network, just select the staking amount on the staking interface and click the Approve button,

Complete the wallet signature in the upper right corner, and wait for the staking to complete; when the Succeed pop-up appears, it indicates completion;

As for what SBTC is, you can check this tweet for details:

https://x.com/H_amiddd/status/1852353342539805038

SBTC is a liquidity asset launched by StakeStone, aimed at releasing liquidity by custodizing BTC while expanding the application of BTC assets in the EVM ecosystem and other blockchain networks.

You can use cbBTC to mint SBTC 1:1 on the ETH mainnet (which can be withdrawn 1:1 at any time); or you can use BTCB to mint SBTC 1:1 on the BNB Chain (which can also be withdrawn 1:1 at any time).

🚨 For detailed content, you can watch: https://www.plumenetwork.xyz/blog/pre-deposit-guide

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。